-

Research Methodology

-

Scope of the Study

- Definition

- Research Objective

- Assumptions

- Limitations

-

Research Process

- Primary Research

- Secondary Research

-

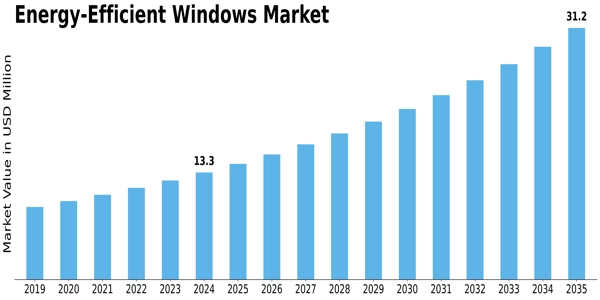

Market size Estimation

-

Forecast Model

-

3... Market Dynamics

-

Market Drivers

-

Market Inhibitors

-

Supply/Value Chain Analysis

-

Porter’s Five Forces Analysis

-

4... Global Energy-Efficient

-

Windows Market, By Glazing Type

-

Double

-

Triple Low-e

-

other

-

5... Global Energy-Efficient Windows Market, By

-

Components

-

Introduction

-

Glass

-

Pane spacers

-

Frame

-

Global Energy-Efficient Windows

-

Market, By Application

-

Introduction

-

Residential

-

Commercial

-

Industrial

-

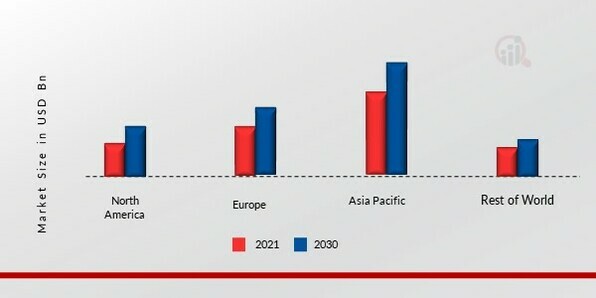

Regional Market

-

Analysis

-

7.1

-

Introduction

-

7.2

-

North America

-

7.2.1

-

U.S.

-

7.2.2

-

Canada

-

Europe

-

7.3.1

-

U.K

-

7.3.2

-

France

-

7.3.3

-

Germany

-

7.3.4

-

Spain

-

7.3.5

-

Rest of Europe

-

7.4

-

Asia-Pacific

-

7.4.1

-

China

-

7.4.2

-

Japan

-

7.4.3

-

India

-

7.4.4

-

Rest of Asia-Pacific

-

7.5

-

Rest of the World

-

8...

-

Competitive Analysis

-

Introduction

-

Competitive Scenario

- Market Share Analysis

- Market Development Analysis

- Product/Service Benchmarking

-

Saint Gobain S.A. (France)

- Overview

- Product/Service Offering

- Strategy

-

Asahi Glass Co., Ltd. (Japan)

- Overview

- Product/Service Offering

- Strategy

-

Masco Corporation (U.S.)

- Overview

- Product/Service Offering

- Strategy

-

Nippon Sheet Glass Co. Ltd. (Japan)

- Overview

- Product/Service Offering

- Strategy

-

SCHOTT AG (Germany)

- Overview

- Product/Service Offering

- Strategy

-

Central Glass Co. Ltd. (Japan)

- Overview

- Product/Service Offering

- Strategy

-

Builders FirstSource, Inc. (U.S.)

- Overview

- Product/Service Offering

- Strategy

-

Jeld-Wen Holding, Inc. (U.S.)

- Overview

- Product/Service Offering

- Strategy

-

YKK AP, Inc. (Japan)

- Overview

- Product/Service Offering

- Strategy

-

Ply Gem Holdings, Inc. (U.S.)

- Overview

- Product/Service Offering

- Strategy

-

LIST OF TABLES

-

TABLE 1

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE

-

TABLE 2

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

TABLE 3

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION

-

TABLE 4

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET, BY REGIONS

-

TABLE 5

-

NORTH AMERICA ENERGY-EFFICIENT WINDOWS MARKET, BY COUNTRY

-

TABLE 6

-

NORTH AMERICA ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE

-

TABLE

-

NORTH AMERICA ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

NORTH AMERICA ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION

-

U.S. ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE

-

U.S. ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

U.S. ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION

-

CANADA ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING

-

TYPE

-

CANADA ENERGY-EFFICIENT WINDOWS MARKET, BY

-

COMPONENTS

-

CANADA ENERGY-EFFICIENT WINDOWS MARKET,

-

BY APPLICATION

-

EUROPE ENERGY-EFFICIENT WINDOWS MARKET,

-

BY COUNTRY

-

EUROPE ENERGY-EFFICIENT WINDOWS MARKET,

-

BY GLAZING TYPE

-

EUROPE ENERGY-EFFICIENT WINDOWS

-

MARKET, BY COMPONENTS

-

EUROPE ENERGY-EFFICIENT WINDOWS

-

MARKET, BY APPLICATION

-

GERMANY ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

GERMANY ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

GERMANY ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

FRANCE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

FRANCE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

FRANCE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

U.K. ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

U.K. ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

U.K. ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

SPAIN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

SPAIN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

SPAIN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

REST OF EUROPE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

REST OF EUROPE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

REST OF EUROPE ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

ASIA-PACIFIC ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COUNTRY

-

ASIA-PACIFIC ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

ASIA-PACIFIC ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

ASIA-PACIFIC ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

CHINA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

CHINA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

CHINA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

JAPAN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

JAPAN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

JAPAN ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

INDIA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE

-

INDIA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS

-

INDIA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION

-

REST OF ASIA-PACIFIC

-

ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE

-

REST

-

OF ASIA-PACIFIC ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

TABLE 49

-

REST OF ASIA-PACIFIC ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION

-

TABLE

-

RoW ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE

-

TABLE

-

RoW ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

TABLE

-

RoW ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION

-

LIST OF FIGURES

-

RESEARCH COMPONENTS

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET: BY GLAZING

-

TYPE (%)

-

GLOBAL ENERGY-EFFICIENT WINDOWS MARKET:

-

BY COMPONENTS (%)

-

GLOBAL ENERGY-EFFICIENT WINDOWS

-

MARKET: BY APPLICATION (%)

-

GLOBAL ENERGY-EFFICIENT

-

WINDOWS MARKET: BY REGION

-

NORTH AMERICA ENERGY-EFFICIENT

-

WINDOWS MARKET, BY GLAZING TYPE (%)

-

NORTH AMERICA

-

ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS (%)

-

NORTH

-

AMERICA ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION (%)

-

FIGURE 9

-

EUROPE ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE (%)

-

FIGURE 10

-

EUROPE ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS (%)

-

FIGURE 11

-

EUROPE ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION (%)

-

FIGURE 12

-

ASIA-PACIFIC ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE (%)

-

FIGURE

-

ASIA-PACIFIC ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENTS

-

(%)

-

ASIA-PACIFIC ENERGY-EFFICIENT WINDOWS MARKET,

-

BY APPLICATION (%)

-

ROW ENERGY-EFFICIENT WINDOWS

-

MARKET, BY GLAZING TYPE (%)

-

ROW ENERGY-EFFICIENT

-

WINDOWS MARKET, BY COMPONENTS (%)

-

ROW ENERGY-EFFICIENT

-

WINDOWS MARKET, BY APPLICATION (%)

Leave a Comment