Market Analysis

In-depth Analysis of Fiberglass Flooring Market Industry Landscape

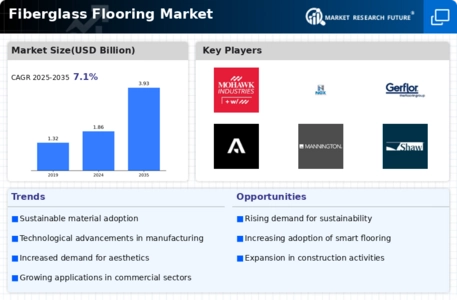

The fiberglass flooring industry is experiencing shifting dynamics influenced by various factors affecting supply, demand, and overall market trends. The rising need for multipurpose resilient floorings serves as another main driver of market dynamics. Furthermore, the evolution of the construction business has shaped the sector's current dynamics. Currently, the construction sector is on an upward trend globally, increasing demand for innovative and reliable floorings. Due to its ability to resist stain, it wears out very slowly and remains attractive even after heavy use; hence, it's preferred by architects, contractors, and end users alike. For instance, fiberglass flooring can withstand high traffic volumes without getting defaced. Precisely speaking, it is a preferred choice for architects, contractors, and end users, given its ability to withstand heavy traffic volumes without losing its value. Globally, fiberglass flooring market dynamics are influenced by the global economic conditions. The construction industry is affected by economic stability and growth, which, in turn, affects the demand for flooring materials. This normally prompts an increase in investments within the building sector whenever there is a strong economy since this results in increased demand for fiberglass flooring. Innovation and technology advancements drive the ever-changing landscape of fiberglass floorings. Thus, manufacturers strive to improve their product features and performance. The introduction of new methods of manufacturing, eco-friendly materials, and design breakthroughs ensures that the market remains responsive to changes in consumer preferences. As such, environmental considerations are increasingly impacting the dynamics of flooring markets, including fiberglass flooring. By doing so, they cater to customers and businesses who are becoming more conscious about sustainability. Specifically, consumers and corporations alike have embraced eco-friendly alternatives if it relates to their floors such as fiberglass. Flooring companies that manufacture fiberglass have responded by producing products made from recycled materials with low carbon emissions, which meet stringent sustainability criteria. As a result, not only does this conscious approach help attract eco-conscious consumers, but it also shapes competition within the fiberglass flooring market. Manufacturers and suppliers are often subject to competitive forces that contribute significantly to market dynamics. The fiberglass flooring industry is characterized by a wide range of players, each competing for market share through their products' characteristics, pricing policies, and available distribution channels. Mergers, acquisitions, and partnerships are typical as firms try to strengthen their positions and increase their reach, while regulatory factors have a significant influence on market dynamics. Government regulations, as well as industrial standards related to safety, quality, and environmental issues about fiberglass flooring, can dictate the production, marketing, or even consumption of these materials. It's not only required by law to abide by these regulations but also an opportunity for businesses to become reputable in the eyes of customers who will see them as responsible corporations.

Leave a Comment