Market Share

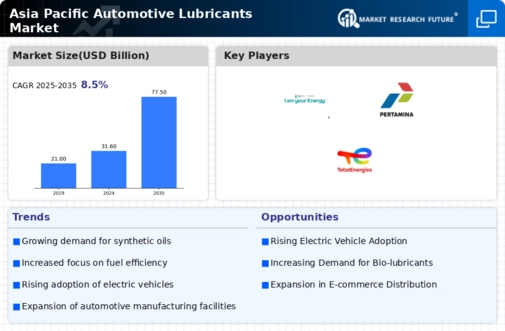

Asia Pacific Automotive Lubricants Market Share Analysis

The Asia Pacific Automotive Lubricants Market is dynamic and competitive, and market share positioning tactics are important to business success. Companies in this region use several strategies to obtain market share and compete. Companies use product differentiation to create lubricants with unique characteristics or advanced compositions for automobile use. Companies target niche customers and become market leaders by supplying unique and specialized products.

Pricing strategies are crucial to Asia Pacific market share positioning. Due to country-specific economic realities, corporations use flexible pricing structures to accommodate consumer purchasing power. Some brands target premium lubricant buyers, while others target price-sensitive audiences. Companies seeking market share in this diverse and broad region must balance quality and price.

Distribution routes also influence market share positioning. Companies strategically work with distributors, retailers, and vehicle service centers to distribute their products. Effective distribution networks enable organizations reach remote and unexplored regions, expanding their footprint and market share. Collaborations with OEMs help companies become trusted automotive partners, boosting their market position.

Market share positioning strategies in the Asia Pacific Automotive Lubricants Market require brand image and reputation. Companies market and brand their products to improve consumer perception. Strong brands build trust and help items stand out in crowded markets. Companies use endorsements, certifications, and client testimonials to build credibility and become dependable regional choices.

Recent trends in sustainable and eco-friendly activities have influenced market share positioning. As environmental concerns grow, Asia Pacific corporations are manufacturing lubricants that meet strict environmental criteria. Companies can align with global sustainability goals and attract environmentally concerned consumers by marketing environmentally responsible products, giving them a competitive edge and market share.

Finally, automotive lubricants market share positioning depends on technological innovation. Research and development help companies create lubricants that satisfy modern vehicle needs for greater performance and lifetime. By staying ahead of technical advances, organizations become industry leaders and attract clients who want cutting-edge automobile lubrication solutions.

Leave a Comment