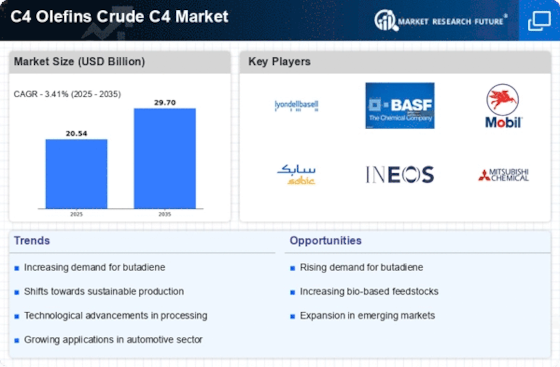

Rising Demand for Petrochemicals

The C4 Olefins Crude C4 Market is experiencing a notable increase in demand for petrochemicals, driven by the expanding automotive and construction sectors. As industries seek to enhance production efficiency, the need for high-quality olefins is becoming more pronounced. In 2025, the demand for butadiene, a key component of C4 olefins, is projected to reach approximately 10 million metric tons, reflecting a compound annual growth rate of around 4.5%. This surge in demand is likely to stimulate investments in production facilities, thereby bolstering the C4 Olefins Crude C4 Market. Furthermore, the growing trend towards lightweight materials in automotive manufacturing is expected to further elevate the consumption of C4 olefins, indicating a robust market trajectory.

Innovations in Production Technologies

Technological advancements are playing a pivotal role in shaping the C4 Olefins Crude C4 Market. Innovations in production processes, such as the development of more efficient catalytic cracking methods, are enhancing yield and reducing operational costs. For instance, recent advancements have led to a 15% increase in the yield of butadiene from naphtha cracking processes. This not only improves profitability for manufacturers but also aligns with sustainability goals by minimizing waste. As companies adopt these cutting-edge technologies, the C4 Olefins Crude C4 Market is likely to witness a transformation in production capabilities, enabling a more competitive landscape. The integration of digital technologies, such as AI and IoT, is also expected to optimize supply chain management, further driving growth in this sector.

Expanding Applications in Various Industries

The versatility of C4 olefins is contributing to their increasing adoption across multiple industries, thereby driving the C4 Olefins Crude C4 Market. Applications in the production of synthetic rubber, plastics, and adhesives are expanding, with the automotive and packaging sectors being the primary consumers. In 2025, the automotive sector alone is anticipated to account for over 30% of the total demand for butadiene. This diversification of applications is likely to create new opportunities for manufacturers and suppliers within the C4 Olefins Crude C4 Market. Additionally, the growing trend towards sustainable materials is prompting industries to explore bio-based alternatives, which may further influence the market dynamics in the coming years.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainability are increasingly influencing the C4 Olefins Crude C4 Market. Governments are implementing stringent regulations aimed at reducing carbon emissions and promoting the use of eco-friendly materials. This regulatory environment is encouraging manufacturers to invest in cleaner production technologies and sustainable practices. For instance, initiatives aimed at reducing greenhouse gas emissions are likely to drive the adoption of bio-based C4 olefins, which could reshape the market landscape. As companies align their operations with these regulations, the C4 Olefins Crude C4 Market may experience a shift towards more sustainable production methods, potentially enhancing its appeal to environmentally conscious consumers and investors.

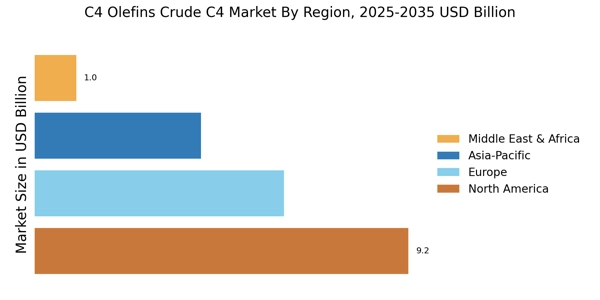

Geopolitical Factors and Supply Chain Dynamics

Geopolitical factors are increasingly impacting the C4 Olefins Crude C4 Market, particularly in terms of supply chain dynamics. Trade policies, tariffs, and international relations can significantly influence the availability and pricing of raw materials. For example, disruptions in oil supply due to geopolitical tensions can lead to fluctuations in the prices of feedstocks used in the production of C4 olefins. This volatility may compel manufacturers to seek alternative sourcing strategies, thereby affecting the overall market stability. Additionally, as companies navigate these complexities, the C4 Olefins Crude C4 Market may witness a shift towards regional sourcing and production, which could reshape competitive dynamics and influence pricing strategies.