Summary Overview

Fleet Management Market Overview:

The global fleet management software market is steadily expanding, driven by rising demand in businesses such as transportation, logistics, construction, and utilities. This sector offers a wide range of solutions, including cloud-based, on-premises, and hybrid systems, all designed to optimize fleet operations. Our paper provides an in-depth investigation of procurement trends, with a concentration on methods to reduce costs and the use of technological advances to improve fleet management and operational workflows.

Looking ahead, key concerns for procurement in fleet management include limiting implementation costs, promising scalability, securing data integrity, and efficiently integrating new technologies with current infrastructure. The use of advanced digital technologies and strategic sourcing is critical for improving fleet management capabilities and retaining a competitive edge over the long term. The global demand for efficient fleet operations continues to rise, businesses are turning to market intelligence to drive operational excellence and mitigate potential risks, ensuring sustainable growth and improved efficiency.

-

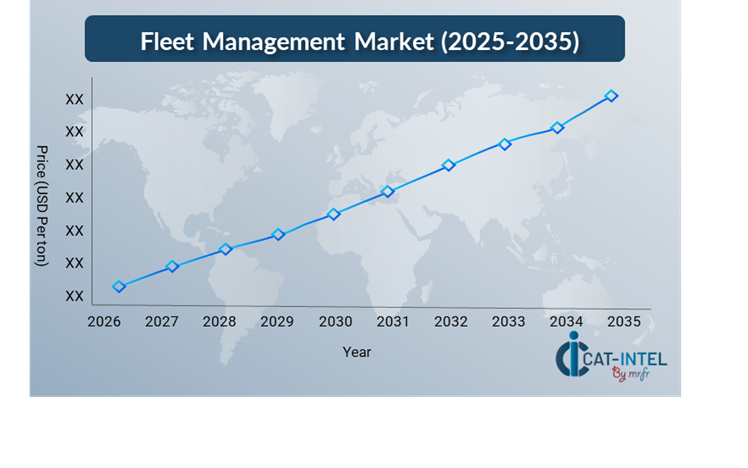

Market Size: The global Fleet Management market is projected to reach USD 108.7 billion by 2035, growing at a CAGR of approximately 14.96% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Optimizing Fleet Operations and Logistics: Real-time data and seamless process integration are becoming more vital to improve fleet operations and logistics management. -

Fleet Management and Transportation Expansion: Adopted advanced fleet management software for better vehicle tracking, route optimization, maintenance scheduling, and customer service interactions. -

Technological Transformation: Emerging innovations such as AI, machine learning, and IoT are improving fleet management software capabilities, permitting predictive maintenance, route optimization, and real-time fleet monitoring. -

Innovations: Modular fleet management systems empower businesses to tailor the system by picking only the elements customers require, lowering operational costs and complexity while maximizing adaptability. -

Investment Initiatives: Businesses are increasingly investing in cloud-based fleet management software to lower infrastructure costs, enhance scalability, and enable remote monitoring and management. -

Regional Insight: North America and Asia Pacific continue to be significant growth drivers, fuelled by strong digital infrastructure and a rising preference for scalable and efficient cloud-based solutions.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The expanding use of cloud-based fleet management systems enables higher scalability, cost-efficiency, and increased data access, hence improving fleet performance and decision-making. -

Advanced Features: Integrating AI, IoT, and blockchain technologies into fleet management software improves route planning, real-time tracking, and total fleet transparency, hence increasing operational efficiency. -

Sustainability Focus: Fleet management software enables more efficient resource management, allowing businesses to track fuel usage, emissions, and lower their overall carbon footprint, thereby supporting sustainability goals. -

Customization Trends: Demand for industry-specific fleet management systems is expanding ith tailored modules for sectors such as healthcare, logistics, and transportation that address unique operational needs. -

Data-Driven Insights: Advanced analytics and reporting features in fleet management systems help firms understand fleet performance, route optimization, maintenance requirements, and fuel usage, resulting in increased efficiency and cost savings.

Growth Drivers:

-

Digital Transformation: The accelerated implementation of digital technologies is altering fleet operations, improving efficacy, enhancing productivity, and enabling smarter decision-making.

-

Demand for Process Automation: The increased dependence on fleet management software to automate regular tasks, such as maintenance scheduling, fuel monitoring, and route optimization, is lowering operational bottlenecks and boosting efficiency.

-

Scalability Needs: Companies require fleet management solutions that can scale as their operations expand, ensuring seamless integration with existing systems while maintaining high performance.

-

Regulatory Compliance: Fleet management software assists businesses in meeting regulatory standards by automating reporting and ensuring accurate data collection and tracking compliance with transportation laws and environmental regulations.

-

Globalization: As businesses expand globally, there is a growing requirement for fleet management systems that support multiple currencies, languages, and international compliance, making it easier to manage fleets across borders.

Overview of Market Intelligence Services for the Fleet Management Market:

Recent analyses have determined significant challenges, such as high implementation costs and the need for system customization. Market intelligence studies are extremely useful for providing practical insights on procurement prospects. These insights assist firms in identifying cost-saving measures, streamlining supplier management, and improving implementation success. They also maintain compliance with industry standards and help the maintenance of high-quality operational processes, all while effectively managing expenses.

Procurement Intelligence for Fleet Management: Category Management and Strategic Sourcing

In the competitive landscape of fleet management software, companies are optimizing purchasing procedures by leveraging advanced spend analysis and tracking vendor performance. Effective category management and strategic sourcing are critical for lowering procurement costs and securing a steady supply of top-tier fleet management solutions. Businesses that use market intelligence can improve their procurement strategy, negotiate better terms, and assure access to innovative solutions that match their fleet management demands. This technique enables businesses to retain operational efficiency while decreasing costs and continuously improving their fleet operations.

Pricing Outlook for Fleet Management: Spend Analysis

The pricing prognosis for fleet management software is projected to be moderately dynamic, with swings caused by several major factors. These include innovations in technology, increased demand for cloud-based solutions, and the requirement for system customization. Regional pricing variations, as well as the growing adoption of AI, IoT integrations, and more emphasis on data security and compliance, are all driving up prices.

Graph shows general upward trend pricing for Fleet Management and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic

Managing procurement processes, improving vendor management, and implementing modular fleet management software are critical for keeping costs in check. Leveraging digital tools for market monitoring, utilizing analytics for price forecasting, and ensuring efficient contract management can further improve cost efficiency.

Building alliances with renowned fleet management firms, negotiating long-term contracts, and investigating flexible subscription-based pricing models are all excellent ways to lower costs. Despite such obstacles, emphasizing on scalability, robust implementation, and implementing cloud-based platforms will be critical to maintaining cost-effectiveness and operational excellence in fleet management.

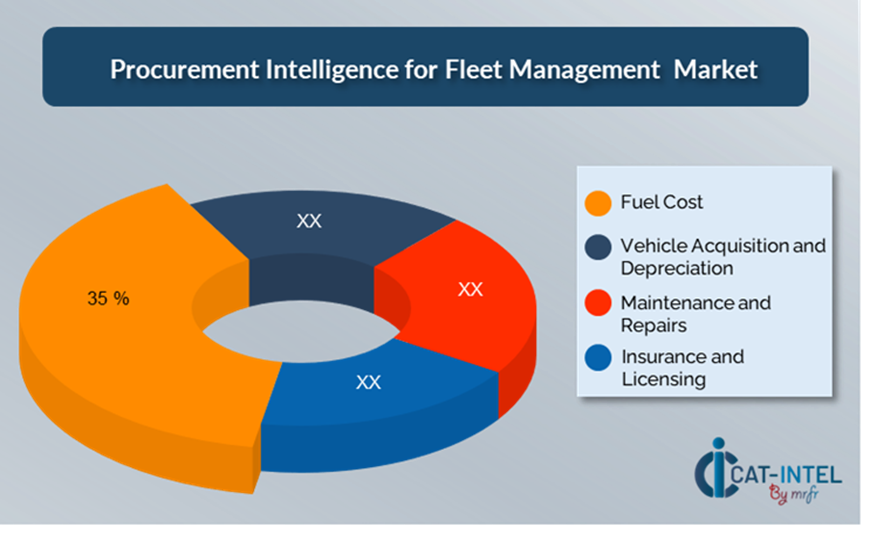

Cost Breakdown for Fleet Management: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Fuel Costs: (35%)

-

Description: Fuel is a primary operational expense that includes gasoline, diesel, and alternative fuels. Fuel consumption and route optimization both have an impact on these expenditures. Fuel management systems and energy-efficient automobiles can help you save money.

-

Trends: The transition to electric and hybrid vehicles, combined with route planning tools and real-time fuel monitoring, is lowering fuel usage and prices.

- Vehicle Acquisition and Depreciation: (XX%)

- Maintenance and Repairs Costs: (XX%)

- Insurance and Licensing Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fleet management software sector, organizing procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Establishing long-term relationships with reputable fleet management software vendors, particularly those offering cloud-based solutions, can lead to more appealing pricing models and terms, such as volume-based discounts and bundled service packages. Subscription-based arrangements and multi-year contracts allow you to lock in savings and defend against price increases over time.

Collaborating with fleet management providers who prioritize innovation and scalability provides additional advantages, such as access to cutting-edge technology like AI-driven analytics, IoT integration, and modular platforms, all of which help to reduce long-term cost of operation. Using digital technologies for procurement, such as contract management systems and utilization data, improves transparency, prevents over-provisioning, and optimizes software utilization across fleets.

Diversifying vendor alternatives and implementing multi-vendor solutions can reduce reliance on a single supplier, mitigate hazards such as service disruptions, and increase bargaining power, resulting in a more flexible and cost-effective fleet management solution.

Supply and Demand Overview for Fleet Management: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Fleet management software industry continues to thrive, led by an increasing emphasis on digital transformation in industries such as transportation, logistics, and construction. Technological developments, industry-specific customized needs, and global economic instances all have an impact on supply and demand dynamics.

Demand Factors:

-

Digital Transformation Initiatives: The heightened necessity of real-time fleet tracking, route optimization, and operational automation contributes to demand for fleet management software in a variety of industries.

-

Cloud Adoption Trends: The transition to cloud-based fleet management systems is generating demand for scalable, subscription-based software that enables for remote monitoring and management of fleet operations.

-

Industry-Specific Requirements: Transportation and logistics businesses demand fleet management solutions that are adapted to regulatory criteria, such as emissions tracking and safety compliance, and that are compatible with their operating workflows.

-

Integration Capabilities: There is a growing demand for fleet management software that effortlessly integrates with other business systems (such as enterprise resource planning or supply chain management) and IoT devices (such as sensors and telematics) to enhance data sharing and analysis.

Supply Factors:

-

Technological Advancements: AI, machine learning, and IoT innovations are boosting fleet management software capabilities, resulting in increased fleet efficiency through predictive maintenance, real-time data analysis, and smarter route planning.

-

Vendor Ecosystem: The expanding number of fleet management software suppliers, from inadequate solutions to large-scale vendors, guarantees consumers have a varied selection of options, allowing businesses to choose the right fit based on their unique needs.

-

Global Economic Factors: Currency exchange rates, labour costs, overall regional technology adoption rates all influence the pricing and availability of fleet management software, while global economic oscillates have an impact on supply chains and expenses.

-

Scalability and Capacity: Modern fleet administration solutions are becoming more modular, allowing providers to offer systems that cater to enterprises of all sizes, from small fleets to large-scale, exacerbated operations, with the capacity to scale as businesses grow.

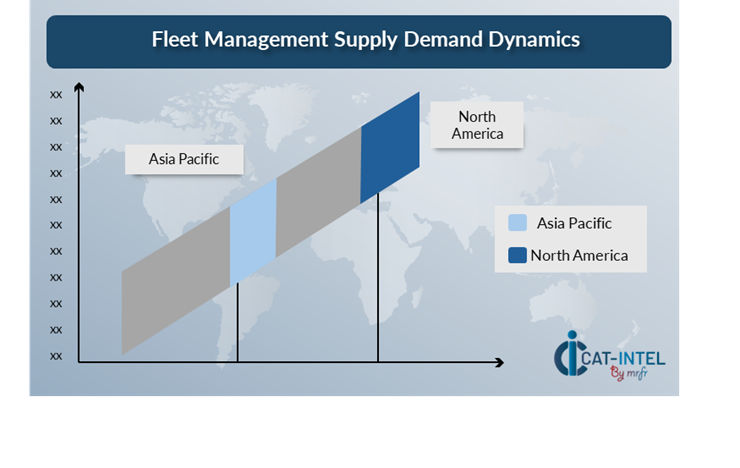

Regional Demand-Supply Outlook: Fleet Management

The Image shows growing demand for Fleet Management in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Fleet Management Market

North America, particularly Canada, is a dominant force in the global Fleet Management market due to several key factors:

-

Advanced Infrastructure: North America's transportation infrastructure is highly developed, making fleet management software critical for optimizing operations, lowering costs, and increasing service delivery throughout the area.

-

High Technology Adoption: The region is at the forefront of adopting digital technologies such as IoT, AI, and machine learning, which are integrated into fleet management systems to improve vehicle monitoring, predictive maintenance, and route optimization.

-

Strong Demand Across Industries: North American industries including logistics, transportation, and e-commerce rely heavily on effective fleet operations, creating a demand for current fleet management systems to manage big, complex fleets.

-

Regulatory Compliance: In North America, strict regulatory requirements for vehicle safety, emissions, and compliance drive firms to invest in fleet management software that helps achieve these criteria while maximizing operations.

-

Innovation and Investment: Several leading fleet management software providers and startups, encouraging continuous innovation and investment in fleet technologies, further strengthening the region's dominance in the market.

North America Remains a key hub Fleet Management Price Drivers Innovation and Growth

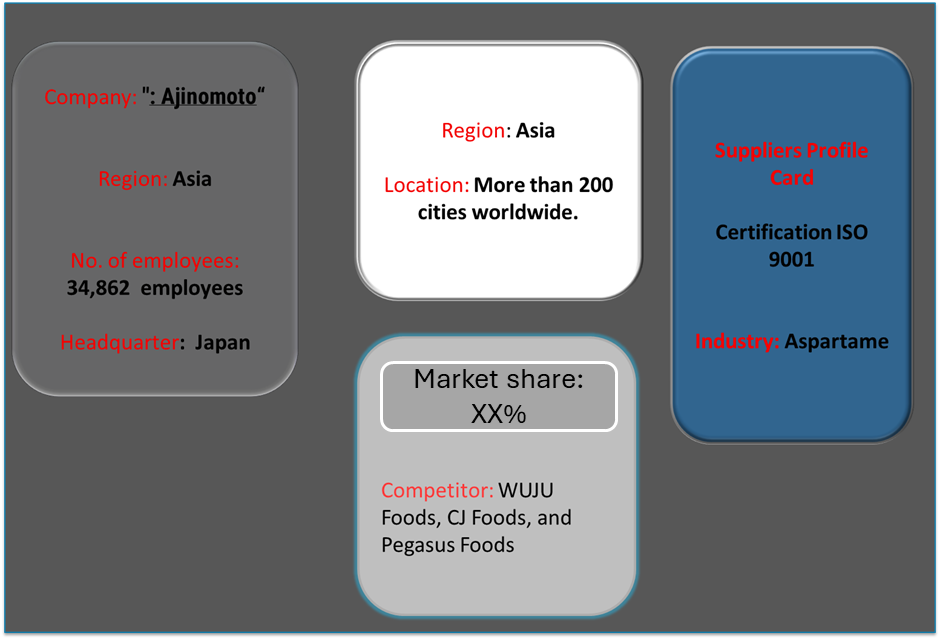

Supplier Landscape: Supplier Negotiations and Strategies

The supplier context of the fleet management software market is both diversified and competitive, with global industry leaders and local businesses influencing critical elements such as pricing strategies, software customisation, and service quality. Established vendors dominate the market with finished fleet management solutions, while smaller, niche adversaries specialize in certain business verticals or unique features such advanced data analytics, AI-powered route optimization, and IoT interfaces.

The fleet management software ecosystem covers important technological innovations regions, with renowned worldwide vendors and innovative local businesses meeting industry-specific demands such as regulatory compliance in transportation and emissions tracking in logistics. As enterprises prioritize digital transformation and better operational efficiency, fleet management software providers are improving cloud capabilities, integrating emerging technologies, and offering flexible subscription models to align with the evolving demands of fleet operations. These advancements allow companies to optimize vehicle performance, improve driver safety, and reduce operational costs.

Key Suppliers of the Fleet Management Market include:

- Geotab

- Samsara

- Fleet Complete

- Trimble Inc.

- Omnitracs

- Teletrac Navman

- Verizon Connect

- Zonar Systems

- Wheels Inc.

- GreenRoad Technologies

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The fleet management software market continues to grow as organizations embrace solutions to increase fleet efficiency, particularly in new markets looking for savings in expenses and service improvement. |

Cloud Adoption |

Scalability, cost-efficiency, and remote fleet monitoring have fuelled the migration to cloud-based fleet management solutions, especially within hybrid work models. |

Product Innovation |

Vendors are improving fleet management solutions with AI analytics, real-time data processing, and industry-specific modules geared to businesses such as logistics and transportation. |

Technological Advancements |

IoT, machine learning, and RPA are altering fleet management by providing predictive insights, automation, and real-time data use. |

Global Trade Dynamics |

Changes in global trade, including compliance and economic rules, have an impact on fleet management adoption for global businesses that manage complicated supply chains. |

Customization Trends |

There is an increasing demand for modular, customizable fleet management systems that allow integration with third-party tools to meet unique business needs. |

Fleet Management Attribute/Metric |

Details |

Market Sizing |

The global Fleet Management market is projected to reach USD 108.7 billion by 2035, growing at a CAGR of approximately 14.96% from 2025 to 2035. |

Fleet Management Technology Adoption Rate |

Approximately 54% of enterprises worldwide have used fleet management technology, with a strong shift toward cloud-based platforms for more scalability and flexibility. |

Top Fleet Management Industry Strategies for 2025 |

Major objectives for 2025 include leveraging AI and machine learning for predictive analytics, implementing modular solutions, addressing cybersecurity, and integrating handheld devices to improve accessibility. |

Fleet Management Process Automation |

Approximately 50% of fleet management software answers automate processes such as maintenance scheduling, route optimization, and compliance reporting to improve operational efficiency. |

Fleet Management Process Challenges |

Fleet management challenges include high implementation costs, employee reluctance to change, data migration concerns, and the requirement for frequent upgrades and maintenance. |

Key Suppliers |

· Leading suppliers in the market are Geotab, Samsara and Fleet Complete, as they prioritize digital transformation and better operational efficiency. |

Key Regions Covered |

Prominent regions for fleet management market are North America and Asia Pacific, fuelled by strong digital infrastructure and a rising preference for scalable and efficient cloud-based solutions |

Market Drivers and Trends |

The market is being pushed by a growing demand for centralized data management, increased cloud use, real-time analytics, and the integration of IoT and AI technologies. |