Feed Binders Size

Market Size Snapshot

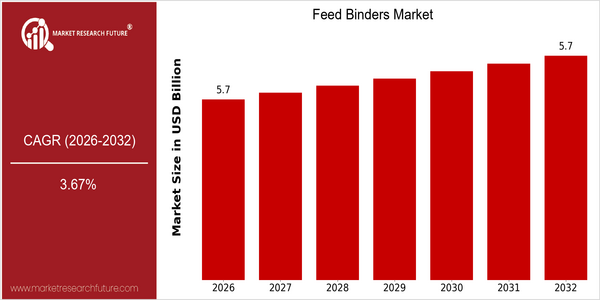

| Year | Value |

|---|---|

| 2026 | USD 5.67 Billion |

| 2032 | USD 5.67 Billion |

| CAGR (2024-2032) | 3.67 % |

Note – Market size depicts the revenue generated over the financial year

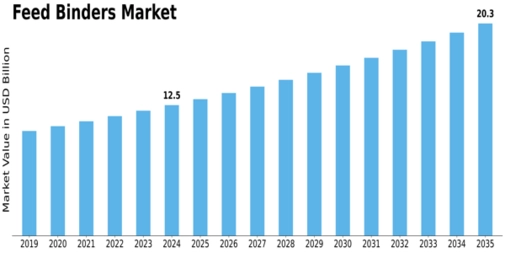

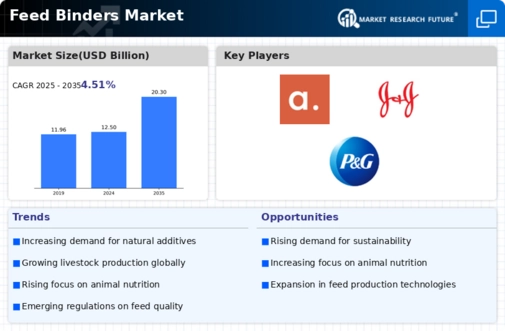

The Feed Binders Market is projected to maintain a steady valuation of USD 5.67 billion from 2026 through 2032, reflecting a compound annual growth rate (CAGR) of 3.67% during the forecast period from 2024 to 2032. This stability in market size indicates a mature sector that is likely to experience gradual growth driven by evolving consumer preferences and advancements in feed technology. The consistent market size suggests that while growth may be moderate, the demand for feed binders remains robust, supported by the increasing need for high-quality animal nutrition and feed efficiency.

Several factors are contributing to the growth of the Feed Binders Market. The rising global population and the corresponding increase in meat consumption are driving the demand for efficient animal feed solutions. Additionally, technological innovations in feed formulation and binder applications are enhancing the performance of feed products, thereby attracting investments from key players in the industry. Companies such as BASF, ADM, and Cargill are actively engaging in strategic initiatives, including partnerships and product launches, to expand their market presence and improve product offerings. For instance, recent collaborations aimed at developing sustainable feed solutions are indicative of the industry's shift towards environmentally friendly practices, further propelling market growth.

Regional Market Size

Regional Deep Dive

The Feed Binders Market is experiencing significant growth across various regions, driven by the increasing demand for high-quality animal feed and the need for improved feed efficiency. In North America, the market is characterized by advanced agricultural practices and a strong focus on livestock health, while Europe emphasizes regulatory compliance and sustainability. The Asia-Pacific region is witnessing rapid expansion due to rising meat consumption and the growing aquaculture industry. Meanwhile, the Middle East and Africa are seeing a gradual increase in feed binder adoption, influenced by economic development and changing dietary preferences. Latin America is also emerging as a key player, with a focus on enhancing feed quality to meet export standards. Overall, the market dynamics are shaped by regional agricultural practices, consumer preferences, and regulatory frameworks.

Europe

- In Europe, the market is significantly shaped by the European Union's stringent regulations on animal feed additives, which are driving innovation in natural and organic feed binders, with companies like BASF leading the charge.

- The rising consumer demand for sustainable and ethically sourced animal products is pushing manufacturers to develop eco-friendly feed binders, aligning with the EU's Green Deal initiatives aimed at reducing the environmental impact of agriculture.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in aquaculture, leading to increased demand for specialized feed binders that enhance feed efficiency and nutrient absorption, with companies like Nutreco expanding their product lines to cater to this market.

- Government initiatives in countries like China and India to boost livestock production are encouraging the adoption of advanced feed technologies, including binders, to improve feed quality and animal health.

Latin America

- Latin America is emerging as a significant player in the Feed Binders Market, with countries like Brazil and Argentina focusing on enhancing feed quality to meet international export standards, particularly in the meat industry.

- The region is also witnessing a trend towards the use of natural feed binders, driven by consumer preferences for healthier and more sustainable animal products, with local companies innovating to meet these demands.

North America

- The North American Feed Binders Market is heavily influenced by the increasing adoption of innovative feed formulations, with companies like Cargill and Archer Daniels Midland investing in research and development to enhance product offerings.

- Regulatory changes, particularly the FDA's guidelines on feed safety, are prompting manufacturers to adopt more stringent quality control measures, thereby improving the overall safety and efficacy of feed binders in the region.

Middle East And Africa

- In the Middle East and Africa, the Feed Binders Market is gradually evolving, with local companies like Al Dahra Agriculture focusing on improving feed quality to meet the growing demand for livestock products in the region.

- Economic diversification efforts in countries like Saudi Arabia are leading to increased investments in the agricultural sector, which is expected to drive the adoption of feed binders as part of modernizing livestock practices.

Did You Know?

“Did you know that the use of feed binders can improve feed efficiency by up to 10%, significantly impacting livestock growth rates and overall productivity?” — Feed Industry Research Journal

Segmental Market Size

The Feed Binders Market is currently experiencing stable growth, driven by the increasing demand for high-quality animal feed and the need for improved feed efficiency. Key factors propelling this segment include the rising global meat consumption and stringent regulatory policies aimed at enhancing animal health and welfare. Additionally, technological advancements in feed formulation are fostering innovation in binder products, making them more effective and appealing to producers.

Currently, the adoption of feed binders is in the mature stage, with notable players like Cargill and BASF leading the way in product development and market penetration. Primary applications include their use in livestock feed, aquaculture, and pet food, where they enhance nutrient absorption and feed texture. Trends such as sustainability initiatives and the push for cleaner production methods are catalyzing growth, as consumers increasingly demand eco-friendly products. Technologies like extrusion and pelleting are shaping the evolution of feed binders, ensuring they meet the diverse needs of the animal nutrition industry.

Future Outlook

The Feed Binders Market is poised for steady growth from 2026 to 2032, with a projected compound annual growth rate (CAGR) of 3.67%, maintaining a market value of approximately $5.67 billion by 2032. This growth trajectory is underpinned by the increasing demand for high-quality animal feed, driven by the rising global population and the corresponding need for efficient livestock production. As the livestock industry continues to expand, the adoption of feed binders will become increasingly critical to enhance feed quality, improve nutrient absorption, and reduce waste, thereby supporting sustainable agricultural practices.

Key technological advancements and regulatory policies are expected to play a significant role in shaping the Feed Binders Market. Innovations in binder formulations, such as the development of natural and organic binders, are likely to gain traction as consumers demand cleaner and more sustainable food sources. Additionally, government initiatives aimed at promoting animal welfare and environmental sustainability will further drive the adoption of feed binders that meet these standards. Emerging trends, including the integration of digital technologies in feed formulation and management, will also enhance the efficiency and effectiveness of feed binders, ensuring their relevance in a rapidly evolving market landscape.

Leave a Comment