Growth in End-Use Industries

The growth in end-use industries is a significant driver for the Olefins and Aromatic Market. Sectors such as packaging, automotive, and electronics are experiencing robust expansion, leading to increased consumption of olefins and aromatics. For example, the packaging industry alone is projected to account for over 30% of the total demand for polyethylene, a major olefin, by 2025. Additionally, the automotive sector's shift towards lightweight materials is driving the demand for polypropylene, another key olefin. The electronics industry also relies heavily on aromatic compounds for manufacturing components. This diverse demand from various end-use industries underscores the critical role that olefins and aromatics play in modern manufacturing, thereby propelling the growth of the Olefins and Aromatic Market.

Rising Demand for Petrochemicals

The increasing demand for petrochemicals is a primary driver for the Olefins and Aromatic Market. As industries such as automotive, construction, and consumer goods expand, the need for various petrochemical products rises. In 2025, the demand for ethylene, a key olefin, is projected to reach approximately 170 million metric tons, reflecting a compound annual growth rate of around 4.5%. This growth is largely attributed to the expanding applications of olefins in producing plastics, synthetic fibers, and other materials. Furthermore, the aromatic compounds, particularly benzene and toluene, are essential in manufacturing solvents, adhesives, and coatings, which are witnessing increased consumption across multiple sectors. Thus, the robust demand for petrochemicals significantly propels the growth of the Olefins and Aromatic Market.

Innovations in Production Technologies

Innovations in production technologies are reshaping the Olefins and Aromatic Market. Advanced methods such as steam cracking and catalytic processes are enhancing the efficiency of olefin production. For instance, the adoption of new catalysts has been shown to improve yield rates and reduce energy consumption, which is crucial in an era where sustainability is paramount. In 2025, it is estimated that the implementation of these technologies could lead to a reduction in production costs by up to 15%. Additionally, the development of biobased feedstocks for aromatic compounds is gaining traction, potentially diversifying the raw material sources and reducing reliance on fossil fuels. These technological advancements not only optimize production but also align with the industry's shift towards more sustainable practices.

Emerging Markets and Economic Development

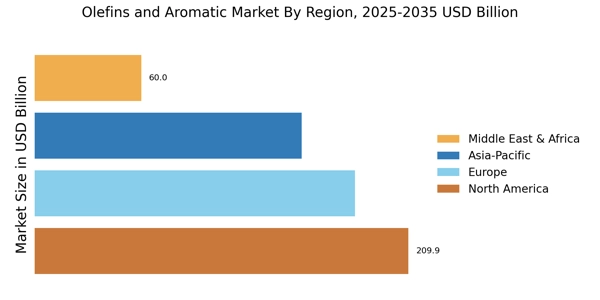

Emerging markets and economic development are pivotal factors influencing the Olefins and Aromatic Market. Countries in Asia and Africa are witnessing rapid industrialization, leading to increased demand for petrochemical products. In 2025, it is projected that the Asia-Pacific region will account for nearly 60% of the global olefin consumption, driven by urbanization and rising living standards. This trend is further supported by investments in infrastructure and manufacturing capabilities in these regions. As economies develop, the demand for consumer goods, packaging, and automotive products rises, subsequently increasing the need for olefins and aromatics. Consequently, the growth of emerging markets presents substantial opportunities for stakeholders within the Olefins and Aromatic Market.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is increasingly influencing the Olefins and Aromatic Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and promoting environmentally friendly production methods. In 2025, it is anticipated that policies encouraging the use of recycled materials in the production of olefins and aromatics will gain momentum. This regulatory landscape is likely to drive investments in cleaner technologies and processes, fostering innovation within the industry. Moreover, compliance with these regulations may enhance the marketability of products derived from sustainable practices, appealing to environmentally conscious consumers. As a result, the regulatory environment is expected to play a pivotal role in shaping the future of the Olefins and Aromatic Market.