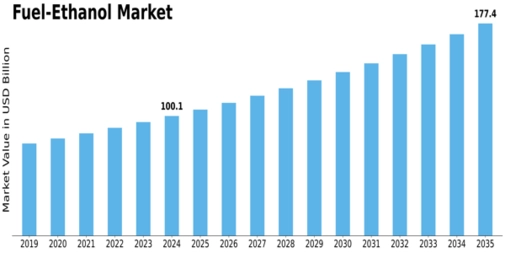

Fuel Ethanol Size

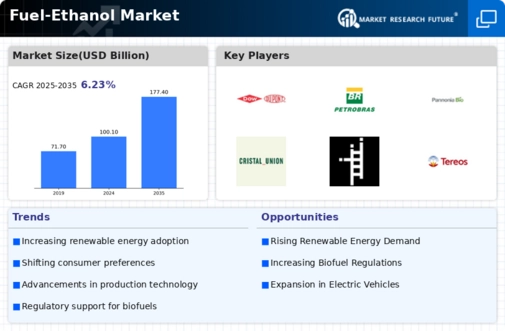

Fuel Ethanol Market Growth Projections and Opportunities

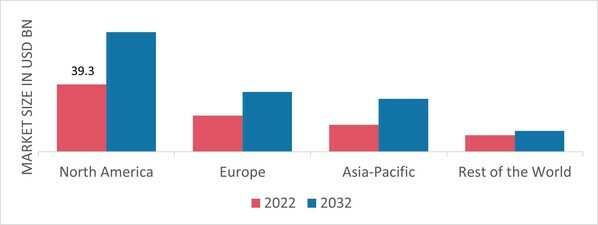

The Fuel-Ethanol Market is fashioned by means of a variety of factors that together impact its dynamics, increase, and usual trajectory. Understanding these market factors is crucial for enterprise participants, policymakers, and traders to navigate demanding situations and capitalize on opportunities within the evolving gasoline-ethanol panorama. Government rules and rules significantly affect the gasoline-ethanol market. Subsidies, mandates, and incentives for biofuel manufacturing and intake immediately impact the market's growth. Concerns about energy protection and the need for diversification inside the energy mix drive call for fuel-ethanol. Governments and industries are seeking options for conventional fossil fuels to decorate power protection, lessen dependence on imported oil, and mitigate environmental effects, fostering the growth of the gas-ethanol market. Crude oil costs play an enormous role within the gas-ethanol marketplace dynamics. In times of volatile oil costs, ethanol's competitiveness as a gas opportunity can be encouraged. Fluctuations in oil fees affect the economic feasibility and elegance of ethanol manufacturing and intake. Ongoing technological advancements in ethanol manufacturing approaches contribute to market factors. Innovations in feedstock usage, fermentation strategies, and production efficiency enhance the competitiveness of ethanol as a gas, making it more cost-effective and environmentally pleasant. Global alternate dynamics, together with tariffs, alternate agreements, and market entry to restrictions, influence the fuel-ethanol marketplace. Changes in international exchange regulations can affect the float of ethanol among nations, affecting market stability and offering challenges or possibilities for industry members. Consumer recognition and acceptance of ethanol as a fuel opportunity make contributions to market elements. Education campaigns, labeling practices, and public perception play a position in shaping customer selections, impacting the demand for ethanol-combined fuels and affecting marketplace dynamics. The availability of funding and funding for ethanol initiatives are vital factors influencing marketplace increase. The accessibility of capital for infrastructure improvement, research, and manufacturing facilities without delay affects the enterprise's potential to extend and meet growing calls. The availability and expenses of feedstocks utilized in ethanol manufacturing, inclusive of corn, sugarcane, or cellulosic substances, impact marketplace dynamics. Fluctuations in feedstock fees can affect production charges, affecting the monetary feasibility of ethanol manufacturing and influencing market trends. The gas-ethanol marketplace operates in the broader biofuels panorama. Competition with other biofuels, along with biodiesel or superior biofuels, affects market dynamics. The relative price-effectiveness, environmental blessings, and coverage assist distinct biofuels from their market proportion in the renewable power region.

Leave a Comment