Public Health Concerns

Growing public health concerns related to environmental issues are driving the environmental monitoring market in the UK. Increased awareness of the health impacts of air and water pollution has led to heightened demand for monitoring solutions that can provide accurate data on environmental quality. The UK government has launched various initiatives aimed at improving air quality, which directly influences the market. For instance, the Clean Air Strategy aims to reduce air pollution and protect public health, thereby increasing the need for effective monitoring systems. This heightened focus on public health is likely to sustain growth in the environmental monitoring market as stakeholders seek reliable data to inform policy and action.

Rising Environmental Regulations

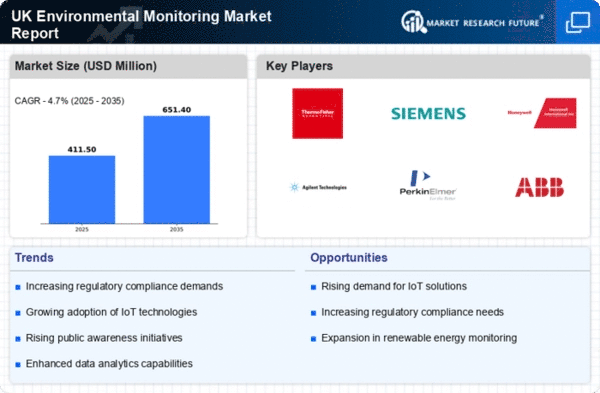

The increasing stringency of environmental regulations in the UK is a pivotal driver for the environmental monitoring market. Regulatory bodies are imposing stricter limits on emissions and pollutants, necessitating advanced monitoring solutions. For instance, the UK government has committed to reducing greenhouse gas emissions by at least 68% by 2030 compared to 1990 levels. This commitment drives demand for sophisticated monitoring technologies that can ensure compliance with these regulations. The environmental monitoring market is expected to grow as industries invest in systems that provide real-time data on air and water quality. This investment helps avoid penalties and enhances sustainability profiles.

Investment in Sustainable Practices

There is a notable shift towards sustainable practices across various sectors in the UK, which significantly influences the environmental monitoring market. Companies are increasingly recognising the importance of sustainability not only for compliance but also for brand reputation. This trend is reflected in the UK’s commitment to achieving net-zero emissions by 2050, which requires comprehensive monitoring of environmental impacts. As businesses allocate budgets towards sustainable initiatives, the environmental monitoring market is likely to see a surge in demand for tools that measure and report on sustainability metrics, thus fostering a culture of accountability and transparency.

Corporate Social Responsibility Initiatives

The rise of corporate social responsibility (CSR) initiatives among UK businesses is a significant driver for the environmental monitoring market. Companies are increasingly held accountable for their environmental impact, leading to a greater emphasis on transparency and sustainability. Many organisations are adopting CSR strategies that include environmental monitoring as a core component. This trend is supported by consumer demand for ethical practices, with studies indicating that 66% of consumers are willing to pay more for sustainable brands. As businesses strive to enhance their CSR profiles, the environmental monitoring market is likely to benefit from increased investments in monitoring technologies that demonstrate commitment to environmental stewardship.

Technological Integration in Monitoring Solutions

The integration of advanced technologies such as IoT, AI, and big data analytics is transforming the environmental monitoring market. These technologies enable more accurate and efficient data collection, analysis, and reporting. For example, IoT devices can provide real-time monitoring of air and water quality, while AI can predict environmental trends based on historical data. The UK is witnessing a rise in smart city initiatives, which further propels the demand for innovative monitoring solutions. As cities aim to enhance their environmental performance, the environmental monitoring market is poised for growth, driven by the need for integrated and intelligent monitoring systems.