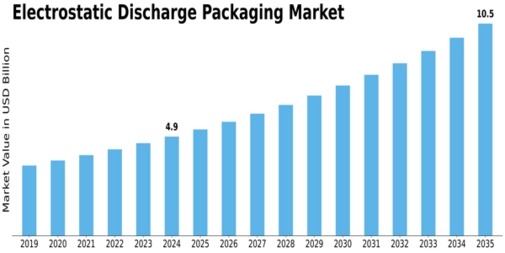

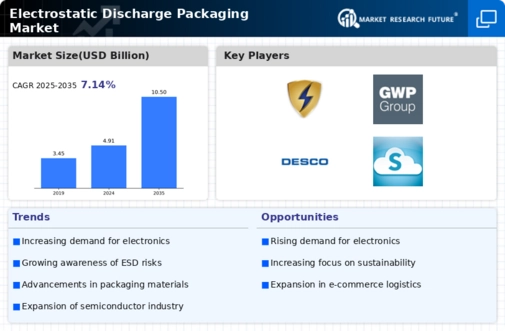

Electrostatic Discharge Packaging Size

Electrostatic Discharge Packaging Market Growth Projections and Opportunities

The global electrostatic discharge (ESD) packaging market is shaped by various factors that determine its dynamics and performance. ESD packaging is designed to protect electronic components and devices from electrostatic discharge during handling, transportation, and storage. One of the primary market factors impacting the global ESD packaging market is the increasing demand for electronic products across various industries. As electronic devices become more prevalent in everyday life, there is a growing need for packaging solutions that can safeguard sensitive electronic components from damage caused by electrostatic discharge. ESD packaging offers effective protection against static electricity, preventing costly damage to electronic devices and driving its adoption in industries such as electronics manufacturing, automotive, aerospace, and healthcare.

The developing worldwide interest determines the Electrostatic Discharge Packaging Market for effectively assembling and transporting electronic segments. The developing assembling of PCs, cell phones, and other systems administration foundation is probably going to be a significant driver for the worldwide Electrostatic Discharge Packaging Market over the estimated time frame, as the interest for electrical and electronic parts is probably going to develop over the estimate time frame and past with the rising dependence on computerized correspondence media. Electrostatic releases bundling shields the item from the impacts of electrostatic release, which can hamper an item even before it is sold and impressively decrease its functional lifetime in the Electrostatic Discharge Packaging Market.

Moreover, technological advancements and innovations significantly influence the global ESD packaging market. Manufacturers are constantly innovating to develop ESD packaging solutions with improved performance, durability, and sustainability. For example, advancements in packaging materials, such as conductive and dissipative plastics, carbon-infused foams, and metallized films, enhance the effectiveness of ESD protection while minimizing environmental impact. Additionally, innovations in packaging designs, such as custom-molded trays and cushioning materials, provide tailored solutions to meet the specific needs of different electronic components and devices, driving adoption in the global market.

Furthermore, regulatory factors play a crucial role in shaping the global ESD packaging market. Regulations and standards related to product safety, transportation, and handling drive the adoption of ESD packaging solutions that meet regulatory requirements. For example, regulations governing the transportation of hazardous materials, such as the International Maritime Dangerous Goods (IMDG) Code and the International Air Transport Association (IATA) Dangerous Goods Regulations, require the use of ESD packaging for electronic components and devices that are sensitive to electrostatic discharge. Compliance with regulatory requirements is essential for ESD packaging manufacturers to access key markets and maintain customer trust.

Market dynamics such as supply chain considerations and technological advancements also impact the global ESD packaging market. The ESD packaging supply chain involves multiple stages, including the sourcing of raw materials, manufacturing of packaging components, assembly of ESD packaging systems, and distribution to end-users. Disruptions at any stage of the supply chain, such as raw material shortages, transportation bottlenecks, or regulatory challenges, can affect the availability and pricing of ESD packaging solutions. Additionally, advancements in ESD packaging technologies, such as static shielding bags, conductive foam inserts, and moisture barrier films, improve product performance and reliability, driving adoption in industries where ESD protection is critical.

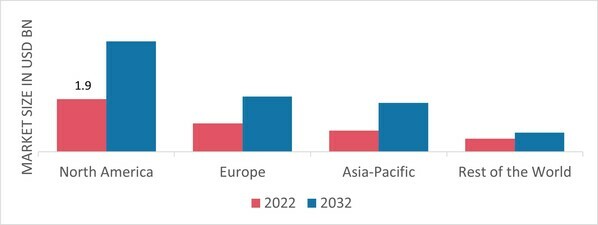

Moreover, market factors such as globalization and trade policies influence the global ESD packaging market. As ESD packaging manufacturers expand their operations to new markets and regions, there is a growing demand for packaging solutions that comply with local regulatory requirements and industry standards. Additionally, trade policies, tariffs, and international agreements related to packaging materials and technologies can impact the competitiveness of ESD packaging manufacturers in global markets, affecting market dynamics and pricing. Understanding these market factors and adapting manufacturing and distribution strategies accordingly is essential for ESD packaging manufacturers to remain competitive in the dynamic and evolving global market.

Leave a Comment