Growing Renewable Energy Projects

The Global Crude Steel Market Industry is witnessing a notable increase in demand due to the expansion of renewable energy projects. Wind and solar energy installations require substantial amounts of steel for infrastructure, including turbines and solar panels. As countries commit to reducing carbon emissions and transitioning to sustainable energy sources, the need for crude steel is expected to rise. This trend aligns with global efforts to combat climate change, potentially leading to a market valuation of 1392.5 USD Billion by 2035. The integration of steel in renewable energy projects signifies a pivotal shift in the industry, emphasizing its role in sustainable development.

Urbanization and Population Growth

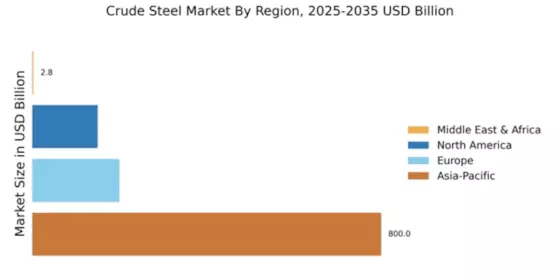

Urbanization and population growth are pivotal factors influencing the Global Crude Steel Market Industry. As more individuals migrate to urban areas, the demand for housing, transportation, and infrastructure escalates. This trend is particularly pronounced in developing nations, where rapid urbanization is occurring. The increasing population necessitates the construction of residential and commercial buildings, which in turn drives the demand for crude steel. With projections indicating a market size of 1152.8 USD Billion in 2024, the industry is poised for growth as urbanization continues to reshape economies and societies globally.

Rising Demand from Automotive Sector

The automotive sector is a significant driver of the Global Crude Steel Market Industry, as manufacturers increasingly rely on high-strength steel for vehicle production. The shift towards lightweight materials to improve fuel efficiency and reduce emissions is propelling the demand for advanced steel grades. In 2024, the automotive industry is expected to contribute substantially to the crude steel market, with projections indicating a compound annual growth rate of 1.73% from 2025 to 2035. This trend suggests that as automotive production ramps up, the crude steel market will likely benefit from sustained demand, reinforcing its position in the global economy.

Increasing Infrastructure Development

The Global Crude Steel Market Industry is experiencing a surge in demand driven by extensive infrastructure development projects worldwide. Governments are investing heavily in transportation, energy, and urban development, which necessitates substantial quantities of crude steel. For instance, in 2024, the market is projected to reach 1152.8 USD Billion, reflecting the critical role of steel in construction and infrastructure. This trend is expected to continue, with significant investments in emerging economies, where urbanization and infrastructure expansion are paramount. The demand for crude steel is likely to grow as these projects unfold, indicating a robust future for the industry.

Technological Advancements in Steel Production

Technological innovations are reshaping the Global Crude Steel Market Industry, enhancing production efficiency and sustainability. Advanced manufacturing processes, such as electric arc furnaces and automation, are being adopted to reduce energy consumption and emissions. These advancements not only lower production costs but also align with global sustainability goals. As the industry adapts to these technologies, it is anticipated that the market will see a steady growth trajectory, potentially reaching 1392.5 USD Billion by 2035. The integration of smart technologies in steel production could further streamline operations, thereby reinforcing the industry's competitive edge.