Summary Overview

Flooring Services Market Overview

The global flooring services market is steadily expanding, driven by demand from key industries like as residential, commercial, healthcare, and industrial. This market offers a wide range of flooring options, including hardwood, vinyl, and carpet, as well as tile, laminated material, and ecofriendly alternatives. Our paper offers a thorough examination of procurement trends, with an emphasis on cost cutting methods and the use of innovative technology for enhancing procurement and efficiency in operations.

Key future problems in flooring services procurement include controlling installation costs, assuring scalability for big assignments, maintaining high quality standards, and integrating new flooring systems with existing infrastructure. The use of digital tools and strategic sourcing is critical for improving procurement procedures and guaranteeing long-term viability. As global demand continues to climb, businesses are utilizing market intelligence to boost operational efficiency, improve customer satisfaction, and mitigate risks.

-

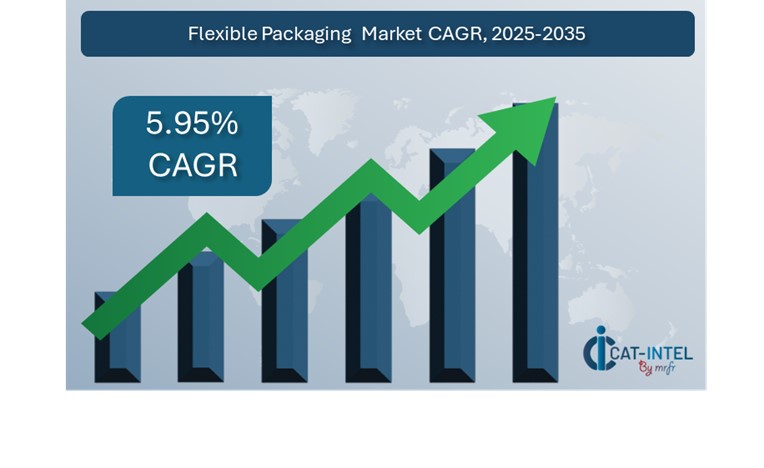

Market Size: The global Flooring Services market is projected to reach USD 567.89 billion by 2035, growing at a CAGR of approximately 5.7% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Production and Supply Chain Optimization: Realtime data and process integration in flooring services is becoming increasingly important in streamlining operations, from initial procurement to installation and maintenance.

-

Growth in Retail and Ecommerce: As online retail grows, flooring service providers are increasingly using innovative software solutions to enhance inventory management, forecasting of demand, and relationship management (CRM), resulting in a smoother customer experience and efficient service delivery.

-

Technological Transformation: Advances in AI and machine learning are boosting flooring services by enabling predictive maintenance, better demand forecasting, and automatic service scheduling, thus boosting operational efficiency.

-

Innovation: The proliferation of modular flooring solutions allows organizations to choose and integrate exactly the components they require, lowering prices and complexity. These advancements offer flexible, adaptable flooring systems that fulfil business needs.

-

Investment Initiatives: Businesses are investing in cloud-based flooring management platforms to save infrastructure costs, enable remote oversight, and improve real time decision making capabilities.

-

Regional Insights: Asia Pacific and North America continue to be key contributors to the flooring services market, owing to strong digital infrastructure, expanding urbanization, and increased adoption of sophisticated flooring technologies.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The growing use of cloud-based flooring management solutions is improving scalability, cost effectiveness, and real time data access, allowing organizations to manage operations from anywhere. -

Advanced Features: Integrating new technologies such as AI, IoT, and blockchain with flooring services improves choices, automates maintenance, and increases supply chain transparency. -

Focus on Sustainability: Flooring service providers are implementing sustainable practices, providing ecofriendly materials and options, and using software to measure and report on sustainability targets such as lowering emissions and waste. -

Customization trends: The demand for industry specific flooring solutions is increasing, with bespoke options available for industries such as healthcare, hotel, and retail to fulfil specific operational and aesthetic requirements. -

Data Driven Insights: Advanced analytics in flooring software allows organizations to forecast materials needs, optimize inventory, and track performance metrics such as installation efficiency and customer satisfaction.

Growth Drivers:

-

The Digital Transformation: The growing use of digital tools and platforms in flooring services is increasing efficiency, allowing for improved project management, and improving client experiences through simpler booking systems and seamless service delivery. -

Demand for Process Automation: The growing dependence on flooring management systems to automate operations such as scheduling, inventory management, and billing is decreasing operational bottlenecks and increasing workflow. -

Scalability requirements: As organizations grow, there is an increasing demand for scalable flooring solutions, with the flexibility to integrate new technologies, materials, and services as needed. -

Regulation Compliance: Flooring companies are increasingly using software to automate compliance reporting, verify safety standards are fulfilled, and track material and labour certifications. -

Globalization: As organizations develop globally, there is an increased demand for flooring solutions that enable multilanguage, multicurrency, and international compliance, ensuring smooth service across borders.

Overview of Market Intelligence Services for the Flooring Services Market:

Recent research has found important constraints in the flooring services market, including as high implementation costs and the requirement for customized solutions to match the various needs of organizations. Market intelligence reports offer useful insights into procurement opportunities, assisting organizations in identifying cost cutting initiatives, optimizing supplier relationships, and improving overall project execution. These insights also help to assure compliance with industry standards and high-quality operating processes, all while managing expenses efficiently.

Procurement Intelligence for Flooring Services Category Management and Strategic Sourcing

To remain competitive in the flooring services market, businesses are improving procurement processes through spend monitoring and vendor performance tracking. Effective category leadership and targeted purchasing are critical for lowering procurement costs while maintaining a consistent supply of high-quality flooring products and services. Businesses can use actionable market intelligence to optimize procurement strategies, negotiate better terms with suppliers, and streamline the acquisition of flooring solutions that fit their unique operational requirements. This method enables businesses to achieve sustained profitability and operational efficiency while reducing risks and assuring quality control throughout the supply chain.

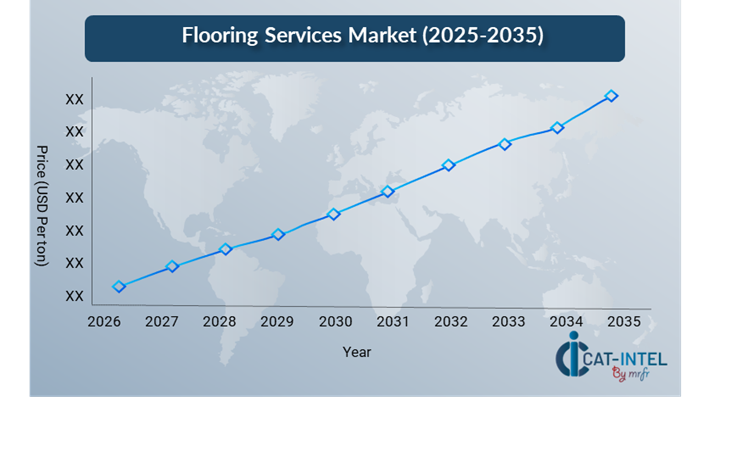

Pricing Outlook for Flooring Services: Spend Analysis

The pricing outlook for flooring services is projected to be moderately dynamic, driven by a number of variables that may create changes. Key drivers include technical developments, need for ecofriendly and sustainable flooring solutions, customized requirements, and pricing variances by location. Furthermore, the increasing use of smart technologies in flooring, such as Io enabled systems for maintenance tracking, along with growing concerns about sustainability and regulatory compliance, is projected to put upward pressure on flooring service costs.

Graph shows general upward trend pricing for Flooring Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, strengthen vendor relationships, and implement modular flooring solutions are critical for cost control. Utilizing digital technologies for market monitoring, pricing forecasting with analytics, and efficient contract administration can dramatically increase cost efficiency.

Partnering with dependable flooring service suppliers, negotiating long-term contracts, and researching subscription-based models for maintenance and service plans are useful cost-cutting solutions. Despite these hurdles, concentrating on scalability, guaranteeing seamless project implementation, and adopting ecofriendly, sustainable flooring solutions will be critical to sustaining cost-effectiveness and operational excellence in the long term.

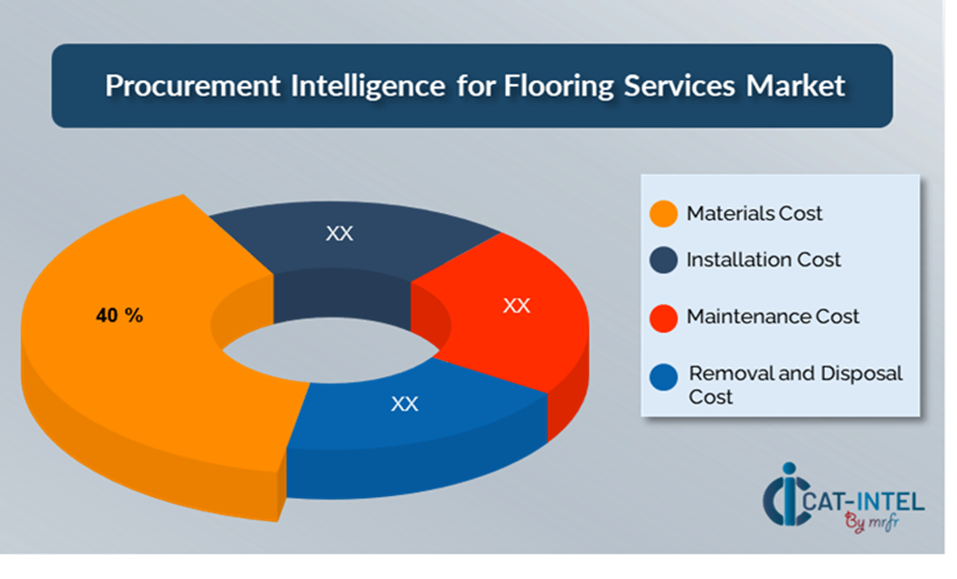

Cost Breakdown for Flooring Services: Total Cost of Ownership (TCO) and Cost Saving Opportunities

- Material Costs: (40%)

-

Description: Material expenses are the prices of the flooring items themselves, which include raw materials such as hardwood, carpet, tile, vinyl, and sustainable options like bamboo or cork. -

Trend: There is an increasing demand for environmentally conscious and sustainable materials, which, while initially more expensive, provide long-term savings due to longevity and lower environmental effect.

- Installation Costs: (XX%)

- Maintenance Costs: (XX%)

- Removal and Disposal Costs: (XX%)

Cost Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the flooring services business, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Longterm partnerships with flooring suppliers, particularly those that provide sustainable and creative solutions, can result in more attractive price structures and terms, such as volume discounts and bundled service packages. Subscription based arrangements and multiyear contracts allow you to lock in reduced rates while also protecting against future price hikes.

Collaborating with flooring providers who prioritize innovation and scalability provides additional benefits, such as access to sophisticated materials, smart flooring innovations, and modular designs, all of which contribute to lower long-term operational expenses. Implementing digital procurement solutions, such as contract management systems and usage analytics, can improve transparency, reduce excess inventory, and maximize material utilization. Diversifying vendor options and implementing multivendor solutions can help to reduce reliance on a single supplier, manage risks like material shortages or service interruptions, and increase negotiation leverage for better terms. By implementing these tactics, businesses may ensure low-cost, high-quality flooring solutions while retaining supply chain flexibility and resilience.

Supply and Demand Overview for Flooring Services: Demand Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The flooring services market is steadily expanding, driven by rising demand for sustainable solutions, technological advancements, and the expansion of building and renovation projects in a variety of industries, including residential, commercial, and healthcare. Flooring material breakthroughs, industry specific customizing requirements, and larger economic conditions all influence supply and demand dynamics.

Demand factors:

-

Sustainability and Green Building Initiatives: As environmental effect and sustainability laws in construction and renovation projects become more widely known, there is a growing demand for ecofriendly, sustainable flooring solutions. -

Technological Integration: The incorporation of smart flooring solutions, such as IoT enabled systems for maintenance tracking and energy efficiency, is increasing demand for more modern flooring materials and systems. -

Industry Specific Requirements: Sectors, such as healthcare and hospitality, have special flooring requirements for safety, hygiene, and aesthetics, resulting in a demand for bespoke flooring solutions. -

Urbanization and Construction Growth: As cities and real estate developments grow, there is a greater demand for high quality, long lasting, and affordable flooring materials for new construction and rehabilitation projects.

Supply Factors:

-

Technological Advancements: Innovations in flooring materials, including modular carpeting, smart flooring technologies, and sustainable materials, are expanding product offers and increasing supplier competitiveness. -

Vendor Ecosystem: The flooring services market has an increasing number of suppliers, including both niche companies and largescale manufacturers, who provide a diverse range of flooring materials, execution services, and maintenance solutions. -

Global Economic Factors: Economic variables such as expenses for raw materials, labour availability, and regional infrastructural development all influence the pricing and availability of flooring solutions. -

Customization and Scalability: Modern flooring solutions are becoming more versatile, allowing vendors to cater to enterprises of various kinds and complexities, from largescale commercial projects to small scale domestic restorations.

Regional Demand Supply Outlook: Flooring Services

The Image shows growing demand for Flooring Services in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Flooring Services Market

Asia Pacific, particularly the South Korea, is a dominant force in the global Flooring Services market due to several key factors:

-

Rapid Urbanization and Infrastructure Development: Asia Pacific is rapidly urbanizing, with a growing number of residential, commercial, and industrial buildings demanding high quality flooring services. -

Expanding Construction and Real Estate Sector: The region's construction and real estate sectors are thriving, with significant investments in both residential and commercial properties, increasing the demand for flooring solutions. -

Economic Expansion and Rising Disposable Income: Strong economic growth in China, India, and Japan has increased disposable money, fuelling demand for high end flooring solutions. As the middle class expands, there is a greater emphasis on home remodelling and premium commercial interiors. -

Technological Developments in Flooring Materials: Asia Pacific countries are adopting novel flooring technologies such as smart flooring systems and ecofriendly materials, positioning them as significant players in the global flooring services market. These developments complement the region's emphasis on sustainability and modernism. -

Cost effectiveness and a Strong Manufacturing Base: The Asia Pacific area has a robust manufacturing base, particularly in China and India, which makes flooring materials more affordable because of lower production costs. This benefits both local and international firms looking for low-cost flooring options.

Asia Pacific Remains a key hub Flooring Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the flooring services market is similarly diversified and competitive, with a mix of global industry leaders and regional players influencing market dynamics. These vendors have a significant impact on pricing models, material selection, workmanship, and overall service quality. Well-established manufacturers dominate the industry, offering a diverse choice of flooring solutions, while smaller, niche players focus on specialty materials, ecofriendly options, or distinctive attributes such as smart flooring technology and custom designs.

The flooring services supplier ecosystem includes both major global manufacturers and creative local firms that cater to industry specific needs. As businesses and homeowners progressively prioritize sustainability, durability, and aesthetics, flooring providers are expanding the utilization of ecofriendly materials, integrating cutting-edge technologies for maintenance and operation tracking, and providing flexible pricing models to meet evolving customer demands. With continued growth in urbanization, construction, and renovation projects, these suppliers are playing a critical role in delivering high-quality flooring solutions while adapting to the changing needs of industries such as healthcare, retail, and hospitality.

Key Suppliers of the Flooring Services Market Include:

- LG Hausys

- Armstrong Flooring

- Forbo Flooring Systems

- Shaw Industries

- Mohawk Industries

- Tarkett

- Interface, Inc.

- Gerflor

- Tarkett

- Mitsubishi Chemical

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The flooring services market is expanding rapidly, driven by rising demand for high-quality, long lasting, and environmentally friendly flooring solutions across a wide range of industries. This trend is especially noticeable in emerging markets, where construction and renovation activity are quickly rising, offering opportunities for flooring service providers. |

Cloud Adoption |

The requirement for scalability, cost efficiency, and improved project management skills has fuelled a significant shift toward digital and cloud-based flooring management solutions. With the rise of hybrid work models and remote monitoring, firms are using cloud technologies to expedite floor installation. |

Product Innovation |

Smart flooring solutions that use IoT devices for upkeep tracking, energy efficiency, and performance management. Furthermore, sustainable materials like bamboo, cork, and recycled content are increasing popularity as firms try to meet growing environmental and regulatory standards in construction. |

Technological Advancements |

Machine intelligence, predictive analytics, and robotics are changing the flooring sector by improving project management, reducing material waste, and automating installation operations. Innovations such as digital floor scheduling instruments and virtual reality for rendering designs are also increasing customer involvement and project productivity. |

Global Trade Dynamics |

Changes in import/export regulations and economic policies are affecting the flooring services market, particularly for multinational corporations with complicated supply chains. Regional variances in material costs, accessibility, and sustainability norms are forcing businesses to change their sourcing and procurement methods to better line with local market demands.

|

Customization Trends |

Demand for flooring services is increasing as businesses seek customizable solutions that are suited to their specific needs, such as modular flooring alternatives and integration with preservation and third-party services. This trend is being driven by industries such as retail, healthcare, and hospitality, which prioritize durability, aesthetics, and cost-efficiency when selecting flooring. |

Flooring Services Attribute/Metric |

Details |

Market Sizing |

The global Flooring Services market is projected to reach USD 567.89 billion by 2035, growing at a CAGR of approximately 5.7% from 2025 to 2035. |

Flooring Services Technology Adoption Rate |

Approximately 60% of flooring service providers worldwide have adopted digital tools and technologies, with a significant shift toward cloud-based platforms that improve scalability, inventory management, and project coordination while also providing a better customer experience via online service bookings and project tracking. |

Top Flooring Services Industry Strategies for 2024 |

In 2025, key strategies for flooring service providers include using sustainable materials, integrating smart technologies for energy efficiency and maintenance tracking, optimizing operations with digital tools such as project management software, and increasing customer engagement through online platforms and virtual design tools.

|

Flooring Services Process Automation |

To increase operational efficiency, over 50% of flooring service installations automate routine processes such as scheduling, inventory management, and billing. Automation also facilitates real time tracking.

|

Flooring Services Process Challenges |

The flooring services market faces significant obstacles, including high upfront material costs, labour shortages, resistance to embracing new technology, and issues in guaranteeing consistent quality across areas. Additionally, managing complex installation processes and ensuring regulatory compliance remain significant challenges.

|

Key Suppliers |

Global manufacturers like as are LG Hausys, Armstrong Flooring and Forbo Flooring Systems among the leading suppliers in the flooring services market, as are local businesses who provide specialty flooring solutions for a variety of industries including healthcare, retail, and hospitality.

|

Key Regions Covered |

Asia Pacific, North America and Europe are key markets for flooring services adoption, with high demand in the construction, hotel, retail, and healthcare industries. |

Market Drivers and Trends |

The increasing demand for sustainable and ecofriendly flooring solutions, the growing need for smart technologies in building design, and innovations in materials that offer enhanced durability and aesthetics, as well as automation in project management, are all driving market growth.

|