-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Definition

- Research Objective

- Assumptions

- Limitations

-

Research Process

- Primary Research

- Secondary Research

-

Market size Estimation

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

- Bargaining Power of Buyers

-

Value Chain/Supply Chain Analysis

-

Market Dynamics

-

Introduction

-

Market Drivers

-

Market Restraints

-

Market Opportunities

-

Market Trends

-

Global Enhanced Flight Vision System Market, By Technology

-

Introduction

-

Infrared

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Synthetic Vision

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Global Positioning System

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Millimeter Wave Radar

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Global Enhanced Flight Vision System Market, By Component

-

Introduction

-

Display Unit

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Camera

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Sensor

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Others

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

-

Global Enhanced flight vision system Market, By Platform

-

Introduction

-

Fixed-Wing

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

Rotary-Wing

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Forecast by Region, 2023-2030

-

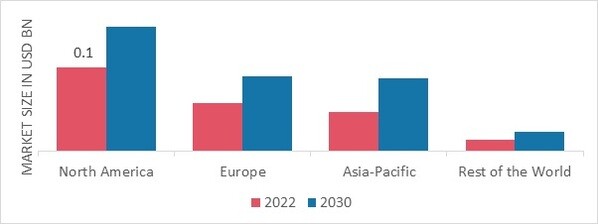

Global Enhanced flight vision system Market, By Region

-

Introduction

-

North America

- Market Estimates & Forecast by Technology 2023-2030

- Market Estimates & Forecast by Component, 2023-2030

- Market Estimates & Forecast by Platform, 2023-2030

- U.S.

- Canada

-

Europe

- Market Estimates & Forecast by Technology 2023-2030

- Market Estimates & Forecast by Component, 2023-2030

- Market Estimates & Forecast by Platform, 2023-2030

- U.K

- Germany

- France

- Russia

- Rest of Europe

-

Asia Pacific

- Market Estimates & Forecast by Technology 2023-2030

- Market Estimates & Forecast by Component, 2023-2030

- Market Estimates & Forecast by Platform, 2023-2030

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Market Estimates & Forecast by Technology 2023-2030

- Market Estimates & Forecast by Component, 2023-2030

- Market Estimates & Forecast by Platform, 2023-2030

-

South America

- Market Estimates & Forecast by Technology 2023-2030

- Market Estimates & Forecast by Component, 2023-2030

- Market Estimates & Forecast by Platform, 2023-2030

-

Competitive Landscape

-

Company Profile

-

Honeywell International Inc.

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

United Technologies Corporation

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

L-3 Communications Holdings, Inc.

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Thales Group

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Elbit Systems Ltd.

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Rockwell Collins, Inc.

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Esterline Technologies Corporation

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Astronics Corporation

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

MBDA

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

Opgal

- Company Overview

- Financial Overview

- Product Offerings

- Key Developments

- SWOT Analysis

-

-

List of Tables

-

Global Enhanced flight vision system Market: By Region, 2023-2030

-

North America Global Enhanced flight vision system Market: By Country, 2023-2030

-

Europe Global Enhanced flight vision system Market: By Country, 2023-2030

-

Asia Pacific Global Enhanced flight vision system Market: By Country, 2023-2030

-

Middle East & Africa Global Enhanced flight vision system Market: By Country, 2023-2030

-

Latin America Global Enhanced flight vision system Market: By Country, 2023-2030

-

Global Enhanced flight vision system Market, By Component, 2023-2030

-

North America Global Enhanced flight vision system Market, By Component, 2023-2030

-

Europe Global Enhanced flight vision system Market, By Component, 2023-2030

-

Asia Pacific Global Enhanced flight vision system Market by Component, 2023-2030

-

Middle East & Africa Global Enhanced flight vision system Market by Component, 2023-2030

-

Latin America Global Enhanced flight vision system Market by Component, 2023-2030

-

Global Enhanced flight vision system Market: By Technology, 2023-2030

-

North America Global Enhanced flight vision system Market: By Technology, 2023-2030

-

Europe Global Enhanced flight vision system Market: By Technology, 2023-2030

-

Asia Pacific Global Enhanced flight vision system Market: By Technology, 2023-2030

-

Middle East & Africa Global Enhanced flight vision system Market: By Technology, 2023-2030

-

Latin America Global Enhanced flight vision system Market by Technology, 2023-2030

-

Global Enhanced flight vision system Market: By Platform, 2023-2030

-

North America Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Europe Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Asia Pacific Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Middle East & Africa Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Latin America Global Enhanced flight vision system Market by Platform, 2023-2030

-

U.S. Global Enhanced flight vision system Market by Component, 2023-2030

-

U.S. Enhanced flight vision system Market: By Technology, 2023-2030

-

U.S. Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Canada Global Enhanced flight vision system Market by Component, 2023-2030

-

Canada Enhanced flight vision system Market: By Technology, 2023-2030

-

Canada Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Germany Global Enhanced flight vision system Market by Component, 2023-2030

-

Germany Enhanced flight vision system Market: By Technology, 2023-2030

-

Germany Global Enhanced flight vision system Market: By Platform, 2023-2030

-

U.K Global Enhanced flight vision system Market by Component, 2023-2030

-

U.K Enhanced flight vision system Market: By Technology, 2023-2030

-

U.K Global Enhanced flight vision system Market: By Platform, 2023-2030

-

France Global Enhanced flight vision system Market by Component, 2023-2030

-

France Enhanced flight vision system Market: By Technology, 2023-2030

-

France Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Russia Global Enhanced flight vision system Market by Component, 2023-2030

-

Russia Enhanced flight vision system Market: By Technology, 2023-2030

-

Russia Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Rest of Europe Global Enhanced flight vision system Market by Component, 2023-2030

-

Rest of Europe Enhanced flight vision system Market: By Technology, 2023-2030

-

Rest of Europe Global Enhanced flight vision system Market: By Platform, 2023-2030

-

China Global Enhanced flight vision system Market by Component, 2023-2030

-

China Enhanced flight vision system Market: By Technology, 2023-2030

-

China Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Japan Global Enhanced flight vision system Market by Component, 2023-2030

-

Japan Enhanced flight vision system Market: By Technology, 2023-2030

-

Japan Global Enhanced flight vision system Market: By Platform, 2023-2030

-

India Global Enhanced flight vision system Market by Component, 2023-2030

-

India Enhanced flight vision system Market: By Technology, 2023-2030

-

India Global Enhanced flight vision system Market: By Platform, 2023-2030

-

Rest of Asia Pacific Global Enhanced flight vision system Market by Component, 2023-2030

-

Rest of Asia Pacific Enhanced flight vision system Market: By Technology, 2023-2030

-

Rest of Asia Pacific Global Enhanced flight vision system Market: By Platform, 2023-2030

-

-

List of Figures

-

Research Process of MRFR

-

Top down & Bottom up Approach

-

Market Dynamics

-

Impact analysis: market drivers

-

Impact analysis: market restraints

-

Porter’s five forces analysis

-

Value chain analysis

-

Global Enhanced flight vision system Market share, By Component, 2020 (%)

-

Global Enhanced flight vision system Market, By Component, 2023-2030 (USD MILLION)

-

Global Enhanced flight vision system Market share, By Technology, 2020 (%)

-

Global Enhanced flight vision system Market, By Technology, 2023-2030 (USD MILLION)

-

Global Enhanced flight vision system Market share (%), BY Platform, 2020

-

Global Enhanced flight vision system Market, BY Platform, 2023-2030 (USD MILLION)

-

North America Global Enhanced flight vision system Market share (%), 2020

-

North America Global Enhanced flight vision system Market BY Country, 2023-2030 (USD MILLION)

-

Europe Global Enhanced flight vision system Market share (%), 2020

-

Europe Global Enhanced flight vision system Market BY Country, 2023-2030 (USD MILLION)

-

Asia Pacific Global Enhanced flight vision system Market share (%), 2020

-

Asia Pacific Global Enhanced flight vision system Market BY Country, 2023-2030 (USD MILLION)

-

Middle East & Africa Global Enhanced flight vision system Market share (%), 2020

-

Middle East & Africa Global Enhanced flight vision system Market BY Country, 2023-2030 (USD MILLION)

-

Latin America Global Enhanced flight vision system Market share (%), 2020

-

Latin America Global Enhanced flight vision system Market BY Country, 2023-2030 (USD MILLION)

Leave a Comment