Market Summary

As per Market Research Future Analysis, the Expanded Polystyrene (EPS) market was valued at USD 11.05 billion in 2023 and is projected to grow to USD 23.22 billion by 2032, with a CAGR of 8.60% from 2024 to 2032. The market is significantly influenced by the construction sector, where over 65% of companies are affected by inactivity. EPS is lightweight, durable, and moisture-resistant, making it versatile for applications in construction, automotive, and packaging. Recent innovations include BEWI's introduction of new EPS grades with lower environmental footprints, aiming to reduce CO₂ emissions by up to 60%. However, the market faces challenges such as raw material cost variations and stringent government regulations, particularly with the upcoming ban on certain Styrofoam products in Abu Dhabi effective June 1, 2024.

Key Market Trends & Highlights

The EPS market is witnessing significant growth driven by various factors.

- Market Size in 2023: USD 11.05 billion.

- Projected Market Size by 2032: USD 23.22 billion.

- CAGR from 2024 to 2032: 8.60%.

- Over 65% of construction companies affected by inactivity.

Market Size & Forecast

| 2023 Market Size | USD 11.05 billion |

| 2024 Market Size | USD 12.01 billion |

| 2032 Market Size | USD 23.22 billion |

| CAGR (2024-2032) | 8.60%. |

Major Players

BASF SE, ACH Foam Technologies Inc, Kaneka Corporation, SABIC, Alpek S.A.B de C.v, Synbra Holding, NOVA Chemicals Corporation, StyroChem, Unipol Holand B.V, Versalis S.P.

Market Trends

The global expanded polystyrene market is poised for growth, driven by increasing demand in the construction and packaging sectors, which underscores its versatility and sustainability in various applications.

U.S. Department of Energy

Expanded Polystyrene Market Market Drivers

Market Growth Projections

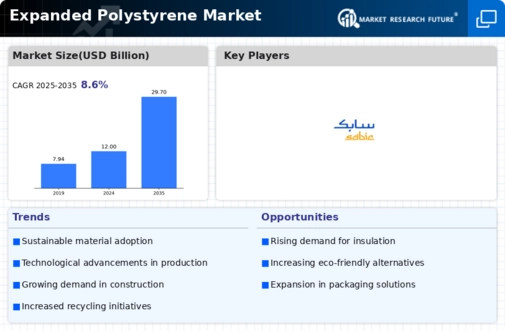

The Global Expanded Polystyrene Market Industry is projected to experience a compound annual growth rate (CAGR) of 8.59% from 2025 to 2035. This growth trajectory suggests a robust expansion driven by various factors, including increased demand in construction, packaging, and insulation applications. As the market evolves, it is anticipated that innovations in production and sustainability practices will further bolster growth. The projected market value reaching 29.7 USD Billion by 2035 indicates a promising future for stakeholders within the industry, highlighting the potential for investment and development opportunities.

Growth in Packaging Applications

The Global Expanded Polystyrene Market Industry benefits from the expanding packaging sector, where the material is favored for its protective qualities and lightweight nature. Industries such as food and electronics increasingly utilize expanded polystyrene for packaging solutions, ensuring product safety during transportation. The material's recyclability and cost-effectiveness further enhance its appeal. As e-commerce continues to thrive, the demand for efficient packaging solutions is expected to rise. This trend suggests that the market could experience substantial growth, potentially contributing to the overall market value projected to reach 29.7 USD Billion by 2035.

Rising Demand in Construction Sector

The Global Expanded Polystyrene Market Industry experiences a robust demand surge driven by the construction sector. Expanded polystyrene is widely utilized in insulation applications due to its lightweight and thermal resistance properties. In 2024, the market is projected to reach 12.0 USD Billion, reflecting the increasing focus on energy-efficient building materials. As countries worldwide implement stringent building codes aimed at reducing energy consumption, the adoption of expanded polystyrene in residential and commercial construction is likely to grow. This trend indicates a significant opportunity for manufacturers to cater to the evolving needs of the construction industry.

Regulatory Support for Energy Efficiency

Regulatory frameworks promoting energy efficiency are significantly influencing the Global Expanded Polystyrene Market Industry. Governments worldwide are implementing policies that encourage the use of energy-efficient materials in construction and manufacturing. These regulations often mandate the use of insulation materials that meet specific energy performance standards, thereby driving the demand for expanded polystyrene. As these regulations become more stringent, the market is likely to see an uptick in adoption rates, further solidifying expanded polystyrene's position as a preferred material in various applications.

Technological Advancements in Production

Technological advancements in the production of expanded polystyrene are poised to enhance the efficiency and sustainability of the Global Expanded Polystyrene Market Industry. Innovations in manufacturing processes, such as the introduction of more environmentally friendly blowing agents, are likely to reduce the carbon footprint associated with production. Additionally, improvements in recycling technologies may facilitate the reuse of expanded polystyrene, aligning with global sustainability goals. These advancements could not only lower production costs but also attract environmentally conscious consumers, thereby expanding the market's reach and appeal.

Increasing Awareness of Environmental Benefits

The Global Expanded Polystyrene Market Industry is witnessing a shift in consumer preferences towards environmentally friendly materials. Expanded polystyrene, known for its energy-saving properties, plays a crucial role in reducing greenhouse gas emissions when used in insulation applications. As awareness of climate change and sustainability grows, consumers and businesses alike are increasingly seeking materials that contribute to energy efficiency. This trend indicates a potential increase in demand for expanded polystyrene products, as they align with global efforts to combat climate change and promote sustainable practices across various industries.

Market Segment Insights

Regional Insights

Key Companies in the Expanded Polystyrene Market market include

Industry Developments

- March 2021 : Around 18 European brands operating in the expanded polystyrene market covering packaging, manufacturing, recycling and raw materials, have come up with an initiative called Smart Packaging Europe. This initiative highlights the economic, social, and environmental advantages of expanded polystyrene (EPS) packaging. This initiative has come up right as the European policymakers are trying to incentivize circular packaging and resource-efficient while preventing the negative effects on the environment. Smart Packaging Europe strives to show that EPS plays a vital role in the packaging market’s future and can be an ideal environment-friendly packaging solution for numerous applications.

- August 2021 : Dixons Carphone, UK-based technology developer, has launched a new scheme that lets consumers at Currys PC World stores recycle expanded polystyrene packaging. The EPS recycling initiative indicates the company’s aim to create 100% of its own proprietary plastic packaging recyclable technology, with reducing the environmental impact being the bigger picture.

- May 22, 2020 -Agilyx Corporation (the US), a leading player in the chemical recycling of post-use plastics, announced its collaboration with Oregon Metro (Metro - the US), a regional government group, to pilot a polystyrene foam collection program. Agilyx is engaged in converting waste plastic into synthetic crude oil. It uses the chemical recycling process to convert post-use plastics back into polymers, chemicals, and low carbon fuels.

- In the year of January 2018, BEWiSynbra merged with Ruukin EPS and manufactured insulation materials. Due to this partnership, the company was highlighted to cover better areas of covering the region geographically and regionally, in Finland, and offers a wide variety of polystyrene insulation materials and good quality packaging solutions as it is being carried out in the rest of Nordics.

- In October 2016, the most renounceable company named Atlas Roofing rebuilt its expanded polystyrene facility in the regions of Perryville, Missouri which was being damaged by a fire.

- In January 2016, BEWiSyndra again launched green EPS which was manufactured from the recycled material of EPS.

- Synthia along with HBCD in May 2015, developed an EPS named Synthia EPS and thus offered packaging applications which was an improvement to other EPS components offered by Synthia.

Future Outlook

Expanded Polystyrene Market Future Outlook

The Global Expanded Polystyrene Market is projected to grow at an 8.59% CAGR from 2024 to 2035, driven by rising demand in construction, packaging, and automotive sectors.

New opportunities lie in:

- Invest in sustainable EPS production technologies to meet eco-friendly regulations.

- Develop innovative EPS applications in the renewable energy sector.

- Expand market presence in emerging economies with tailored marketing strategies.

By 2035, the Expanded Polystyrene Market is expected to achieve substantial growth, solidifying its role in various industries.

Market Segmentation

RECENT DEVELOPMENTS

- Synthia along with HBCD in May 2015, developed an EPS named Synthia EPS and thus offered packaging applications which was an improvement to other EPS components offered by Synthia.

- In January 2016, BEWiSyndra again launched green EPS which was manufactured from the recycled material of EPS.

- In October 2016, the most renounceable company named Atlas Roofing rebuilt its expanded polystyrene facility in the regions of Perryville, Missouri which was being damaged by a fire.

- In the year of January 2018, BEWiSynbra merged with Ruukin EPS and manufactured insulation materials. Due to this partnership, the company was highlighted to cover better areas of covering the region geographically and regionally, in Finland, and offers a wide variety of polystyrene insulation materials and good quality packaging solutions as it is being carried out in the rest of Nordics.

- May 22, 2020 -Agilyx Corporation (the US), a leading player in the chemical recycling of post-use plastics, announced its collaboration with Oregon Metro (Metro - the US), a regional government group, to pilot a polystyrene foam collection program. Agilyx is engaged in converting waste plastic into synthetic crude oil . It uses the chemical recycling process to convert post-use plastics back into polymers, chemicals, and low carbon fuels.

- August 2021 : Dixons Carphone, UK-based technology developer, has launched a new scheme that lets consumers at Currys PC World stores recycle expanded polystyrene packaging. The EPS recycling initiative indicates the company’s aim to create 100% of its own proprietary plastic packaging recyclable technology, with reducing the environmental impact being the bigger picture.

- March 2021 : Around 18 European brands operating in the expanded polystyrene market covering packaging, manufacturing, recycling and raw materials, have come up with an initiative called Smart Packaging Europe. This initiative highlights the economic, social, and environmental advantages of expanded polystyrene (EPS) packaging. This initiative has come up right as the European policymakers are trying to incentivize circular packaging and resource-efficient while preventing the negative effects on the environment. Smart Packaging Europe strives to show that EPS plays a vital role in the packaging market’s future and can be an ideal environment-friendly packaging solution for numerous applications.

COMPETITIVE ANALYSIS

- Versalis S.P of Italy

- Unipol Holand B.V of the Netherlands

- StyroChem of Cannada

- NOVA Chemicals Corporation of Cannada

- Synbra Holding of the Netherlands

- Alpek S.A.B de C.v of Mexico

- SABIC of Saudi Arabia

- Kaneka Corporation of Japan

- ACH Foam Technologies Inc of the United States

- BASF SE of Germany

- Synthia along with HBCD in May 2015, developed an EPS named Synthia EPS and thus offered packaging applications which was an improvement to other EPS components offered by Synthia.

- In January 2016, BEWiSyndra again launched green EPS which was manufactured from the recycled material of EPS.

- In October 2016, the most renounceable company named Atlas Roofing rebuilt its expanded polystyrene facility in the regions of Perryville, Missouri which was being damaged by a fire.

- In the year of January 2018, BEWiSynbra merged with Ruukin EPS and manufactured insulation materials. Due to this partnership, the company was highlighted to cover better areas of covering the region geographically and regionally, in Finland, and offers a wide variety of polystyrene insulation materials and good quality packaging solutions as it is being carried out in the rest of Nordics.

- May 22, 2020 -Agilyx Corporation (the US), a leading player in the chemical recycling of post-use plastics, announced its collaboration with Oregon Metro (Metro - the US), a regional government group, to pilot a polystyrene foam collection program. Agilyx is engaged in converting waste plastic into synthetic crude oil . It uses the chemical recycling process to convert post-use plastics back into polymers, chemicals, and low carbon fuels.

- August 2021 : Dixons Carphone, UK-based technology developer, has launched a new scheme that lets consumers at Currys PC World stores recycle expanded polystyrene packaging. The EPS recycling initiative indicates the company’s aim to create 100% of its own proprietary plastic packaging recyclable technology, with reducing the environmental impact being the bigger picture.

- March 2021 : Around 18 European brands operating in the expanded polystyrene market covering packaging, manufacturing, recycling and raw materials, have come up with an initiative called Smart Packaging Europe. This initiative highlights the economic, social, and environmental advantages of expanded polystyrene (EPS) packaging. This initiative has come up right as the European policymakers are trying to incentivize circular packaging and resource-efficient while preventing the negative effects on the environment. Smart Packaging Europe strives to show that EPS plays a vital role in the packaging market’s future and can be an ideal environment-friendly packaging solution for numerous applications.

Report Scope

| Attribute/Metric | Details |

| Market Size 2023 | USD 11.05 Billion |

| Market Size 2024 | USD 12.01 Billion |

| Market Size 2032 | USD 23.22 Billion |

| CAGR | 8.60% (2024–2032) |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Historical Data | 2019 & 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | BASF SE (Germany), ACH Foam Technologies, Inc (U.S.), Kaneka Corporation (Japan), SABIC (Saudi Arabia), Alpek S.A.B. de C.V (Mexico), Synbra Holding bv (the Netherlands), NOVA Chemicals Corporation (Canada), StyroChem® (Canada), Unipol Holland B.V. (the Netherlands), and Versalis S.p.A (Italy) among others. |

| Key Market Opportunities | The lightweight, durable, moisture resistance, versatile and easy use properties of the product are the important trends |

| Key Market Drivers | Its growing use in packaging applications such egg trays, fast foods owing to its cost effective, convenient to use, and versatile nature. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the significance of the North American region?

Due to the increase in usage of polystyrene in packaging, building, and construction the North American region is growing at a high rate due to the increase in disposable income and rise in expanded polystyrene market revenue by the end-users industries drive the market and increase its size. The United States, China, and India have shown growth in the use of polystyrene products which has propelled up the market growth.

What is the significance of the European market?

The European market has increased its value and volume due to it following the rules and regulations of the government. The government has been impressed by the use up of lightweight and biocompatible ex[anded polystyrene products. Here market has experienced growth in all the sectors. Manufacturing of innovative products by using advanced technology helps in steering up the market in the regions of the United Kingdom, France, Italy.

How Latin American region has experienced growth?

Latin American region experiences development due to rise in usage of low density, humid obstruction materials, using the environment-friendly products enhances the expanded polystyrene market value. The Middle East and African regions are expanding their business due to the use of polystyrene in buildings and construction purposes.

Why building and construction are expected to be the largest segment?

It is the dominant and fastest-growing market where the expanded polystyrene products have physical and mechanical properties satisfying the insulating needs. It is the greatest choice for green building construction and offers environmental benefits which increase energy efficiency which improves the quality of the environment.

What are the challenging factors in the region?

In some regions, the use of extended polystyrene products has been banned. The products of styrofoam are a type of extended polystyrene that is unable to be recycled. As it being non-biodegradable, some of the consumers are unable to use single-throw products. The major challenging factor is the use of certain polystyrene foam products like cups and plates for the packaging of peanuts.

What is the new marketing? Trends that are being adopted in the industry?

Floorings and ceiling sector covers the largest portion of their market followed by roofing systems. EPS is being preferred for roofing systems because it gives proper thermal insulation to them.

-

Table of Contents:

-

1 Executive Summary

-

2 Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Markets Structure

-

3 Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model

-

4 Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

- Value Chain/Supply Chain of Global Expanded polystyrene Market

-

Five Forces Analysis

-

5 Industry Overview of Global Expanded polystyrene Market

- Introduction

- Growth Drivers

- Impact analysis

- Market Challenges

-

6 Market Trends

- Introduction

- Growth Trends

- Impact analysis

-

Global Expanded polystyrene Market by Type

- Introduction

-

White expanded polystyrene

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Grey expanded polystyrene

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Black expanded polystyrene

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Global Expanded polystyrene Market by Application

- Introduction

-

Construction & buildings

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Packaging

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Automotive

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Others

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Region, 2020-2027

-

Global Expanded polystyrene Market by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- U.S.

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Germany

- France

- Italy

- U.K

-

Asia Pacific

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Saudi Arabia

- Qatar

- North Africa

- GCC

- Rest of Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast by Type, 2020-2027

- Market Estimates & Forecast by Application, 2020-2027

- Brazil

- Argentina

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

BASF SE

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

ACH Foam Technologies, Inc

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Kaneka Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SABIC

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Alpek S.A.B. de C.V

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Synbra Holding bv

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

NOVA Chemicals Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

StyroChem®

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Unipol Holland B.V.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Versalis S.p.A

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

BASF SE

-

12 Conclusion

-

List of Tables and Figures

- List of Tables:

- Table 1 World Population by Major Regions (2020-2027)

- Table 2 Global Expanded polystyrene Market: By Region, 2020-2027

- Table 3 North America Expanded polystyrene Market: By Country, 2020-2027

- Table 4 Europe Expanded polystyrene Market: By Country, 2020-2027

- Table 5 Asia-Pacific Expanded polystyrene Market: By Country, 2020-2027

- Table 6 Middle East & Africa Expanded polystyrene Market: By Country, 2020-2027

- Table 7 Latin America Expanded polystyrene Market: By Country, 2020-2027

- Table 8 Global Expanded polystyrene by Type Market: By Regions, 2020-2027

- Table 9 North America Expanded polystyrene by Type Market: By Country, 2020-2027 Table10 Europe Expanded polystyrene by Type Market: By Country, 2020-2027 Table11 Asia-Pacific Expanded polystyrene by Type Market: By Country, 2020-2027 Table12 Middle East & Africa Expanded polystyrene by Type Market: By Country, 2020-2027 Table13 Latin America Expanded polystyrene by Type Market: By Country, 2020-2027 Table14 Global Expanded polystyrene by Application Market: By Regions, 2020-2027 Table15 North America Expanded polystyrene by Application Market: By Country, 2020-2027 Table16 Europe Expanded polystyrene by Application Market: By Country, 2020-2027 Table17 Asia-Pacific Expanded polystyrene by Application Market: By Country, 2020-2027 Table18 Middle East & Africa Expanded polystyrene by Application Market: By Country, 2020-2027 Table19 Latin America Expanded polystyrene by Application Market: By Country, 2020-2027 Table20 Global Type Market: By Region, 2020-2027 Table21 Global Application Market: By Region, 2020-2027 Table22 North America: Expanded polystyrene Market, By Country Table23 North America: Expanded polystyrene Market, By Type Table24 North America: Expanded polystyrene Market, By Application Table25 Europe: Expanded polystyrene Market, By Country Table26 Europe: Expanded polystyrene Market, By Type Table27 Europe: Expanded polystyrene Market, By Application Table28 Asia-Pacific: Expanded polystyrene Market, By Country Table29 Asia-Pacific: Expanded polystyrene Market, By Type Table30 Asia-Pacific: Expanded polystyrene Market, By Application Table31 Middle East & Africa: Expanded polystyrene Market, By Country Table32 Middle East & Africa: Expanded polystyrene Market, By Type Table33 Middle East & Africa: Expanded polystyrene Market, By Application Table34 Latin America: Expanded polystyrene Market, By Country Table35 Latin America: Expanded polystyrene Market, By Type Table36 Latin America: Expanded polystyrene Market, By Application List Of Figures:

- FIGURE 1 Global Expanded polystyrene Market Segmentation

- FIGURE 2 Forecast Methodology

- FIGURE 3 Five Forces Analysis of Global Expanded polystyrene Market

- FIGURE 4 Value Chain of Global Expanded polystyrene Market

- FIGURE 5 Share of Global Expanded polystyrene Market in 2020, by country (in %)

- FIGURE 6 Global Expanded polystyrene Market, 2020-2027,

- FIGURE 7 Sub segments of Type

- FIGURE 8 Global Expanded polystyrene Market size by Type, 2020

- FIGURE 9 Share of Global Expanded polystyrene Market by Type, 2020-2027

- FIGURE 10 Global Expanded polystyrene Market size by Application, 2020

- FIGURE 11 Share of Global Expanded polystyrene Market by Application, 2020-2027

Expanded Polystyrene Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment