-

EXECUTIVE SUMMARY

-

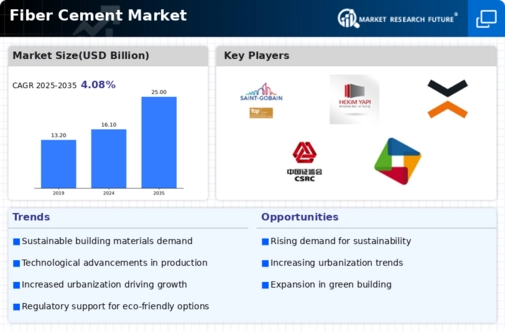

Market Overview

-

Key Findings

-

Market Segmentation

-

Competitive Landscape

-

Challenges and Opportunities

-

1.6.

-

Future Outlook

-

MARKET INTRODUCTION

-

2.1.

-

Definition

-

Scope of the study

- Research Objective

- Limitations

-

2.2.2.

-

Assumption

-

RESEARCH METHODOLOGY

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown

-

of Primary Respondents

-

Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

Data Triangulation

-

Validation

-

MARKET DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

MARKET

-

FACTOR ANALYSIS

-

Value chain Analysis

-

Porter's Five Forces

- Bargaining Power of Suppliers

- Bargaining Power

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

Analysis

-

of Buyers

-

COVID-19 Impact Analysis

- Regional Impact

- Opportunity and

-

5.3.1.

-

Market Impact Analysis

-

Threat Analysis

-

FIBER CEMENT MARKET, BY APPLICATION (USD

-

BILLION)

-

Siding

-

Roofing

-

Flooring

-

Interior

-

Walls

-

Precast Structures

-

FIBER CEMENT MARKET, BY END USE (USD

-

BILLION)

-

Residential

-

Commercial

-

Industrial

-

FIBER CEMENT MARKET, BY PRODUCT TYPE (USD BILLION)

-

Fiber Cement

-

Board

-

Fiber Cement Slab

-

Fiber Cement Panel

-

FIBER

-

CEMENT MARKET, BY MANUFACTURING PROCESS (USD BILLION)

-

Semi-Dry Process

-

Wet Process

-

Other Processes

-

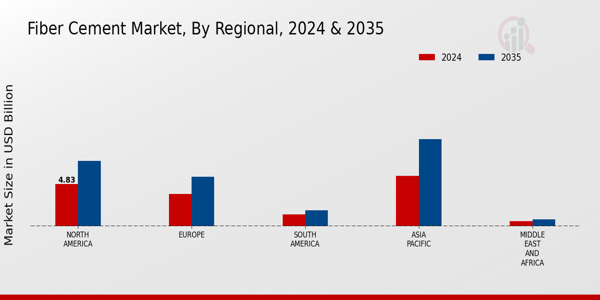

FIBER CEMENT MARKET,

-

BY REGIONAL (USD BILLION)

-

North America

- US

-

10.1.2.

-

Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest

-

of Europe

-

APAC

- China

- India

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

10.3.3.

-

Japan

-

South America

- Mexico

- Argentina

- Rest of South

-

10.4.1.

-

Brazil

-

America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

COMPETITIVE LANDSCAPE

-

11.1.

-

Overview

-

Competitive Analysis

-

Market share Analysis

-

Major Growth Strategy in the Fiber Cement Market

-

Competitive

-

Benchmarking

-

Leading Players in Terms of Number of Developments in the

-

Fiber Cement Market

-

Key developments and growth strategies

- Merger & Acquisitions

- Joint Ventures

-

11.7.1.

-

New Product Launch/Service Deployment

-

Major Players Financial Matrix

- Major Players R&D Expenditure. 2023

-

11.8.1.

-

Sales and Operating Income

-

COMPANY PROFILES

-

James Hardie Industries

- Financial

- Products Offered

- Key Developments

- Key Strategies

-

Overview

-

12.1.4.

-

SWOT Analysis

-

SaintGobain

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

12.2.1.

-

Financial Overview

-

Fiber Cement

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Technologies

-

Allura

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Toray Industries

- Financial Overview

- Products

- Key Developments

- SWOT Analysis

-

Offered

-

12.5.5.

-

Key Strategies

-

Etex Group

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

12.6.2.

-

Products Offered

-

Cement Board Services

- Financial

- Products Offered

- Key Developments

- Key Strategies

-

Overview

-

12.7.4.

-

SWOT Analysis

-

Cembrit Holding

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

12.8.1.

-

Financial Overview

-

Owens Corning

- Financial Overview

- Products Offered

- Key

- SWOT Analysis

- Key Strategies

- Financial Overview

- Products

- Key Developments

- SWOT Analysis

-

Developments

-

12.10.

-

GAF Materials Corporation

-

Offered

-

12.10.5.

-

Key Strategies

-

Celltech Metals

- Financial Overview

- Products Offered

- Key Developments

- SWOT

- Key Strategies

-

Analysis

-

Tegral Building Products

- Financial Overview

- Products Offered

- Key

- SWOT Analysis

- Key Strategies

- Financial Overview

- Products

- Key Developments

- SWOT Analysis

-

Developments

-

12.13.

-

Hume Cemboard Industries

-

Offered

-

12.13.5.

-

Key Strategies

-

SCG Building Materials

- Financial Overview

- Products Offered

- Key Developments

- SWOT

- Key Strategies

-

Analysis

-

Nichiha Corporation

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

12.15.1.

-

Financial Overview

-

APPENDIX

-

References

-

Related Reports

-

LIST OF TABLES

-

TABLE

-

LIST OF ASSUMPTIONS

-

NORTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

NORTH AMERICA

-

FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

NORTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

NORTH AMERICA FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

NORTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY REGIONAL, 2019-2035 (USD BILLIONS)

-

US FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

TABLE 8.

-

US FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD

-

BILLIONS)

-

US FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

US FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

US FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035

-

(USD BILLIONS)

-

CANADA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY APPLICATION, 2019-2035 (USD BILLIONS)

-

CANADA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE

-

CANADA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035

-

(USD BILLIONS)

-

CANADA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

CANADA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

EUROPE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

EUROPE FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

EUROPE FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

EUROPE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

EUROPE FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 22.

-

GERMANY FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

GERMANY FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

GERMANY FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

GERMANY FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

GERMANY FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 27.

-

UK FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

UK FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY END USE, 2019-2035 (USD BILLIONS)

-

UK FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

TABLE

-

UK FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS,

-

UK FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

FRANCE FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

FRANCE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE,

-

FRANCE FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

FRANCE

-

FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035

-

(USD BILLIONS)

-

FRANCE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY REGIONAL, 2019-2035 (USD BILLIONS)

-

RUSSIA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

TABLE

-

RUSSIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035

-

(USD BILLIONS)

-

RUSSIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

RUSSIA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

RUSSIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

ITALY FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ITALY FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

ITALY FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD BILLIONS)

-

ITALY FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

TABLE 46.

-

ITALY FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035

-

(USD BILLIONS)

-

SPAIN FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SPAIN FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE

-

SPAIN FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035

-

(USD BILLIONS)

-

SPAIN FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

SPAIN FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

REST OF EUROPE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

APPLICATION, 2019-2035 (USD BILLIONS)

-

REST OF EUROPE FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE

-

REST OF EUROPE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD BILLIONS)

-

REST OF EUROPE FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

REST OF EUROPE FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY REGIONAL, 2019-2035 (USD BILLIONS)

-

APAC FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

TABLE 58.

-

APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD

-

BILLIONS)

-

APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

APAC FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

CHINA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

CHINA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

CHINA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD BILLIONS)

-

CHINA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

TABLE 66.

-

CHINA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035

-

(USD BILLIONS)

-

INDIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY APPLICATION, 2019-2035 (USD BILLIONS)

-

INDIA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE

-

INDIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035

-

(USD BILLIONS)

-

INDIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

INDIA FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

JAPAN FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

JAPAN FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

JAPAN FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

JAPAN FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

JAPAN FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 77.

-

SOUTH KOREA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

SOUTH KOREA FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

SOUTH KOREA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

SOUTH KOREA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

SOUTH KOREA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

MALAYSIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

MALAYSIA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

MALAYSIA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

MALAYSIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

MALAYSIA FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 87.

-

THAILAND FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

THAILAND FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

THAILAND FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

THAILAND FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

THAILAND FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 92.

-

INDONESIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

INDONESIA FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

INDONESIA FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

INDONESIA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

INDONESIA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

REST OF APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST,

-

BY APPLICATION, 2019-2035 (USD BILLIONS)

-

REST OF APAC FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE

-

REST OF APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

REST OF APAC FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

REST OF APAC FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

REGIONAL, 2019-2035 (USD BILLIONS)

-

SOUTH AMERICA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

TABLE

-

SOUTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE,

-

SOUTH AMERICA FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

TABLE

-

SOUTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

SOUTH AMERICA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE

-

BRAZIL FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

BRAZIL FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

BRAZIL FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

BRAZIL FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

BRAZIL FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 112.

-

MEXICO FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

MEXICO FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

MEXICO FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

MEXICO FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

MEXICO FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 117.

-

ARGENTINA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035

-

(USD BILLIONS)

-

ARGENTINA FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

ARGENTINA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

ARGENTINA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

ARGENTINA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

REST OF SOUTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

REST OF SOUTH

-

AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035

-

(USD BILLIONS)

-

REST OF SOUTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

REST

-

OF SOUTH AMERICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

REST OF SOUTH AMERICA FIBER CEMENT

-

MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

MEA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

MEA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

MEA FIBER

-

CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

MEA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

MEA FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 132.

-

GCC COUNTRIES FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

GCC COUNTRIES FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

TABLE 134.

-

GCC COUNTRIES FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

GCC COUNTRIES FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

GCC COUNTRIES FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY

-

REGIONAL, 2019-2035 (USD BILLIONS)

-

SOUTH AFRICA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

TABLE

-

SOUTH AFRICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE,

-

SOUTH AFRICA FIBER CEMENT MARKET SIZE

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

-

TABLE

-

SOUTH AFRICA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY MANUFACTURING

-

PROCESS, 2019-2035 (USD BILLIONS)

-

SOUTH AFRICA FIBER CEMENT MARKET

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE

-

REST OF MEA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

REST OF MEA FIBER CEMENT MARKET SIZE ESTIMATES

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

REST OF MEA

-

FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD

-

BILLIONS)

-

REST OF MEA FIBER CEMENT MARKET SIZE ESTIMATES &

-

FORECAST, BY MANUFACTURING PROCESS, 2019-2035 (USD BILLIONS)

-

REST

-

OF MEA FIBER CEMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035

-

(USD BILLIONS)

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

ACQUISITION/PARTNERSHIP

-

LIST OF FIGURES

-

FIGURE

-

MARKET SYNOPSIS

-

NORTH AMERICA FIBER CEMENT MARKET ANALYSIS

-

US FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

US FIBER

-

CEMENT MARKET ANALYSIS BY END USE

-

US FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

US FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

US FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

CANADA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

CANADA FIBER

-

CEMENT MARKET ANALYSIS BY END USE

-

CANADA FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

CANADA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

CANADA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

EUROPE FIBER CEMENT MARKET ANALYSIS

-

GERMANY FIBER CEMENT MARKET

-

ANALYSIS BY APPLICATION

-

GERMANY FIBER CEMENT MARKET ANALYSIS BY

-

END USE

-

GERMANY FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

GERMANY FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

FIGURE

-

GERMANY FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

UK FIBER CEMENT

-

MARKET ANALYSIS BY APPLICATION

-

UK FIBER CEMENT MARKET ANALYSIS

-

BY END USE

-

UK FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

UK FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

FIGURE

-

UK FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FRANCE FIBER CEMENT

-

MARKET ANALYSIS BY APPLICATION

-

FRANCE FIBER CEMENT MARKET ANALYSIS

-

BY END USE

-

FRANCE FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

FRANCE FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

FRANCE FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

RUSSIA

-

FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

RUSSIA FIBER CEMENT

-

MARKET ANALYSIS BY END USE

-

RUSSIA FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

RUSSIA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

RUSSIA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

ITALY FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

ITALY FIBER

-

CEMENT MARKET ANALYSIS BY END USE

-

ITALY FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

ITALY FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

ITALY FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

SPAIN FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

SPAIN FIBER

-

CEMENT MARKET ANALYSIS BY END USE

-

SPAIN FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

SPAIN FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

SPAIN FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

REST OF EUROPE FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

FIGURE 45.

-

REST OF EUROPE FIBER CEMENT MARKET ANALYSIS BY END USE

-

REST OF

-

EUROPE FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

REST OF EUROPE

-

FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

REST OF EUROPE

-

FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

APAC FIBER CEMENT MARKET

-

ANALYSIS

-

CHINA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

CHINA FIBER CEMENT MARKET ANALYSIS BY END USE

-

CHINA

-

FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

CHINA FIBER CEMENT

-

MARKET ANALYSIS BY MANUFACTURING PROCESS

-

CHINA FIBER CEMENT MARKET

-

ANALYSIS BY REGIONAL

-

INDIA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

INDIA FIBER CEMENT MARKET ANALYSIS BY END USE

-

FIGURE 57.

-

INDIA FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

INDIA FIBER

-

CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

INDIA FIBER CEMENT

-

MARKET ANALYSIS BY REGIONAL

-

JAPAN FIBER CEMENT MARKET ANALYSIS

-

BY APPLICATION

-

JAPAN FIBER CEMENT MARKET ANALYSIS BY END USE

-

JAPAN FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

FIGURE 63.

-

JAPAN FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

JAPAN

-

FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

SOUTH KOREA FIBER CEMENT

-

MARKET ANALYSIS BY APPLICATION

-

SOUTH KOREA FIBER CEMENT MARKET

-

ANALYSIS BY END USE

-

SOUTH KOREA FIBER CEMENT MARKET ANALYSIS BY

-

PRODUCT TYPE

-

SOUTH KOREA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING

-

PROCESS

-

SOUTH KOREA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

MALAYSIA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

FIGURE 71.

-

MALAYSIA FIBER CEMENT MARKET ANALYSIS BY END USE

-

MALAYSIA FIBER

-

CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

MALAYSIA FIBER CEMENT MARKET

-

ANALYSIS BY MANUFACTURING PROCESS

-

MALAYSIA FIBER CEMENT MARKET

-

ANALYSIS BY REGIONAL

-

THAILAND FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

THAILAND FIBER CEMENT MARKET ANALYSIS BY END USE

-

FIGURE 77.

-

THAILAND FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

THAILAND

-

FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

THAILAND

-

FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

INDONESIA FIBER CEMENT

-

MARKET ANALYSIS BY APPLICATION

-

INDONESIA FIBER CEMENT MARKET ANALYSIS

-

BY END USE

-

INDONESIA FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

INDONESIA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

INDONESIA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

FIGURE

-

REST OF APAC FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

REST

-

OF APAC FIBER CEMENT MARKET ANALYSIS BY END USE

-

REST OF APAC FIBER

-

CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

REST OF APAC FIBER CEMENT

-

MARKET ANALYSIS BY MANUFACTURING PROCESS

-

REST OF APAC FIBER CEMENT

-

MARKET ANALYSIS BY REGIONAL

-

SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS

-

BRAZIL FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

FIGURE

-

BRAZIL FIBER CEMENT MARKET ANALYSIS BY END USE

-

BRAZIL FIBER

-

CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

BRAZIL FIBER CEMENT MARKET

-

ANALYSIS BY MANUFACTURING PROCESS

-

BRAZIL FIBER CEMENT MARKET ANALYSIS

-

BY REGIONAL

-

MEXICO FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

MEXICO FIBER CEMENT MARKET ANALYSIS BY END USE

-

FIGURE 98.

-

MEXICO FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

MEXICO FIBER

-

CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

MEXICO FIBER CEMENT

-

MARKET ANALYSIS BY REGIONAL

-

ARGENTINA FIBER CEMENT MARKET ANALYSIS

-

BY APPLICATION

-

ARGENTINA FIBER CEMENT MARKET ANALYSIS BY END USE

-

ARGENTINA FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

FIGURE

-

ARGENTINA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

FIGURE

-

ARGENTINA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

REST OF

-

SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

REST

-

OF SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS BY END USE

-

REST

-

OF SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

FIGURE 109.

-

REST OF SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

REST OF SOUTH AMERICA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

MEA FIBER CEMENT MARKET ANALYSIS

-

GCC COUNTRIES FIBER

-

CEMENT MARKET ANALYSIS BY APPLICATION

-

GCC COUNTRIES FIBER CEMENT

-

MARKET ANALYSIS BY END USE

-

GCC COUNTRIES FIBER CEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE

-

GCC COUNTRIES FIBER CEMENT MARKET ANALYSIS BY

-

MANUFACTURING PROCESS

-

GCC COUNTRIES FIBER CEMENT MARKET ANALYSIS

-

BY REGIONAL

-

SOUTH AFRICA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

SOUTH AFRICA FIBER CEMENT MARKET ANALYSIS BY END USE

-

FIGURE

-

SOUTH AFRICA FIBER CEMENT MARKET ANALYSIS BY PRODUCT TYPE

-

FIGURE 120.

-

SOUTH AFRICA FIBER CEMENT MARKET ANALYSIS BY MANUFACTURING PROCESS

-

FIGURE

-

SOUTH AFRICA FIBER CEMENT MARKET ANALYSIS BY REGIONAL

-

REST

-

OF MEA FIBER CEMENT MARKET ANALYSIS BY APPLICATION

-

REST OF MEA

-

FIBER CEMENT MARKET ANALYSIS BY END USE

-

REST OF MEA FIBER CEMENT

-

MARKET ANALYSIS BY PRODUCT TYPE

-

REST OF MEA FIBER CEMENT MARKET

-

ANALYSIS BY MANUFACTURING PROCESS

-

REST OF MEA FIBER CEMENT MARKET

-

ANALYSIS BY REGIONAL

-

KEY BUYING CRITERIA OF FIBER CEMENT MARKET

-

RESEARCH PROCESS OF MRFR

-

DRO ANALYSIS OF FIBER

-

CEMENT MARKET

-

DRIVERS IMPACT AN

Leave a Comment