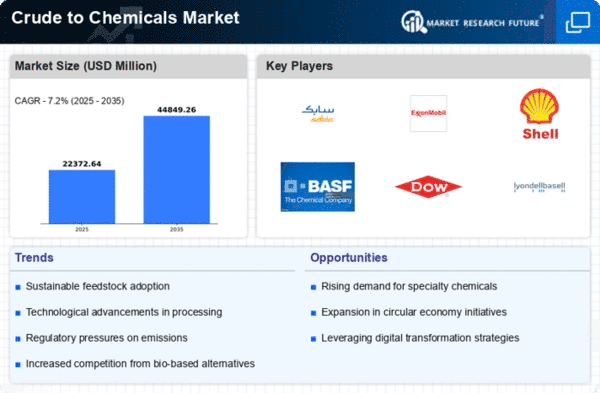

Market Growth Projections

The Global Crude-to-Chemicals Market Industry is projected to experience substantial growth over the next decade, with forecasts indicating a market size of 20.9 USD Billion in 2024 and an anticipated increase to 44.9 USD Billion by 2035. This growth trajectory, characterized by a CAGR of 7.2% from 2025 to 2035, reflects the increasing integration of crude oil processing into the broader chemical manufacturing landscape. As companies innovate and adapt to changing market conditions, the crude-to-chemicals sector is likely to become a vital component of the global economy, contributing to both energy security and sustainable development.

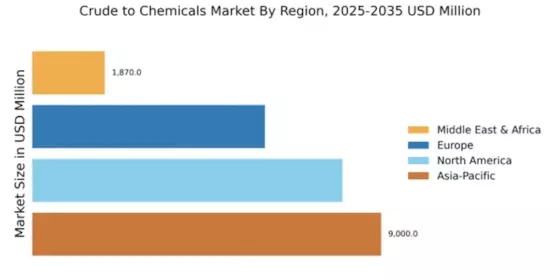

Global Supply Chain Dynamics

The Global Crude-to-Chemicals Market Industry is intricately linked to global supply chain dynamics, which are currently undergoing significant transformations. Disruptions in traditional supply chains have prompted companies to reassess their sourcing strategies and production locations. This reassessment is leading to a more localized approach to crude oil processing, which may enhance resilience against global market fluctuations. The shift towards regional supply chains could also facilitate quicker responses to market demands and regulatory changes. As companies adapt to these dynamics, the overall efficiency and sustainability of the crude-to-chemicals sector may improve, positioning it for future growth.

Increasing Global Energy Demand

The Global Crude-to-Chemicals Market Industry is significantly influenced by the rising global energy demand, particularly in developing economies. As populations grow and urbanization accelerates, the need for energy and chemical products is expected to surge. This demand is driving investments in crude oil processing facilities that can efficiently convert crude into valuable chemicals. By 2035, the market is projected to expand to 44.9 USD Billion, indicating a robust growth trajectory. The interplay between energy consumption and chemical production is likely to create new opportunities for market participants, as they adapt to meet the evolving needs of consumers and industries alike.

Government Policies and Incentives

Government policies and incentives are shaping the landscape of the Global Crude-to-Chemicals Market Industry, as many nations implement regulations aimed at promoting cleaner production methods. Subsidies for renewable energy and tax incentives for companies investing in sustainable technologies are becoming increasingly common. These measures encourage the transition from traditional fossil fuel-based processes to more environmentally friendly alternatives. As governments worldwide commit to reducing greenhouse gas emissions, the crude-to-chemicals sector is likely to benefit from favorable regulatory frameworks. This supportive environment could enhance market growth and innovation, ultimately leading to a more sustainable chemical industry.

Rising Demand for Sustainable Chemicals

The Global Crude-to-Chemicals Market Industry is experiencing a notable shift towards sustainability, driven by increasing consumer awareness and regulatory pressures. As industries seek to reduce their carbon footprints, the demand for sustainable chemical alternatives derived from crude oil is on the rise. This trend is exemplified by the growing adoption of bio-based chemicals and the implementation of circular economy principles. By 2024, the market is projected to reach 20.9 USD Billion, reflecting a significant transformation in production methodologies. Companies are investing in innovative technologies to enhance the sustainability of their operations, which could further propel market growth.

Technological Advancements in Processing

Technological innovation plays a crucial role in the Global Crude-to-Chemicals Market Industry, as advancements in processing techniques enhance efficiency and yield. New catalytic processes and integrated refining technologies are emerging, allowing for the conversion of crude oil into a broader range of chemicals. These innovations not only improve the economic viability of crude-to-chemicals operations but also reduce waste and energy consumption. As a result, companies are likely to invest heavily in research and development to stay competitive. The anticipated growth trajectory, with a CAGR of 7.2% from 2025 to 2035, suggests that these technological advancements will be pivotal in shaping the future of the industry.