Summary Overview

Fraud Prevention Systems Market Overview:

The global fraud prevention systems market is expanding rapidly, fuelled by rising demand in industries such as banking, ecommerce, healthcare, and government. This market covers a wide range of preventative solutions, including Ai powered, machine learning based, and traditional rule based systems. Our research provides a thorough examination of procurement trends, with an emphasis on cost-cutting tactics and the use of digital tools to improve fraud detection and mitigation efforts.

The key future difficulties in fraud prevention are minimizing installation costs, guaranteeing system scalability, protecting sensitive data, and integrating fraud protection solutions with existing IT infrastructures. Digital tools and strategic sourcing are crucial for increasing fraud prevention system uptake and long-term resilience. As global threats continue to rise, businesses are increasingly leveraging market knowledge to improve detection capabilities, reduce operational losses, and mitigate fraud risks.

-

Market Size: The global Fraud Prevention Systems market is projected to reach USD 476 billion by 2035, growing at a CAGR of approximately 23.2% from 2025 to 203

Growth Rate: 23.2%

-

Sector Contributions: Growth in the market is driven by:-

Manufacturing and Supply Chain Optimization: There is a growing demand for real time data and process integration to expedite fracking proppant production and transportation, enhancing operational efficiency across the whole supply chain. -

Expansion of the Oil and Gas Industry: As global energy demand rises, the use of improved fracking proppants is critical for increasing extraction rates, operational efficiency, and cost effectiveness in the energy sector.

-

-

Technological Advancements: Innovations like artificial intelligence and machine learning are being integrated into fracking proppant production, allowing predictive analytics to improve production schedules and reduce waste. Automation improves the efficiency of production processes. -

Product Customization: New trends suggest a shift towards more specialized proppants, such as resin coated and ceramic proppants, which are suited to specific well conditions and geological formations. This customization improves overall well performance and reduces downtime. -

Investment Initiatives: Companies are progressively investing in high-performance, long-lasting fracking proppants, notably ceramic proppants that can handle high pressure, deeper wells. Additionally, investments in sustainable manufacturing techniques are increasing. -

Regional Insights: North America and Asia Pacific remain key contributors to the fracking proppants industry. North America's oil and gas industry is rapidly embracing improved proppants, while Asia Pacific is increasing investment in energy extraction technologies.

Key Trends and Sustainability Outlook:

-

Sustainable Practices: As environmental concerns grow, the sector focuses on creating ecofriendly fracking proppants and implementing sustainable production procedures. Companies are complying with requirements to lessen their environmental effect and improve resource efficiency. -

Advanced Features: Integrating technologies such as IoT into fracking operations improves real time data monitoring, decision making, and well management. -

Customization Trends: There is a growing need for customized fracking proppants that fit the specific needs of diverse extraction conditions (e.g., high pressure, deepwater drilling), allowing enterprises to optimize their operations and reduce operational risks. -

Data Driven Insights: With the emergence of advanced analytics, organizations in the fracking proppants industry are better positioned to estimate demand, track product performance, and improve inventory management, resulting in increased overall operational efficiency.

Growth Drivers:

-

Digital Transformation: A greater dependence on digital tools and technologies is increasing fracking sector productivity, especially through automation and data analytics that maximize the use of proppants in drilling operations. -

Demand for Process Automation: Businesses are relying more on automated production and delivery systems to expedite the manufacturing and distribution of fracking proppants, lowering costs and raising operational speed. -

Scalability Requirements: As the oil and gas industry expands, there is a greater need for scalable solutions in proppant production and logistics that can manage larger orders and high demand projects without sacrificing quality. -

Regulatory Compliance: As environmental impact and sustainability requirements tighten, players in the fracking proppants sector are implementing solutions to assure compliance while also reducing environmental harm through improved tracking and reporting. -

Globalization: As oil and gas extraction expands across borders, proppants that are suitable for varied geological conditions and can satisfy international energy extraction compliance criteria will be in high demand.

Overview of Market Intelligence Services for the Fraud Prevention Systems Market:

Recent investigations have revealed significant hurdles in the fracking proppants sector, including as high production costs, supply chain complications, and the requirement for customization to fit unique well conditions. Market intelligence studies provide useful information that assist businesses identify cost cutting methods, optimize relationships with vendors, and ensure faster product integration. These insights also help with adhering to industry standards, producing high quality products, and successfully managing expenses.

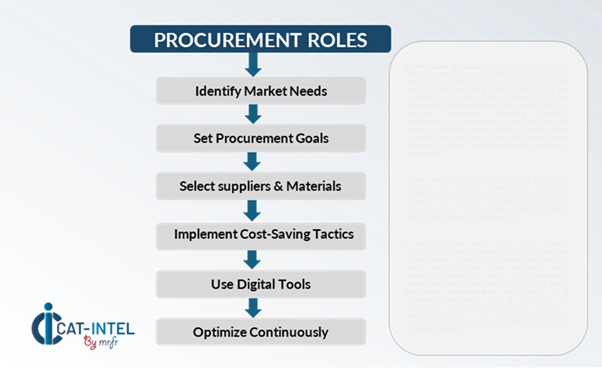

Procurement Intelligence for Fraud Prevention Systems: Category Management and Strategic Sourcing

To remain competitive in the fracturing proppants industry, organizations are improving procurement processes through spend analysis and vendor performance evaluation. Effective category administration and strategic sourcing are critical in minimizing procurement costs while guaranteeing a consistent supply of high-quality proppants. Businesses can use actionable market intelligence to improve their procurement strategies, negotiate better terms with suppliers, and secure a consistent, cost-effective supply of proppants that meet their specific operational needs.

Pricing Outlook for Fraud Prevention Systems: Spend Analysis

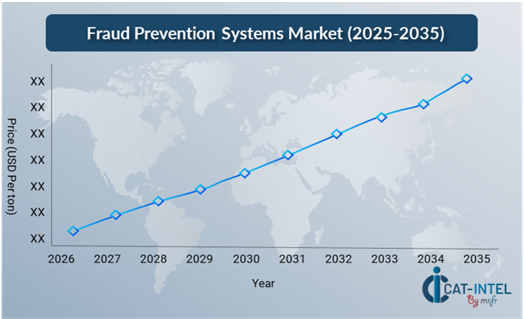

The pricing prognosis for fraud prevention systems is likely to be moderately dynamic, with potential swings caused by a variety of variables. Technological improvements, the growing demand for AI powered solutions, the desire for personalization, and regional pricing variances are all important factors to consider. Furthermore, the growing integration of IoT and the increased emphasis on data security and compliance are putting upward pressure on the price of fraud protection systems.

Graph shows general upward trend pricing for Fraud Prevention Systems and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement scalable fraud prevention technologies are critical for cost management. Leveraging digital tools for market monitoring, advanced analytics-based pricing predictions, and effective contract administration will help to reduce costs even further.

Partnering with reputable fraud protection providers, negotiating multiyear contracts, and investigating subscription-based pricing structures are all critical tactics for cost management. Despite these challenges, focusing on scalability, ensuring robust system integration, and adopting cloud based solutions will be critical to maintaining cost-effectiveness and ensuring a high level of operational security.

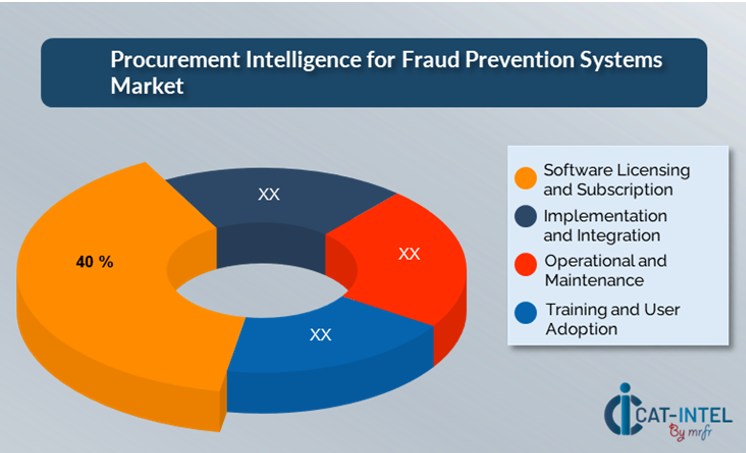

Cost Breakdown for Fraud Prevention Systems: Total Cost of Ownership (TCO) and Cost Saving Opportunities

- Software Licensing and Subscription – (40%)

-

Description: The expense of getting software rights, whether through upfront licensing fees or recurring subscription rates. -

Trend: Cloud based fraud protection solutions are increasingly using subscription models due to their flexibility, scalability, and cheaper upfront costs.

-

- Implementation and Integration – (XX%)

- Operational and Maintenance – (XX%)

- Training and User Adoption – (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fraud prevention systems market, streamlining procurement processes and using strategic bargaining methods can result in significant cost savings and increased security efficiency. Longterm relationships with fraud protection providers, particularly those delivering cloud-based solutions, can result in more attractive pricing structures and terms, such as volume discounts and bundled service packages. Subscription based approaches and multiyear contracts offer chances to negotiate reduced rates while mitigating price rises over time.

Collaboration with fraud protection providers that prioritize innovation and scalability provides additional benefits, such as access to sophisticated analytics, AI integration, and modular architectures, all of which assist to lower long-term operational costs while enhancing fraud detection capabilities. Implementing digital procurement tools, such as contract management systems and use data, improves transparency, reduces overprovisioning, and optimizes system utilization. Diversifying vendor options and employing multivendor strategies can reduce dependency on a single provider, mitigate risks like service outages, and strengthen negotiating leverage, ensuring long-term value in fraud prevention efforts.

Supply and Demand Overview for Fraud Prevention Systems: Demand Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The fraud prevention systems market is expanding steadily, driven by increased efforts across industries such as banking, retail, and healthcare to protect against financial fraud and cyber threats. Technological improvements, industry specific demands, and global economic conditions all have an impact on supply and demand dynamics.

Demand Factor:

-

Digital Transformation Initiatives: Advanced fraud protection solutions are in high demand due to the increased requirement for centralized fraud detection systems and security process automation. -

Cloud Adoption Trends: The trend to cloud based fraud protection solutions is driving up demand for scalable, subscription-based software with remote access and lower infrastructure expenses. -

Industry Specific Requirements: Industries such as banking, retail, and healthcare necessitate fraud protection systems that follow regulatory requirements, operational workflows, and sensitive data handling procedures. -

Integration Capabilities: There is an increasing demand for fraud prevention solutions that work seamlessly with other corporate software, security tools, and IoT devices to improve realtime monitoring and detection.

Supply Factors:

-

Technological Advancements: Advances in AI, machine learning, and big data analytics are improving fraud prevention products by providing smarter threat detection and prediction capabilities. -

Vendor Ecosystem: A rising number of fraud prevention system suppliers, including both niche and largescale vendors, guarantees that solutions are adapted to varied sectors and security demands. -

Global Economic Factors: Exchange rates, regional regulations, and local market dynamics all have an impact on the pricing and availability of fraud protection solutions globally. -

Scalability and Flexibility: Modern fraud prevention systems are more modular, allowing suppliers to provide scalable solutions that can suit to companies of various sizes and complexities, ensuring flexibility in fraud detection and prevention strategies.

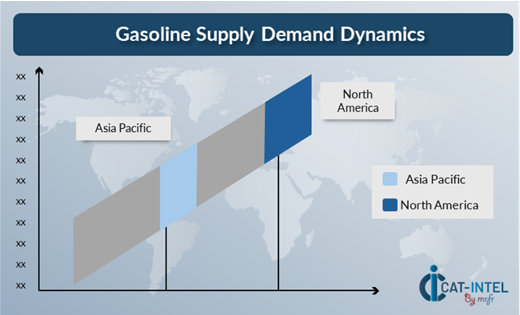

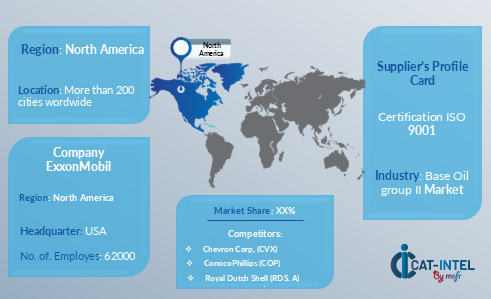

Regional Demand Supply Outlook: Fraud Prevention Systems

The Image shows growing demand for Fraud Prevention Systems in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Fraud Prevention Systems Market

North America, particularly the United States, is a dominant force in the global Fraud Prevention Systems market due to several key factors:

-

Advanced technology Infrastructure: North America's technology infrastructure is highly developed, facilitating the adoption and deployment of advanced fraud prevention technologies such as artificial intelligence, machine learning, and real time data analytics. -

High Cybersecurity Concerns: The region has a high amount of cyberattacks and fraud instances, particularly in banking, ecommerce, and healthcare, resulting in an increased need for advanced fraud prevention solutions to secure sensitive data and financial transactions. -

Regulatory Environment: North America, particularly the United States, has stringent rules and legal obligations (e.g., PCIDSS, GDPR), requiring firms to have robust fraud prevention systems in order to avoid penalties and maintain adherence to security standards. -

Market Size and Economic Power: North America has a significant number of high value firms and financial institutions that are eager to invest in cutting edge fraud prevention technologies to protect their operations and customer trust. -

Innovation and Research Investment: North American businesses and governments make significant investments in cybersecurity research and development, resulting in ongoing innovation in fraud prevention systems.

North America Remains a key hub for Fraud Prevention Systems Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The fraud prevention systems market has a diversified and highly competitive supplier ecosystem, with global market leaders and regional players defining industry dynamics. These providers have a significant impact on pricing models, system customisation, and service quality. The market is dominated by well-known security organizations that provide full detection and avoidance suites, while smaller, niche players specialize in certain business verticals or unique features such as sophisticated algorithms for machine learning and AI driven analytics.

The fraud prevention supplier ecosystem extends across important technological regions, with prominent worldwide vendors and creative local businesses catering to industry specific needs such as financial services, retail, and healthcare. As firms prioritize cybersecurity and theft mitigation, fraud prevention platform suppliers are expanding cloud-based solutions, incorporating cutting edge technologies such as AI and blockchain, and offering flexible subscription models to meet the evolving needs of businesses worldwide.

Key Suppliers in the Fraud Prevention Systems market include:

- Symantec

- SAS Institute

- IBM

- FICO

- Nice Systems

- Forter

- ACI Worldwide

- ThreatMetrix (LexisNexis Risk Solutions)

- Experian McAfee

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The fraud prevention systems market is expanding rapidly as organizations recognize the need to safeguard their operations and data against emerging threats and decrease financial losses, particularly in banking, retail, and ecommerce. |

Cloud Adoption |

There is a growing shift towards cloud-based fraud prevention solutions, driven by the need for scalable, cost-effective, and remotely accessible security systems, which are critical in today's hybrid work environments, while also allowing businesses to scale security measures as needed. |

Product Innovation |

Fraud prevention system providers are expanding their solutions to include AI powered analytics, real time fraud detection, and fraud analytics specialized to specific industries such as financial services, ecommerce, and healthcare. |

Technological Advancements |

Advancements in machine learning, IoT integration, and robotic process automation (RPA) are improving fraud prevention systems' capabilities, driving predictive insights, automating routine checks, and providing greater accuracy in identifying potential fraud threats before they impact operations. |

Global Trade Dynamics |

Changes in global trade regulations, compliance necessities, and regional economic policies are all impacting fraud prevention trends, especially for multinational corporations that must protect themselves against cross border fraud. |

Customization Trends |

There is a growing demand for fraud prevention systems that are suited to specific business requirements, such as customizable detection algorithms, adaptable security structures, and integration with third party tools. |

|

Fraud Prevention Systems Attribute/Metric |

Details |

Market Sizing |

The global Fraud Prevention Systems market is projected to reach USD 476 billion by 2035, growing at a CAGR of approximately 23.2% from 2025 to 2035. |

Fraud Prevention Systems Technology Adoption Rate |

Approximately 65% of firms worldwide have implemented fraud prevention systems, with a major move towards cloud-based platforms for improved scalability, real time monitoring, and affordable solutions. |

Top Fraud Prevention Systems Industry Strategies for 2025 |

Key strategies include integrating AI and machine learning for fraud detection, automating fraud identification processes, improving cybersecurity, and implementing mobile fraud prevention tools to ensure seamless monitoring across devices. |

Fraud Prevention Systems Process Automation |

Approximately 55% of fraud prevention systems automate regular checks such as transaction monitoring, identity verification, and compliance reporting to improve accuracy and operational efficiency. |

Fraud Prevention Systems Process Challenges |

Major challenges consist of high implementation costs, integration issues with current systems, employee resistance to implementing new security measures, and the ongoing need for system updates and maintenance to keep up with evolving threats. |

Key Suppliers |

Symantec, SAS Institute and IBM are among the leading fraud prevention software suppliers, offering comprehensive solutions to identify, prevent, and analyse fraud across industries. |

Key Regions Covered |

North America and Asia Pacific are the most prominent regions for fraud prevention technology adoption, with considerable demand in the financial services, ecommerce, and retail industries. |

Market Drivers and Trends |

Growth is being driven by a growing need for real time fraud detection, rising interest in cloud-based security solutions, demand for better regulation compliance, and the integration of advanced technologies such as AI, machine learning, and blockchain to enhance fraud prevention capabilities. |