Rising Environmental Concerns

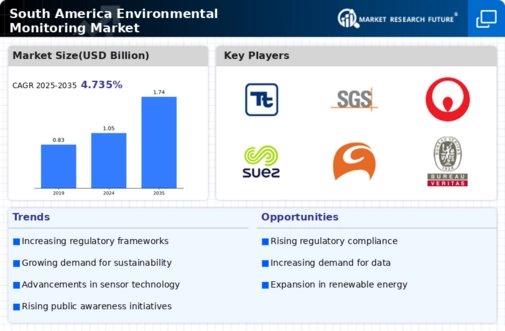

The increasing awareness of environmental issues in South America is driving the environmental monitoring market. Citizens and organizations are becoming more conscious of pollution, deforestation, and climate change. This heightened awareness is leading to greater demand for monitoring solutions that can provide real-time data on air and water quality. In 2025, the market is projected to grow by approximately 15%, reflecting the urgency to address these environmental challenges. Governments and NGOs are investing in technologies that facilitate better monitoring and reporting, thereby enhancing the capabilities of the environmental monitoring market. As a result, stakeholders are more inclined to adopt innovative solutions that can help mitigate environmental degradation.

Investment in Sustainable Development

Investment in sustainable development initiatives is significantly influencing the environmental monitoring market in South America. Governments and private sectors are allocating substantial funds to projects aimed at promoting sustainability. For instance, in 2025, investments in environmental monitoring technologies are expected to reach $500 million, driven by the need for effective resource management and compliance with international environmental standards. This trend indicates a growing recognition of the importance of monitoring systems in achieving sustainability goals. The environmental monitoring market is thus positioned to benefit from these investments, as they facilitate the development of advanced monitoring tools and methodologies that support sustainable practices.

Strengthening of Environmental Policies

The strengthening of environmental policies across South America is a key driver for the environmental monitoring market. Governments are implementing stricter regulations to combat pollution and promote sustainable practices. This regulatory environment is compelling industries to adopt comprehensive monitoring systems to ensure compliance. By 2025, it is expected that the market for environmental monitoring solutions will expand by 12% as companies invest in technologies that align with these policies. The environmental monitoring market is thus experiencing a surge in demand for solutions that can provide accurate and timely data to meet regulatory requirements, fostering a culture of accountability and transparency.

Technological Integration in Monitoring Systems

The integration of advanced technologies such as IoT, AI, and big data analytics is reshaping the environmental monitoring market in South America. These technologies enable more efficient data collection, analysis, and reporting, which are crucial for effective environmental management. In 2025, it is anticipated that the adoption of IoT-based monitoring systems will increase by 20%, enhancing the capabilities of the environmental monitoring market. This technological evolution allows for real-time monitoring and predictive analytics, which can significantly improve decision-making processes. As organizations seek to optimize their environmental strategies, the demand for sophisticated monitoring solutions is likely to rise.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a vital driver for the environmental monitoring market in South America. Partnerships are being formed to leverage resources and expertise in addressing environmental challenges. This collaborative approach is facilitating the development of innovative monitoring solutions that are tailored to local needs. In 2025, it is projected that joint ventures in the environmental monitoring market will increase by 18%, reflecting a shared commitment to environmental stewardship. Such collaborations not only enhance the effectiveness of monitoring efforts but also promote knowledge sharing and capacity building among stakeholders, ultimately leading to improved environmental outcomes.