-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TYPE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- GROWING INCIDENCES OF CANCER AND RARE DISORDERS

- INCREASING LAUNCH OF BIOSIMILARS

- RISING HEALTHCARE COSTS

-

RESTRAINTS

- REGULATORY AND APPROVAL BARRIERS

- LIMITED REIMBURSEMENT AND MARKET ACCESS

-

OPPORTUNITY

- EXPANSION IN EMERGING MARKETS

- PARTNERSHIPS AND COLLABORATIONS

-

MARKET FACTOR ANALYSIS

-

PORTER'S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

IMPACT OF COVID-19 ON GLOBAL BIOSIMILAR MARKET

-

GLOBAL BIOSIMILAR MARKET, BY DRUG CLASS

-

OVERVIEW

-

MONOCLONAL ANTIBODIES

- ADALIMUMAB

- INFLIXIMAB

- RITUXIMAB

- BEVACIZUMAB

- TRASTUZUMAB

- USTEKINUMAB

- TOCILIZUMAB

- AFLIBERCEPT

- DUPILUMAB

- DENOSUMAB

- OTHERS

-

INSULIN

-

GRANULOCYTE COLONY- STIMULATING FACTOR

-

ERYTHROPOIETIN

-

RECOMBINANT HUMAN GROWTH HORMONE

-

ETANERCEPT

-

FOLLITROPIN

-

TERIPARATIDE

-

ANTICOAGULANTS

-

OTHERS

-

GLOBAL BIOSIMILAR MARKET, BY APPLICATION

-

OVERVIEW

-

ONCOLOGY

- BREAST CANCER

- LUNG CANCER

- PROSTATE CANCER

- LEUKEMIA

- BLADDER CANCER

- COLORECTAL CANCER

- OTHERS

-

AUTOIMMUNE DISEASES

-

INFECTIOUS DISEASES

-

BLOOD DISORDERS

-

OTHERS

-

GLOBAL BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION

-

OVERVIEW

-

SUBCUTANEOUS

-

INTRAVENOUS

-

GLOBAL BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL

-

OVERVIEW

-

HOSPITAL PHARMACIES

-

RETAIL PHARMACIES

-

ONLINE PHARMACIES

-

SPECIALTY PHARMACIES

-

GLOBAL BIOSIMILAR MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- FRANCE

- UK

- ITALY

- SPAIN

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

-

REST OF THE WORLD

- MIDDLE EAST AND AFRICA

- SOUTH AMERICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

MARKET SHARE ANALYSIS, 2024

-

COMPETITOR DASHBOARD

-

PUBLIC PLAYERS STOCK SUMMARY

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT LAUNCH

- PRODUCT APPROVAL

- AGREEMENT/COLLABORATION/PARTNERSHIP

-

COMPANY PROFILE

-

ELI LILLY AND COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SAMSUNG BIOEPIS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

AMGEN INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PFIZER INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

NOVARTIS AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

BIOGEN

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

BIOCON

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

DR. REDDY’S LABORATORIES LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCT OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

FRESENIUS KABI USA, LLC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

KIDSWELL BIO CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCT OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

DATA CITATIONS

-

DATA CITATIONS

-

DATA CITATIONS

-

\r\n

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

GLOBAL BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ADALIMUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR INFLIXIMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR RITUXIMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR BEVACIZUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR TRASTUZUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR USTEKINUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR TOCILIZUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR AFLIBERCEPT, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR DUPILUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR DENOSUMAB, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR INSULIN, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR GRANULOCYTE COLONY- STIMULATING FACTOR, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ERYTHROPOIETIN, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR RECOMBINANT HUMAN GROWTH HORMONE, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ETANERCEPT, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR FOLLITROPIN, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR TERIPARATIDE, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ANTICOAGULANTS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ONCOLOGY, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR BREAST CANCER, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR LUNG CANCER, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR PROSTATE CANCER, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR LEUKEMIA, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR BLADDER CANCER, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR COLORECTAL CANCER, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR AUTOIMMUNE DISEASES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR INFECTIOUS DISEASES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR BLOOD DISORDERS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR OTHERS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR SUBCUTANEOUS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR INTRAVENOUS, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR HOSPITAL PHARMACIES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR RETAIL PHARMACIES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR ONLINE PHARMACIES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, FOR SPECIALTY PHARMACIES, BY REGION, 2019–2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, BY REGION, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

US BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

CANADA BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

MEXICO BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

GERMANY BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

FRANCE BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

UK BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

ITALY BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

SPAIN BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, BY DRUG CLASS, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, FOR MONICLONAL ANTIBODIES, BY TYPE, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, FOR ONCOLOGY, BY TYPE, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLION)

-

REST OF EUROPE BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, BY COUNTRY, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

CHINA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

INDIA -PACIFIC: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

INDIA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

INDIA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

INDIA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

INDIA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

INDIA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

JAPAN: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

AUSTRALIA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

SOUTH KOREA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

REST OF ASIA-PACIFIC: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, BY COUNTRY, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

MIDDLE EAST AND AFRICA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, BY DRUG CLASS, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, FOR MONOCLONAL ANTIBODIES, BY TYPE, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, BY APPLICATION, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, FOR ONCOLOGY, BY TYPE, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2019–2035 (USD BILLION)

-

SOUTH AMERICA: BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2019–2035 (USD BILLION)

-

PUBLIC PLAYERS STOCK SUMMARY

-

PRODUCT LAUNCH

-

PRODUCT APPROVAL

-

AGREEMENT/COLLABORATION/PARTNERSHIP

-

ELI LILLY AND COMPANY: PRODUCTS OFFERED

-

ELI LILLY AND COMPANY: KEY DEVELOPMENTS

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCTS OFFERED

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.: KEY DEVELOPMENTS

-

SAMSUNG BIOEPIS: PRODUCT OFFERED

-

SAMSUNG BIOEPIS: KEY DEVELOPMENTS

-

AMGEN INC.: PRODUCTS OFFERED

-

AMGEN INC.: KEY DEVELOPMENTS

-

PFIZER INC.: PRODUCTS OFFERED

-

PFIZER INC.: KEY DEVELOPMENTS

-

NOVARTIS AG: PRODUCTS OFFERED

-

NOVARTIS AG: KEY DEVELOPMENTS

-

BIOGEN: PRODUCTS OFFERED

-

BIOGEN: KEY DEVELOPMENTS

-

BIOCON: PRODUCTS OFFERED

-

BIOCON: KEY DEVELOPMENTS

-

DR. REDDY'S LABORATORIES LTD.: PRODUCTS OFFERED

-

DR. REDDY LABORATORIES: KEY DEVELOPMENTS

-

FRESENIUS KABI USA, LLC.: PRODUCT OFFERED

-

FRESENIUS KABI USA, LLC.: KEY DEVELOPMENTS

-

KIDSWELL BIO CORPORATION: PRODUCTS OFFERED

-

PROCTER & GAMBLE: KEY DEVELOPMENTS

-

\r\n

-

-

LIST OF FIGURES

-

GLOBAL BIOSIMILARS MARKET: STRUCTURE

-

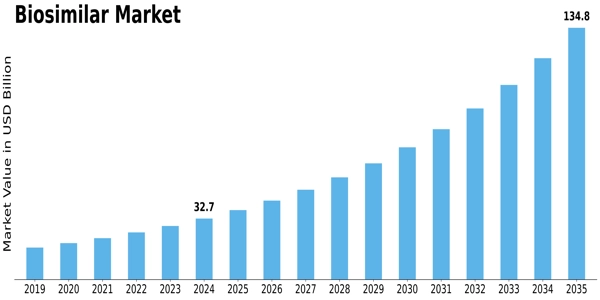

GLOBAL BIOSIMILAR MARKET: MARKET GROWTH FACTOR ANALYSIS (2024-2035)

-

DRIVER IMPACT ANALYSIS (2024-2035)

-

RESTRAINT IMPACT ANALYSIS (2024-2035)

-

PORTER'S FIVE FORCES ANALYSIS: GLOBAL BIOSIMILAR MARKET

-

GLOBAL BIOSIMILAR MARKET, BY DRUG CLASS, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL BIOSIMILAR MARKET, MONOCLONAL ANTIBODIES, BY TYPE SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET, BY DRUG CLASS, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET SHARE (%), BY DRUG CLASS, 2024

-

GLOBAL BIOSIMILAR MARKET, BY APPLICATION, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL BIOSIMILAR MARKET, BY APPLICATION, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET SHARE (%), BY APPLICATION, 2024

-

GLOBAL BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL BIOSIMILAR MARKET, BY ROUTE OF ADMINISTRATION, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET SHARE (%), BY APPLICATION, 2024

-

GLOBAL BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, SEGMENT ATTRACTIVENESS ANALYSIS

-

GLOBAL BIOSIMILAR MARKET, BY DISTRIBUTION CHANNEL, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET SHARE (%), BY DISTRIBUTION CHANNEL, 2024

-

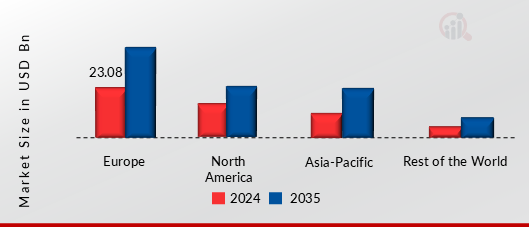

GLOBAL BIOSIMILAR MARKET, BY REGION, 2024 & 2035 (USD BILLION)

-

GLOBAL BIOSIMILAR MARKET SHARE (%), BY REGION, 2024

-

NORTH AMERICA MARKET ANALYSIS: BIOSIMILAR MARKET, 2019-2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

NORTH AMERICA BIOSIMILAR MARKET SHARE (%), BY COUNTRY, 2024

-

EUROPE MARKET ANALYSIS: BIOSIMILARS MARKET, 2019-2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

EUROPE BIOSIMILARS MARKET SHARE (%), BY COUNTRY, 2024

-

ASIA-PACIFIC: BIOSIMILAR MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

ASIA-PACIFIC: BIOSIMILAR MARKET SHARE, BY COUNTRY, 2024 (%)

-

REST OF THE WORLD: BIOSIMILAR MARKET SHARE, BY COUNTRY, 2024 & 2035 (USD BILLION)

-

REST OF THE WORLD: BIOSIMILAR MARKET SHARE, BY COUNTRY, 2024 (%)

-

GLOBAL BIOSIMILAR MARKET PLAYERS: COMPETITIVE ANALYSIS, 2024

-

COMPETITOR DASHBOARD: GLOBAL BIOSIMILAR MARKET

-

ELI LILLY AND COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

ELI LILLY AND COMPANY: SWOT ANALYSIS

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.: FINANCIAL OVERVIEW SNAPSHOT

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.: SWOT ANALYSIS

-

AMGEN INC.: FINANCIAL OVERVIEW SNAPSHOT

-

AMGEN INC.: SWOT ANALYSIS

-

PFIZER INC.: FINANCIAL OVERVIEW SNAPSHOT

-

PFIZER INC.: SWOT ANALYSIS

-

NOVARTIS AG: FINANCIAL OVERVIEW SNAPSHOT

-

BIOGEN: FINANCIAL OVERVIEW SNAPSHOT

-

BIOCON: FINANCIAL OVERVIEW SNAPSHOT

-

BIOCON.: SWOT ANALYSIS

-

DR. REDDY'S LABORATORIES LTD.: FINANCIAL OVERVIEW SNAPSHOT

-

KIDSWELL BIO CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

KIDSWELL BIO CORPORATION: SWOT ANALYSIS

-

\r\n

-

"

Leave a Comment