-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

MARKET RESEARCH METHODOLOGY

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

MARKET LANDSCAPE

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Internal Rivalry

-

MARKET DYNAMICS OF THE GLOBAL DECAF COFFEE MARKET

-

Introduction

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

GLOBAL DECAF COFFEE MARKET, BY TYPE

-

Introduction

-

Arabica

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Robusta

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Others

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY CATEGORY

-

Introduction

-

Organic

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Conventional

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY FORM

-

Introduction

-

Whole

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Ground

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- Instant Coffee Powder

- Portioned Coffee

-

Others

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY DISTRIBUTION CHANNEL

-

Introduction

-

Store-Based

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- Hypermarkets & Supermarkets

- Convenience Stores

- Others

-

Non-Store-Based

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

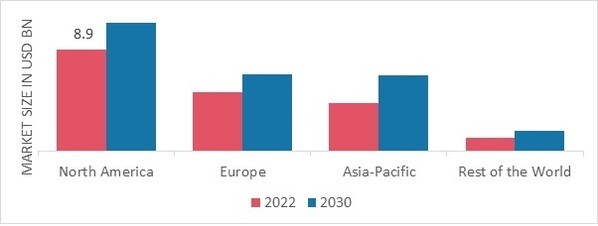

GLOBAL DECAF COFFEE MARKET, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- South America

- Middle East

- Africa

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Market Strategy

-

Key Development Analysis (Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

COMPANY PROFILES

-

Don Pablo Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

The Kraft Heinz Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Cravium Foods LLP

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Colombian Brew Ground Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Nestlé S.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Lifeboost Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Dunkin'' Brands Group, Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Fresh Roasted Coffee LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Volcanica Coffee, LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Kicking Horse Coffee Co. Ltd.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Koffee Kult

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Eight O’Clock Coffee Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Cafedirect PLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Grindhouse Coffee Roasters

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Luigi Lavazza S.P.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

CONCLUSION LIST OF TABLES

-

Global Decaf Coffee Market, by Region, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Region 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million) LIST OF FIGURES

-

Global Decaf Coffee Market Segmentation

-

Forecast Research Methodology

-

Five Forces Analysis of the Global Decaf Coffee Market

-

Value Chain of the Global Decaf Coffee Market

-

Share of the Global Decaf Coffee Market in

-

Global Decaf Coffee Market, by Region, 2022–2030

-

Global Decaf Coffee Market Size, by Type,

-

Share of the Global Decaf Coffee Market, by Type, 2022–2030 (%)

-

Global Decaf Coffee Market Size, by Category,

-

Share of the Global Decaf Coffee Market, by Category, 2022–2030 (%)

-

Global Decaf Coffee Market Size, by Form,

-

Share of the Global Decaf Coffee Market, by Form, 2022–2030 (%)

-

Global DecTable of Contents

-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

MARKET RESEARCH METHODOLOGY

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

MARKET LANDSCAPE

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Internal Rivalry

-

MARKET DYNAMICS OF THE GLOBAL DECAF COFFEE MARKET

-

Introduction

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

GLOBAL DECAF COFFEE MARKET, BY TYPE

-

Introduction

-

Arabica

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Robusta

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Others

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY CATEGORY

-

Introduction

-

Organic

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Conventional

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY FORM

-

Introduction

-

Whole

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Ground

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- Instant Coffee Powder

- Portioned Coffee

-

Others

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY DISTRIBUTION CHANNEL

-

Introduction

-

Store-Based

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- Hypermarkets & Supermarkets

- Convenience Stores

- Others

-

Non-Store-Based

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

GLOBAL DECAF COFFEE MARKET, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Country, 2022–2030

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Category, 2022–2030

- Market Estimates & Forecast, by Form, 2022–2030

- Market Estimates & Forecast, by Distribution Channel, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

- South America

- Middle East

- Africa

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Market Strategy

-

Key Development Analysis (Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

COMPANY PROFILES

-

Don Pablo Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

The Kraft Heinz Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Cravium Foods LLP

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Colombian Brew Ground Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Nestlé S.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Lifeboost Coffee

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Dunkin'' Brands Group, Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Fresh Roasted Coffee LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Volcanica Coffee, LLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Kicking Horse Coffee Co. Ltd.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Koffee Kult

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Eight O’Clock Coffee Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Cafedirect PLC

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Grindhouse Coffee Roasters

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Luigi Lavazza S.P.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

CONCLUSION LIST OF TABLES

-

Global Decaf Coffee Market, by Region, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Global Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

North America: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

US: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Canada: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Mexico: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Europe: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Germany: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

France: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Italy: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Spain: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

UK: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of Europe: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Country, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Asia-Pacific: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

China: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

India: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Japan: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Australia & New Zealand: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of Asia-Pacific: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Region 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Rest of the World (RoW): Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

South America: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Middle East: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Type, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Category,2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Form, 2022–2030 (USD Million)

-

Africa: Decaf Coffee Market, by Distribution Channel, 2022–2030 (USD Million) LIST OF FIGURES

-

Global Decaf Coffee Market Segmentation

-

Forecast Research Methodology

-

Five Forces Analysis of the Global Decaf Coffee Market

-

Value Chain of the Global Decaf Coffee Market

-

Share of the Global Decaf Coffee Market in

-

Global Decaf Coffee Market, by Region, 2022–2030

-

Global Decaf Coffee Market Size, by Type,

-

Share of the Global Decaf Coffee Market, by Type, 2022–2030 (%)

-

Global Decaf Coffee Market Size, by Category,

-

Share of the Global Decaf Coffee Market, by Category, 2022–2030 (%)

-

Global Decaf Coffee Market Size, by Form,

-

Share of the Global Decaf Coffee Market, by Form, 2022–2030 (%)

-

Global Decaf Coffee Market Size, by Distribution Channel,

-

Share of the Global Decaf Coffee Market, by Distribution Channel, 2022–2030 (%) af Coffee Market Size, by Distribution Channel,

-

Share of the Global Decaf Coffee Market, by Distribution Channel, 2022–2030 (%) '

Leave a Comment