Market Analysis

In-depth Analysis of Cosmetic Pigments Market Industry Landscape

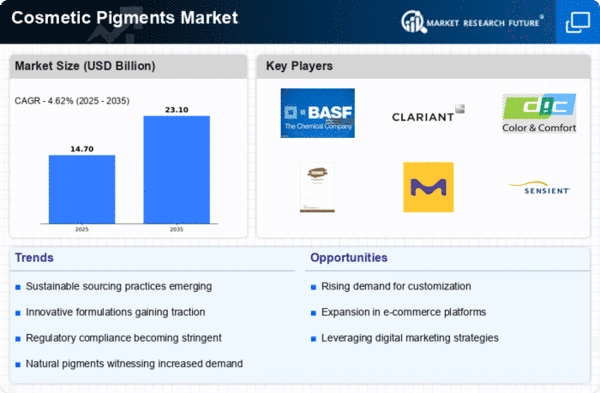

The market dynamics of the cosmetic pigments industry are driven by various factors that influence supply, demand, and pricing within the market. One of the primary drivers of this market is the increasing demand for cosmetic pigments across various segments of the beauty and personal care industry. Cosmetic pigments play a crucial role in enhancing the visual appeal and color intensity of cosmetics products such as lipsticks, eyeshadows, blushes, and nail polishes. As consumers continue to seek innovative and trendy cosmetic products, there is a corresponding increase in the demand for high-quality pigments, driving market growth in this segment.

Moreover, technological advancements in cosmetic pigment formulations play a significant role in shaping market dynamics. Manufacturers are constantly innovating to develop pigments with enhanced color stability, dispersion properties, and skin compatibility. These advancements cater to the evolving needs of cosmetic companies and contribute to the development of vibrant and long-lasting cosmetic products, driving demand for cosmetic pigments.

Furthermore, changing consumer preferences and lifestyle trends are key factors influencing the cosmetic pigments market dynamics. With the increasing emphasis on personal grooming, self-expression, and social media influence, consumers are more inclined towards experimenting with different cosmetic colors and finishes. Cosmetic companies are responding to these trends by launching new product lines and color collections, driving the demand for a diverse range of cosmetic pigments.

Additionally, regulatory compliance and safety concerns are crucial factors shaping the cosmetic pigments market dynamics. Governments worldwide are implementing stricter regulations aimed at ensuring the safety and purity of cosmetic ingredients, including pigments. Cosmetic companies are required to adhere to stringent standards and guidelines for the use of pigments in cosmetic formulations, driving the demand for compliant and safe pigment options. Manufacturers are responding to these regulatory requirements by developing pigments that meet or exceed industry standards, thereby driving market expansion in this segment.

Competition within the cosmetic pigments market is intense, with several key players vying for market share. Companies differentiate themselves through product quality, color range, and technical support services. Moreover, strategic partnerships, mergers, and acquisitions are common strategies employed by industry players to expand their market presence and gain a competitive edge. Additionally, pricing strategies play a crucial role in market dynamics, with manufacturers often adjusting prices in response to changes in raw material costs, competition, and market demand.

Global economic conditions and geopolitical factors also influence the cosmetic pigments market dynamics. Fluctuations in currency exchange rates, trade tariffs, and political instability can impact the cost of raw materials, transportation, and regulatory compliance, affecting both supply chains and pricing strategies. Furthermore, shifts in consumer spending patterns and purchasing power across different regions influence market demand and consumption patterns, driving manufacturers to adapt their strategies accordingly.

Leave a Comment