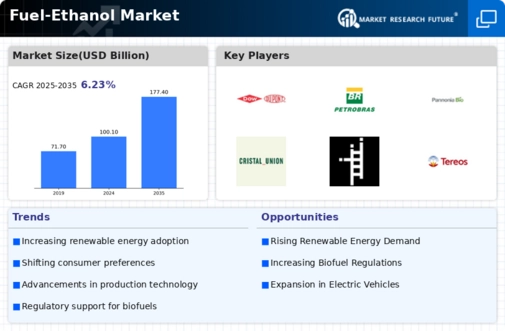

Market Analysis

In-depth Analysis of Fuel Ethanol Market Industry Landscape

The dynamics of the fuel-ethanol market are motivated by a myriad of factors that together form its boom, developments, and typical trajectory. Understanding those marketplace dynamics is crucial for enterprise participants, policymakers, and investors to navigate the complex landscape and capitalize on rising possibilities inside the renewable energy region. Crude oil fees have a direct effect on the dynamics of the fuel-ethanol market. In times of unstable oil prices, the financial feasibility of ethanol manufacturing and its competitiveness as an opportunity fuel may be prompted. Ethanol's attractiveness tends to increase while oil fees are high. Growing environmental issues and international climate trade dreams are using forces within the fuel-ethanol market dynamics. Ongoing technological advancements in ethanol production approaches significantly affect marketplace dynamics. Consumer calls for and cognizance play a crucial role in shaping the dynamics of the gasoline-ethanol market. Global exchange dynamics, consisting of price lists, trade agreements, and marketplace right of entry, affect the gas-ethanol market. Changes in global alternate rules can affect the go with the flow of ethanol among international locations, affecting marketplace balance and offering challenges or opportunities for enterprise contributors. The availability and fees of feedstocks used in ethanol production, such as corn, sugarcane, or cellulosic materials, without delay influence marketplace dynamics. Fluctuations in feedstock charges can affect manufacturing charges, affecting the monetary feasibility of ethanol production and influencing market traits. The improvement of infrastructure, including mixing centers and fueling stations, is a critical element in market dynamics. The availability of an efficient ethanol distribution infrastructure complements customers' entry to and usage of ethanol-mixed fuels, contributing to a market boom. The competitive panorama and marketplace proportion positioning strategies of enterprise gamers make contributions to market dynamics. Concerns about strength safety and the need for diversification inside the power mix are driving factors in market dynamics. Ethanol, as a renewable and regionally produced gasoline, aligns with desires to beautify, strengthen security, and reduce dependence on imported oil. The resilience of the supply chain and effective threat control strategies impact market dynamics. Public policy and legislative changes, consisting of new rules or amendments to current policies, could have a profound impact on marketplace dynamics.

Leave a Comment