Fortified Foods Size

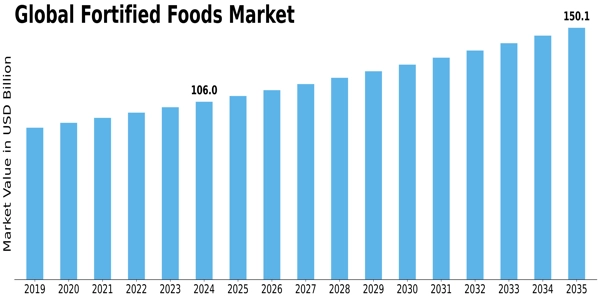

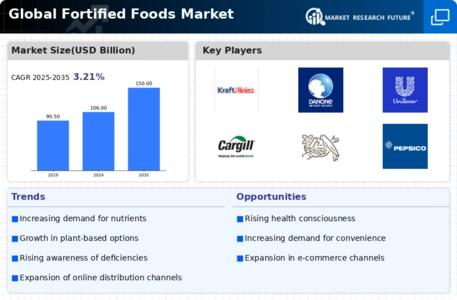

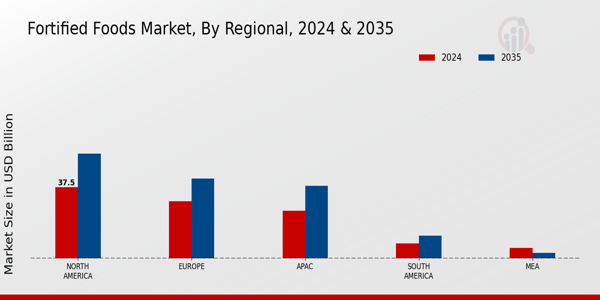

Fortified Foods Market Growth Projections and Opportunities

The fortified foods market is propelled by many factors that collectively influence its growth, innovation, and consumer appeal. Awareness among consumers and emphasis on health and well-being are therefore the main driving forces of the primary market. As more people lead health-conscious lifestyles, food consumers search increasingly for foods that are reinforced with extra nutritional value in addition to maintaining the body. Foods fortified with various kinds of vitamins, minerals and bioactive components also meet this need, presenting people with convenient ways to add nutrients lacking from their daily diets. As individuals’ understanding of the link between nutrition and general health becomes clearer, the desire for fortified foods rises, with people trying to resolve or prevent certain health problems or nutritional deficiencies. Fortified foods constitute a market in and of themselves, and as such the nutritional needs of consumers and dietary considerations have a great influence over the market factors. Due to their different physiological characteristics, children, pregnant women, the old, and even people with certain illnesses need different foods. These needs were carefully catered to in fortified foods, providing answers for filling the absence of various nutrients. New encapsulation techniques extend the effective lifetime and bioavailability of nutrients. This guarantees that fortified foods retain their nutritional performance from beginning to end. These technological breakthroughs spur providers to come up with various fortified food offerings, so that their quality people can enjoy is better and less costly. Guidelines and regulation, along with oversight, are important factors affecting the fortified foods market. There are also government regulations governing fortification practice. Each type of food has fixed criteria governing the quantity and categories of added nutrients. As long as these regulations are complied with, fortified foods are both safe and efficacious and are properly labeled, and they secure the health of consumers. Compliance with regulatory requirements determines formulations for products, strategies for product labels, and methods of getting the products to market. All these in turn influence the nature of fortified food products on the market and what consumers buy. Shifting dietary patterns and the declining birthrate aren't the only factors at play in the industry for fortified foods. Even the competitive strategies and marketing efforts of the firms contribute to changes in the fortified foods market. The industry's major players offering fortified foods will undertake activity in product development, branding, and promotional campaigns, focusing on the health benefits and nutritional advantages of full-benefit foods. Globalization and cultural influences also impact market factors in the fortified foods segment.

Leave a Comment