Integration of Big Data Analytics

The integration of big data analytics into the environmental monitoring market is transforming how data is collected, analyzed, and utilized. By leveraging large datasets, organizations can gain deeper insights into environmental trends and patterns, which is essential for informed decision-making. The ability to analyze vast amounts of data in real-time enhances the effectiveness of monitoring systems, allowing for quicker responses to environmental changes. This trend is expected to drive growth in the market, as companies increasingly seek to adopt data-driven approaches to environmental management. The potential for predictive analytics to forecast environmental issues further underscores the importance of big data in the environmental monitoring market, suggesting a future where data-driven strategies become the norm.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the environmental monitoring market. Various federal and state programs are being implemented to enhance environmental protection and sustainability. For example, funding for research and development in monitoring technologies has increased, with allocations reaching millions of dollars annually. These initiatives aim to improve data collection and analysis capabilities, which are essential for effective environmental management. The environmental monitoring market is likely to benefit from these government efforts, as they not only provide financial support but also establish regulatory frameworks that encourage the adoption of advanced monitoring systems. As a result, the market may see a significant uptick in demand for innovative solutions that align with governmental objectives.

Technological Advancements in Sensors

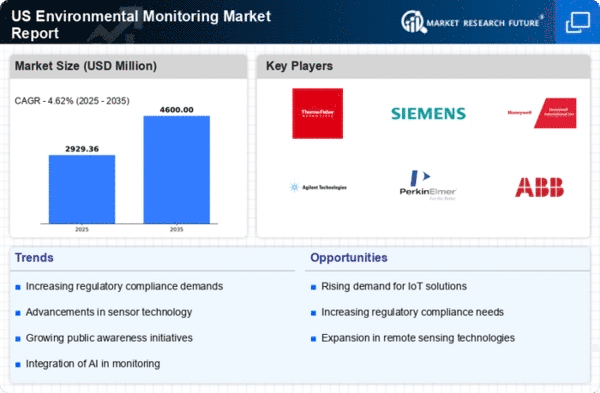

The environmental monitoring market is experiencing a surge in technological advancements, particularly in sensor technology. Innovations in sensor design and functionality are enabling more accurate and real-time data collection. For instance, the integration of miniaturized sensors allows for extensive monitoring of air and water quality, which is crucial for compliance with environmental regulations. The market for these advanced sensors is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next five years. This growth is driven by the increasing demand for precise environmental data, which is essential for both regulatory compliance and public health initiatives. As a result, The environmental monitoring market is likely to benefit from these advancements, enhancing the capabilities of systems across various sectors.

Rising Demand for Sustainable Practices

The growing emphasis on sustainability is significantly influencing the environmental monitoring market. As industries and consumers alike prioritize eco-friendly practices, there is an increasing need for monitoring systems that can track environmental impacts effectively. This demand is particularly evident in sectors such as manufacturing, agriculture, and energy, where compliance with sustainability standards is becoming a prerequisite. The market is likely to expand as organizations invest in monitoring technologies that facilitate sustainable practices, such as waste reduction and resource conservation. Furthermore, the alignment of corporate social responsibility initiatives with environmental monitoring efforts suggests a robust future for the market, as businesses recognize the value of sustainability in enhancing their brand reputation and operational efficiency.

Increased Public Awareness of Environmental Issues

Public awareness regarding environmental issues is on the rise, significantly impacting the environmental monitoring market. As communities become more informed about pollution, climate change, and sustainability, there is a growing demand for transparency in environmental data. This heightened awareness is prompting both governmental and non-governmental organizations to invest in monitoring systems that provide accurate and accessible information. Reports indicate that the market is expected to expand as more stakeholders seek to understand and mitigate environmental impacts. The increasing pressure from the public for accountability and action is likely to drive investments in monitoring technologies, thereby fostering growth in the environmental monitoring market. This trend suggests a shift towards more proactive environmental management strategies, which could further enhance the market's development.