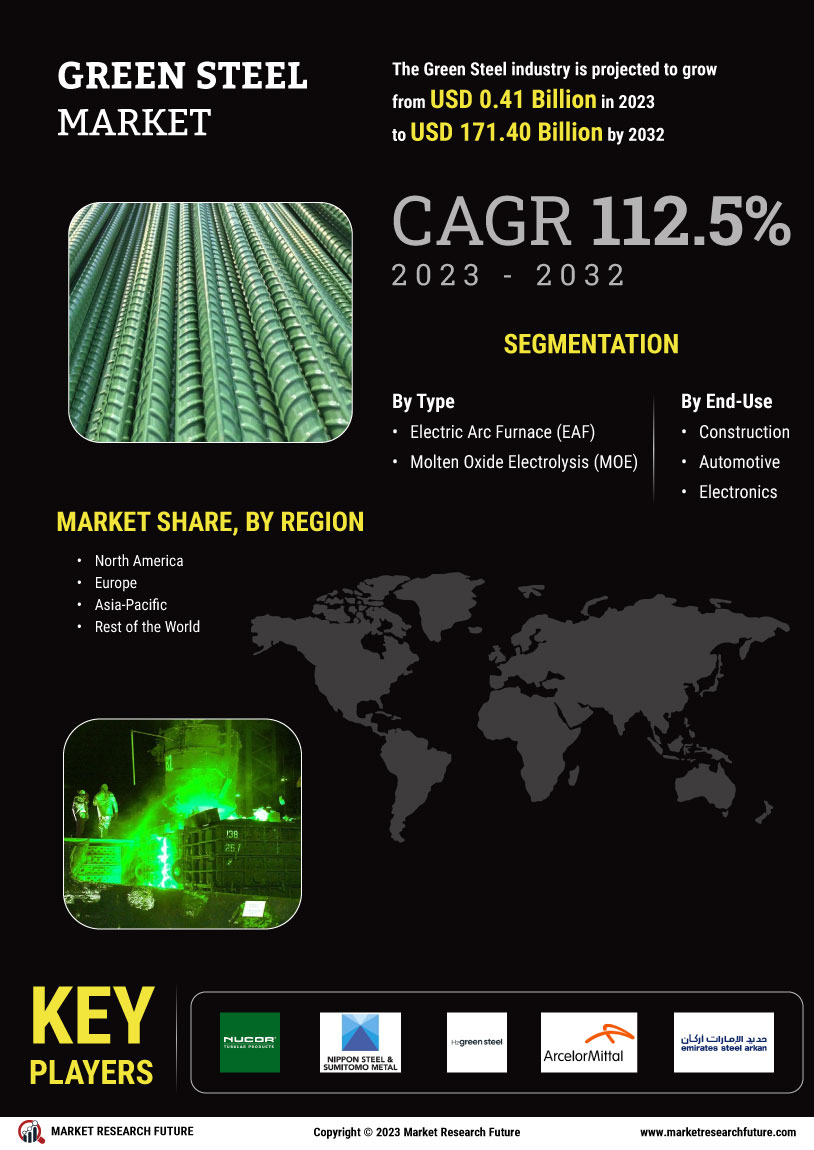

Market Growth Projections

The Global Green Steel Market Industry is projected to experience remarkable growth, with estimates suggesting a market value of 50 USD Billion by 2035. This anticipated expansion is driven by various factors, including rising demand for sustainable products, government regulations, and technological advancements. The industry is expected to witness a compound annual growth rate of 29.5% from 2025 to 2035, indicating a robust trajectory. As stakeholders increasingly recognize the importance of sustainable practices, the green steel sector is likely to play a crucial role in the global transition towards a low-carbon economy.

Government Regulations and Incentives

Government regulations play a pivotal role in shaping the Global Green Steel Market Industry. Many countries are implementing stringent emissions standards and offering incentives for companies that adopt greener practices. For instance, initiatives aimed at reducing carbon emissions are encouraging steel manufacturers to invest in green technologies. Such policies not only promote the use of green steel but also create a competitive advantage for compliant firms. As the regulatory landscape evolves, it is likely that the market will expand, with projections indicating a growth trajectory that could reach 50 USD Billion by 2035. This regulatory push underscores the importance of aligning with environmental goals.

Investment in Renewable Energy Sources

Investment in renewable energy sources is becoming increasingly critical for the Global Green Steel Market Industry. The integration of renewable energy into steel production processes can drastically lower carbon emissions, making green steel more competitive. As companies seek to transition away from fossil fuels, the reliance on solar, wind, and hydropower is expected to rise. This shift not only supports sustainability goals but also aligns with global energy trends. The growing emphasis on renewable energy solutions indicates a promising future for the green steel sector, as it positions itself as a key player in the broader transition to a low-carbon economy.

Rising Demand for Sustainable Products

The Global Green Steel Market Industry experiences a notable surge in demand for sustainable products as consumers and industries increasingly prioritize environmental responsibility. This shift is reflected in the growing adoption of green steel, which is produced with significantly lower carbon emissions compared to traditional methods. As of 2024, the market is valued at approximately 2.91 USD Billion, indicating a robust interest in eco-friendly alternatives. Industries such as automotive and construction are leading the charge, seeking to reduce their carbon footprints. This trend suggests that the Global Green Steel Market Industry is poised for substantial growth as sustainability becomes a core value across sectors.

Technological Advancements in Steel Production

Technological advancements are transforming the Global Green Steel Market Industry, enabling more efficient and sustainable production methods. Innovations such as hydrogen-based direct reduction processes and electric arc furnaces are gaining traction, significantly reducing the carbon intensity of steel production. These technologies not only enhance productivity but also align with global sustainability goals. As manufacturers adopt these cutting-edge techniques, the market is expected to witness a compound annual growth rate of 29.5% from 2025 to 2035. This rapid technological evolution indicates a shift towards a more sustainable steel industry, positioning green steel as a viable alternative in the global market.

Consumer Awareness and Corporate Responsibility

Consumer awareness regarding environmental issues is driving the Global Green Steel Market Industry towards more sustainable practices. As consumers become more informed about the impacts of their purchasing decisions, they increasingly favor products made from green steel. This shift is prompting companies to adopt corporate responsibility initiatives that prioritize sustainability in their supply chains. The growing demand for transparency and eco-friendly products is likely to influence manufacturers to invest in green steel technologies. As a result, the market is expected to expand significantly, reflecting a broader societal shift towards sustainability and responsible consumption.