Summary Overview

Floating Production Storage and Offloading (FPS & FPSO) Market Overview:

The global Floating Production Storage and Offloading (FPSO) market is steadily expanding, driven by rising demand for offshore oil and gas exploration and production. This market includes a variety of FPSO solutions, including as newly built units, converted units, and lease choices. Our paper presents a full examination of procurement trends, with an emphasis on cost optimization tactics and the use of digital technology to increase operational efficiency in FPSO operations.

Key future procurement complications include managing capital and operational spending, guaranteeing system scalability for changing production capacities, maintaining safety and sustainability standards, and integrating FPSOs with existing onshore infrastructure. Modern procurement tools and strategic sourcing are critical for maximizing FPSO adoption, reducing costs, and assuring long-term operational success. As global consumption of energy continues to increase, companies are leveraging market intelligence to enhance offshore production capabilities, mitigate risks, and navigate the complexities of regulatory compliance and operational logistics.

-

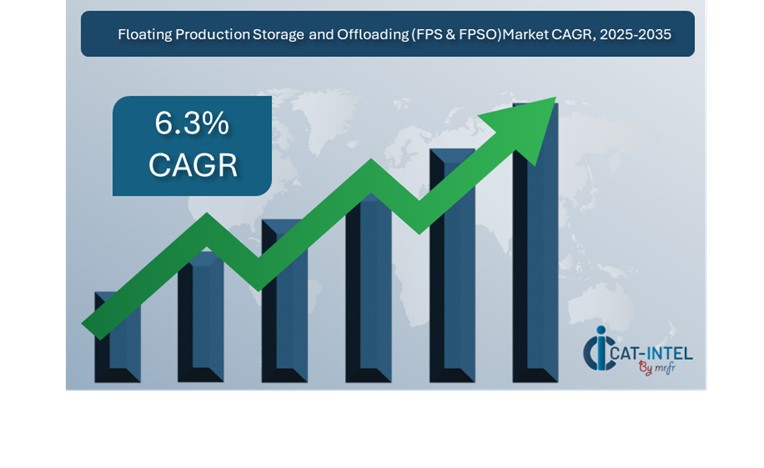

Market Size: The global Floating Production Storage and Offloading (FPS & FPSO) market is projected to reach USD 47.1 billion by 2035, growing at a CAGR of approximately 6.3% from 2025 to 2035

Growth Rate: 6.3%

-

Sector Contributions: Growth in the market is driven by: -

Optimizing Offshore Production and Exploration: Real-time monitoring and process integration are becoming increasingly important to streamline operations on offshore platforms. -

Energy and Resource Demand: Use FPSO units to optimize oil and gas extraction, increase production efficiency, and reduce environmental impact. -

Technological Transformation: Developments in automation, computational intelligence, and data analytics are enhancing FPSO capabilities, allowing for real-time data processing, predictive maintenance, and optimized systems. -

Innovations: Newer, versatile FPSO designs enable businesses to grow operations, cut costs, and respond to changing market conditions and exploration objectives. -

Investment Initiatives: Increased investment in FPSO technologies to support oil and gas projects, lower infrastructure costs, and enable more remote and safe offshore production. -

Regional Insights: The Asia-Pacific and Middle Eastern areas remain key contributors, with increasing demand fuelled by offshore oil and gas production and strong infrastructure investments.

Key Trends and Sustainability Outlook:

-

Environmental and Safety Focus: The growing use of FPSOs to fulfil higher environmental regulations while optimizing offshore capacity for manufacturing. -

Advanced Features: Use of smart technologies such as IoT and predictive maintenance tools to enhance decision-making, operational efficiency, and transparency. -

Sustainability Focus: By reducing emissions and enhancing production monitoring, FPSOs assist businesses in effectively handling resources and meeting sustainability goals,

-

Customization Trends: There is an increasing demand for FPSO units designed specifically for offshore projects such as offshore exploration, oilfield development, and the extraction of natural gas. -

Data-Driven Insights: Real-time analytics on FPSOs improves decision-making, resource management, and safety standards.

Growth Drivers:

-

Energy Transition: The global trend towards sustainable energy and greater oil and gas advancement is driving demand for efficient FPSO systems. -

Operational Efficiency: Leveraging FPSOs to decrease operational bottlenecks, boost offshore production, and optimize supply chain logistics. -

Scalability Requirements: Companies want adaptable FPSO solutions that can support rising offshore production capacity while improving operating performance. -

Regulatory Compliance: FPSO systems help meet safety, environmental, and production reporting regulations. -

Globalization: The desire for FPSOs that can operate in a variety of offshore sites with varying regulatory, environmental, and production requirements.

Overview of Market Intelligence Services for the Floating Production Storage and Offloading (FPS & FPSO) Market:

Recent evaluations have revealed major problems in the Floating Production Storage and Offloading (FPSO) business, including as costly initial capital expenditure and the complexity of modifying units for unique offshore operations. Market intelligence reports give meaningful insights to help businesses uncover cost-cutting possibilities, optimize supplier management, and improve the success of FPSO deployments. These insights also help with meeting environmental and safety standards, preserving operational efficiency, and minimizing long-term operating expenses.

Procurement Intelligence for Floating Production Storage and Offloading (FPS & FPSO): Category Management and Strategic Sourcing

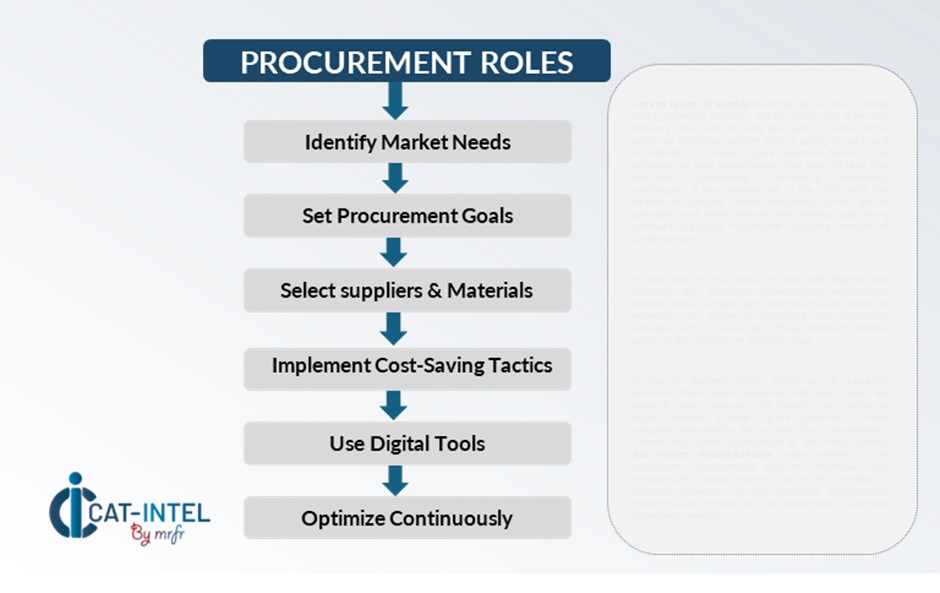

To remain competitive in the FPSO market, organizations optimize procurement procedures through spend monitoring and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while maintaining the supply of dependable, high-quality FPSO units. Businesses can use actionable market intelligence to enhance their procurement strategies and acquire favourable terms for FPSO units and ensure long-term operational success with efficient and scalable solutions.

Pricing Outlook for Floating Production Storage and Offloading (FPS & FPSO): Spend Analysis

The pricing outlook for Floating Production Storage and Offloading (FPSO) units is likely to be moderately dynamic, with potential changes caused by a variety of causes. Advancements in offshore technology, increased demand for advanced FPSO units, customization demands for specific oil and gas projects, and regional cost variances are all crucial variables to consider. Furthermore, the growing emphasis on sustainability, environmental restrictions, and safety specifications puts upward pressure on FPSO prices.

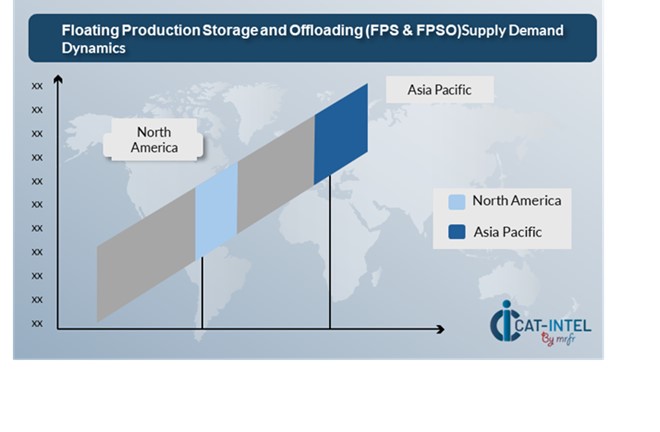

Graph shows general upward trend pricing for Floating Production Storage and Offloading (FPS & FPSO) and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic

Efforts to optimize procurement procedures, improve vendor management, and examine modular FPSO designs are critical for cost control. The use of digital technologies for market surveillance, price forecasting through analytics, and efficient contract administration will only enhance cost-efficiency.

Partnering with dependable FPSO suppliers, negotiating long-term contracts, and exploring flexible pricing methods are essential techniques for efficiently managing FPSO procurement expenses. Despite challenges, focusing on scalability, ensuring robust offshore operations, and adopting innovative FPSO technologies will be critical to maintaining cost-effectiveness and operational excellence in the long term.

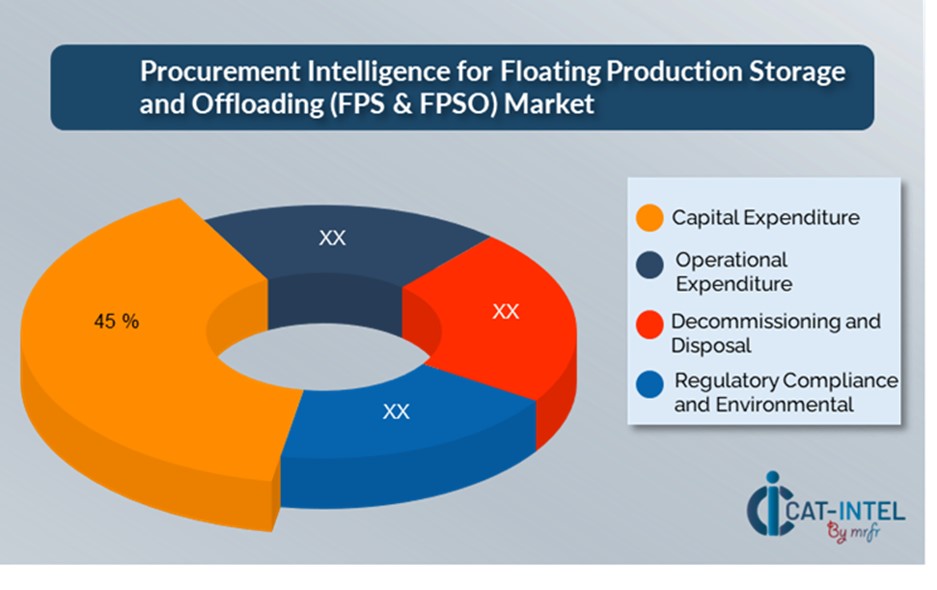

Cost Breakdown for Floating Production Storage and Offloading (FPS & FPSO): Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Capital Expenditure: (40%)

-

Description: CapEx comprises the initial costs for designing, building, and installing the FPSO unit, as well as the equipment and systems needed for operation. This is usually the greatest and most important investment in the FPSO lifespan. -

Trend: To minimize initial expenses, CapEx is increasingly shifting toward more modular and standardized designs. Additionally, there is a greater emphasis on utilizing sophisticated technology to improve design efficiency and reduce resource consumption during construction.

- Operational Expenditure: (XX%)

- Decommissioning and Disposal: (XX%)

- Regulatory Compliance and Environmental: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Floating Production Storage and Offloading (FPSO) industry, streamlining procurement processes and employing smart bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with FPSO providers, particularly those providing flexible, scalable solutions, can result in more attractive pricing structures and terms, such as volume-based discounts and bundled service packages. Multi-year contracts and flexible pricing structures allow you to achieve competitive rates while minimizing price changes over time.

Partnering with FPSO suppliers who value innovation, modularity, and environmental sustainability can bring additional benefits such as access to cutting-edge offshore technologies, improved integration with new systems, and reduced operational costs. Implementing digital technologies for procurement, such as contract administration systems and operational data analytics, increases transparency, reduces resource underutilization, and ensures optimal asset performance. Diversifying vendor options and employing multi-vendor strategies can reduce dependence on a single supplier, mitigate risks like downtime, and strengthen negotiation power, ensuring long-term success in FPSO deployments.

Supply and Demand Overview for Floating Production Storage and Offloading (FPS & FPSO): Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Floating Production Storage and Offloading (FPSO) industry is steadily expanding, fuelled by increased investment in offshore oil and gas production, particularly deep-water and ultra-deep-water projects. Advancements in offshore technologies, regulatory changes, and global energy price fluctuations all have an impact on supply and demand dynamics.

Demand Factors:

-

Demand for Offshore Exploration and Production: The growing need for dependable offshore manufacturing alternatives in oil and gas development is boosting demand for FPSOs. -

Environmental and Sustainability Standards: As environmental rules become progressively stricter, demand for eco-friendly FPSO systems that cut emissions and have a low environmental impact is increasing. -

Custom Solutions for Deepwater Projects: There is a growing need for FPSO units tailored to the special needs of deepwater oil fields, including the capacity to process heavier crudes and manage higher pressures. -

Integration with Advanced Technologies: There is an increasing requirement for FPSOs to integrate with other offshore technologies such as subsea systems, IoT devices, and AI for enhanced predictive maintenance and operating efficiency.

Supply Factors:

-

Technological Advancements: Innovations in FPSO design and floating technology, including increased storage capacity, enhanced offshore safety measures, and digital integration, are driving supplier competitiveness. -

Vendor Ecosystem: The expanding number of FPSO suppliers, including large-scale and specialty providers, provides energy businesses with a variety of options, ranging from huge multinational firms to specialized operators. -

Global Energy Price Fluctuations: Changes in oil prices and energy demand affect the availability and cost of FPSO units, with rising prices often resulting in increased investment in offshore projects. -

Modular and Flexible Solutions: As modern FPSOs become increasingly modular, they may be customized to the individual needs of various oil and gas projects, increasing operator flexibility.

Regional Demand-Supply Outlook: Floating Production Storage and Offloading (FPS & FPSO)

The Image shows growing demand for Floating Production Storage and Offloading (FPS & FPSO) in both Asia Pacific and North America, with potential price increases and increased Competition

Asia Pacific: Dominance in the Floating Production Storage and Offloading (FPS & FPSO) Market

Asia Pacific, particularly Singapore, is a dominant force in the global Floating Production Storage and Offloading (FPS & FPSO) market due to several key factors:

-

Rising Offshore Oil & Gas Exploration: Asia Pacific has several emerging offshore oil and gas deposits, which are increasing demand for FPSO units in nations like as India, Malaysia, China, and Australia. The region's vast coastline and unexplored reserves make it a hotspot for offshore exploration. -

Strong Investments in Energy Infrastructure: Governments and entrepreneurs in Asia Pacific have made significant investments in energy infrastructure, particularly FPSO units, to improve their oil and gas production capacity. These investments are critical for ensuring energy security and addressing the region's expanding demand. -

Cost-Effective Manufacturing: Asia Pacific, specifically countries such as China, South Korea, and Singapore, has significant manufacturing capabilities that allow them to construct FPSOs at lower costs than other regions. This creates the region. This makes the region an attractive location for both building and leasing FPSO units.

-

Technological Advancements: Asia Pacific countries are progressively incorporating modern technology into offshore oil production, including advances in FPSO units. These developments, such as increased efficiency and sustainability features, help the area maintain its competitive advantage in the global FPSO industry. -

Strategic Location for International Trading: The Asia Pacific region's closeness to key shipping routes and global energy trading hubs, particularly in the South China Sea and neighbouring areas, adds logistical value to FPSO deployment. This makes the region appropriate for both operating and transportation requirements for FPSO systems.

Asia Pacific Remains a key hub Floating Production Storage and Offloading (FPS & FPSO) Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The FPSO (Floating Production Storage and Offloading) market is extremely competitive, with a mix of global leaders and specialised regional suppliers influencing its dynamics. Leading companies, including SBM Offshore, MODEC, and Samsung Heavy Industries, lead the industry by providing modern FPSO units with extensive production, storage, and offloading capabilities. These big firms are committed to providing high-quality, scalable solutions, whilst smaller, specialized businesses focus on specific market sectors, offering innovations such as AI-powered maintenance, digital monitoring, and eco-friendly designs geared to harsh offshore settings.

The supplier landscape is also distinguished by the incorporation of new technologies such as cloud-based monitoring systems and predictive analytics, which improve operational efficiency and minimize downtime. Furthermore, FPSO providers are considering flexible pricing options, such as leasing and long-term contracts, which align with the financial needs of energy companies. Regional suppliers also play an important role, emphasizing compliance with local regulations and providing more customized solutions. As the offshore oil and gas sector evolves, FPSO vendors respond to demand by providing adaptable, cost-effective, and innovative solutions to accommodate the growing complexity of offshore exploration and production.

Key Suppliers in the Floating Production Storage and Offloading Market include:

- Keppel Offshore & Marine

- Shell TotalEnergies

- TechnipFMC

- Sembcorp Marine

- MODEC

- BP

- Saipem

- Yinson

- Bumi Armada

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The FPSO industry is quickly expanding, driven by rising demand for offshore oil and gas production, particularly in emerging markets. FPSOs are preferred for their versatility, scalability, and efficiency in harsh offshore conditions. |

Cloud Adoption |

Digital technology such as cloud-based management and immediate analytics are enhancing FPSO operations. AI-driven servicing and sustainability features optimize production and reduce downtime. |

Product Innovation |

The FPSO sector is using machine learning, IoT, and RPA to improve projections, evaluation of performance, and resource allocation, hence increasing operational efficiency in offshore projects. |

Technological Advancements |

The FPSO sector is using machine learning, IoT, and RPA to improve forecasting, performance monitoring, and resource allocation, hence increasing operational efficiency in offshore projects. |

Global Trade Dynamics |

Changes in global trade legislation, compliance requirements, and regional policies are influencing FPSO adoption patterns, particularly among multinational corporations operating complex offshore supply chains. |

Customization Trends |

There is increasing need for bespoke FPSOs to specific project needs, with customization options like modular designs and integrated storage or offshore processing capabilities, providing more operational flexibility. |

|

Floating Production Storage and Offloading (FPS & FPSO) Attribute/Metric |

Details |

Market Sizing |

The global Floating Production Storage and Offloading (FPS & FPSO) market is projected to reach USD 47.1 billion by 2035, growing at a CAGR of approximately 6.3% from 2025 to 2035.

|

Floating Production Storage and Offloading (FPS & FPSO) Technology Adoption Rate |

As of 2024, about 50% of offshore oil and gas operations use FPSO systems for storage and processing, with cloud-based and automated monitoring systems being integrated for improved performance and resource allocation.

|

Top Floating Production Storage and Offloading (FPS & FPSO) Industry Strategies for 2025 |

Leading FPSO suppliers are concentrating on boosting technology capabilities, offering novel solutions like as autonomous boats, incorporating sustainable designs, and improving energy efficiency to enable ecologically responsible operations in offshore oil and gas.

|

Floating Production Storage and Offloading (FPS & FPSO) Process Automation |

Approximately 45% of Floating Production Storage and Offloading (FPSO) operations use automation technologies to improve regular procedures like oil extraction, storage management, and compliance reporting.

|

Floating Production Storage and Offloading (FPS & FPSO) Process Challenges |

Key problems include the large initial capital investment, the complexity of installation, the necessity for specialized personnel skills, and environmental and regulatory compliance in offshore oil production. |

Key Suppliers |

Leading Suppliers in the market include Keppel Offshore & Marine, Shell Total Energies and Technip FMC.

|

Key Regions Covered |

Asia-Pacific, North America, and Latin America are major markets for FPSOs, with strong demand in oil-rich locations including the Gulf of Mexico, Brazil, and Southeast Asia.

|

Market Drivers and Trends |

Growth factors include rising energy consumption, increased offshore oil and gas development, and advances in FPSO technology that enable more efficient extraction and retention in deepwater conditions. |