Market Analysis

In-depth Analysis of Asia Pacific Suture Needles Market Industry Landscape

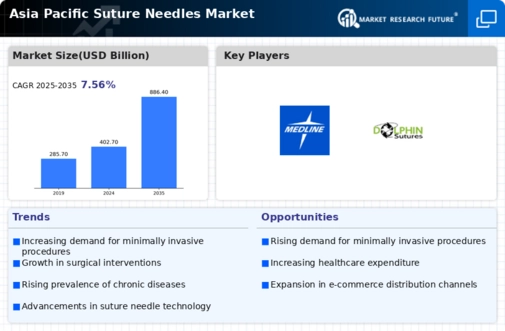

The Asia Pacific suture needle market has grown significantly. This development is due to the growing elder population, rising surgical demand, and improved healthcare infrastructure. Due to their role in wound suturing, suture needles are crucial to many medical procedures. As medical costs climb in Asia-Pacific nations, the necessity for high-quality medical equipment like suturing needles has grown. The frequency of elective and emergency surgeries in this area has increased, expanding the demand for suture needles. Technological advances and product enhancements in suture needle and material design have advanced the industry. Medical experts' evolving demands are driving needle manufacturers to improve accuracy, strength, and tissue stress. This is done to fulfill medical industry needs. Ageing populations in Asia Pacific are contributing to the demographic transition. Surgical operations on the elderly are a major driver of suture needle demand. This demographic trend is expected to boost market growth in the near future. Due to greater awareness among medical professionals and patients of the advantages of less intrusive surgery, suture needle sales have surged. This is because these therapies may benefit. The quest for smaller incisions and faster healing has driven the adoption of customized needles for these procedures. Regulatory frameworks and quality standards in Asia-Pacific affect the suture needle industry. Medical device development and marketing are heavily regulated in a competitive industry where compliance is crucial. Regulations have created a competitive atmosphere. Despite development prospects, the industry faces cost-related hurdles. High-quality suture needles may be hard to get for healthcare organizations, particularly in developing nations. This may affect market penetration since these institutions may have trouble getting suture needles. Manufacturers are seeking efficient and cost-effective solutions as a result. To ensure suture needle availability in Asia Pacific, effective and resilient supply chain management distribution networks are needed. This is the only method to ensure suture needle availability. Many market participants are optimizing their distribution networks to guarantee people have quick access to medical facilities and clinical practitioners. The big companies in the industry form smart partnership, work together, and join to get a bigger share of the market. This boosts their market standing. Such agreements promote innovation and enhance suture needle technology. Suture needles in Asia and the Pacific provide rising countries growth prospects in a large untapped market. Many factors are driving market expansion in these areas. These include increased healthcare knowledge, disposable money, and infrastructure. Considering the significance of ecologically responsible business strategies, the Asia Pacific suture needle market should do well. The worldwide trend toward environmentally aware healthcare solutions is expanding as manufacturers use more environmentally friendly materials and sustainable production methods.

Leave a Comment