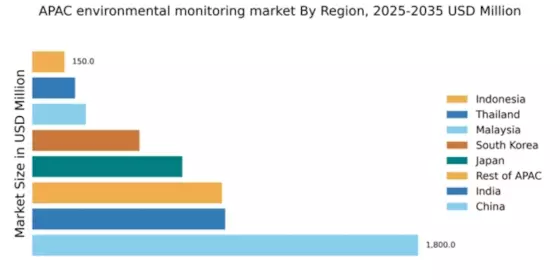

China : Rapid Growth Driven by Regulations

Key markets include major cities like Beijing, Shanghai, and Shenzhen, where industrial activities are concentrated. The competitive landscape features significant players such as Thermo Fisher Scientific and Honeywell International Inc., which have established strong local partnerships. The business environment is favorable, with increasing investments in smart city initiatives and environmental sustainability. Applications span various sectors, including manufacturing, agriculture, and public health.

India : Government Initiatives Fuel Growth

Key markets include metropolitan areas such as Delhi, Mumbai, and Bengaluru, where pollution levels are critically high. The competitive landscape is evolving, with local players and international firms like Agilent Technologies and PerkinElmer Inc. vying for market share. The business environment is becoming more conducive to innovation, with a focus on smart technologies and IoT applications in environmental monitoring. Industries such as construction and manufacturing are primary consumers of these technologies.

Japan : Focus on Innovation and Quality

Key markets include Tokyo and Osaka, where industrial activities are concentrated. The competitive landscape features major players like Horiba Ltd. and Teledyne Technologies Inc., known for their innovative solutions. The business environment is characterized by a strong emphasis on R&D and collaboration between public and private sectors. Applications are diverse, spanning air quality, water quality, and industrial emissions monitoring.

South Korea : Focus on Air Quality Monitoring

Key markets include Seoul and Busan, where air quality issues are prevalent. The competitive landscape includes major players like Siemens AG and Emerson Electric Co., which are actively involved in the market. The business environment is supportive of innovation, with a focus on smart city initiatives and public health applications. Industries such as construction and transportation are significant consumers of environmental monitoring solutions.

Malaysia : Sustainable Practices on the Rise

Key markets include Kuala Lumpur and Penang, where industrial activities are concentrated. The competitive landscape features both local and international players, including ABB Ltd. and Honeywell International Inc. The business environment is becoming more favorable for investments in environmental technologies, with applications spanning waste management, air quality, and water monitoring. The focus is on integrating smart technologies into existing systems.

Thailand : Government Policies Support Development

Key markets include Bangkok and Chiang Mai, where pollution levels are a concern. The competitive landscape includes local firms and international players like Thermo Fisher Scientific. The business environment is evolving, with increasing investments in environmental monitoring technologies. Applications are diverse, covering air quality, water quality, and industrial emissions monitoring, with a focus on sustainable practices.

Indonesia : Focus on Urban Pollution Challenges

Key markets include Jakarta and Surabaya, where industrial activities are concentrated. The competitive landscape features both local and international players, including Agilent Technologies and PerkinElmer Inc. The business environment is becoming more conducive to innovation, with a focus on smart technologies and IoT applications in environmental monitoring. Industries such as manufacturing and construction are primary consumers of these technologies.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include countries like Vietnam, Philippines, and Singapore, each with unique environmental challenges. The competitive landscape is diverse, featuring both local and international players. The business environment varies significantly, with some countries fostering innovation while others face regulatory hurdles. Applications span various sectors, including agriculture, manufacturing, and public health, with a focus on sustainable practices.