-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

-

Value Chain/Supply Chain of Global Cosmetic Pigments Market

-

Industry Overview of Global Cosmetic Pigments Market

-

Introduction

-

Growth Drivers

-

Impact analysis

-

Market Challenges

-

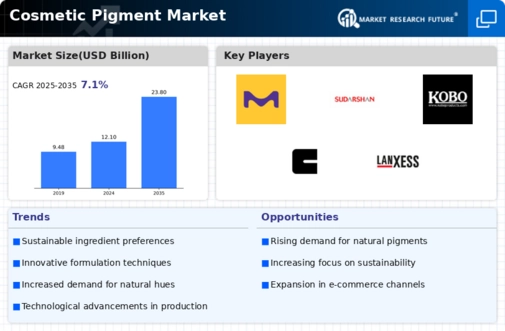

Market Trends

-

Introduction

-

Growth Trends

-

Impact analysis

-

Global Cosmetic Pigments Market by Composition

-

Introduction

-

Organic

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Inorganic

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Global Cosmetic Pigments Market by Type

-

Introduction

-

Special effect

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Surface treated

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Nano

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Global Cosmetic Pigments Market by Application

-

Introduction

-

Facial make up

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Eye makeup

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Lip products

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Nail products

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Hair color products

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Global Cosmetic Pigments Market by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Composition, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- U.S.

- Mexico

- Canada

-

Europe

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Composition, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Germany

- France

- Italy

- Spain

- U.K

- Rest of Europe

-

Asia Pacific

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Composition, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia Pacific

-

The Middle East & Africa

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Composition, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Turkey

- Israel

- North Africa

- GCC

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Composition, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Brazil

- Argentina

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

Sun Chemical Corporation

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Sensient Cosmetic Technologies

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Merck KGaA

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Sudarshan Chemical Industries Limited

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Kobo Products Inc

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

BASF SE

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Clariant

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Huntsman International LLC

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

LANXESS

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Geotech International B.V.

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Koel Colours Pvt. Ltd

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Li Pigments

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Chem India Pigments

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Nubiola

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Sandream Impact LLC

- Company Overview

- Composition/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

List of Tables:

-

World Population by Major Regions (2020 To 2027)

-

Global Cosmetic Pigments Market: By Region, 2020-2027

-

North America Cosmetic Pigments Market: By Country, 2020-2027

-

Europe Cosmetic Pigments Market: By Country, 2020-2027

-

Asia-Pacific Cosmetic Pigments Market: By Country, 2020-2027

-

Middle East & Africa Cosmetic Pigments Market: By Country, 2020-2027

-

Latin America Cosmetic Pigments Market: By Country, 2020-2027

-

Global Cosmetic Pigments by Composition Market: By Regions, 2020-2027

-

North America Cosmetic Pigments by Composition Market: By Country, 2020-2027

-

Table10 Europe Cosmetic Pigments by Composition Market: By Country, 2020-2027

-

Table11 Asia-Pacific Cosmetic Pigments by Composition Market: By Country, 2020-2027

-

Table12 Middle East & Africa Cosmetic Pigments by Composition Market: By Country, 2020-2027

-

Table13 Latin America Cosmetic Pigments by Composition Market: By Country, 2020-2027

-

Table14 Global Cosmetic Pigments by Type Market: By Regions, 2020-2027

-

Table15 North America Cosmetic Pigments by Type Market: By Country, 2020-2027

-

Table16 Europe Cosmetic Pigments by Type Market: By Country, 2020-2027

-

Table17 Asia-Pacific Cosmetic Pigments by Type Market: By Country, 2020-2027

-

Table18 Middle East & Africa Cosmetic Pigments by Type Market: By Country, 2020-2027

-

Table19 Latin America Cosmetic Pigments by Type Market: By Country, 2020-2027

-

Table20 Global Cosmetic Pigments by Application Market: By Regions, 2020-2027

-

Table21 North America Cosmetic Pigments for Application Market: By Country, 2020-2027

-

Table22 Europe Cosmetic Pigments for Application Market: By Country, 2020-2027

-

Table23 Asia-Pacific Cosmetic Pigments for Application Market: By Country, 2020-2027

-

Table24 Middle East & Africa Cosmetic Pigments for Application Market: By Country, 2020-2027

-

Table25 Latin America Cosmetic Pigments for Application Market: By Country, 2020-2027

-

Table26 Global Composition Market: By Region, 2020-2027

-

Table27 Global Type Market: By Region, 2020-2027

-

Table28 Global Application Market: By Region, 2020-2027

-

Table29 North America Cosmetic Pigments Market, By Country

-

Table30 North America Cosmetic Pigments Market, By Composition

-

Table31 North America Cosmetic Pigments Market, By Type

-

Table32 North America Cosmetic Pigments Market, By Application

-

Table33 Europe: Cosmetic Pigments Market, By Country

-

Table34 Europe: Cosmetic Pigments Market, By Composition

-

Table35 Europe: Cosmetic Pigments Market, By Type

-

Table36 Europe: Cosmetic Pigments Market, By Application

-

Table37 Asia-Pacific: Cosmetic Pigments Market, By Country

-

Table38 Asia-Pacific: Cosmetic Pigments Market, By Composition

-

Table39 Asia-Pacific: Cosmetic Pigments Market, By Type

-

Table40 Asia-Pacific: Cosmetic Pigments Market, By Application

-

Table41 Middle East & Africa: Cosmetic Pigments Market, By Country

-

Table42 Middle East & Africa Cosmetic Pigments Market, By Composition

-

Table43 Middle East & Africa Cosmetic Pigments Market, By Type

-

Table44 Middle East & Africa: Cosmetic Pigments Market, By Application

-

Table45 Latin America: Cosmetic Pigments Market, By Country

-

Table46 Latin America Cosmetic Pigments Market, By Composition

-

Table47 Latin America Cosmetic Pigments Market, By Type

-

Table48 Latin America: Cosmetic Pigments Market, By Application

-

List of Figures:

-

Global Cosmetic Pigments market segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Cosmetic Pigments Market

-

Value Chain of Global Cosmetic Pigments Market

-

Share of Global Cosmetic Pigments Market in 2020, by country (in %)

-

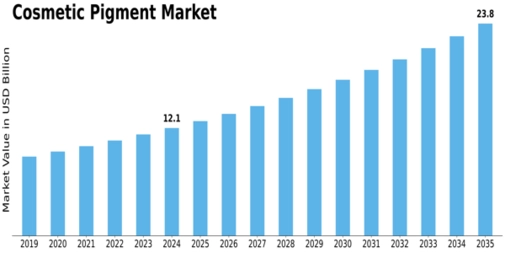

Global Cosmetic Pigments Market, 2020-2027,

-

Sub segments of Composition

-

Global Cosmetic Pigments Market size by Composition, 2020

-

Share of Global Cosmetic Pigments Market by Composition, 2020 to 2027

-

Global Cosmetic Pigments Market size by Type, 2020

-

Share of Global Cosmetic Pigments Market by Type, 2020 to 2027

-

Global Cosmetic Pigments Market size by Application, 2020

-

Share of Global Cosmetic Pigments Market by Application, 2020 to 2027

Leave a Comment