-

EXECUTIVE SUMMARY

-

MARKET ATTRACTIVENESS ANALYSIS

- GLOBAL CHOCOLATE MARKET, BY PRODUCT TYPE

- GLOBAL CHOCOLATE MARKET, BY NATURE

- GLOBAL CHOCOLATE MARKET, BY FORM

- GLOBAL CHOCOLATE MARKET, BY APPLICATION

- GLOBAL CHOCOLATE MARKET, BY PRICE

- GLOBAL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

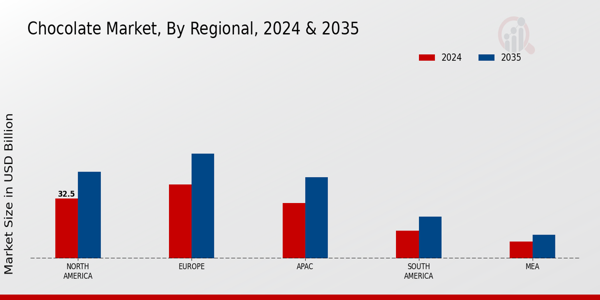

- GLOBAL CHOCOLATE MARKET, BY REGION

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

KEY BUYING CRITERIA

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- CONSUMPTION & NET TRADE APPROACH

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- RISING DEMAND FOR PREMIUM AND GOURMET CHOCOLATES

- INCREASING USE OF ARTIFICIAL CHOCOLATE IN BAKERY & DESSERTS

-

RESTRAINTS

- PRICE VOLATILITY OF COCOA BEANS IMPACTING PRODUCTION COSTS

- HEALTH CONCERNS OVER SUGAR CONTENT IN TRADITIONAL CHOCOLATES

-

OPPORTUNITY

- INNOVATION IN LOW-CALORIE AND FUNCTIONAL CHOCOLATE VARIETIES

- GROWING INTEREST IN BLOCKCHAIN FOR COCOA TRACEABILITY AND INTEGRATION OF AI IN CHOCOLATE FORMULATION AND PRODUCTION

-

CHALLENGES

- SUSTAINABILITY CONCERNS REGARDING COCOA FARMING

- HIGH IMPORT/EXPORT TARIFFS ON COCOA PRODUCTS

-

STRATEGIC INSIGHTS

- TECHNOLOGY UPDATE

- REGIONAL MARKETS TO LOOKOUT FOR

-

REGULATORY UPDATE

-

MARKET TRENDS

-

IMPACT ANALYSIS OF COVID -

- IMPACT ON OVERALL FOOD & BEVERAGES INDUSTRY

- IMPACT ON GLOBAL CHOCOLATE MARKET

- IMPACT ON SUPPLY CHAIN OF CHOCOLATE MARKET

- IMPACT ON MARKET DEMAND OF CHOCOLATE MARKET

- IMPACT ON PRICING OF CHOCOLATE MARKET

-

MARKET FACTOR ANALYSIS

-

VALUE CHAIN ANALYSIS

- RAW MATERIALS

- MANUFACTURING / PRODUCTION/ PROCESSING

- PACKAGING

-

SUPPLY CHAIN ANALYSIS

- PARTICIPANTS (AT DIFFERENT NODES)

- INTEGRATION LEVELS

- KEY ISSUES ADDRESSED (KEY SUCCESS FACTORS)

-

PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

GLOBAL CHOCOLATE MARKET, BY PRODUCT TYPE

-

INTRODUCTION

-

TRADITIONAL

-

ARTIFICIAL

-

GLOBAL CHOCOLATE MARKET, BY NATURE

-

INTRODUCTION

-

UNSWEETENED

-

SEMISWEET/BITTERSWEET

-

GLOBAL CHOCOLATE MARKET, BY FORM

-

INTRODUCTION

-

CHOCOLATE BARS

-

SHARDS

-

LIQUID CHOCOLATE

-

CLUSTERS/TRUFFLES CHOCOLATES

-

OTHERS

-

GLOBAL CHOCOLATE MARKET, BY APPLICATION

-

INTRODUCTION

-

RESIDENTIAL/RETAIL

-

BAKERY

-

CONFECTIONERY

-

FROZEN DESSERTS & ICE-CREAM

-

BEVERAGES

-

OTHERS

-

GLOBAL CHOCOLATE MARKET, BY PRICE

-

INTRODUCTION

-

MASS/ECONOMY

-

PREMIUM

-

GLOBAL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

-

INTRODUCTION

-

SUPERMARKETS & HYPERMARKETS

-

SPECIALTY STORES

-

CONVENIENCE STORES

-

ONLINE

-

GLOBAL CHOCOLATE MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- BELGIUM

- GERMANY

- FRANCE

- UK

- SPAIN

- ITALY

- IRELAND

- DENMARK

- REST OF EUROPE

-

ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

MIDDLE EAST & AFRICA

- GCC COUNTRIES

- TURKEY

- NORTHERN AFRICA

- SOUTHERN AFRICA

- REST OF MEA

-

COMPETITIVE LANDSCAPE

-

COMPETITIVE OVERVIEW

-

MAJOR PLAYERS IN THE GLOBAL CHOCOLATE MARKET

-

MAJOR PLAYERS IN TERMS OF MARKET DISRUPTORS & INNOVATORS

-

COMPETITIVE BENCHMARKING

-

STRATEGIES OF MARKET LEADERS IN THE GLOBAL CHOCOLATE MARKET

- THE HERSHEY COMPANY

- MARS, INCORPORATED

- FERRERO INTERNATIONAL S.A.

- CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

- BARRY CALLEBAUT AG

- NORTH AMERICA: MAJOR PLAYERS

- EUROPE: MAJOR PLAYERS

- APAC: MAJOR PLAYERS

- SOUTH AMERICA: MAJOR PLAYERS

- MEA: MAJOR PLAYERS

-

LEADING PLAYERS IN TERMS OF THE NUMBER OF DEVELOPMENTS IN GLOBAL CHOCOLATE MARKET

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- CONTRACTS AND AGREEMENT

- PRODUCT LAUNCH/PRODUCT DEVELOPMENT

- EXPANSION/ACQUISITION/PARTNERSHIP

-

COMPANY PROFILES

-

FERRERO INTERNATIONAL S.A.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

MARS, INCORPORATED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

THE HERSHEY COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BARRY CALLEBAUT AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

CARGILL, INCORPORATED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PATCHI

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

VALRHONA SAS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

CONFISERIE LEONIDAS S.A.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

NEUHAUS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LAKE CHAMPLAIN CHOCOLATE CO.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

J.H. WHITTAKER AND SONS, LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ROCOCO CHOCOLATES

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

GLOBAL CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

GLOBAL CHOCOLATE MARKET, BY REGION, 2019-2035 (USD MILLION)

-

GLOBAL CHOCOLATE MARKET, BY REGION, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

NORTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

NORTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

NORTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

US CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

US CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

CANADA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

CANADA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

MEXICO CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

MEXICO CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

EUROPE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

EUROPE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

EUROPE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

BELGIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

BELGIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

GERMANY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

GERMANY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

FRANCE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

FRANCE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

UK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

UK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

SPAIN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

SPAIN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

ITALY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

ITALY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

IRELAND CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

IRELAND CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

DENMARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

DENMARK CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

REST OF EUROPE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

REST OF EUROPE CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

ASIA PACIFIC CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

ASIA PACIFIC CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

ASIA PACIFIC CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

CHINA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

CHINA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

INDIA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

INDIA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

JAPAN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

JAPAN CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

SOUTH KOREA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

SOUTH KOREA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

REST OF ASIA-PACIFIC CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

SOUTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

SOUTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

SOUTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

BRAZIL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

BRAZIL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

ARGENTINA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

ARGENTINA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

REST OF SOUTH AMERICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

GCC COUNTRIES CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

GCC COUNTRIES CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

TURKEY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

TURKEY CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

NORTHERN AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

SOUTHERN AFRICA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY NATURE, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY NATURE, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY FORM, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY FORM, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY APPLICATION, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY PRICE, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY PRICE, 2019-2035 (KILO TON)

-

REST OF MEA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION)

-

REST OF MEA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (KILO TON)

-

MAJOR PLAYERS IN TERMS OF MARKET DISRUPTORS & INNOVATORS

-

NORTH AMERICA: MAJOR PLAYERS

-

EUROPE: MAJOR PLAYERS

-

APAC: MAJOR PLAYERS

-

SOUTH AMERICA: MAJOR PLAYERS

-

MEA: MAJOR PLAYERS

-

THE MOST ACTIVE PLAYERS IN THE GLOBAL CHOCOLATE MARKET

-

CONTRACTS AND AGREEMENT

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT

-

EXPANSION/ACQUISITION/ PARTNERSHIP

-

FERRERO INTERNATIONAL S.A.: PRODUCTS/SERVICES OFFERED

-

MARS, INCORPORATED: PRODUCTS OFFERED

-

CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG: PRODUCTS OFFERED

-

CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG: KEY DEVELOPMENTS

-

THE HERSHEY COMPANY: PRODUCTS OFFERED

-

MARS, INCORPORATED: KEY DEVELOPMENTS

-

BARRY CALLEBAUT AG: PRODUCTS OFFERED

-

CARGILL, INCORPORATED: PRODUCTS OFFERED

-

PATCHI: PRODUCTS/SERVICES OFFERED

-

PATCHI: KEY DEVELOPMENTS

-

VALRHONA SAS: PRODUCTS OFFERED

-

VALRHONA SAS: KEY DEVELOPMENTS

-

CONFISERIE LEONIDAS S.A.: PRODUCTS OFFERED

-

CONFISERIE LEONIDAS S.A.: KEY DEVELOPMENTS

-

NEUHAUS: PRODUCTS OFFERED

-

LAKE CHAMPLAIN CHOCOLATE CO.: PRODUCTS OFFERED

-

LAKE CHAMPLAIN CHOCOLATE CO.: KEY DEVELOPMENTS

-

J.H. WHITTAKER AND SONS, LTD: PRODUCTS OFFERED

-

ROCOCO CHOCOLATES: PRODUCTS OFFERED LIST OF FIGURES

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL CHOCOLATE MARKET

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY PRODUCT TYPE,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY NATURE,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY FORM,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY APPLICATION,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY PRICE,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY DISTRIBUTION CHANNEL,

-

GLOBAL CHOCOLATE MARKET ANALYSIS, BY REGION,

-

GLOBAL CHOCOLATE MARKET: STRUCTURE

-

KEY BUYING CRITERIA FOR CHOCOLATE

-

GLOBAL CHOCOLATE MARKET: MARKET DYNAMICS

-

DRIVER IMPACT ANALYSIS (2019-2035)

-

RESTRAINT IMPACT ANALYSIS (2019-2035)

-

SUPPLY CHAIN ANALYSIS: GLOBAL CHOCOLATE MARKET

-

PORTER’S FIVE FORCES MODEL: GLOBAL CHOCOLATE MARKET

-

GLOBAL CHOCOLATE MARKET, BY PRODUCT TYPE,

-

GLOBAL CHOCOLATE MARKET, BY NATURE,

-

GLOBAL CHOCOLATE MARKET, BY FORM,

-

GLOBAL CHOCOLATE MARKET, BY APPLICATION,

-

GLOBAL CHOCOLATE MARKET, BY PRICE,

-

GLOBAL CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL,

-

GLOBAL MARKET: COMPARATIVE ANALYSIS

-

GLOBAL CHOCOLATE MARKET, BY REGION,

-

NORTH AMERICA MARKET: COMPARATIVE ANALYSIS

-

NORTH AMERICA CHOCOLATE MARKET, BY COUNTRY,

-

EUROPE MARKET: COMPARATIVE ANALYSIS

-

EUROPE CHOCOLATE MARKET, BY COUNTRY,

-

ASIA PACIFIC MARKET: COMPARATIVE ANALYSIS

-

ASIA PACIFIC CHOCOLATE MARKET, BY COUNTRY,

-

SOUTH AMERICA MARKET: COMPARATIVE ANALYSIS

-

SOUTH AMERICA CHOCOLATE MARKET, BY COUNTRY,

-

MIDDLE EAST & AFRICA MARKET: COMPARATIVE ANALYSIS

-

MIDDLE EAST & AFRICA CHOCOLATE MARKET, BY COUNTRY,

-

MAJOR PLAYERS IN THE GLOBAL CHOCOLATE MARKET: MARKET SHARE

-

BENCHMARKING OF MAJOR COMPETITORS

-

FERRERO INTERNATIONAL S.A.: SWOT ANALYSIS

-

MARS, INCORPORATED: SWOT ANALYSIS

-

CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG: FINANCIAL OVERVIEW SNAPSHOT

-

CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG: SWOT ANALYSIS

-

THE HERSHEY COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

THE HERSHEY COMPANY: SWOT ANALYSIS

-

BARRY CALLEBAUT AG: FINANCIAL OVERVIEW SNAPSHOT

-

BARRY CALLEBAUT AG: SWOT ANALYSIS

-

CARGILL, INCORPORATED: SWOT ANALYSIS

-

PATCHI: SWOT ANALYSIS

-

VALRHONA SAS: SWOT ANALYSIS

-

CONFISERIE LEONIDAS S.A.: SWOT ANALYSIS

-

NEUHAUS: SWOT ANALYSIS

-

LAKE CHAMPLAIN CHOCOLATE CO.: SWOT ANALYSIS

-

J.H. WHITTAKER AND SONS, LTD: SWOT ANALYSIS

-

ROCOCO CHOCOLATES: SWOT ANALYSIS

Leave a Comment