Summary Overview

Procurement Intelligence for the Car Rental Market: Enhancing Service Management and Risk Mitigation

Market Overview

The global car rental market is witnessing robust growth due to increasing urbanization, growing tourism, and rising preferences for on-demand transportation services. Shifting consumer habits and technological innovations in rental platforms further propel this market's expansion. Our comprehensive report analysis emerging procurement trends, highlights opportunities for cost optimization, and addresses potential risks in the supply chain. Digital tools, such as predictive analytics and inventory management platforms, are emphasized to help stakeholders streamline their procurement processes.

Key Market Trends and Projections

-

Market Size: The global car rental market is projected to grow from approximately USD 98 billion in 2020 to around USD 140 billion by 2032, with a CAGR of 4-5% from 2024 to 2032.

Growth Rate: 4 -5 %

Growth Drivers:

-

Urbanization and Mobility Demand: Rising urban populations and the decline of private vehicle ownership foster the need for flexible rental services. -

Tourism Growth: Increasing domestic and international travel drives short-term rental demand. -

Digital Transformation: The adoption of advanced booking platforms and app-based services enhances user convenience. -

Sustainability: Growing demand for electric and hybrid rental cars aligns with global green initiatives.

Sector Contributions

-

Business Segment: Corporate travellers represent a significant revenue share due to their reliance on premium car rentals. -

Leisure Segment: Growth in recreational travel is driving demand for economy cars and short-term rentals. -

Regional Insights:

-

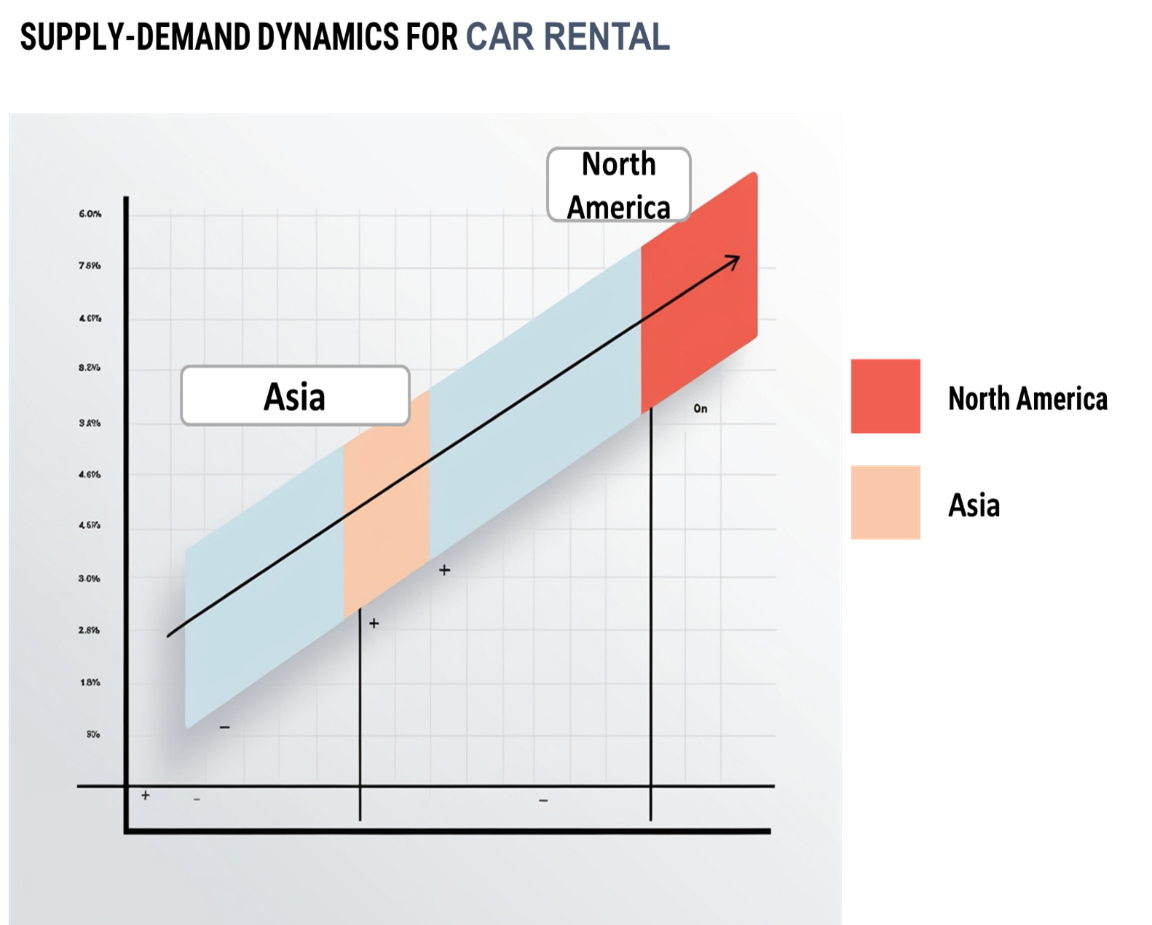

North America: Dominates with over 50% revenue share, driven by a well-established corporate travel industry. -

Asia-Pacific: Expected to experience the fastest growth due to urbanization and increasing disposable incomes.

Procurement and Sustainability Insights

-

Technological Innovations:Advances in fleet management systems and AI-driven platforms optimize operational efficiency. -

Sustainability Practices:Rental companies are focusing on fleet electrification to address environmental concerns.

Overview of Market Intelligence Services for car rentals market

The car rental market faces challenges such as fluctuating demand and pricing influenced by seasonal travel patterns and fuel costs. Market intelligence services offer actionable insights into procurement strategies, enabling stakeholders to mitigate risks and optimize decision-making. Leveraging these insights, companies can ensure cost-effective sourcing while enhancing service quality and fleet availability.

Procurement Intelligence for the Car Rental Market: Category Management and Strategic Sourcing

To remain competitive in the car rental market, companies are adopting advanced procurement strategies, integrating spend analysis solutions to manage vendor expenses effectively, and optimizing supply chain operations using supply market intelligence. Procurement category management is proving critical in identifying cost-saving opportunities while ensuring consistent service quality. Strategic sourcing plays a vital role in negotiating long-term partnerships with key suppliers, addressing dynamic market demands, and leveraging technology to improve efficiency.

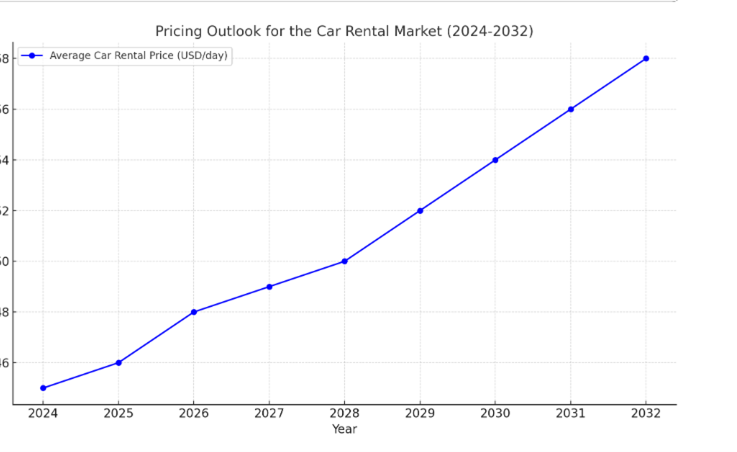

Pricing Outlook for the Car Rental Market: spend analysis

The global car rental market is projected to experience significant price dynamics influenced by technological innovations, shifting consumer demands, and macroeconomic factors. Below is a comprehensive overview:

line chart illustrating the pricing outlook for the car rental market from 2024 to 2032.

-

Technological Advancements: Increased adoption of automated management systems and electric vehicle fleets are driving operational efficiencies, potentially balancing some pricing pressures. -

Growing Demand: Expansion of car rentals for business and leisure travel, especially in North America and Europe, is contributing to steady price growth. The rising trend of eco-conscious choices, like electric vehicles, adds premium value. -

Infrastructure and Environmental Costs: Investments in sustainable practices, including carbon offset programs and EV infrastructure, are likely to impact pricing trends over time. -

Regional Variations:

-

North America: Expected to lead with significant market share, influenced by robust demand and established service providers like Hertz and Avis. -

Asia-Pacific: Rapid urbanization and the popularity of ride-sharing apps are boosting market growth, creating competitive pricing pressures.

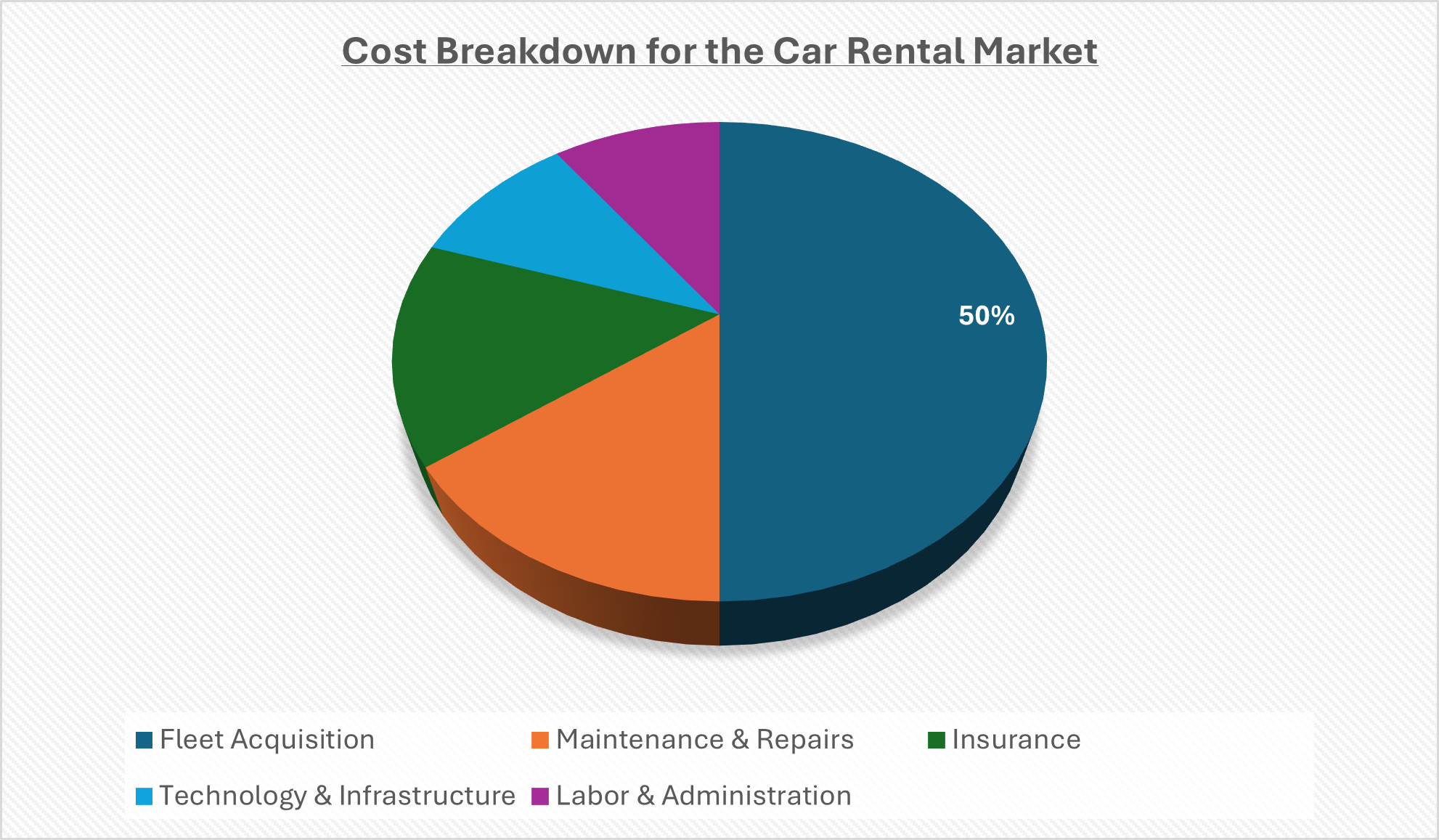

Cost Breakdown for the Car Rental Market: Cost-Saving Opportunities

- Fleet Acquisition (50%)

-

Description: Represents the largest cost component, covering vehicle purchase or leasing expenses, including electric and fuel-efficient vehicles, which are gaining traction. -

Trends: Fleet costs are influenced by global automotive supply chain disruptions, fluctuating vehicle prices, and increasing preference for electric vehicles (EVs). In 2024, the shift toward EV adoption is anticipated to slightly elevate fleet acquisition costs but offers long-term savings in fuel and maintenance.

- Maintenance & Repairs (XX%)

- Insurance (XX%)

- Technology & Infrastructure (XX%)

- Labor & Administration (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the car rental market, cost-saving opportunities can be unlocked through strategic negotiation and procurement practices. Bulk vehicle purchases or leases allow for discounts, while adopting electric vehicles can reduce long-term fuel and maintenance costs. Collaborating with other businesses to pool fleets or resources helps share operational expenses. Additionally, leveraging data analytics for maintenance optimization and negotiating fuel discounts can further reduce costs. Investing in digital tools for fleet management and marketing partnerships can streamline operations and cut advertising expenses, ultimately enhancing profitability and efficiency.

Supply and Demand Overview of the Car Rental Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The car rental market is seeing fluctuations driven by changing consumer behaviour, economic conditions, and technological advancements. With an increasing preference for convenience and mobility, the demand for car rental services is growing, particularly in urban areas, travel hubs, and through digital channels.

Demand Factors:

-

Urbanization and Mobility Trends: The growing trend of urbanization and the need for flexible mobility options in cities is driving demand for short-term vehicle rentals. -

Tourism and Business Travel: Increased tourism, particularly after the COVID-19 pandemic recovery, and business travel are fuelling demand for car rental services, especially in popular tourist destinations. -

On-Demand Economy: The rise of the gig economy and consumer preference for on-demand services, such as car-sharing and app-based rentals, has expanded the car rental market. -

E-commerce Growth: With online booking platforms becoming more prominent, consumers can now conveniently rent cars through mobile apps or websites, increasing accessibility and demand.

Supply Factors:

-

Vehicle Availability and Fleet Management: Rental companies face challenges in maintaining adequate fleet sizes due to supply chain disruptions, vehicle shortages, and rising vehicle costs, which can impact supply. -

Technological Advancements: Fleet management technologies, such as GPS tracking, automated bookings, and predictive analytics, help optimize fleet utilization and ensure timely availability of vehicles. -

Electric Vehicle (EV) Integration: The adoption of electric vehicles in rental fleets is gradually increasing, driven by sustainability concerns and the need to meet environmental regulations, diversifying the supply. -

Competition and Market Saturation: Increased competition among car rental providers, especially in high-demand locations, affects supply availability, pricing, and service quality.

Regional Demand-Supply Outlook: Car Rental Market

The image shows growing demand for car rentals market in both North America and Asia, with potential price increases and increased competition

North America: A Key Player in the Car Rental Market

North America, particularly the U.S., plays a significant role in the car rental market, driven by:

-

Leading Rental Providers: Major car rental companies like Enterprise, Hertz, and Avis dominate the U.S. market, providing a broad range of rental options and contributing significantly to the global car rental industry. -

Strong Tourism and Business Travel: The U.S. sees consistent demand for car rentals from both domestic and international travellers, especially in cities and tourist hotspots. -

Shift to Digital Platforms: The growing use of digital platforms and mobile apps for car rentals is making it easier for consumers to book rentals quickly and efficiently, driving further market growth. -

Focus on Sustainability: Many U.S. car rental companies are integrating electric and hybrid vehicles into their fleets to meet environmental demands, providing eco-friendly rental options. -

Consumer Trends: The demand for flexible mobility solutions, such as ride-sharing and car subscriptions, is increasing, contributing to new trends within the car rental industry.

North America remains a key hub Car rentals market and its growth

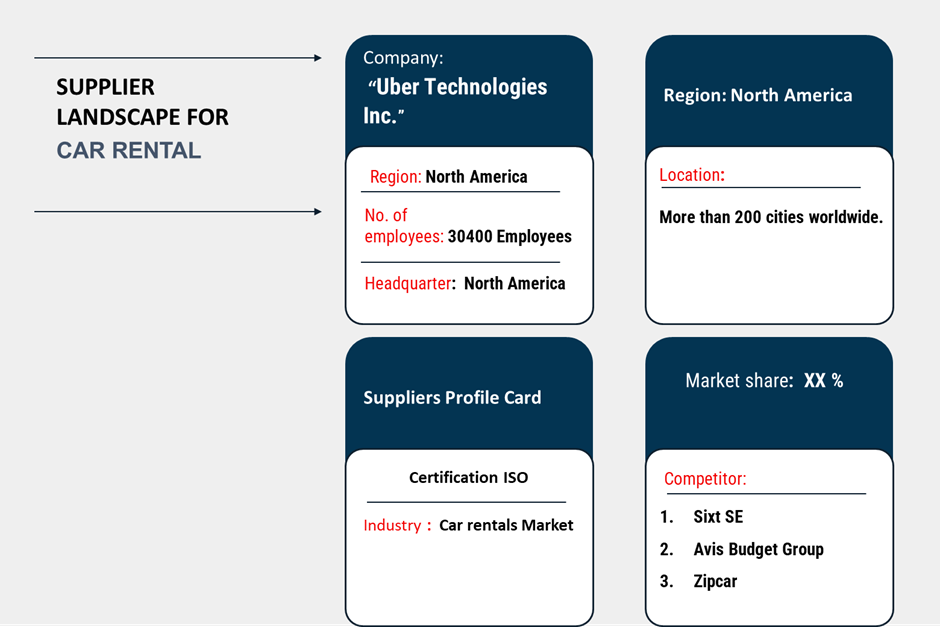

Supplier Landscape: Supplier Negotiations and Strategies in the Car Rental Market

The car rental market has a diverse and dynamic supplier landscape that consists of both global and regional players providing a range of services and products essential for the operation and growth of the industry. Key suppliers include vehicle manufacturers, fleet management services, insurance providers, technology solution providers (for booking systems and fleet management), and infrastructure services such as fuelling stations and vehicle maintenance providers.

Currently, the supplier landscape is highly competitive, with car rental companies focusing on building strong relationships with vehicle suppliers, fleet management partners, and tech innovators to ensure efficient operations, customer satisfaction, and sustainability. This collaboration is essential to streamline the booking process, maintain vehicle quality, and expand service offerings to meet changing customer demands.

Key suppliers and strategic players in the car rental market include:

- Toyota Motor Corporation

- Volkswagen Group

- Enterprise Holdings

- Hertz Global Holdings

- Sixt SE

- Avis Budget Group

- Zipcar

- Uber Technologies Inc.

- Europcar Mobility Group

- Fleet Complete

Key Development: Procurement Category Significant Developments in the Car Rental Market

Procurement Category |

Significant Development |

Impact |

Fleet Management |

Increasing adoption of electric vehicles (EVs) and hybrid vehicles. |

Reduces carbon footprint, enhances sustainability, and meets demand for eco-friendly options. |

Vehicle Procurement |

Strategic partnerships with vehicle manufacturers for custom fleet options. |

Improves fleet quality, reduces costs, and ensures availability of new vehicle models. |

Technology Solutions |

Implementation of advanced booking systems and fleet management software. |

Enhances customer experience, improves operational efficiency, and provides real-time tracking. |

Insurance |

Development of new insurance products tailored to fleet management and short-term rentals. |

Reduces risk, improves profitability, and ensures better customer service. |

Maintenance & Servicing |

Use of predictive maintenance technologies to monitor vehicle health in real-time. |

Increases vehicle uptime, reduces unplanned maintenance costs, and improves fleet reliability. |

Sustainability Initiatives |

Procurement of sustainable products and services, such as eco-friendly cleaning supplies. |

Meets consumer demand for environmentally conscious services and reduces operational costs. |

Partnerships & Collaborations |

Growth in strategic alliances with ride-sharing platforms (e.g., Uber, Lyft). |

Expands service offerings, increases market share, and improves fleet utilization. |

Fleet Optimization |

Use of AI-driven algorithms to optimize fleet size, location, and availability. |

Reduces idle time, improves asset utilization, and lowers operating costs. |

Customer Experience |

Integration of mobile apps for seamless booking, vehicle pick-up, and return. |

Enhances customer satisfaction, boosts repeat business, and increases brand loyalty. |

Pricing & Revenue Management |

Dynamic pricing models based on demand, location, and vehicle availability. |

Maximizes revenue, enhances competitiveness, and improves resource allocation. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The global car rental market is projected to grow from USD 81.03 billion in 2023 to USD 140 billion by 2032, with a CAGR of 4 to 5% during the forecast period. |

Adoption of Electric and Hybrid Vehicles |

The rising demand for eco-friendly transportation options is driving the adoption of electric and hybrid vehicles in rental fleets. |

Top Strategies for 2024 |

Focus on fleet diversification (electric and hybrid vehicles), dynamic pricing models, and enhanced customer experience through technology (e.g., mobile apps). |

Automation in Car Rental Operations |

Approximately 35% of car rental companies are implementing automated booking, vehicle pick-up, and return systems to improve efficiency and customer convenience. |

Procurement Challenges |

Key challenges include fluctuating fuel prices, maintaining fleet availability amid rising demand, and adapting to regulatory changes related to environmental standards. |

Key Suppliers |

Major players include Enterprise Rent-A-Car, Hertz Global Holdings, Avis Budget Group, and Sixt SE, focusing on fleet management, technology solutions, and partnerships with OEMs. |

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with significant demand from the U.S., Germany, and China. |

Market Drivers and Trends |

Growth is driven by the rise in domestic and international travel, increasing demand for eco-friendly vehicles, and the growing popularity of car-sharing and ride-hailing services. |