Market Share

Europe Sustainable Packaging Market Share Analysis

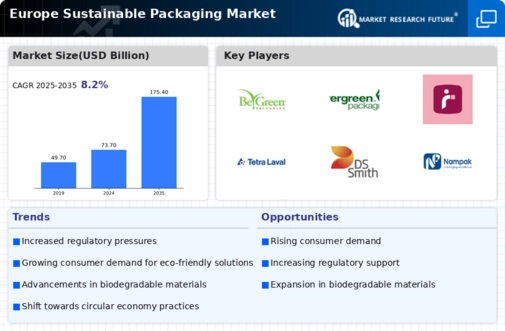

Europe’s Sustainable Packaging Market is experiencing ongoing transitions of its market shares positions as firms are increasingly embracing sustainability due to rising environmental problems. A popular strategy in this regard would be differentiating products using innovative materials and designs. To have a solution for packaging that not only minimizes any effect on the environment, but also stands out from the rest, companies are now investing in research and development programs aimed at creating such innovative solutions. This has led to use of biodegradable materials, recycling packaging and eco-designs all aiming at attracting environmentally conscious customers thus getting a competitive advantage.

In addition, strategic alliances and partnership also play significant roles in market share positioning with respect to sustainable packaging industry. Businesses partner with stakeholders such as suppliers and recyclers in order to develop closed-loop systems. In doing so, stable supply chain for sustainable materials can be achieved while leading to increased sustainability throughout the package’s life cycle. Collaborative efforts allow corporations to pool resources together especially on their knowledge about best practices that lead to more sustainable industry.

Moreover, Europe’s Sustainable Packaging Market requires the cost competitiveness aspect when it comes to market share positioning issues. It has been realized many companies today understand that sustainable packaging can be both eco-friendly and financially viable. Consequently, by investing in efficient manufacturing processes, optimizing logistics, exploring cost-effective sustainable materials; businesses are able to sell green products without necessarily having to lower their profits margins or forego profitability altogether thereby opening up into new markets by making it possible for small firms to afford them.

Another crucial aspect of market share strategy formulation for organizations operating within the sustainable packaging sector is brand positioning and communication has become very important among players in this industry. One way through which companies differentiate themselves from each other while building strong brand identities which entail responsibility towards environment is leveraging their commitment towards sustainability.Successful marketing whereby customers acknowledge the environmental benefits arising out of using company’s packages builds trust between it and its clients (Gunning et al., 2013). This way they get more buyers who take care of nature when buying goods from them.

Regulatory compliance and adherence to industry standards are a must in positioning companies’ market share in Europe’s sustainable packaging market. In response to increasing importance of environmental regulations, companies are aligning their operations with the required legalities and norms within the industry. Certification of sustainable practices coupled with strict adherence to set standards further enhances the trustworthiness of firms operating within the market. Consequently, as businesses become leading players in sustainable packaging, customers will be confident about them.

Moreover, educating customers has a significant impact on the growth rate of Europe’s Sustainable Packaging Market. Businesses are now running campaigns informing purchasers about classical packaging materials that pollute environment and advantages realized from employing new solutions. Therefore, by providing more knowledge on responsible consumption, people can choose product that is packed sustainably thereby increasing amongst its clients over time.

Leave a Comment