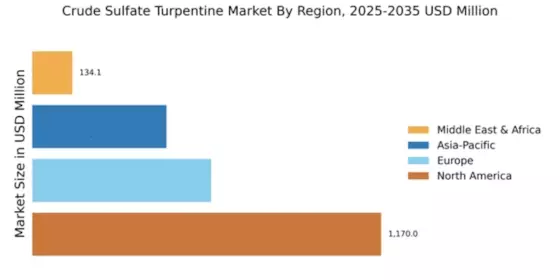

North America : Market Leader in Turpentine

North America is poised to maintain its leadership in the Crude Sulfate Turpentine market, holding a significant market share of 1170.0. The region benefits from robust demand driven by the expanding applications in adhesives, paints, and coatings. Regulatory support for sustainable forestry practices further enhances growth prospects, ensuring a steady supply of raw materials.

The competitive landscape is characterized by key players such as Georgia-Pacific LLC, Kraton Corporation, and Pine Chemical Group, which are leveraging advanced technologies to optimize production. The U.S. remains the largest contributor, supported by a well-established infrastructure and favorable trade policies. This positions North America as a critical hub for innovation and market expansion.

Europe : Emerging Market Dynamics

Europe is witnessing a notable increase in the Crude Sulfate Turpentine market, with a size of 600.0. The growth is fueled by rising demand for eco-friendly products and stringent regulations promoting sustainable practices. The European Union's commitment to reducing carbon emissions is a significant catalyst, encouraging investments in renewable resources and bioproducts.

Leading countries like Germany, France, and the UK are at the forefront, with companies such as DRT and Sappi Lanaken Mill driving innovation. The competitive landscape is evolving, with a focus on enhancing product quality and sustainability. As the market matures, collaboration among industry players is expected to intensify, fostering a more resilient supply chain.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is emerging as a significant player in the Crude Sulfate Turpentine market, with a size of 450.0. The growth is driven by increasing industrialization and urbanization, leading to higher demand for turpentine in various applications, including fragrances and solvents. Government initiatives to promote sustainable forestry are also contributing to market expansion.

Countries like India and China are leading the charge, with local players such as Sundar Chemicals capitalizing on the growing market. The competitive landscape is becoming more dynamic, with both established and new entrants vying for market share. As the region continues to develop, investment in technology and sustainable practices will be crucial for long-term growth.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region is gradually developing its Crude Sulfate Turpentine market, currently valued at 134.13. The growth is primarily driven by increasing demand for natural products in the cosmetics and food industries. Additionally, the region's rich natural resources provide a unique opportunity for local production and export.

Countries like South Africa and Kenya are emerging as key players, with a focus on enhancing production capabilities. The competitive landscape is still in its infancy, but the presence of international companies is expected to stimulate growth. As the market matures, regulatory frameworks will play a crucial role in shaping industry standards and practices.