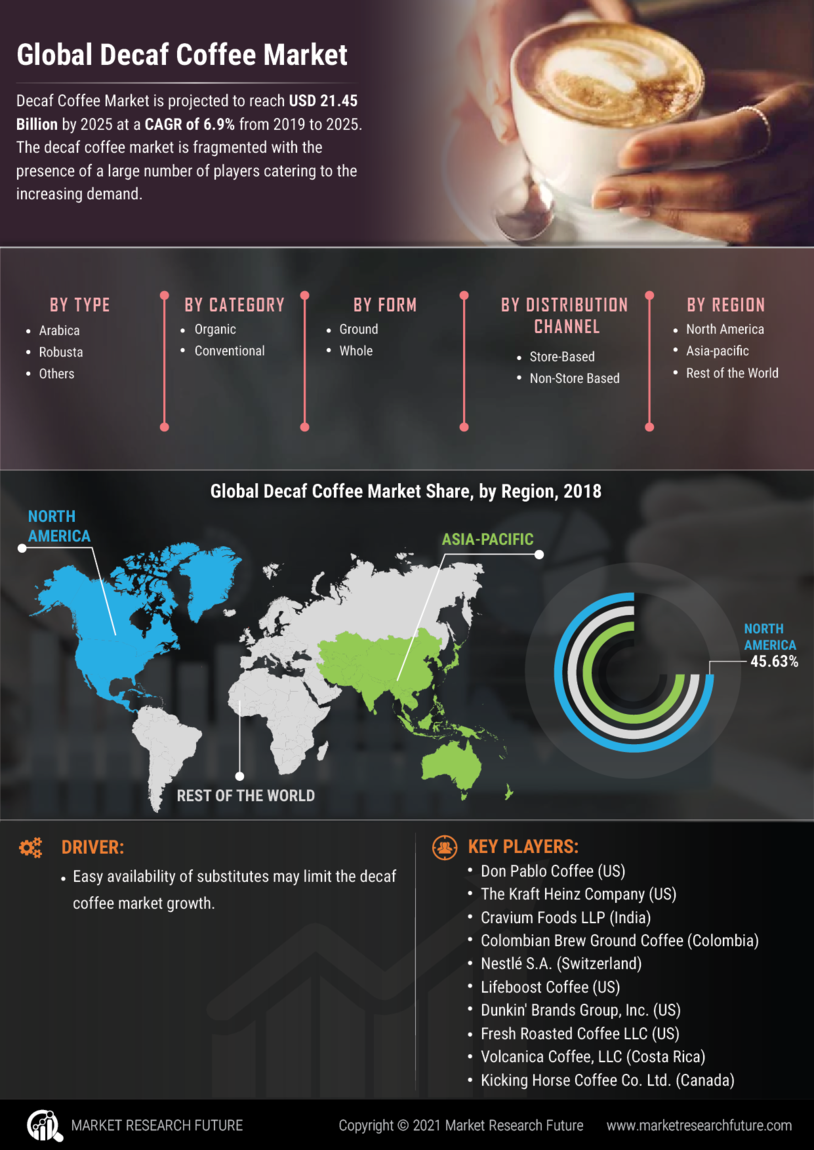

The Global Decaf Coffee is currently characterized by a dynamic competitive landscape, driven by evolving consumer preferences for healthier beverage options and the increasing demand for premium coffee products. Major players such as Starbucks (US), Nestle (CH), and Dunkin' (US) are strategically positioning themselves to capitalize on these trends through innovation and market expansion. Starbucks (US) has focused on enhancing its product offerings by introducing new decaf blends that cater to health-conscious consumers, while Nestle (CH) has been investing in sustainable sourcing practices to appeal to environmentally aware customers. Dunkin' (US), on the other hand, has been expanding its menu to include more decaf options, thereby broadening its appeal to a diverse customer base. Collectively, these strategies not only enhance brand loyalty but also intensify competition within the market.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to reduce costs and improve efficiency. The competitive structure of the decaf coffee market appears moderately fragmented, with several key players vying for market share. This fragmentation allows for niche brands to emerge, yet the influence of major players remains substantial, as they set trends and standards that smaller companies often follow.

In August 2025, Starbucks (US) announced the launch of a new line of organic decaf coffee sourced from sustainable farms in South America. This initiative not only aligns with the growing consumer demand for organic products but also reinforces Starbucks' commitment to sustainability. By focusing on high-quality, ethically sourced ingredients, Starbucks aims to differentiate itself in a crowded market, potentially attracting a more discerning customer base.

In September 2025, Nestle (CH) unveiled a partnership with a leading technology firm to enhance its decaf coffee production through AI-driven quality control systems. This strategic move is indicative of Nestle's commitment to innovation and efficiency, as it seeks to streamline operations while ensuring product consistency. The integration of advanced technology into the production process may provide Nestle with a competitive edge, allowing for quicker responses to market demands and consumer preferences.

In October 2025, Dunkin' (US) launched a promotional campaign highlighting its new range of decaf beverages, which includes seasonal flavors aimed at attracting customers during the fall. This marketing strategy not only seeks to boost sales but also positions Dunkin' as a versatile player in the decaf segment. By leveraging seasonal trends, Dunkin' aims to enhance customer engagement and drive foot traffic to its stores.

As of October 2025, the competitive trends within The Global Decaf Coffee are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to enhance their market positions. Looking ahead, it is likely that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may ultimately reshape consumer expectations and redefine success within the market.

Leave a Comment