Summary Overview

Flexible Intermediate Bulk Containers (FIBC) Market Overview

The global Flexible Intermediate Bulk Containers (FIBC) market is steadily expanding, fuelled by demand from industries such as manufacturing, agriculture, chemicals, and logistics. This market provides a variety of FIBC solutions, including regular, anti-static, and food-grade containers. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of sophisticated technology to improve procurement and operational efficiency.

Key future procurement concerns include controlling raw material costs, ensuring container durability, adhering to industry standards, and incorporating FIBC solutions into current supply chains. Digital procurement tools and strategic sourcing are critical to maximizing FIBC adoption and guaranteeing long-term competitiveness. As global demand continues to climb, businesses are harnessing market intelligence to boost operational efficiency and manage risks in the supply chain.

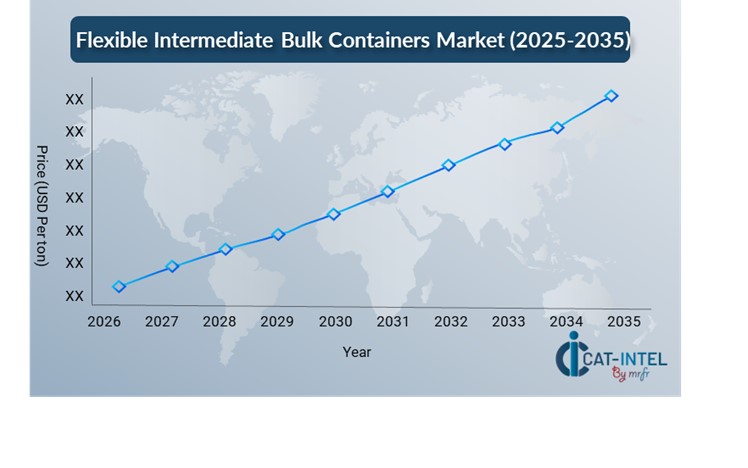

· Market Size: The global Flexible Intermediate Bulk Containers (FIBC) market is projected to reach USD 14.10 billion by 2035, growing at a CAGR of approximately 5.4% from 2025 to 2035.

· Sector Contributions: Growth in the market is driven by:

Ø Manufacturing and supply chain optimization: Real-time data and linked treatments are becoming ever more essential for streamlining FIBC operations, assuring effective material handling, and decreasing supply chain delays.

Ø Retail and E-commerce Growth: The need for FIBCs is growing with the growth of e-commerce, as businesses strive to improve packaging efficiency, storage, and shipment of bulk goods while satisfying customer expectations.

· Technological Transformation: AI and machine learning advancements are enhancing FIBC logistics by providing smarter inventory management, route optimization, and predictive analytics to increase supply chain efficiency.

· Innovations: Modular FIBC designs are being offered, allowing businesses to choose containers that are suited to their needs, lowering prices while increasing functionality and storage efficiency.

· Investment Initiatives: Businesses are investing in innovative FIBC materials and production technology to increase container performance, reduce environmental impact, and lower long-term operational costs.

· Regional insights: Asia Pacific and North America are key FIBC markets, owing to robust industrial sectors and rising demand for low-cost bulk packaging solutions.

Key Trends and Sustainability Outlook:

· Cloud Integration: There is a growing use of digital tools to track FIBC inventory, improve logistics, and increase supply chain transparency.

· Advanced Features: The use of IoT and blockchain to improve FIBC management, ensuring safe tracking and effective waste management.

· Sustainability Focus: There is an increase in demand for eco-friendly FIBCs, as well as a shift toward recyclable and reusable materials to meet sustainability standards.

· Customization Trends: There is a growing need for industry-specific FIBC solutions, such as food-grade containers for agricultural use and anti-static choices for chemical handling.

· Data-Driven Insights: Advanced analytics allow for better forecasting, inventory optimization, and real-time tracking of FIBC usage, reducing waste and improving operational efficiency.

· Digital Transformation: A greater reliance on digital technologies to improve FIBC tracking, inventory management, and operational efficiency.

· Demand for Process Automation: Automate conventional packaging and logistics procedures to improve productivity and reduce manual labour expenses in FIBC operations.

· Scalability Needs: Businesses want scalable FIBC systems that can expand with their needs, allowing for greater packaging and shipping flexibility.

· Regulatory Compliance: FIBC solutions that adhere to international regulations, ensuring the safe handling and transportation of bulk products.

· Globalization: There is growing demand for FIBCs that fulfil multi-regional standards, such as various regulatory and compliance requirements between nations.

Overview of Market Intelligence Services for the Flexible Intermediate Bulk Containers (FIBC) Market:

Recent evaluations have revealed significant procurement problems for Flexible Intermediate Bulk Containers (FIBC), including high material costs and the necessity for container customization. Market intelligence studies provide significant data that can assist businesses identify reducing expenses possibilities, streamline supplier management, and increase procurement efficiency. These insights also ensure industry compliance, high-quality operational operations, and smart expenditure control.

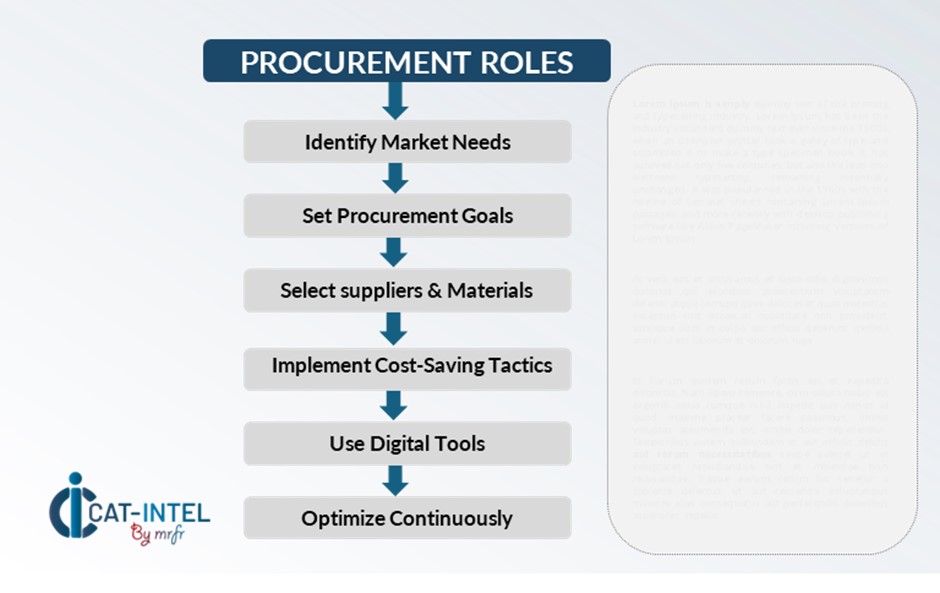

Procurement Intelligence for Flexible Intermediate Bulk Containers (FIBC): Category Management and Strategic Sourcing

To remain competitive in the FIBC market, businesses are fine-tuning their procurement strategies through expenditure analysis and vendor performance monitoring. Effective category management and strategic sourcing are critical for lowering procurement costs while promising a consistent supply of high-quality FIBC products. By employing actionable market intelligence, businesses can optimize their sourcing strategy and negotiate competitive prices with FIBC suppliers, assuring long-term value and operational

Pricing Outlook for Flexible Intermediate Bulk Containers (FIBC): Spend Analysis

The pricing outlook for Flexible Intermediate Bulk Containers (FIBC) is likely to be moderately volatile, impacted by several factors. Raw material price fluctuations, need for specialized container designs, regional cost variances, and rising sustainability standards are all major drivers. Furthermore, the deployment of new production methods, combined with a greater emphasis on safety and compliance, is putting increased pressure on FIBC price.

Efforts to optimize procurement procedures, improve vendor management, and implement modular FIBC solutions are critical for cost control. Leveraging digital tools for market monitoring, analytics-based pricing predictions, and effective contract administration can help to reduce costs even more.

Partnering with reputable FIBC suppliers, establishing agreements for a long time, and investigating bulk purchasing options are all excellent strategies for managing FIBC expenses. Despite the hurdles, focusing on container durability, adopting sustainable materials, and streamlining logistics will be critical to maintaining cost-effectiveness and operational efficiency.

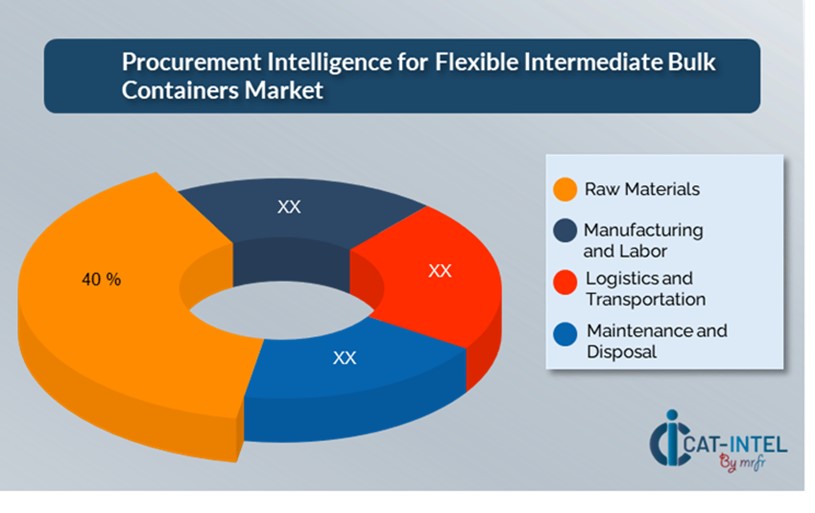

Cost Breakdown for Flexible Intermediate Bulk Containers (FIBC): Total Cost of Ownership (TCO) and Cost-Saving Opportunities

1. Raw Material Costs: (40%)

Ø Description: The majority of FIBC raw material expenditures are for polypropylene (PP) fabric, with additional prices for additives, liners, and discharge spouts. Price changes are affected by market demand and geopolitical conditions.

Ø Trends: Polypropylene prices fluctuate due to global oil prices and supply chain problems. There is an increasing demand for environmentally friendly and recyclable products, which has an impact on cost structures.

2. Manufacturing and Labour Costs: (XX%)

3. Logistics and Transportation Costs: (XX%)

4. Maintenance and disposal Costs (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Flexible Intermediate Bulk Containers (FIBC) industry, streamlining procurement processes and utilizing strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term relationships with FIBC suppliers, particularly those who provide innovative and sustainable solutions, can result in improved pricing structures and more advantageous conditions, such as volume-based discounts and bundled service packages. Bulk purchase methods and multi-year contracts allow you to achieve lower rates and better control costs over time.

Collaborating with FIBC suppliers who encourage innovation and scalability provides additional benefits, such as access to innovative materials, eco-friendly possibilities, and customizable designs, which reduce long-term operational expenses. Implementing digital procurement approaches, such as contract management systems and usage statistics, improves transparency, reduces overspending, and optimizes container utilization. Diversifying vendor options and employing multi-vendor strategies can reduce dependency on a single supplier, mitigate risks such as supply chain disruptions, and strengthen negotiating leverage.

Supply and Demand Overview for Flexible Intermediate Bulk Containers (FIBC): Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Flexible Intermediate Bulk Containers (FIBC) market is steadily expanding, fuelled by rising demand in industries such as manufacturing, agriculture, and logistics. Technological improvements, industry-specific requirements, and global economic situations possess an influence on supply and demand dynamics.

Demand Factors:

1. Additional Logistics Requirements: Growing demand for efficient storage and transportation options is driving FIBC growth, particularly in the bulk shipping sector.

2. Shift Towards Sustainable Practices: Developing environmental awareness and the use of eco-friendly containers drive demand for FIBC solutions.

3. Customization and Industry-unique Solutions: Industries such as food, pharmaceuticals, and chemicals demand FIBC solutions that are suited to regulatory standards and unique operational requirements.

4. Integration Capabilities: The demand for FIBC systems that connect easily into automated packaging and shipping operations is increasing.

Supply Factors:

1. Technological Advancements: Novel material science and production techniques improve FIBC performance and supplier competitiveness.

2. Vendor Ecosystem: With an expanding number of FIBC suppliers, both major and niche, businesses have a varied range of possibilities.

3. Global Economic Factors: Raw material price oscillations, transportation costs, and regional production capacities all have an impact on FIBC pricing and availability.

4. Scalability and Flexibility: Modern FIBC systems are growing more configurable, enabling suppliers to cater to enterprises of all sizes and industries.

Regional Demand-Supply Outlook: Flexible Intermediate Bulk Containers (FIBC)

Asia Pacific: Dominance in the Flexible Intermediate Bulk Containers Market

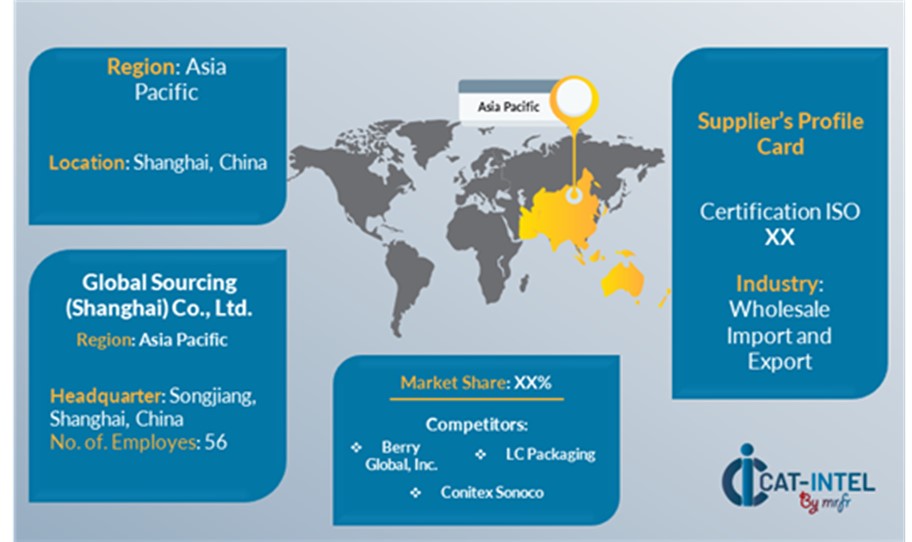

Asia Pacific, particularly China, is a dominant force in the global FIBC software market due to several key factors:

1. Strong Manufacturing Capabilities: Asia Pacific possesses a well-established manufacturer base, particularly in China, India, and Thailand, where FIBC production is affordable due to lower labour and overhead costs.

2. Growing Industrial Demand: The region's growing industrialization, particularly in industries such as chemicals, agriculture, and construction, has raised demand for FIBCs to efficiently carry commodities in bulk.

3. Export Hub for FIBCs: Asia Pacific, particularly China and India, is a global hub for FIBC production, with considerable exports to North America, Europe, and other countries, contribute to the region's market domination.

4. Material Availability: The location has ready access to vital raw resources, such as polypropylene, which is used extensively in FIBC production, providing a competitive edge in production costs and supply chain efficiency.

5. Technological Advancements: Asia Pacific has witnessed significant advancements in FIBC manufacturing technologies, enabling suppliers to produce high-quality, durable, and customized solutions at a large scale, meeting diverse industry requirements

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the Flexible Intermediate Bulk Containers (FIBC) market is both expanded and competitive, with an amalgamation of global leaders and regional players affecting important market dynamics. These vendors influence crucial elements such as cost, product individualization, and service quality. Large, established FIBC manufacturers dominate the market with comprehensive, standardized solutions, whilst smaller, specialist providers cater to certain industries, offering tailored options such as eco-friendly containers, sophisticated package designs, and unique material possibilities.

The FIBC supplier ecosystem spans important global regions, with big companies and creative local providers catering to specific industry demands such as agriculture, chemicals, and food packaging. As organizations adopt more sustainable practices and efficiency-driven solutions, FIBC vendors are upgrading material technology, delivering customized container solutions, and providing flexible pricing and delivery models to address evolving market demands.

Key Suppliers in the FIBC market include:

· Global Sourcing (Shanghai) Co., Ltd.· Berry Global, Inc.· Conitex Sonoco· LC Packaging· Greif, Inc.· Sackmaker· Rishi FIBC· Yuanxiang Plastic Co., Ltd.· Uttam Poly Plast Pvt Ltd.· Taihua Groupeeting diverse industry requirements.Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The FIBC market continues to grow as businesses seek cost-effective, efficient packaging solutions, particularly in emerging markets where agriculture, chemicals, and food processing are prevalent. |

Cloud Adoption |

The application of cloud-based FIBC solutions is growing due to scalability, cost-effectiveness, and the necessity for quick, remote access, particularly with the emergence of hybrid operational models. |

Product Innovation |

Manufacturers are updating FIBC products with novel features like as eco-friendly materials, customisable designs, and enhanced monitoring capabilities to meet unique market demands. |

Technological Advancements |

The integration of technologies such as IoT for real-time tracking and automation enhances the functionality of FIBC systems, allowing organizations to optimize logistics and inventory management. |

Global Trade Dynamics |

Changes in global trade legislation and compliance standards affect the need for customized FIBC solutions, particularly for companies managing complex, international supply chains. |

Customization Trends |

Industries in search of flexible and efficient packaging solutions are driving an increase in demand for tailored FIBC products with adjustable sizes, materials, and additional functionality. |

|

Attribute/Metric |

Details |

Market Sizing |

The global Flexible Intermediate Bulk Containers (FIBC) market is projected to reach USD 14.10 billion by 2035, growing at a CAGR of approximately 5.4% from 2025 to 2035.

|

FIBC Technology Adoption Rate |

Approximately 60% of enterprises globally use Flexible Intermediate Bulk Containers (FIBC) for bulk packaging, with a focus on innovative materials and designs for increased scalability and efficiency.

|

Top FIBC Industry Strategies for 2024 |

Principal strategies include integrating smart packaging solutions based on AI and IoT for real-time tracking, optimizing shipping operations with customisable FIBC solutions, improving product safety with improved materials, and using eco-friendly, reusable options to reduce environmental effect.

|

FIBC Process Automation |

Material handling and operational procedures such as filling, sealing, and tracking, are automated in approximately 54% of FIBC deployments, to improve operational efficiency and reduce labour costs.

|

FIBC Process Challenges |

Major hurdles include high upfront prices for sophisticated materials, the difficulty of standardizing across industries, environmental concerns about single-use plastics, and the necessity for constant innovation to suit changing market demands |

Key Suppliers |

Leading suppliers for FIBC market include Global Sourcing (Shanghai) Co., Ltd., Berry Global, Inc. and Conitex Sonoco.

|

Key Regions Covered |

Prominent regions for FIBC are Asia Pacific and North America, owing to robust industrial sectors and rising demand for low-cost bulk packaging solutions. |

Market Drivers and Trends |

The growing need for effective bulk packaging solutions, increased demand for sustainable and reusable packaging, advances in material science, and the incorporation of smart technologies for supply chain optimization all contribute to growth.

|