-

Executive Summary

-

Market Attractiveness Analysis 19

-

1.1.1

-

Global Aluminum Flat-Rolled Products Market, By Product Type 19

-

Aluminum Flat-Rolled Products Market, End-Use Industry 20

-

Global

-

Global Aluminum

-

Flat-Rolled Products Market, By Region 21

-

Market Introduction

-

Definition

-

22

-

Scope Of The Study 22

-

Market Structure 23

-

Key Buying

-

Criteria 23

-

Market Insights

-

Research Methodology

-

Research

-

Process 27

-

Primary Research 28

-

Secondary Research 29

-

4.4

-

Market Size Estimation 29

-

Forecast Model 30

-

List Of Assumptions

-

31

-

Market Dynamics

-

Introduction 32

-

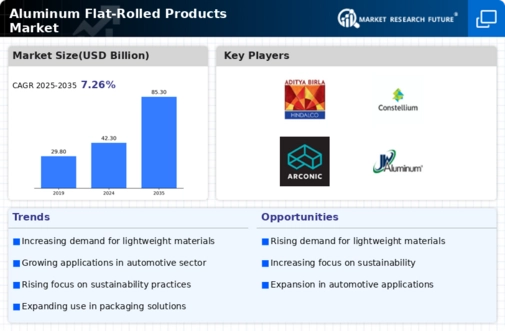

Drivers 33

- High Demand For Aluminum Foils In The Packaging Industry

- Drivers Impact Analysis 35

-

5.2.1

-

Increasing Demand For Aluminum Flat-Rolled Products In The Automotive And Aerospace

-

Industries 33

-

34

-

Restraints 35

- Environmental

- Restraints Impact Analysis

-

Hazards Associated With Bauxite Mining 35

-

36

-

Opportunities 36

- Expanding Construction Industry 36

- Fluctuating Raw Material Prices 37

-

5.5

-

Challenges 37

-

Market Factor

-

Analysis

-

Supply Chain Analysis 38

- Raw Material Suppliers 39

- Aluminum Flat-Rolled Product Manufacturers 39

- Distribution Channel

- End-Use Industries 39

-

39

-

Porter’s Five Forces Model 40

- Threat Of New Entrants 40

- Intensity Of Competitive Rivalry 41

- Threat Of Substitutes 41

- Bargaining Power Of Suppliers 41

- Bargaining Power Of Buyers 41

-

Cost Analysis Of Aluminum Flat-Rolled

-

Plates 42

-

Global Aluminum Flat-Rolled Products Market, By Product Type

-

Introduction 43

-

Plates 45

-

Sheets 47

-

Standard GEQ

-

48

-

Circles 49

-

Foil Stock 50

-

Can Stock 51

-

Fin

-

Stock 52

-

Others 53

-

Global Aluminum Flat-Rolled Products Market,

-

By End-Use Industry

-

Introduction 55

-

Building & Construction

-

57

-

Automotive & Transportation 58

-

Consumer Goods 60

-

8.5

-

Electrical & Electronics 61

-

Industrial 62

-

Packaging 63

-

Others 64

-

Global Aluminum Flat-Rolled Products Market, By Region

-

Introduction 66

-

North America 70

- US 73

- Canada

-

76

-

Europe 78

- Germany 82

- Russia 84

- UK 87

- France 89

- Spain 92

- Italy 94

- The Netherlands

- Belgium 99

- Poland 101

- Rest Of Europe 103

-

96

-

Asia-Pacific 106

- China 110

- Japan 112

- India

- South Korea 117

- Indonesia 119

- Thailand 121

- Australia & New Zealand 124

- Malaysia 127

- Rest

-

114

-

Of Asia-Pacific 129

-

Latin America 132

- Mexico 135

- Argentina 140

- Rest Of Latin America 142

- North Africa 148

- Turkey 150

- GCC 152

- Israel 155

- Rest Of Middle East & Africa

-

9.5.2

-

Brazil 137

-

9.6

-

The Middle East & Africa 144

-

157

-

Competitive Landscape

-

Introduction 70

-

North America

- US 79

- Canada 82

-

76

-

Europe 86

- Germany

- UK 93

- Russia 96

- France 99

- Spain

- Italy 105

- Poland 108

- Belgium 111

- Rest Of The Europe 117

-

90

-

102

-

10.3.9

-

The Netherlands 114

-

Asia-Pacific 121

- China 125

- Japan 128

- India 131

- South

- Australia & New Zealand 137

- Malaysia 140

- Thailand 143

- Indonesia 146

- Rest Of The Asia-Pacific

-

Korea 134

-

149

-

The Middle East & Africa 153

- Saudi Arabia 157

- Israel 163

- Turkey 166

- Rest Of The Middle

-

10.5.2

-

UAE 160

-

East & Africa 169

-

Latin America 172

- Mexico 176

- Argentina 182

- Rest Of Latin America 185

-

10.6.2

-

Brazil 179

-

11

-

Company Profiles

-

Hindalco Industries Limited 165

- Company Overview

- Financial Overview 166

- Products/Services Offered 166

- Key Developments 167

- SWOT Analysis 167

- Key Strategies

-

165

-

167

-

Alcoa Corporation 168

- Company Overview 168

- Products/Services Offered 169

- Key

- SWOT Analysis 169

- Key Strategies 169

-

11.2.2

-

Financial Overview 168

-

Developments 169

-

Constellium 170

- Company Overview 170

- Financial Overview

- Products/Services Offered 171

- Key Developments 171

- SWOT Analysis 171

- Key Strategies 171

-

170

-

Norsk Hydro

- Company Overview 172

- Financial Overview 172

- Key Developments 173

- SWOT

- Key Strategies 174

-

ASA 172

-

11.4.3

-

Products/Services Offered 173

-

Analysis 174

-

Aluminum Corporation Of China

- Company Overview 175

- Financial Overview 175

- Products/Services Offered 176

- Key Developments 176

- Key Strategies 176

-

(Chalco) 175

-

11.5.5

-

SWOT Analysis 176

-

Arconic 177

- Financial Overview 177

- Products/Services

- Key Developments 178

- SWOT Analysis 178

-

11.6.1

-

Company Overview 177

-

Offered 178

-

11.6.6

-

Key Strategies 178

-

NALCO 179

- Company Overview 179

- Products/Services Offered 180

- Key

- SWOT Analysis 180

- Key Strategies 180

-

11.7.2

-

Financial Overview 179

-

Developments 180

-

UACJ Corporation 181

- Company Overview 181

- Financial

- Products/Services Offered 182

- Key Developments

- SWOT Analysis 183

- Key Strategies 183

-

Overview 181

-

182

-

Elvalhalcor

- Company Overview 184

- Financial Overview 184

- Products Offering 185

- Key

- SWOT Analysis 185

- Key Strategies 185

-

Hellenic Copper And Aluminum Industry S.A. 184

-

Developments 185

-

JW Aluminum 186

- Company Overview 186

- Financial

- Products/Services Offered 186

- Key Developments

- SWOT Analysis 187

- Key Strategies 187

-

Overview 186

-

186

-

Appendix

-

List Of Tables

-

LIST OF ASSUMPTIONS 31

-

ALUMINUM

-

FLAT-ROLLED PLATES, COST ANALYSIS, 2023 42

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 44

-

GLOBAL ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 45

-

TABLE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PLATES, BY REGION, 2023-2032 (USD

-

MILLION) 46

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PLATES,

-

BY REGION, 2023-2032 (KILO TONS) 46

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET FOR SHEETS, BY REGION, 2023-2032 (USD MILLION) 47

-

GLOBAL ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET FOR SHEETS, BY REGION, 2023-2032 (KILO TONS) 47

-

TABLE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR STANDARD GEQ, BY REGION, 2023-2032

-

(USD MILLION) 48

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR STANDARD

-

GEQ, BY REGION, 2023-2032 (KILO TONS) 48

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR CIRCLES, BY REGION, 2023-2032 (USD MILLION) 49

-

TABLE 12

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CIRCLES, BY REGION, 2023-2032 (KILO

-

TONS) 49

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FOIL STOCK,

-

BY REGION, 2023-2032 (USD MILLION) 50

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR FOIL STOCK, BY REGION, 2023-2032 (KILO TONS) 51

-

TABLE 15

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CAN STOCK, BY REGION, 2023-2032

-

(USD MILLION) 51

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CAN

-

STOCK, BY REGION, 2023-2032 (KILO TONS) 52

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR FIN STOCK, BY REGION, 2023-2032 (USD MILLION) 52

-

TABLE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FIN STOCK, BY REGION, 2023-2032

-

(KILO TONS) 53

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS,

-

BY REGION, 2023-2032 (USD MILLION) 53

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (KILO TONS) 54

-

GLOBAL

-

ALUMINUM FLAT-ROLLED PRODUCTS, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 56

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 57

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING

-

& CONSTRUCTION, BY REGION, 2023-2032

-

(USD MILLION) 57

-

GLOBAL

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING & CONSTRUCTION, BY REGION,

-

(KILO TONS) 58

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION,

-

59

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR AUTOMOTIVE &

-

TRANSPORTATION, BY REGION,

-

GLOBAL ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET FOR CONSUMER GOODS, BY REGION, 2023-2032 (USD MILLION)

-

60

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CONSUMER GOODS,

-

BY REGION, 2023-2032 (KILO TONS) 60

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION,

-

61

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR ELECTRICAL &

-

ELECTRONICS, BY REGION, 2023-2032 (KILO TONS) 61

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR INDUSTRIAL, BY REGION, 2023-2032 (USD MILLION) 62

-

TABLE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR INDUSTRIAL, BY REGION, 2023-2032

-

(KILO TONS) 62

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PACKAGING,

-

BY REGION, 2023-2032 (USD MILLION) 63

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET FOR PACKAGING, BY REGION, 2023-2032 (KILO TONS) 64

-

TABLE 35

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD

-

MILLION) 64

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS,

-

BY REGION, 2023-2032 (KILO TONS) 65

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY REGION, 2023-2032 (USD MILLION) 67

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY REGION, 2023-2032 (KILO TONS) 67

-

GLOBAL ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 68

-

TABLE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO

-

TONS) 68

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 69

-

NORTH AMERICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 70

-

TABLE 44

-

NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO

-

TONS) 70

-

NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 ( USD MILLION) 71

-

NORTH AMERICA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 71

-

NORTH AMERICA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

72

-

NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (KILO TONS) 72

-

US ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 73

-

US ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 74

-

US ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 74

-

US ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 75

-

CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 ( USD MILLION) 76

-

CANADA ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 76

-

CANADA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 77

-

CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 77

-

EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY,

-

EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY COUNTRY, 2023-2032 (KILO TONS) 79

-

EUROPE ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 79

-

EUROPE ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 80

-

TABLE

-

EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD

-

MILLION) 81

-

EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (KILO TONS) 81

-

GERMANY ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 82

-

GERMANY ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 82

-

TABLE

-

GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 83

-

GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (KILO TONS) 83

-

RUSSIA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 84

-

RUSSIA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 85

-

RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 85

-

RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (KILO TONS) 86

-

UK ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 87

-

UK ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 87

-

UK ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 88

-

UK ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 89

-

FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 ( USD MILLION) 89

-

FRANCE ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 90

-

FRANCE ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 91

-

FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 91

-

SPAIN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 ( USD MILLION) 92

-

SPAIN ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 92

-

SPAIN ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 93

-

SPAIN

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS)

-

93

-

ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

( USD MILLION) 94

-

ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 (KILO TONS) 95

-

ITALY ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 95

-

ITALY ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 96

-

TABLE

-

THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

( USD MILLION) 96

-

THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 (KILO TONS) 97

-

THE NETHERLANDS ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 98

-

THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 99

-

BELGIUM ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 99

-

BELGIUM

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

100

-

BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 101

-

POLAND ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 102

-

POLAND

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

102

-

POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 103

-

REST OF EUROPE

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 104

-

REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 105

-

ASIA-PACIFIC

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 106

-

ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032

-

(KILO TONS) 107

-

ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 107

-

ASIA-PACIFIC ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 108

-

TABLE

-

ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 109

-

ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 109

-

CHINA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 110

-

CHINA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 110

-

CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 111

-

CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (KILO TONS) 111

-

JAPAN ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 112

-

JAPAN

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 113

-

JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 113

-

JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (KILO TONS) 114

-

INDIA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 114

-

INDIA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 115

-

INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 116

-

INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (KILO TONS) 116

-

SOUTH KOREA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 117

-

TABLE

-

SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS) 117

-

SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 118

-

SOUTH KOREA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 118

-

TABLE

-

INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (

-

USD MILLION) 119

-

INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 (KILO TONS) 120

-

INDONESIA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 120

-

TABLE 128

-

INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO

-

TONS) 121

-

THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 ( USD MILLION) 121

-

THAILAND ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 122

-

THAILAND

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

123

-

THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 124

-

AUSTRALIA

-

& NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS) 125

-

AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 125

-

TABLE 136

-

AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 127

-

MALAYSIA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 127

-

TABLE

-

MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 128

-

MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 128

-

REST OF ASIA-PACIFIC

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION)

-

129

-

REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

PRODUCT TYPE, 2023-2032 (KILO TONS) 130

-

REST OF ASIA-PACIFIC ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 130

-

REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (KILO TONS) 131

-

LATIN AMERICA ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 132

-

LATIN AMERICA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 132

-

TABLE

-

LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

( USD MILLION) 133

-

LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 (KILO TONS) 133

-

LATIN AMERICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 134

-

LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 (USD MILLION) 135

-

MEXICO ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 136

-

MEXICO

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

136

-

MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 137

-

BRAZIL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 138

-

BRAZIL

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

139

-

BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 140

-

ARGENTINA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 140

-

TABLE

-

ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 141

-

ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 141

-

REST OF LATIN AMERICA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION)

-

142

-

REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

PRODUCT TYPE, 2023-2032 (KILO TONS) 143

-

REST OF LATIN AMERICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 143

-

REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (KILO TONS) 144

-

THE MIDDLE EAST & AFRICA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 144

-

THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

COUNTRY, 2023-2032 (KILO TONS) 145

-

THE MIDDLE EAST & AFRICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 145

-

TABLE

-

THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 (KILO TONS) 146

-

THE MIDDLE EAST & AFRICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (KILO TONS) 147

-

NORTH AFRICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 148

-

TABLE

-

NORTH AFRICA. ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS) 148

-

NORTH AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 149

-

NORTH AFRICA ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 149

-

TABLE

-

TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD

-

MILLION) 150

-

TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT

-

TYPE, 2023-2032 (KILO TONS) 151

-

TURKEY ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 151

-

TURKEY ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 152

-

TABLE

-

GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION)

-

152

-

GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS) 153

-

GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (USD MILLION) 154

-

GCC ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 154

-

ISRAEL ALUMINUM

-

FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 155

-

TABLE

-

ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO

-

TONS) 156

-

ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (USD MILLION) 156

-

ISRAEL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 157

-

REST

-

OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE,

-

(USD MILLION) 157

-

REST OF MIDDLE EAST & AFRICA

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS)

-

158

-

REST OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS

-

MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 159

-

REST

-

OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY,

-

(KILO TONS) 159

-

MERGER & ACQUISITION 161

-

TABLE

-

AGREEMENTS 162

-

EXPANSION 162

-

INVESTMENTS 163

-

COLLABORATION 163

-

JOINT VENTURE 164

-

List Of Figures

-

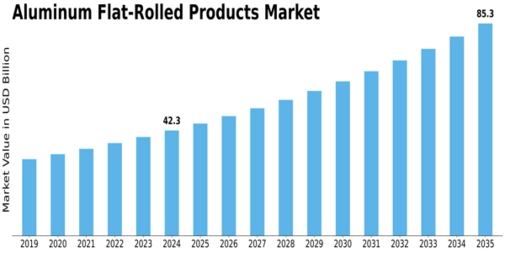

MARKET SYNOPSIS 18

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET 19

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET ANALYSIS, BY PRODUCT TYPE 19

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET ANALYSIS, END-USE INDUSTRY 20

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET ANALYSIS, BY REGION 21

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET: MARKET STRUCTURE 23

-

KEY BUYING CRITERIA IN THE GLOBAL

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET 23

-

NORTH AMERICA MARKET SIZE

-

& MARKET SHARE, BY COUNTRY, (2023-2032) 24

-

EUROPE MARKET SIZE

-

& MARKET SHARE, BY COUNTRY, (2023-2032) 24

-

ASIA-PACIFIC SIZE

-

& MARKET SHARE, BY COUNTRY, (2023-2032) 25

-

LATIN AMERICA SIZE

-

& MARKET SHARE, BY COUNTRY, (2023-2032) 25

-

MIDDLE EAST &

-

AFRICA MARKET SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 26

-

FIGURE 13

-

RESEARCH PROCESS OF MRFR 27

-

TOP-DOWN & BOTTOM-UP APPROACH 30

-

MARKET DYNAMICS OVERVIEW 32

-

GLOBAL AUTOMOBILE PRODUCTION,

-

MILLION UNITS (2023-2032) 33

-

GROWTH OF THE GLOBAL METAL PACKAGING

-

INDUSTRY 34

-

DRIVERS IMPACT ANALYSIS 35

-

RESTRAINTS

-

IMPACT ANALYSIS 36

-

GLOBAL SPENDING ON THE CONSTRUCTION INDUSTRY (2023-2032)

-

37

-

ALUMINUM PRICES, USD PER TON, (2023-2032) 37

-

SUPPLY

-

CHAIN: GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 38

-

PORTER'S FIVE

-

FORCES ANALYSIS OF THE GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 40

-

FIGURE

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023 (% SHARE)

-

43

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE,

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET,

-

BY END-USE INDUSTRY, 2023 (% SHARE) 55

-

GLOBAL ALUMINUM FLAT-ROLLED

-

PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 56

-

GLOBAL

-

ALUMINUM FLAT-ROLLED PRODUCTS MARKET BY REGION, 2023-2032 (USD MILLION) 66

Leave a Comment