-

MARKET FACTOR ANALYSIS

-

\r\n5.1. Value chain Analysis

-

\r\n5.2. Porter's Five Forces Analysis

-

\r\n5.2.1.

-

Bargaining Power of Suppliers

-

\r\n5.2.2.

-

Bargaining Power of Buyers

-

\r\n5.2.3. Threat

-

of New Entrants

-

\r\n5.2.4. Threat of Substitutes

-

\r\n5.2.5. Intensity of Rivalry

-

\r\n5.3. COVID-19 Impact Analysis

-

\r\n5.3.1.

-

Market Impact Analysis

-

\r\n5.3.2. Regional

-

Impact

-

\r\n5.3.3. Opportunity and Threat

-

Analysis

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

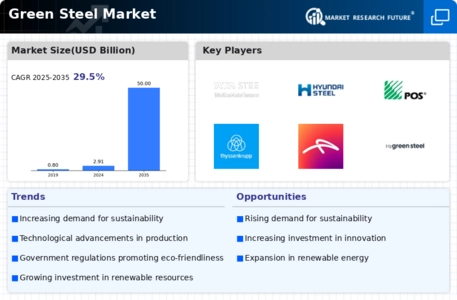

\r\n6. GREEN STEEL MARKET BY METHOD OF PRODUCTION (USD BILLION)

-

\r\n6.1. Hydrogen-Based Reduction

-

\r\n6.2.

-

Electrolysis

-

\r\n6.3. Biomass Direct Reduction

-

\r\n6.4. Recycling

-

\r\n7. GREEN

-

STEEL MARKET BY END USE INDUSTRY (USD BILLION)

-

\r\n7.1. Construction

-

\r\n7.2. Automotive

-

\r\n7.3. Manufacturing

-

\r\n7.4. Energy

-

\r\n8.

-

GREEN STEEL MARKET BY FORM (USD BILLION)

-

\r\n8.1. Flat Steel

-

\r\n8.2. Long Steel

-

\r\n8.3. Steel

-

Products

-

\r\n9. GREEN STEEL MARKET BY QUALITY

-

GRADE (USD BILLION)

-

\r\n9.1. High Strength Steel

-

\r\n9.2. Low Alloy Steel

-

\r\n9.3. Stainless

-

Steel

-

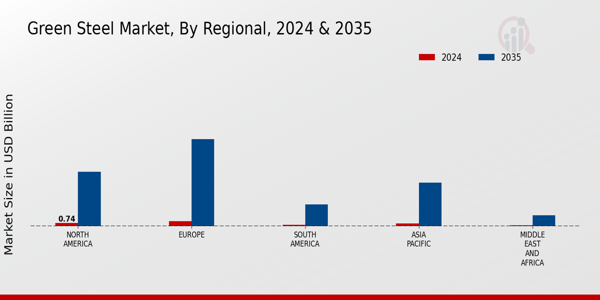

\r\n10. GREEN STEEL MARKET BY REGIONAL

-

(USD BILLION)

-

\r\n10.1. North America

-

\r\n10.1.1.

-

US

-

\r\n10.1.2. Canada

-

\r\n10.2. Europe

-

\r\n10.2.1. Germany

-

\r\n10.2.2. UK

-

\r\n10.2.3.

-

France

-

\r\n10.2.4. Russia

-

\r\n10.2.5. Italy

-

\r\n10.2.6.

-

Spain

-

\r\n10.2.7. Rest of Europe

-

\r\n10.3. APAC

-

\r\n10.3.1.

-

China

-

\r\n10.3.2. India

-

\r\n10.3.3. Japan

-

\r\n10.3.4.

-

South Korea

-

\r\n10.3.5. Malaysia

-

\r\n10.3.6. Thailand

-

\r\n10.3.7.

-

Indonesia

-

\r\n10.3.8. Rest of APAC

-

\r\n10.4. South America

-

\r\n10.4.1.

-

Brazil

-

\r\n10.4.2. Mexico

-

\r\n10.4.3. Argentina

-

\r\n10.4.4.

-

Rest of South America

-

\r\n10.5. MEA

-

\r\n10.5.1. GCC Countries

-

\r\n10.5.2.

-

South Africa

-

\r\n10.5.3. Rest of MEA

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n11. COMPETITIVE LANDSCAPE

-

\r\n11.1. Overview

-

\r\n11.2. Competitive Analysis

-

\r\n11.3.

-

Market share Analysis

-

\r\n11.4. Major Growth Strategy

-

in the Green Steel Market

-

\r\n11.5. Competitive Benchmarking

-

\r\n11.6. Leading Players in Terms of Number of Developments

-

in the Green Steel Market

-

\r\n11.7. Key developments and

-

growth strategies

-

\r\n11.7.1. New Product Launch/Service Deployment

-

\r\n11.7.2. Merger & Acquisitions

-

\r\n11.7.3. Joint Ventures

-

\r\n11.8. Major Players Financial Matrix

-

\r\n11.8.1.

-

Sales and Operating Income

-

\r\n11.8.2. Major

-

Players R&D Expenditure. 2023

-

\r\n12.

-

COMPANY PROFILES

-

\r\n12.1. Tata Steel

-

\r\n12.1.1.

-

Financial Overview

-

\r\n12.1.2. Products

-

Offered

-

\r\n12.1.3. Key Developments

-

\r\n12.1.4. SWOT Analysis

-

\r\n12.1.5. Key Strategies

-

\r\n12.2. Hyundai Steel

-

\r\n12.2.1. Financial Overview

-

\r\n12.2.2. Products Offered

-

\r\n12.2.3. Key Developments

-

\r\n12.2.4.

-

SWOT Analysis

-

\r\n12.2.5. Key Strategies

-

\r\n12.3. POSCO

-

\r\n12.3.1.

-

Financial Overview

-

\r\n12.3.2. Products

-

Offered

-

\r\n12.3.3. Key Developments

-

\r\n12.3.4. SWOT Analysis

-

\r\n12.3.5. Key Strategies

-

\r\n12.4. Thyssenkrupp

-

\r\n12.4.1. Financial Overview

-

\r\n12.4.2. Products Offered

-

\r\n12.4.3. Key Developments

-

\r\n12.4.4.

-

SWOT Analysis

-

\r\n12.4.5. Key Strategies

-

\r\n12.5. ArcelorMittal

-

\r\n12.5.1.

-

Financial Overview

-

\r\n12.5.2. Products

-

Offered

-

\r\n12.5.3. Key Developments

-

\r\n12.5.4. SWOT Analysis

-

\r\n12.5.5. Key Strategies

-

\r\n12.6. H2 Green Steel

-

\r\n12.6.1. Financial Overview

-

\r\n12.6.2. Products Offered

-

\r\n12.6.3. Key Developments

-

\r\n12.6.4.

-

SWOT Analysis

-

\r\n12.6.5. Key Strategies

-

\r\n12.7. Steel Dynamics

-

\r\n12.7.1.

-

Financial Overview

-

\r\n12.7.2. Products

-

Offered

-

\r\n12.7.3. Key Developments

-

\r\n12.7.4. SWOT Analysis

-

\r\n12.7.5. Key Strategies

-

\r\n12.8. Nucor

-

\r\n12.8.1. Financial Overview

-

\r\n12.8.2. Products Offered

-

\r\n12.8.3. Key Developments

-

\r\n12.8.4.

-

SWOT Analysis

-

\r\n12.8.5. Key Strategies

-

\r\n12.9. ClevelandCliffs

-

\r\n12.9.1.

-

Financial Overview

-

\r\n12.9.2. Products

-

Offered

-

\r\n12.9.3. Key Developments

-

\r\n12.9.4. SWOT Analysis

-

\r\n12.9.5. Key Strategies

-

\r\n12.10. SAIL

-

\r\n12.10.1. Financial Overview

-

\r\n12.10.2. Products Offered

-

\r\n12.10.3. Key Developments

-

\r\n12.10.4.

-

SWOT Analysis

-

\r\n12.10.5. Key Strategies

-

\r\n12.11. SSAB

-

\r\n12.11.1.

-

Financial Overview

-

\r\n12.11.2. Products

-

Offered

-

\r\n12.11.3. Key Developments

-

\r\n12.11.4. SWOT Analysis

-

\r\n12.11.5. Key Strategies

-

\r\n12.12. Voestalpine

-

\r\n12.12.1. Financial Overview

-

\r\n12.12.2. Products Offered

-

\r\n12.12.3. Key Developments

-

\r\n12.12.4.

-

SWOT Analysis

-

\r\n12.12.5. Key Strategies

-

\r\n12.13. John Wood Group

-

\r\n12.13.1.

-

Financial Overview

-

\r\n12.13.2. Products

-

Offered

-

\r\n12.13.3. Key Developments

-

\r\n12.13.4. SWOT Analysis

-

\r\n12.13.5. Key Strategies

-

\r\n12.14. United States Steel

-

\r\n12.14.1. Financial

-

Overview

-

\r\n12.14.2. Products Offered

-

\r\n12.14.3. Key Developments

-

\r\n12.14.4. SWOT Analysis

-

\r\n12.14.5.

-

Key Strategies

-

\r\n12.15. Sierra

-

Steel

-

\r\n12.15.1. Financial Overview

-

\r\n12.15.2. Products Offered

-

\r\n12.15.3.

-

Key Developments

-

\r\n12.15.4. SWOT Analysis

-

\r\n12.15.5. Key Strategies

-

\r\n13. APPENDIX

-

\r\n13.1.

-

References

-

\r\n13.2. Related Reports

-

\r\nLIST OF TABLES

-

\r\n

-

\r\n

-

TABLE 1.

-

LIST OF ASSUMPTIONS

-

\r\nTABLE 2. NORTH AMERICA GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 3. NORTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES &

-

FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

NORTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 5. NORTH AMERICA GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

NORTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 7. US GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

US GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 9. US GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 10.

-

US GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 11. US GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

CANADA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 13. CANADA GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 14. CANADA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 15. CANADA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 16. CANADA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 17. EUROPE GREEN

-

STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 18. EUROPE GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

EUROPE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 20. EUROPE GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

EUROPE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 22. GERMANY GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 23. GERMANY GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 24. GERMANY

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 25. GERMANY GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 26. GERMANY

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 27. UK GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY

-

METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 28. UK

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 29. UK GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 30.

-

UK GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 31. UK GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

FRANCE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 33. FRANCE GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 34. FRANCE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 35. FRANCE GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 36. FRANCE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 37. RUSSIA GREEN

-

STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 38. RUSSIA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

RUSSIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 40. RUSSIA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

RUSSIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 42. ITALY GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

ITALY GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 44. ITALY GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 45.

-

ITALY GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 46. ITALY GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SPAIN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 48. SPAIN GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 49. SPAIN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 50. SPAIN GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 51. SPAIN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 52. REST OF EUROPE

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 53. REST OF EUROPE GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 54. REST OF EUROPE GREEN STEEL MARKET SIZE ESTIMATES &

-

FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 55. REST

-

OF EUROPE GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 56. REST OF EUROPE GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

APAC GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 58. APAC GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 59. APAC GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 60. APAC GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 61. APAC GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 62. CHINA GREEN

-

STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 63. CHINA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

CHINA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 65. CHINA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

CHINA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 67. INDIA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

INDIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 69. INDIA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 70.

-

INDIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 71. INDIA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

JAPAN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 73. JAPAN GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 74. JAPAN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 75. JAPAN GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 76. JAPAN GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 77. SOUTH KOREA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 78. SOUTH KOREA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH KOREA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 80. SOUTH KOREA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH KOREA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 82. MALAYSIA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 83. MALAYSIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 84. MALAYSIA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 85. MALAYSIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 86. MALAYSIA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 87. THAILAND GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 88.

-

THAILAND GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 89. THAILAND GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

THAILAND GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 91. THAILAND GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

INDONESIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 93. INDONESIA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 94. INDONESIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 95. INDONESIA GREEN

-

STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 96. INDONESIA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 97. REST OF APAC

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 98. REST OF APAC GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 99. REST OF APAC GREEN STEEL MARKET SIZE ESTIMATES &

-

FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 100. REST

-

OF APAC GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 101. REST OF APAC GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF

-

PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 103. SOUTH AMERICA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 104. SOUTH AMERICA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE

-

\r\nTABLE 106. SOUTH AMERICA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 107. BRAZIL GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 108.

-

BRAZIL GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 109. BRAZIL GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

BRAZIL GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 111. BRAZIL GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

MEXICO GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 113. MEXICO GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 114. MEXICO GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 115. MEXICO GREEN

-

STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 116. MEXICO GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 117. ARGENTINA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 118. ARGENTINA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

ARGENTINA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 120. ARGENTINA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

ARGENTINA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 122. REST OF SOUTH AMERICA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 123. REST OF SOUTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES

-

& FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

REST OF SOUTH AMERICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY FORM

-

\r\nTABLE 125. REST OF SOUTH AMERICA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 126. REST OF SOUTH AMERICA GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

MEA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION

-

\r\nTABLE 128. MEA GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 129. MEA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 130. MEA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035 (USD BILLIONS)

-

\r\nTABLE 131. MEA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST

-

BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 132. GCC COUNTRIES

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF PRODUCTION 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 133. GCC COUNTRIES GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD BILLIONS)

-

\r\nTABLE 134. GCC COUNTRIES GREEN STEEL MARKET SIZE ESTIMATES &

-

FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE 135. GCC

-

COUNTRIES GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE 2019-2035

-

(USD BILLIONS)

-

\r\nTABLE 136. GCC COUNTRIES GREEN STEEL MARKET

-

SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH AFRICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY METHOD OF

-

PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE 138. SOUTH AFRICA

-

GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY 2019-2035 (USD

-

BILLIONS)

-

\r\nTABLE 139. SOUTH AFRICA GREEN STEEL MARKET SIZE

-

ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

SOUTH AFRICA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE

-

\r\nTABLE 141. SOUTH AFRICA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 142. REST OF MEA GREEN STEEL MARKET SIZE ESTIMATES &

-

FORECAST BY METHOD OF PRODUCTION 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

REST OF MEA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY END USE INDUSTRY

-

\r\nTABLE 144. REST OF MEA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY FORM 2019-2035 (USD BILLIONS)

-

\r\nTABLE

-

REST OF MEA GREEN STEEL MARKET SIZE ESTIMATES & FORECAST BY QUALITY GRADE

-

\r\nTABLE 146. REST OF MEA GREEN STEEL

-

MARKET SIZE ESTIMATES & FORECAST BY REGIONAL 2019-2035 (USD BILLIONS)

-

\r\nTABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

\r\nTABLE

-

ACQUISITION/PARTNERSHIP

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

LIST OF FIGURES

-

\r\n

-

\r\n

-

MARKET SYNOPSIS

-

\r\nFIGURE

-

NORTH AMERICA GREEN STEEL MARKET ANALYSIS

-

\r\nFIGURE 3. US GREEN

-

STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 4. US GREEN

-

STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 5. US GREEN STEEL

-

MARKET ANALYSIS BY FORM

-

\r\nFIGURE 6. US GREEN STEEL MARKET ANALYSIS

-

BY QUALITY GRADE

-

\r\nFIGURE 7. US GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

CANADA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

CANADA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

CANADA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 11. CANADA

-

GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 12. CANADA GREEN

-

STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 13. EUROPE GREEN STEEL

-

MARKET ANALYSIS

-

\r\nFIGURE 14. GERMANY GREEN STEEL MARKET ANALYSIS BY

-

METHOD OF PRODUCTION

-

\r\nFIGURE 15. GERMANY GREEN STEEL MARKET ANALYSIS

-

BY END USE INDUSTRY

-

\r\nFIGURE 16. GERMANY GREEN STEEL MARKET ANALYSIS

-

BY FORM

-

\r\nFIGURE 17. GERMANY GREEN STEEL MARKET ANALYSIS BY QUALITY

-

GRADE

-

\r\nFIGURE 18. GERMANY GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

UK GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

UK GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 21.

-

UK GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 22. UK GREEN STEEL

-

MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 23. UK GREEN STEEL MARKET

-

ANALYSIS BY REGIONAL

-

\r\nFIGURE 24. FRANCE GREEN STEEL MARKET ANALYSIS

-

BY METHOD OF PRODUCTION

-

\r\nFIGURE 25. FRANCE GREEN STEEL MARKET ANALYSIS

-

BY END USE INDUSTRY

-

\r\nFIGURE 26. FRANCE GREEN STEEL MARKET ANALYSIS

-

BY FORM

-

\r\nFIGURE 27. FRANCE GREEN STEEL MARKET ANALYSIS BY QUALITY

-

GRADE

-

\r\nFIGURE 28. FRANCE GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

RUSSIA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

RUSSIA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

RUSSIA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 32. RUSSIA

-

GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 33. RUSSIA GREEN

-

STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 34. ITALY GREEN STEEL MARKET

-

ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 35. ITALY GREEN STEEL MARKET

-

ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 36. ITALY GREEN STEEL MARKET

-

ANALYSIS BY FORM

-

\r\nFIGURE 37. ITALY GREEN STEEL MARKET ANALYSIS BY

-

QUALITY GRADE

-

\r\nFIGURE 38. ITALY GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

SPAIN GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

SPAIN GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

SPAIN GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 42. SPAIN GREEN

-

STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 43. SPAIN GREEN STEEL

-

MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 44. REST OF EUROPE GREEN STEEL

-

MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 45. REST OF EUROPE

-

GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 46. REST

-

OF EUROPE GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 47. REST OF

-

EUROPE GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 48. REST

-

OF EUROPE GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 49. APAC

-

GREEN STEEL MARKET ANALYSIS

-

\r\nFIGURE 50. CHINA GREEN STEEL MARKET

-

ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 51. CHINA GREEN STEEL MARKET

-

ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 52. CHINA GREEN STEEL MARKET

-

ANALYSIS BY FORM

-

\r\nFIGURE 53. CHINA GREEN STEEL MARKET ANALYSIS BY

-

QUALITY GRADE

-

\r\nFIGURE 54. CHINA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

INDIA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

INDIA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

INDIA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 58. INDIA GREEN

-

STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 59. INDIA GREEN STEEL

-

MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 60. JAPAN GREEN STEEL MARKET

-

ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 61. JAPAN GREEN STEEL MARKET

-

ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 62. JAPAN GREEN STEEL MARKET

-

ANALYSIS BY FORM

-

\r\nFIGURE 63. JAPAN GREEN STEEL MARKET ANALYSIS BY

-

QUALITY GRADE

-

\r\nFIGURE 64. JAPAN GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

SOUTH KOREA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

SOUTH KOREA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

SOUTH KOREA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 68. SOUTH

-

KOREA GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 69. SOUTH

-

KOREA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 70. MALAYSIA

-

GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 71. MALAYSIA

-

GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 72. MALAYSIA

-

GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 73. MALAYSIA GREEN STEEL

-

MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 74. MALAYSIA GREEN STEEL

-

MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 75. THAILAND GREEN STEEL MARKET

-

ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 76. THAILAND GREEN STEEL

-

MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 77. THAILAND GREEN STEEL

-

MARKET ANALYSIS BY FORM

-

\r\nFIGURE 78. THAILAND GREEN STEEL MARKET ANALYSIS

-

BY QUALITY GRADE

-

\r\nFIGURE 79. THAILAND GREEN STEEL MARKET ANALYSIS

-

BY REGIONAL

-

\r\nFIGURE 80. INDONESIA GREEN STEEL MARKET ANALYSIS BY

-

METHOD OF PRODUCTION

-

\r\nFIGURE 81. INDONESIA GREEN STEEL MARKET ANALYSIS

-

BY END USE INDUSTRY

-

\r\nFIGURE 82. INDONESIA GREEN STEEL MARKET ANALYSIS

-

BY FORM

-

\r\nFIGURE 83. INDONESIA GREEN STEEL MARKET ANALYSIS BY QUALITY

-

GRADE

-

\r\nFIGURE 84. INDONESIA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

REST OF APAC GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

REST OF APAC GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

REST OF APAC GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 88.

-

REST OF APAC GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE

-

REST OF APAC GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

SOUTH AMERICA GREEN STEEL MARKET ANALYSIS

-

\r\nFIGURE 91. BRAZIL

-

GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 92. BRAZIL

-

GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 93. BRAZIL

-

GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 94. BRAZIL GREEN STEEL

-

MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 95. BRAZIL GREEN STEEL MARKET

-

ANALYSIS BY REGIONAL

-

\r\nFIGURE 96. MEXICO GREEN STEEL MARKET ANALYSIS

-

BY METHOD OF PRODUCTION

-

\r\nFIGURE 97. MEXICO GREEN STEEL MARKET ANALYSIS

-

BY END USE INDUSTRY

-

\r\nFIGURE 98. MEXICO GREEN STEEL MARKET ANALYSIS

-

BY FORM

-

\r\nFIGURE 99. MEXICO GREEN STEEL MARKET ANALYSIS BY QUALITY

-

GRADE

-

\r\nFIGURE 100. MEXICO GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

ARGENTINA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

ARGENTINA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

ARGENTINA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 104. ARGENTINA

-

GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 105. ARGENTINA

-

GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 106. REST OF SOUTH

-

AMERICA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

REST OF SOUTH AMERICA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

REST OF SOUTH AMERICA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE

-

REST OF SOUTH AMERICA GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE

-

REST OF SOUTH AMERICA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

MEA GREEN STEEL MARKET ANALYSIS

-

\r\nFIGURE 112. GCC COUNTRIES GREEN

-

STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 113. GCC COUNTRIES

-

GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE 114. GCC

-

COUNTRIES GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 115. GCC COUNTRIES

-

GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE 116. GCC COUNTRIES

-

GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE 117. SOUTH AFRICA

-

GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE 118.

-

SOUTH AFRICA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

SOUTH AFRICA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 120.

-

SOUTH AFRICA GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE

-

SOUTH AFRICA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

REST OF MEA GREEN STEEL MARKET ANALYSIS BY METHOD OF PRODUCTION

-

\r\nFIGURE

-

REST OF MEA GREEN STEEL MARKET ANALYSIS BY END USE INDUSTRY

-

\r\nFIGURE

-

REST OF MEA GREEN STEEL MARKET ANALYSIS BY FORM

-

\r\nFIGURE 125.

-

REST OF MEA GREEN STEEL MARKET ANALYSIS BY QUALITY GRADE

-

\r\nFIGURE

-

REST OF MEA GREEN STEEL MARKET ANALYSIS BY REGIONAL

-

\r\nFIGURE

-

KEY BUYING CRITERIA OF GREEN STEEL MARKET

-

\r\nFIGURE 128. RESEARCH

-

PROCESS OF MRFR

-

\r\nFIGURE 129. DRO ANALYSIS OF GREEN STEEL MARKET

-

\r\nFIGURE

-

DRIVERS IMPACT ANALYSIS GREEN STEEL MARKET

-

\r\nFIGURE 131. RESTRAINTS

-

IMPACT ANALYSIS GREEN STEEL MARKET

-

\r\nFIGURE 132. SUPPLY / VALUE CHAIN

-

GREEN STEEL MARKET

-

\r\nFIGURE 133. GREEN STEEL MARKET BY METHOD OF PRODUCTION

-

\r\nFIGURE 134. GREEN STEEL BY METHOD OF PRODUCTION 2019

-

TO 2035 (USD Billions)

-

\r\nFIGURE 135. GREEN STEEL BY END USE INDUSTRY

-

\r\nFIGURE 136. GREEN STEEL BY END USE INDUSTRY 2019

-

TO 2035 (USD Billions)

-

\r\nFIGURE 137. GREEN STEEL BY FORM 2025 (% SHARE)

-

\r\nFIGURE

-

GREEN STEEL BY FORM 2019 TO 2035 (USD Billions)

-

\r\nFIGURE 139.

-

GREEN STEEL BY QUALITY GRADE 2025 (% SHARE)

-

\r\nFIGURE 140. GREEN STEEL

-

BY QUALITY GRADE 2019 TO 2035 (USD Billions)

-

\r\nFIGURE 141. GREEN STEEL

-

BY REGIONAL 2025 (% SHARE)

-

\r\nFIGURE 142. GREEN STEEL BY REGIONAL 2019

-

TO 2035 (USD Billions)

-

\r\nFIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

-

\r\n

Leave a Comment