Summary Overview

Heavy Mining Equipment Market Overview

The global heavy mining equipment market is steadily expanding, propelled by rising demand in industries such as construction, mining, and infrastructure development. This market covers a wide range of heavy equipment, comprising excavators, dumpers, loaders, and drilling equipment, with technological improvements affecting the evolution of technology. Our analysis focuses on procurement trends, including cost-cutting tactics and the use of digital technologies to increase operational efficiency and safety measures.

Key future procurement difficulties include controlling the high costs of procuring and maintaining heavy gear, assuring operational scalability, complying with environmental standards, and integrating new technologies into current equipment fleets. The use of digital tools, such as scheduled upkeep and fleet management platforms, is critical for improving equipment utilization and lowering operational downtime. As worldwide demand for commodities and infrastructure projects grows, businesses are increasingly using market data to improve performance, reduce risks, and assure long-term competitiveness in a fast-changing industry.

Market Size: The global Heavy Mining Equipment market is projected to reach USD 596.51 billion by 2035, growing at a CAGR of approximately 5.77% from 2025 to 2035.

Growth Rate: 5.77%

- Manufacturing and Operating Efficiency: Operators are using modern technology to boost production, eliminate operational delays, and maximize equipment use.

- Mining and Infrastructure Development: As worldwide appetite for minerals and construction projects increases, mining corporations invest in cutting-edge machinery and equipment to boost productivity.

- Technological Transformation: Artificial intelligence, machine learning, and automation are redefining the heavy mining equipment sector, with innovations such as autonomous vehicles, smart sensors, and predictive maintenance.

- Innovations: Modern heavy mining machinery is becoming more modular, allowing mining companies to pick and integrate exactly the functionalities needed for their operations.

- Investment Initiatives: The heavy mining industry is increasingly using cloud-based technologies to manage equipment fleets, track performance, and optimize supply chains.

- Regional Insights: Asia-Pacific and North America continue to be major regions for heavy mining equipment demand due to their robust mining industries and excellent infrastructure.

Key Trends and Sustainability Outlook:

- Cloud Integration: The mining industry is increasingly relying on cloud technologies to track equipment efficiency, enhance fleet management, and cut infrastructure costs.

- Advanced Features: Artificial intelligence, Internet of Things, and blockchain technologies are being incorporated into heavy mining equipment to enhance operational efficiency, predictive analytics, and safety.

- Focus on Sustainability: Heavy mining equipment technologies contribute to sustainability goals by improving fuel efficiency and lowering emissions.

- Customization Trends: The growing need for specialized mining equipment designed for specific purposes, such as underground mines, surface mining, and mineral extraction, is pushing innovation and providing more personalized solutions.

- Data-Driven Insights: Advanced data analytics and IoT-enabled devices in mining equipment provide real-time performance tracking, better forecasting of maintenance schedules, and more efficient resource allocation.

Growth Drivers:

- Digital Transformation: Mining businesses are increasingly using digital solutions such as remote surveillance systems, maintenance prediction technologies, and automated machinery.

- Demand for Process Automation: Mining equipment and operations are automated to decrease manual labour, streamline processes, and eliminate bottlenecks in mining operations.

- Scalability Needs: businesses want heavy mining equipment that can scale to meet their needs, offering flexibility in terms of equipment deployment and interaction with current systems.

- Regulatory Compliance: Mining businesses use innovative technologies in their equipment to ensure compliance with environmental rules and reporting requirements, lowering the risk of fines and reputational harm.

- Globalization: As demand for heavy mining equipment grows, organizations require equipment solutions that support different geographical operations, including multi-language and multi-currency capabilities.

Overview of Market Intelligence Services for the Heavy Mining Equipment Market

Recent evaluations have revealed important problems in the heavy mining equipment industry, such as high acquisition and maintenance costs, as well as the necessity to customize equipment and systems to fit unique mining requirements. Market intelligence studies offer useful insights into procurement opportunities, allowing mining businesses to find cost-cutting methods, improve supplier management, and assure the smooth installation of new equipment and technologies.

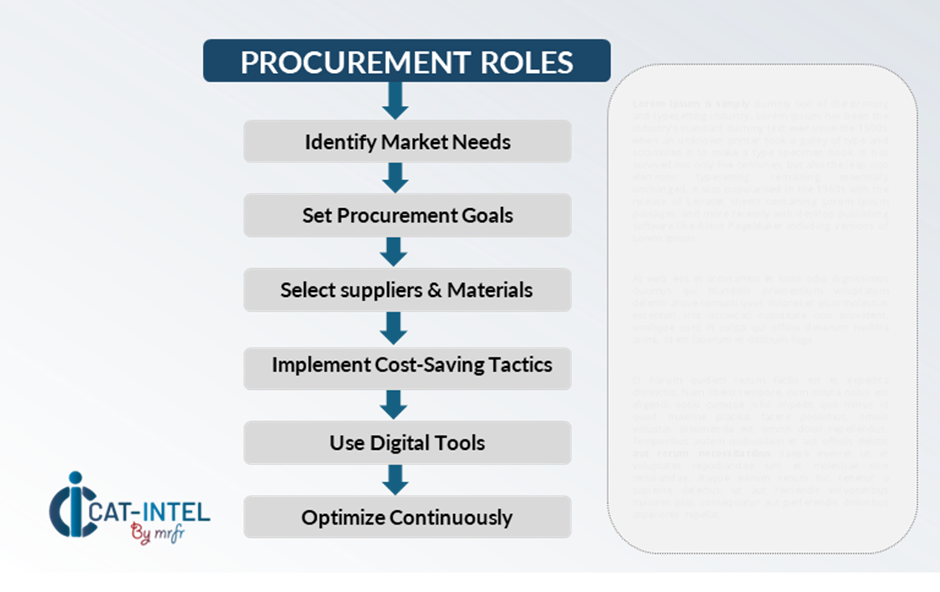

Procurement Intelligence for Heavy Mining Equipment: Category Management and Strategic Sourcing

To be competitive in the heavy mining equipment market, organizations are improving procurement processes with precise spend monitoring and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs and maintaining a consistent supply of high-quality mining equipment. Mining businesses can improve their procurement strategies, negotiate better equipment purchase terms, and assure timely acquisition of dependable and efficient machinery by employing actionable market intelligence.

Pricing Outlook for Heavy Mining Equipment: Spend Analysis

The price prognosis for heavy mining equipment is projected to be moderately volatile, affected by several major factors. Price changes are being driven by technological advancements, rising demand for more energy-efficient machinery, and increased usage of automation. Customization needed to match individual mining operations, as well as regional pricing variances, playing a significant role.

Graph shows general upward trend pricing for Heavy Mining Equipment and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement processes, improve vendor management, and investigate modular equipment options will be critical for cost control. Mining businesses can improve cost efficiency and preserve a competitive advantage by embracing digital solutions for market monitoring, analytics-driven pricing forecasting, and efficient contract administration.

Partnering with reputable equipment providers, negotiating long-term purchase agreements, and investigating flexible financing or leasing options will all be critical methods for properly managing heavy mining equipment expenses. Despite these pricing problems, focusing on scalability, guaranteeing strong execution, and adopting more sustainable and technologically advanced equipment will be crucial for long-term operating efficiency and cost-effectiveness.

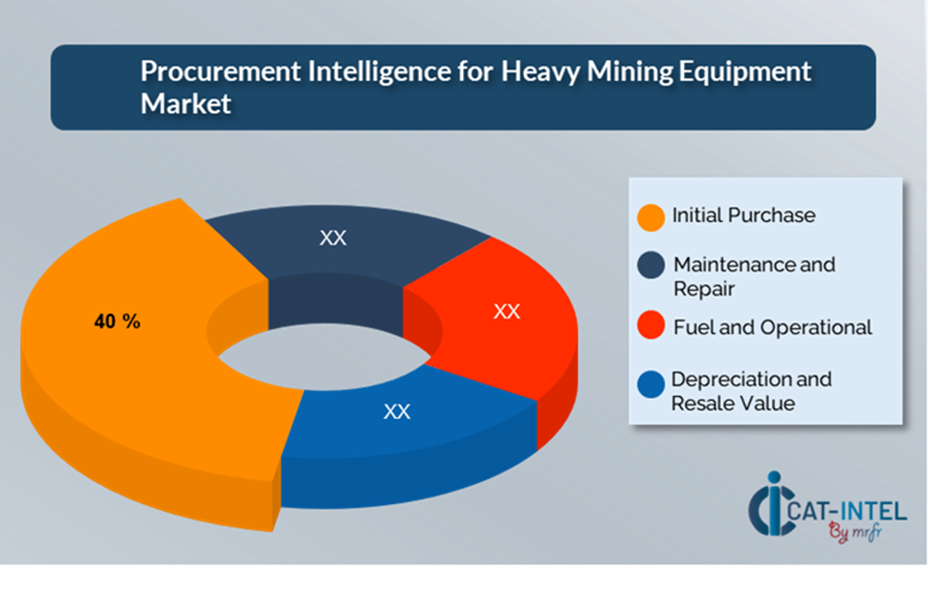

Cost Breakdown for Heavy Mining Equipment: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Cost Breakdown for Heavy Mining Equipment: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Purchase (40%)

- Description: This covers the cost of the equipment itself, as well as any optional features or customizations needed for specific mining activities.

- Trends: Equipment suppliers are increasingly providing financing and leasing solutions to alleviate the strain of large upfront prices.

- Maintenance and Repair: (XX%)

- Fuel and Operational: (XX%)

- Depreciation and Resale Value: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the heavy mining equipment industry, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operating efficiency. Long-term partnerships with equipment suppliers, particularly those that offer advanced and configurable machinery, can result in more attractive price structures and terms, such as volume discounts, longer warranties, and bundled service packages. Leasing and financing models allow you to achieve lower rates while minimizing your upfront capital expenditure.

Collaborating with equipment providers who promote innovation, scalability, and environmental sustainability provides additional benefits, such as access to cutting-edge technologies like AI-powered maintenance predictions, IoT-enabled fleet management, and energy-efficient gear. These advancements can help lower long-term operational costs, increase equipment lifespan, and boost overall mining production.

Supply and Demand Overview for Heavy Mining Equipment: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The heavy mining equipment market is steadily expanding, fuelled by an increasing need for advanced machinery and technology, along with a shift toward more efficient and sustainable mining operations. Technological breakthroughs alter the dynamics of supply and demand, industry-specific requirements, and global economic conditions

Demand Factors:

- Mining Technological Advancements: As automation, remote monitoring, and predictive maintenance become more prevalent, demand for modern heavy mining equipment is increasing.

- Sustainability Initiatives: Rising environmental restrictions and a push for more sustainable mining practices are driving demand for energy-efficient and environmentally friendly equipment.

- Industry-Specific Requirements: Mining firms require specialized equipment designed for specific situations, such as underground or surface mining.

- Integration with IoT and AI: There is an increasing demand for mining equipment that can smoothly interact with IoT sensors, AI systems, and fleet management systems.

Supply Factors:

- Technological Advancements: Suppliers are increasingly providing advanced features including automated operation, real-time data monitoring, and energy optimization.

- Vendor Ecosystem: The heavy mining equipment market has a wide spectrum of vendors, from major global giants to developing startups that provide specialist solutions.

- Global Economic Factors: Exchange rates, raw material costs, and regional mining activity, all of which influence the pricing and availability of heavy mining equipment.

- Scalability and Flexibility: Because modern heavy mining equipment is increasingly modular, providers may provide flexible solutions to organizations of various sizes and operating complexities.

Regional Demand-Supply Outlook: Heavy Mining Equipment

The Image shows growing demand for Heavy Mining Equipment in both Asia Pacific and Asia Pacific, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Heavy Mining Equipment Market

Asia Pacific, particularly Japan, is a dominant force in the global Heavy Mining Equipment market due to several key factors

- High Resource Demand: The region's abundant mineral deposits, particularly in China, India, Australia, and Indonesia, make it a worldwide mining powerhouse and a primary driver of heavy mining equipment demand.

- Rapid Infrastructure Development: The region is seeing tremendous expansion of infrastructure, particularly in emerging economies.

- Investment in Technological Advancements: Asia-Pacific is in the forefront of incorporating modern technologies such as automation, IoT, and AI into mining operations, increasing demand for advanced equipment capable of improving operational efficiency and productivity.

- Cost-Effectiveness and Local Manufacturing: Local manufacturers and distributors contribute to lower operational costs, making Asia-Pacific an appealing market for heavy mining equipment.

- Supportive Government Policies: Governments in the Asia-Pacific region are actively supporting the mining industry through advantageous policies, infrastructure investments, and regulatory frameworks.

Asia Pacific Remains a key hub, Heavy Mining Equipment Price Drivers Innovation and Growth

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the heavy mining equipment market is diversified and competitive, with global market leaders and regional providers influencing industry dynamics. These vendors impact critical elements such as pricing models and equipment customization, and after-sales service quality. Established equipment manufacturers dominate the industry, providing comprehensive heavy mining machinery, while smaller, specialist providers offer specialized solutions or innovative technologies such as automation, artificial intelligence, and sustainability-focused equipment.

The supplier ecosystem in important mining regions comprises both well-known worldwide vendors and innovative local businesses catering to specific mining demands such as underground mining, mineral extraction, and harsh environmental equipment. As mining operations prioritize automation, efficiency, and sustainability, suppliers are expanding their capabilities to include more autonomous apparatus, IoT integration for real-time monitoring, and sustainable machinery to meet sustainability laws. With a rising emphasis on digital transformation and operational optimization in the mining industry, suppliers are improving their products with smart technology, predictive maintenance tools, and flexible financing or leasing methods to accommodate the different needs of mining enterprises.

Key Suppliers in the Heavy Mining Equipment Market Include

- Komatsu Ltd.

- Caterpillar Inc.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Volvo Construction Equipment

- Sandvik AB

- Doosan Infracore

- XCMG Construction Machinery

- China National Petroleum Corporation

- Terex Corporation

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The heavy mining equipment market is expanding rapidly, driven by rising demand for modern machinery and technologies aimed at enhancing operating efficiency, safety, and sustainability. |

Cloud Adoption |

The heavy mining sector is seeing an increase in the use of cloud-based solutions, which provide scalability, cost efficiency, and remote access for fleet management, monitoring, and upkeep in line with hybrid work patterns. |

Product Innovation |

Equipment makers are constantly innovating by including modern technology such as AI-powered predictive maintenance, real-time data monitoring, and autonomous features for mining equipment. |

Technological Advancements |

Machine learning, IoT integration, and robotic automation are transforming the capabilities of heavy mining equipment. These advances enable predictive insights for equipment maintenance and real-time monitoring of mining operations. |

Global Trade Dynamics |

Shifting global trade rules, environmental compliance standards, and regional economic policies are all influencing the heavy mining equipment industry, particularly for multinational corporations that manage mining operations in multiple locations. |

Customization Trends |

The demand for customisable mining equipment is increasing, with businesses seeking modular solutions that can be adjusted to unique mining conditions, such as different types of mineral extraction, geological situations, or safety standards. |

|

Heavy Mining Equipment Attribute/Metric |

Details |

Market Sizing |

The global Heavy Mining Equipment market is projected to reach USD 596.51 billion by 2035, growing at a CAGR of approximately 5.77% from 2025 to 2035.

|

Heavy Mining Equipment Technology Adoption Rate |

Approximately 60% of mining companies worldwide have implemented sophisticated heavy equipment solutions, with a major shift toward self-contained, energy-efficient, and IoT-enabled machinery to improve operations and safety. |

Top Heavy Mining Equipment Industry Strategies for 2025 |

Key solutions include incorporating AI and machine learning for predictive maintenance, automating for better safety and efficiency, prioritizing sustainable practices, and investing in modular equipment that can be customized for individual mining needs. |

Heavy Mining Equipment Process Automation |

To expedite operations, decrease human error, and increase production, around 50% of heavy mining equipment now has automation features such as self-driving trucks, drills, and excavators. |

Heavy Mining Equipment Process Challenges |

Major hurdles include costly initial capital investment, managing equipment downtime, supply chain interruptions, integrating new technology with legacy systems, and adhering to strict environmental standards. |

Key Suppliers |

Komatsu Ltd., Caterpillar Inc. and Hitachi Construction Machinery are among the leading manufacturers of heavy mining equipment, providing full solutions for both surface and underground mining activities. |

Key Regions Covered |

Asia-Pacific, and North America are popular regions for heavy mining equipment adoption, with strong demand in countries with large-scale mining operations. |

Market Drivers and Trends |

Growth is being driven by increased mining output, technical improvements such as IoT integration and automated machinery, the need for ethical mining practices, and the deployment of improved predictive maintenance technology.

|