Summary Overview

Flexible Packaging Australia Market Overview:

The flexible packaging market in Australia is expanding rapidly, driven by rising demand in major industries such as food and beverage, medical treatment, consumer products, and retailing. This market covers a variety of solutions for packaging, such as sustainable, multi-layer, and resealable presentation, to meet distinct consumer preferences and sustainability trends. Our analysis focuses on procurement trends, with an emphasis on methods to reduce costs and the use of novel packaging technologies to improve manufacturing and distribution processes.

Future procurement problems involve monitoring production costs, assuring scalability for big numbers, maintaining product integrity during distribution, and addressing environmental concerns with sustainable packaging solutions. As market demand grows, businesses use advanced market information and targeted procurement to increase operational efficiencies, eliminate waste, and limit risks. This strategy is essential for long-term competitiveness and positioning in a rapidly evolving market.

-

Market Size: The global Flexible Packaging Australia market is projected to reach AUD 6.9 billion by 2035, growing at a CAGR of approximately 7.70% from 2025 to 203

Growth Rate: 7.70%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: There is an expanding need for real-time data and process automation to streamline production and distribution while increasing cost efficiency and agility.

-

Growth in shopping and E-Commerce: There is a demand for sustainable and efficient packaging solutions to support inventory management and environmentally sensitive consumer preferences in online shopping.

-

Technological Transformation: Advances in machine learning and artificial intelligence improve forecasting, production efficiency, and packaging personalization.

-

Packaging Innovations: Modular, customizable packaging solutions help to reduce waste, complexity, and cost while fulfilling consumer desire for personalized options.

-

Investment Initiatives: Increasing investments in sustainable, environmentally friendly packaging solutions to meet consumer and regulatory expectations.

-

Regional Insights: Australia is concentrating on improving digital infrastructure to improve packaging operations and meet market demand for sustainability.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Using cloud-based solutions to enhance scalability, reduce costs, and improve data access across supply chains.

-

Advanced Features: AI, IoT, and blockchain integration for improved monitoring, waste reduction, and transparency in packaging operations.

-

Sustainability Focus: Eco-friendly materials and environmentally conscious packaging solutions are prioritized to meet regulatory criteria and consumer demand.

-

Customization Trends: There is a growing demand for specific to an industry packaging solution to help differentiate products in competitive marketplaces.

-

Data-Driven Insights: Advanced analytics for improved inventory management, minimizing waste, and demand forecasting.

Growth Drivers:

-

Digital Transformation: Using digital technologies to boost productivity and automate critical procedures.

-

Demand for Process Automation: Automation is increasingly being used in packaging to decrease bottlenecks and increase consistency.

-

Scalability Requirements: Flexible packaging options that can accommodate rising demand without compromising product quality.

-

Regulatory Compliance: Packaging solutions developed to meet changing environmental requirements and industrial norms.

-

Globalization: Increased demand for adaptable packaging that fulfils international market requirements, such as bilingual labelling and compliance.

Overview of Market Intelligence Services for the Flexible Packaging Australia Market:

Recent evaluations have revealed significant obstacles, including high implementation costs and the requirement for system modification. Market data delivers significant information that help businesses identify cost-cutting possibilities, optimize supplier management, and increase implementation success. These insights also enable industry compliance, high-quality operations, and optimal cost management.

Procurement Intelligence for Flexible Packaging Australia: Category Management and Strategic Sourcing

To be competitive in the flexible packaging market, organizations are improving procurement through spend monitoring and supplier performance tracking. Strong category management and strategic sourcing are critical for lowering procurement costs and ensuring a steady supply of high-quality packaging solutions. Companies can improve their procurement strategies and negotiate better terms with packaging materials and suppliers by using market intelligence

Pricing Outlook for Flexible Packaging Australia: Spend Analysis

The pricing outlook for flexible packaging in Australia is projected to be moderately dynamic, influenced by technology improvements, need for sustainable packaging, customization requirements, and regional cost variances. The growing adoption of smart packaging technologies such as IoT integration, along with an increased emphasis on environmental and regulatory compliance, is projected to drive up packaging costs.

Graph shows general upward trend pricing for Flexible Packaging Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To control costs, businesses must focus on streamlining procurement procedures, enhancing supplier management, and using flexible packaging solutions that meet market demands. Using digital technologies for market monitoring, pricing forecasting using analytics, and efficient contract administration will increase cost efficiency.

Partnering with reputable Australian manufacturing suppliers, arranging long-term contracts, and investigating volume-based pricing methods will all assist to control costs. Despite these obstacles, concentrating on scalability and efficient supply chain management, and adopting sustainable, eco-friendly packaging options will be crucial for maintaining cost-effectiveness and operational excellence in the Australian market.

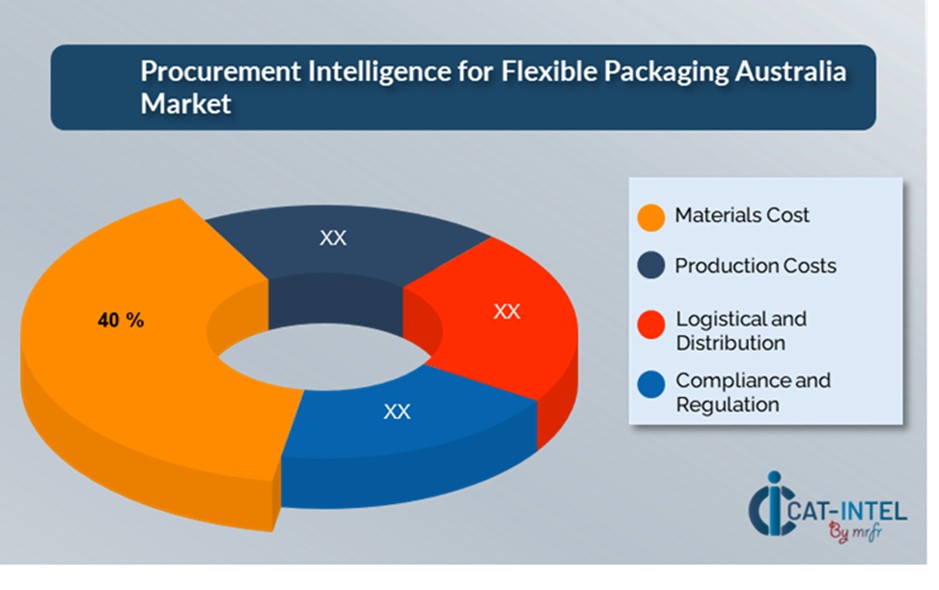

Cost Breakdown for Flexible Packaging Australia: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

-

Material Costs: (40%)

-

Description: Material costs account for the majority of flexible packaging expenses, including the procurement of raw materials such as films, foils, laminates, inks, and coatings. The kind, quality, and sustainability of materials have a direct impact on pricing.

-

Trends: As organizations seek to reduce their environmental effect, there is an increasing demand for eco-friendly packaging materials.

-

2. Production Costs: (XX%) - Logistical and Distribution: (XX%)

-

Compliance and Regulation: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the flexible packaging business, streamlining procurement processes and implementing strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term agreements with packaging suppliers, particularly those that provide sustainable and creative solutions, can result in more favourable price arrangements, such as volume-based discounts and bundled service packages. Subscription-based models and multi-year contracts provide options to get better rates while reducing the risk of price rises over time.

Partnering with suppliers who prioritize innovation and scalability brings additional benefits, such as access to eco-friendly packaging solutions, sophisticated materials, and customisation choices, all of which assist to lower long-term operating expenses. Implementing digital procurement technologies such as contract management systems and use analytics increases transparency, reduces overordering, and optimizes package utilization. Diversifying vendor alternatives and implementing a multi-vendor system strategy can also reduce dependence on a single supplier, mitigate risks like supply chain disruptions, and strengthen negotiating leverage, ultimately ensuring a more resilient and cost-effective procurement strategy.

Supply and Demand Overview for Flexible Packaging Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The flexible packaging market in Australia is growing steadily, driven by rising demand for creative and sustainable packaging solutions in industries such as food & beverage, healthcare, and retail. Technological improvements, industry-specific needs, and macroeconomic situations all have an impact on supply and demand dynamics.

Demand Factors:

-

Sustainability Initiatives: As organizations seek to lessen their environmental imprint, there is an increasing need for eco-friendly and recyclable packaging solutions across multiple industries.

-

E-Commerce and Retail Growth: The rise of online shopping is increasing need for efficient, long-lasting, and adaptable packaging to facilitate rapid and safe product deliveries.

-

Industry-special Requirements: Industries like as food and beverage and pharmaceuticals require packaging solutions that are adapted to regulatory standards, product safety, and special operational requirements.

-

Integration with Smart Technologies: There is a growing demand for flexible packaging that works with IoT devices and other smart technologies to improve tracking, traceability, and supply chain visibility.

Supply Factors:

-

Technological Advancements: Advances in packaging materials, automation, and electronic printing technologies are expanding flexible packaging alternatives, increasing supplier competitiveness, and boosting production efficiency.

-

Vendor Ecosystem: The Australian market is seeing an increase in the number of flexible packaging providers, ranging from huge international organizations to niche, local producers with a diversified product offering.

-

Global Economic Factors: Exchange rates, labour costs, and regional willingness to embrace environmentally conscious packaging trends all influence the pricing and availability of packaging materials in Australia.

-

Scalability and Customization: Modern flexible packaging solutions are more modular, enabling suppliers to tailor to businesses of various sizes and product types, from small businesses to large-scale manufacturers.

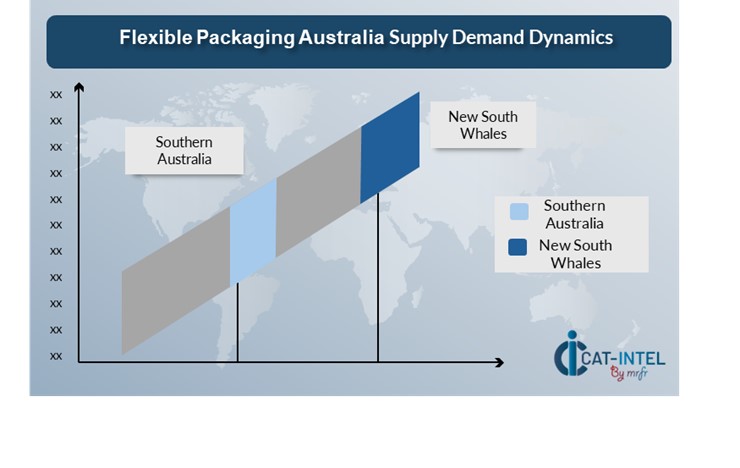

Regional Demand-Supply Outlook: Flexible Packaging Australia

The Image shows growing demand for Flexible Packaging in Australia in both New South Whales and Southern Australia, with potential price increases and increased Competition

New South Whales: Dominance in the Flexible Packaging Australia Market

New South Whales, particularly the Sydney, is a dominant force in the global Flexible Packaging Australia market due to several key factors:

-

Strategic Location and Infrastructure: NSW is strategically located near major ports such as Sydney and Newcastle, making it easily accessible to both local and international markets. This robust logistics infrastructure enables efficient transportation and distribution of packaging materials.

-

Concentration of Manufacturing and Industrial Activity: New South Wales has a huge number of enterprises and industries that rely extensively on flexible packaging, particularly in the food, beverage, and consumer goods sectors. The concentration of these businesses drives the demand for packaging solutions.

-

Access to a trained Workforce: The state provides a highly trained workforce with knowledge in packaging technology, innovation, and design, which is critical.

-

Focus on Sustainability and Innovation: Many regional suppliers are working to produce recyclable, biodegradable, and low-impact packaging choices, which aligns with rising customer and regulatory needs for environmentally friendly products.

-

Large Number of Key Packaging Suppliers: Many of Australia's largest flexible packaging suppliers, such as Amcor and Sealed Air, have a significant presence in New South Wales.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the Australian flexible packaging market is diversified and fiercely competitive, with a mix of global industry leaders and regional players dictating market dynamics. These providers influence pricing structures, options for customization, and service quality. The market is dominated by well-known multinational packaging businesses that provide complete, large-scale packaging solutions, while lessened, specialized businesses focus on niche markets or distinctive features such as sustainable materials and smart packaging technology.

Australia's flexible packaging ecosystem comprises both well-known worldwide vendors and creative local firms that cater to industry-specific demands. As businesses prioritize sustainability, efficiency, and customer convenience, packaging providers are developing eco-friendly materials, incorporating smart packaging technology, and providing flexible alternatives to meet changing business demands. These suppliers are also adapting to trends in customization, regulatory compliance, and scalability, ensuring packaging solutions are tailored to the diverse needs of Australian industries.

Key Suppliers in the Flexible Packaging in Australia include:

- Detmold Group

- Amcor Limited

- Sealed Air

- Polyart (Australia)

- Sappi Lanaken

- SUEZ Recycling & Recovery

- Novolex

- Kerry Group

- Australian Packaging and Processing Machinery Association (APPMA)

- Klockner Pentaplast

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The flexible packaging market in Australia is expanding rapidly, driven by the demand for creative, sustainable packaging solutions in industries such as food and beverage, healthcare, and retailing. Companies are increasingly focusing on packaging that simplifies operations, improves product safety, and meets consumer demand for environmentally responsible solutions. |

Cloud Adoption |

In Australia, there is an increasing trend of using cloud-based technologies for packaging supply chain management. This change is driven by the demand for scalability, cost-efficiency, and remote accessibility, particularly as firms transition to hybrid work models and seek to optimize operations across multiple sectors. |

Product Innovation |

Australian flexible packaging suppliers are increasing their product offerings with smart packaging technologies that combine IoT and RFID for real-time tracking. Also, AI-powered package designs and advanced materials are being developed to meet the increasing demand. |

Technological Advancements |

IoT, machine learning, and automation are improving packaging capabilities in Australia. These advances enable organizations to monitor packaging materials in real time, decrease production waste, increase productivity, and provide more sustainable options to meeting regulatory demands. |

Global Trade Dynamics |

Changes in global trade legislation and compliance requirements are altering Australia's flexible packaging market. Multinational corporations are adjusting to new environmental rules, with Australian suppliers providing solutions that meet international sustainability and compliance criteria, resulting in easier operations in global supply chains. |

Customization Trends |

In Australia, there is an increasing demand for customized flexible packaging solutions. Companies seek modular, adjustable package solutions that match individual product needs and provide flexibility for interaction with third-party tools, ensuring both sustainability and superior functionality for diverse industries. |

|

Flexible Packaging Australia Software Attribute/Metric |

Details |

Market Sizing |

The global Flexible Packaging Australia market is projected to reach AUD 6.9 billion by 2035, growing at a CAGR of approximately 7.70% from 2025 to 2035.

|

Flexible Packaging Australia Technology Adoption Rate |

Approximately 65% of Australian businesses are implementing sophisticated flexible packaging technologies, with a strong emphasis on sustainable and smart packaging solutions that include IoT and AI for improved tracking and efficiency.

|

Top Flexible Packaging Australia Industry Strategies for 2025 |

Key strategies for the Australian flexible packaging market in 2024 include integrating AI and machine learning for predictive analytics, increasing production efficiency, and implementing modular packaging solutions to reduce waste. |

Flexible Packaging Australia Process Automation |

Approximately 55% of Australian packaging industries automate regular processes such as inventory management, production scheduling, and compliance reporting. |

Flexible Packaging Australia Process Challenges |

Major obstacles in the Australian flexible packaging sector include high costs associated with new technology adoption, and resistance to change. |

Key Suppliers |

Leading suppliers in the Flexible Packaging Market in Australia include Detmold Group, Amcor Limited and Sealed Air. |

Key Regions Covered |

Prominent regions for the market are New South Whales, Southern Australia, Victoria, dominating the market of flexible packaging. |

Market Drivers and Trends |

The Australian flexible packaging market is expanding due to the growing demand for sustainable packaging, the increased usage of smart packaging technologies such as IoT, and the growing demand for packaging solutions that provide real-time business data.

|