Summary Overview

Crates Market Overview:

The global crates market is witnessing consistent growth, driven by demand across industries such as logistics, agriculture, food and beverage, and manufacturing. This market encompasses various types of crates, including plastic crates, wooden crates, and metal crates. Our report provides a detailed analysis of procurement trends, emphasizing cost optimization strategies and the adoption of digital tools to enhance procurement and supply chain processes.

Key future challenges in procurement include managing fluctuating raw material prices, maintaining supply chain stability, and meeting growing demands for sustainable packaging solutions. Digital procurement tools and strategic sourcing are essential for optimizing the crate supply chain and ensuring long-term competitiveness. As global demand continues to rise, companies are leveraging market intelligence to enhance operational efficiency and mitigate risks.

The crate market is expected to maintain steady growth through 2032, with key highlights including:

-

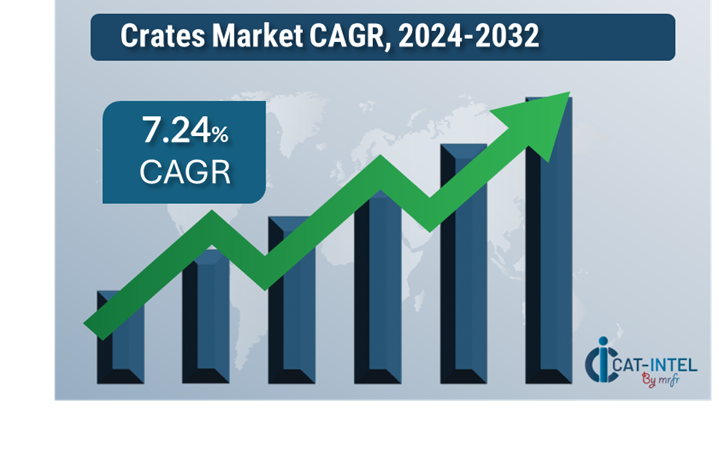

Market Size: The global crates market is projected to reach USD 6.47 billion by 2032, growing at a CAGR of approximately 7.24 % from 2024 to 2032.

-

Sector Contributions: Growth in the market is driven by: -

Logistics and Warehousing Demand: Increased need for durable and stackable crates to streamline transportation and storage. -

Agriculture and Food Sector Growth: Rising adoption of crates for efficient packaging and handling of fresh produce and perishable goods. -

Technological Transformation: Advancements in material technology, such as lightweight and durable plastic crates, are enhancing performance and reducing costs. -

Innovations: Innovative designs for collapsible and stackable crates improve space utilization and logistics efficiency. -

Investment Initiatives: Companies are investing in advanced manufacturing techniques, such as injection molding and 3D printing, to enhance crate production and customization capabilities. -

Regional Insights: Asia Pacific remain significant contributors due to robust logistics infrastructure and growing adoption of sustainable packaging solutions.

Key Trends and Sustainability Outlook:

-

Digital Integration: Automation in crate manufacturing and inventory management is improving efficiency and reducing errors. -

Advanced Materials: Use of eco-friendly and recyclable materials like biodegradable plastics and sustainably sourced wood. -

Focus on Sustainability: Increasing emphasis on reducing environmental impact through waste reduction and the adoption of circular economy practices. -

Customization Trends: Rising demand for crates designed for specific applications, such as temperature-controlled crates for perishables. -

Data-Driven Manufacturing: Utilizing analytics to optimize production processes and ensure consistent quality standards.

Growth Drivers:

-

Logistics Sector Growth: Expanding e-commerce and global trade driving demand for durable and reusable crates. -

Agriculture and Food Industry Needs: Growing reliance on efficient packaging for transport and storage of agricultural produce and perishable items. -

Sustainability Goals: Companies investing in eco-friendly crates to meet regulatory and environmental standards. -

Regulatory Compliance: Adherence to stringent safety and quality regulations in food, agriculture, and logistics industries. -

Customization: Increasing need for tailored crate solutions for niche industries, including automotive and pharmaceuticals.

Overview of Market Intelligence Services for the Crates Market:

Recent analyses have highlighted key challenges such as fluctuating material costs and the need for customized crate solutions. Market intelligence reports offer actionable insights into procurement opportunities, helping companies identify cost-saving measures, optimize supplier management, and enhance supply chain resilience. These insights also support compliance with industry regulations and uphold high standards of quality while effectively managing costs.

Procurement Intelligence for Crates: Category Management and Strategic Sourcing:

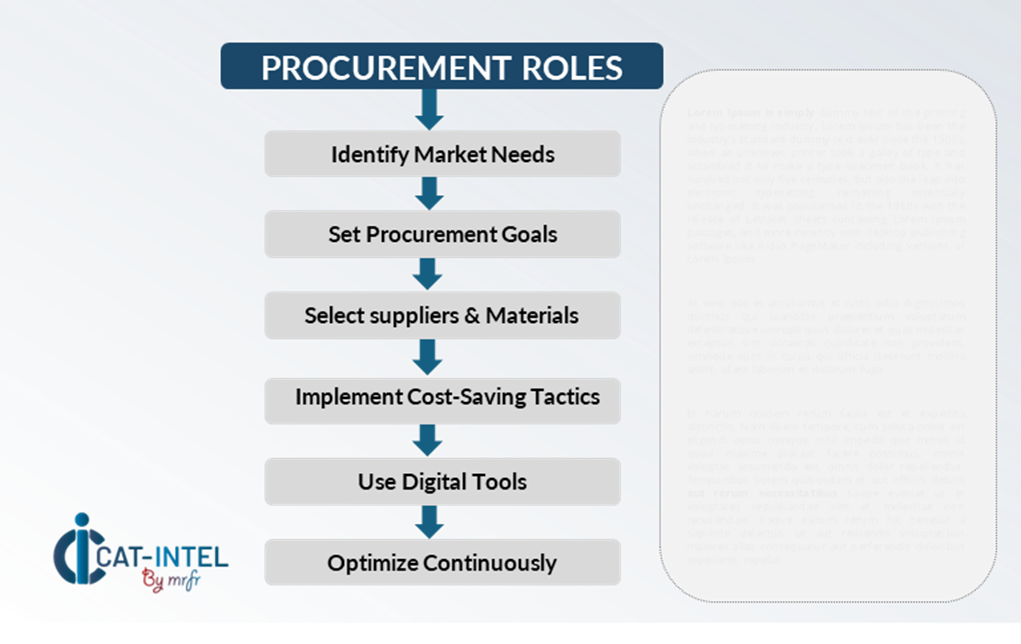

To stay competitive in the crates market, companies are streamlining procurement processes through spend analysis and supplier performance tracking. Effective category management and strategic sourcing are critical to reducing procurement costs and ensuring a consistent supply of high-quality crates. By leveraging actionable market intelligence, businesses can refine their procurement strategies and negotiate favourable terms for their crate requirements.

Pricing Outlook for Crates: Spend Analysis

The pricing outlook for crates is expected to remain moderately stable, with potential variations influenced by several key factors. Changes in raw material costs, such as plastic, wood, or metal, fluctuations in transportation expenses, and evolving regulatory standards for sustainable packaging are significant drivers of crate price trends. Additionally, the rising demand for eco-friendly crates, including those made from recyclable or biodegradable materials, is contributing to upward price pressures.

Graph shows general upward trend pricing for crates and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, improve supplier management, and adopt sustainable material innovations are essential for controlling costs. Leveraging digital tools for market monitoring, price forecasting through analytics, and efficient inventory planning can further enhance cost management.

Partnering with dependable crate suppliers, negotiating long-term contracts, and optimizing production workflows are key strategies to effectively manage crate pricing. Despite these challenges, maintaining product durability, aligning with sustainability goals, and adopting advanced manufacturing techniques will be critical to sustaining cost efficiency.

Cost Breakdown for Crates: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials (60%)

- Description: The primary costs in crate procurement include the purchase of raw materials like plastic resins, sustainably sourced wood, or metal components. These costs are significantly influenced by global material availability, market demand, and regional sourcing conditions.

- Trends: Companies are adopting strategies such as bulk material purchases, long-term supplier agreements, and sourcing from regional suppliers to mitigate price volatility. The increased use of recycled and biodegradable materials is also shaping price trends, often resulting in higher premiums for sustainable options.

- Labor (XX%)

- Publishing Services (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the crates industry, optimizing procurement processes and employing strategic negotiation tactics can lead to significant cost savings and improved operational efficiency. Establishing long-term agreements with crate suppliers, particularly in key production regions, can result in better pricing and favourable terms such as volume discounts and reduced shipping costs. Bulk purchasing and forward contracts also provide opportunities to secure lower rates and mitigate price volatility.

Collaborating with suppliers that prioritize sustainability and innovation can offer additional advantages, including access to eco-friendly crate solutions and cost reductions through efficient production methods. Implementing digital tools for supply chain management, such as real-time inventory tracking and demand forecasting systems, enhances operational efficiency, minimizes stockouts, and reduces overall procurement costs. Diversifying supplier networks and adopting multi-supplier strategies can mitigate risks such as material shortages or logistical disruptions and provide greater leverage during negotiations.

Supply and Demand Overview for Crates: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The crates market is experiencing steady growth, driven by rising demand across industries such as agriculture, logistics, and retail. The balance between supply and demand is influenced by factors like material availability, production costs, and global trade conditions.

Demand Factors:

-

Logistics and Supply Chain Requirements: The increasing demand for durable, reusable crates in logistics and warehousing is driving the need for reliable crate solutions. -

Sustainability Goals: The growing emphasis on sustainable packaging has increased demand for eco-friendly crates made from recycled or biodegradable materials. -

Industry-Specific Needs: Sectors such as agriculture and food packaging require specialized crate designs to meet regulatory standards and ensure product safety. -

Customization Trends: Rising demand for custom crates tailored to specific dimensions and operational requirements is pushing suppliers to offer innovative solutions.

Supply Factors:

-

Raw Material Costs: Availability and pricing of materials like plastic, wood, or metal significantly impact crate supply and costs. -

Technological Advancements: Innovations in manufacturing processes, such as automated molding and energy-efficient production, are improving supply reliability. -

Global Trade and Regulations: Trade policies, tariffs, and compliance with international standards influence the availability and pricing of crates in global markets. -

Operational Efficiency: Enhanced production techniques and streamlined logistics systems are ensuring consistent supply and shorter lead times.

Regional Demand-Supply Outlook: Crates

The Image shows growing demand for crates in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Crates Market

The Asia Pacific region, particularly China and India, is emerging as a dominant force in the global crates market due to several factors:

-

High Production Capacity: The region accounts for a significant share of global crate manufacturing, supported by expansive industrial zones and cost-effective production methods. -

Technological Integration: Automation in production processes and innovations in material science have enhanced the region's supply efficiency. -

Growing Logistics Sector: The booming e-commerce and agriculture industries in Asia Pacific are driving significant demand for crates. -

Focus on Sustainability: Manufacturers are increasingly adopting eco-friendly practices, including the use of recycled materials and energy-efficient production processes, to align with global sustainability standards. -

Innovation-Driven Growth: Investment in advanced manufacturing techniques and custom design capabilities is enabling the region to meet diverse market needs effectively.

Asia Pacific Remains a key hub Crates price drivers Innovation and Growth.

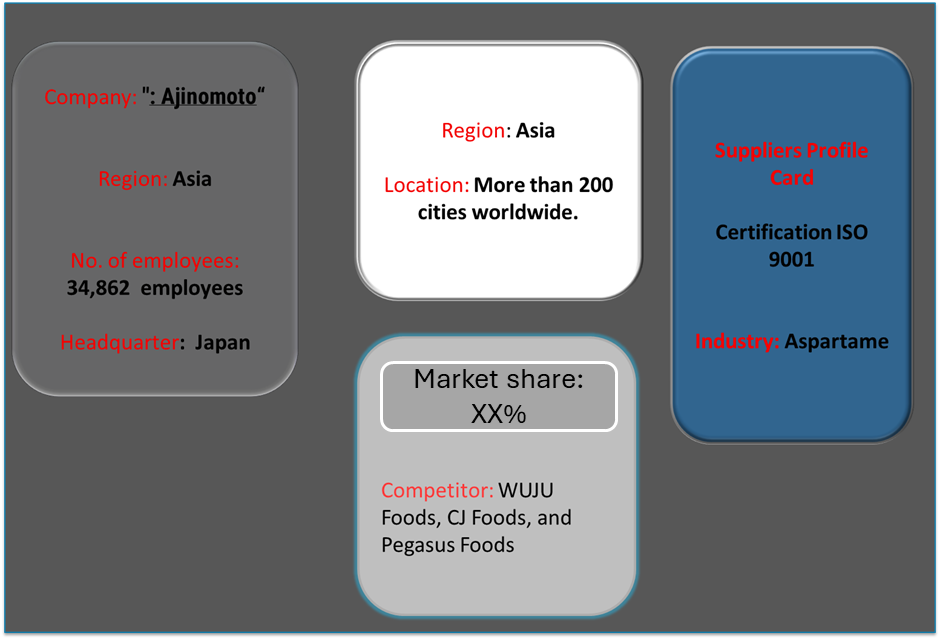

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the crates market is diverse and highly competitive, with a mix of global and regional suppliers driving industry trends. These suppliers significantly impact key factors such as pricing, material innovation, and service quality. The market is led by established manufacturers offering a wide range of crate solutions, while smaller, specialized suppliers cater to niche demands, such as custom-designed crates and eco-friendly materials.

The crate supplier ecosystem in major manufacturing regions includes prominent leaders and emerging players meeting global and regional needs. As demand for crates grows across industries like logistics, agriculture, and retail, suppliers are enhancing production capabilities, integrating advanced manufacturing technologies, and adopting sustainable practices to deliver high-quality, cost-effective, and environmentally friendly solutions.

Key Suppliers in the Crates Market Include:

- Tianjin Plastic Industry Co., Ltd.

- Shandong Lingling Crate Co., Ltd.

- Nippon Crates Corporation

- Kawasaki Heavy Industries

- Hanwha Solutions Corporation

- Hyundai Rotem Co.

- Sakura Crates Industries

- Plastic Centre SD Bud

- Dongguan Yufu Industrial Co., Ltd.

- Advance Crates Co., Ltd.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The crates market is witnessing steady growth due to rising demand in industries like agriculture, logistics, and manufacturing, particularly in emerging markets. |

Sustainability Focus |

There is an increasing emphasis on environmentally friendly crates, with a growing demand for recyclable, biodegradable, and reusable crate materials to reduce the environmental footprint. |

Product Innovation |

Manufacturers are diversifying their product lines, offering customized crate designs, stackable solutions, and specialty crates tailored for various industries like automotive and food packaging. |

Technological Advancements |

Innovations in crate production, such as automated injection molding and advanced material processing technologies, are improving durability, enhancing load capacity, and reducing production costs. |

Global Trade Dynamics |

Shifts in international trade policies, tariffs, and regional economic agreements are impacting crate supply chains, influencing material availability and pricing. |

Customization Trends |

The demand for crates designed for specific applications, such as temperature-controlled crates for perishable goods and heavy-duty crates for industrial equipment, is on the rise. |

|

Crates Attribute/Metric |

Details |

Market Sizing |

The global crates market is projected to reach USD 6.47 billion by 2032, growing at a CAGR of approximately 7.24 % from 2024 to 2032. |

Crate Technology Adoption Rate |

Around 50% of manufacturers are adopting advanced production technologies, such as automated injection molding and recycled materials, to enhance efficiency and sustainability. |

Top Crate Industry Strategies for 2024 |

Key strategies include adopting eco-friendly materials, optimizing supply chain management, focusing on product customization, and enhancing durability for various applications. |

Crate Process Automation |

Approximately 40% of crate manufacturers have implemented automation in molding, assembly, and quality control to improve productivity and reduce operational costs. |

Crate Process Challenges |

Major challenges include managing raw material price fluctuations, meeting environmental standards, ensuring consistent product quality, and addressing supply chain disruptions. |

Key Suppliers |

Leading suppliers in the crates market include Tianjin Plastic Industry Co. (China), Shanghai Pallet Industry Co. (China), and Neelkamal Limited (India), offering diverse crate solutions. |

Key Regions Covered |

Prominent crate manufacturing regions include Asia-Pacific, Europe, and North America, with significant demand in logistics, agriculture, and manufacturing industries. |

Market Drivers and Trends |

Growth is driven by the rising demand for reusable and sustainable crates, advancements in production technology, the need for cost-effective logistics solutions, and increasing customization for industry-specific applications. |