Market Share

Electrostatic Discharge Packaging Market Share Analysis

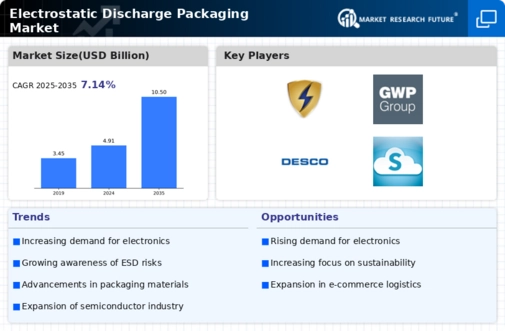

In the dynamic and competitive landscape of the global electrostatic discharge (ESD) packaging market, companies deploy various strategies to establish their presence and secure a significant market share. Differentiation is a primary strategy where companies emphasize unique features or capabilities of their ESD packaging solutions. This could involve offering innovative packaging materials with superior ESD protection properties, such as conductive foam, shielding bags, or dissipative films, that effectively mitigate the risks of electrostatic discharge damage to sensitive electronic components. By positioning themselves as providers of distinctive and high-quality ESD packaging options, companies can attract clients seeking reliable and comprehensive solutions for protecting their electronic products, thus gaining a competitive edge in the market.

The developing interest for cell phones and other buyer hardware is probably going to be a significant driver for the worldwide Electrostatic Discharge Packaging Market over the figure time frame, as the developing interest for purchaser gadgets is probably going to bring about an expanding interest for the transportation of the equivalent from the assembling locales to the get-together units. The developing interest for correspondence network framework is additionally liable to be a significant driver for the worldwide Electrostatic Discharge Packaging Market over the estimated time frame, as the tasks of the mechanical area just as other, administration situated areas like BFSI, medical care, and government, are probably going to depend progressively on advanced, twenty-first-century specialized techniques in the coming forecasted years.

Cost leadership is another critical strategy in the ESD packaging market. Companies strive to offer cost-effective packaging solutions without compromising on quality or ESD protection capabilities. Achieving cost leadership involves optimizing manufacturing processes, sourcing packaging materials efficiently, and leveraging economies of scale. By positioning themselves as providers of affordable ESD packaging options, companies can appeal to cost-conscious clients, particularly in industries where cost efficiency is a significant concern. However, it's crucial to ensure that cost savings do not compromise the effectiveness of ESD protection or the durability of the packaging to maintain customer satisfaction and trust in the long run.

Niche positioning strategies are also prevalent in the global ESD packaging market. Companies often specialize in providing packaging solutions tailored to specific industries or applications. For example, a company may focus on ESD packaging for the semiconductor industry, offering options that meet stringent ESD protection standards and requirements for transporting sensitive microchips and electronic components. Alternatively, a company might specialize in ESD packaging for medical devices, addressing requirements for sterile packaging and compliance with regulatory standards. By positioning themselves as experts in a particular niche, companies can cater to the unique needs of customers in that segment, gaining a competitive advantage and a larger market share.

Distribution and channel strategies play a vital role in market share positioning within the global ESD packaging market. Companies must establish efficient distribution channels to reach customers effectively. This may involve collaborating with electronics manufacturers, distributors, or directly supplying ESD packaging solutions to semiconductor companies, medical device manufacturers, or aerospace contractors. Additionally, leveraging digital platforms and e-commerce channels can enhance accessibility and reach a global customer base. By optimizing distribution channels, companies can increase market share and competitiveness in the ESD packaging market.

Branding and marketing efforts are essential components of market share positioning strategies in the global ESD packaging market. Companies must develop strong and recognizable brands that resonate with their target audience. This involves investing in branding initiatives that communicate the company's values, commitment to quality, and innovation in ESD protection technology. Marketing efforts should focus on showcasing the unique features and benefits of the company's ESD packaging solutions, along with demonstrating how they address specific industry challenges and customer needs. By effectively branding and marketing their products, companies can differentiate themselves from competitors and gain a larger market share.

Customer experience and service are critical factors in market share positioning strategies within the global ESD packaging market. Providing excellent customer service, offering personalized solutions, and ensuring reliable post-sales support are essential for building strong relationships with clients. Companies must prioritize responsiveness, flexibility, and transparency to meet the diverse needs of customers and ensure their satisfaction. By positioning themselves as dependable partners who prioritize customer success and ESD protection, companies can enhance their reputation and gain a competitive edge in the ESD packaging market.

Leave a Comment