Public Health Concerns

Public health concerns related to environmental issues are driving the demand for the environmental monitoring market in Canada. Increasing awareness of the health impacts of pollution and climate change has led to a heightened focus on monitoring air and water quality. Citizens and advocacy groups are calling for more transparency and accountability from industries, prompting companies to adopt comprehensive monitoring strategies. This growing public scrutiny is likely to result in increased investments in monitoring technologies, as organizations strive to address health concerns and comply with public expectations. The environmental monitoring market is poised to expand as a response to these public health challenges.

Rising Environmental Regulations

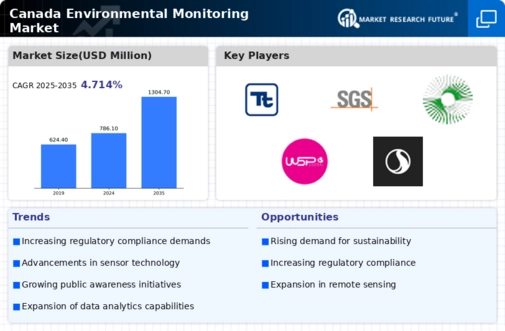

The increasing stringency of environmental regulations in Canada is a primary driver for the environmental monitoring market. Government bodies are implementing more rigorous standards to ensure compliance with environmental protection laws. This trend is evident in the recent introduction of regulations aimed at reducing greenhouse gas emissions and monitoring air quality. As a result, industries are compelled to invest in advanced monitoring technologies to meet these requirements. The environmental monitoring market is projected to grow as companies seek solutions to comply with these regulations, with an estimated market value reaching $1.5 billion by 2026. This regulatory landscape creates a robust demand for innovative monitoring solutions, thereby propelling market growth.

Increased Investment in Sustainability

The growing emphasis on sustainability among Canadian businesses is a significant driver for the environmental monitoring market. Companies are increasingly recognizing the importance of sustainable practices, leading to heightened investments in environmental monitoring solutions. This trend is reflected in the rising budgets allocated for environmental compliance and sustainability initiatives, with many organizations committing to reducing their carbon footprints. The environmental monitoring market is expected to benefit from this shift, as businesses seek to implement effective monitoring systems to track their environmental impact. It is estimated that investments in sustainability could reach $2 billion by 2027, further stimulating market growth.

Technological Innovations in Monitoring

Technological advancements are significantly influencing the environmental monitoring market in Canada. Innovations such as remote sensing, IoT devices, and AI-driven analytics are enhancing the capabilities of monitoring systems. These technologies allow for real-time data collection and analysis, improving the accuracy and efficiency of environmental assessments. The integration of these advanced technologies is expected to increase the market's value, with projections indicating a growth rate of approximately 10% annually over the next five years. As organizations seek to leverage these innovations, the demand for sophisticated monitoring solutions is likely to rise, further driving the environmental monitoring market.

Collaboration Between Government and Industry

Collaboration between government agencies and private industry is emerging as a key driver for the environmental monitoring market. Initiatives aimed at fostering partnerships for environmental protection are gaining traction, with various stakeholders working together to enhance monitoring capabilities. These collaborations often involve sharing data and resources, which can lead to more effective monitoring solutions. The Canadian government has been actively promoting such partnerships, recognizing their potential to improve environmental outcomes. As these collaborative efforts continue to grow, the environmental monitoring market is likely to see increased demand for integrated monitoring systems that can support both regulatory compliance and sustainability goals.