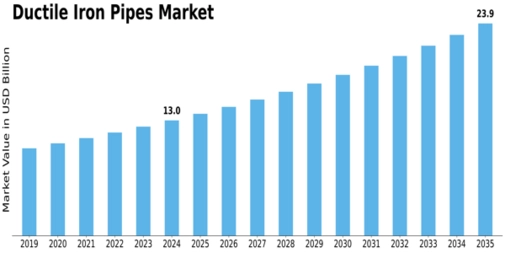

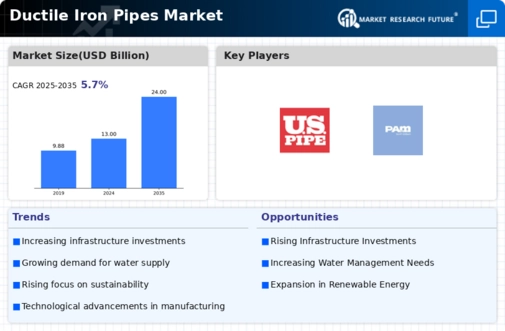

Ductile Iron Pipes Size

Ductile Iron Pipes Market Growth Projections and Opportunities

The Ductile Iron Pipes Market is influenced by various factors that contribute to its dynamics and growth. A key driver is the increasing demand for reliable and durable water and wastewater infrastructure, particularly in urban areas and industrial settings. Ductile iron pipes, known for their strength, durability, and corrosion resistance, have become a preferred choice for conveying water and sewage. The growing emphasis on infrastructure development, replacement of aging pipelines, and the need for resilient piping solutions propels the demand for ductile iron pipes globally.

The unparalleled growth of the end-use industries has resulted in the substantial growth of the ductile iron pipes market. Ductile iron, a type of cast iron and are used extensively for the construction of pipelines for physically transporting water and wastewater for irrigation, drinking, and other purposes. There are various benefits associated with these pipes, which makes them fit to be used in various end-use industries, owing to their durability, efficiency, and reliability.

Raw material availability and pricing play a crucial role in the ductile iron pipes market. The primary raw materials for manufacturing ductile iron pipes include iron ore, scrap metal, and alloys. Fluctuations in the prices of these raw materials, influenced by factors such as iron ore prices, market demand, and supply chain dynamics, can impact the overall production cost of ductile iron pipes. Ensuring a stable and cost-effective supply of high-quality raw materials is essential for manufacturers to maintain competitiveness in the market.

Technological advancements in ductile iron pipe production processes contribute to market growth. Innovations in casting techniques, coatings, and quality control lead to the development of pipes with improved corrosion resistance, longer service life, and enhanced structural integrity. Continuous research and development in the industry drive advancements, expanding the applications of ductile iron pipes in various water supply and wastewater systems and influencing the market's expansion.

End-user industries significantly influence the demand for ductile iron pipes. The water and wastewater sector is a major consumer, utilizing ductile iron pipes for applications such as water distribution, sewer systems, and stormwater management. Municipalities and utilities also contribute to the market as they recognize the reliability and longevity of ductile iron pipes for their critical infrastructure. Companies in the ductile iron pipes sector need to understand the specific requirements of these end-user industries to tailor their products accordingly and meet market demands.

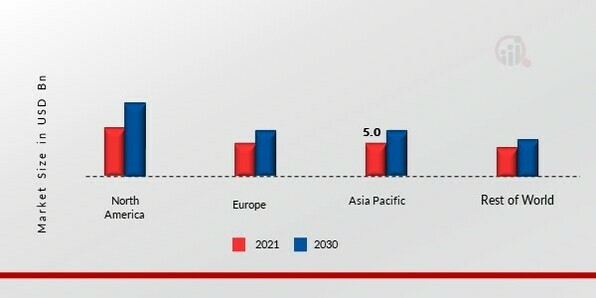

Global economic conditions and infrastructure development play a role in shaping the ductile iron pipes market. Changes in construction spending, urbanization trends, and government investments in water infrastructure projects can impact the demand for ductile iron pipes. Companies in the market must monitor global economic dynamics to ensure stability in their operations and explore new opportunities in emerging markets.

Environmental considerations and sustainability are gaining importance in the ductile iron pipes market. As awareness of environmental issues grows, there is an increasing preference for materials that are recyclable and have a lower environmental impact. Ductile iron pipes, with their recyclability and long service life, align well with sustainability goals. Companies adopting green manufacturing practices and promoting the environmental benefits of their ductile iron pipes can gain a competitive edge.

Consumer preferences for reliability, longevity, and ease of installation influence the ductile iron pipes market. Engineers, contractors, and municipalities seek piping solutions that offer a robust and long-lasting infrastructure with minimal maintenance requirements. Ductile iron pipes, with their resilience to external pressures, resistance to corrosion, and ease of installation, meet these preferences. Companies that focus on delivering ductile iron pipes with consistent quality and performance can attract a broader customer base.

Quality standards and certifications are critical factors in the ductile iron pipes market. Meeting industry standards for manufacturing, testing, and product quality is essential for gaining customer trust and regulatory compliance. Companies need to adhere to international standards and obtain certifications to ensure that their ductile iron pipes meet the required specifications and performance criteria.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment