Global Supply Chain Resilience

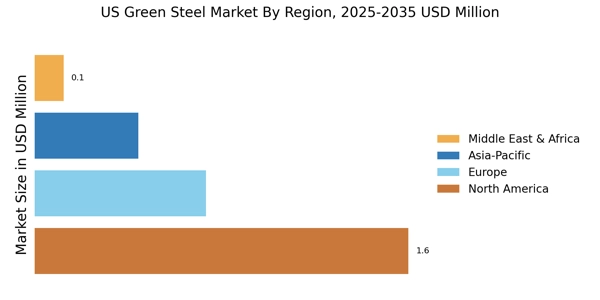

The US Green Steel Market is also affected by the need for global supply chain resilience. Recent disruptions have highlighted vulnerabilities in traditional supply chains, prompting manufacturers to seek more sustainable and reliable sources of raw materials. This shift is leading to an increased focus on local sourcing and the development of circular economy practices. By utilizing recycled materials and reducing dependency on imported steel, the industry can enhance its sustainability profile. This trend not only supports the growth of the US Green Steel Market but also aligns with broader efforts to create a more resilient and sustainable economy.

Government Regulations and Policies

The US Green Steel Market is significantly influenced by government regulations and policies aimed at reducing carbon emissions. Legislative measures, such as the Clean Air Act and various state-level initiatives, are pushing steel manufacturers to adopt greener practices. The Biden administration's commitment to achieving net-zero emissions by 2050 further underscores the urgency for the industry to transition towards sustainable practices. Financial incentives, such as tax credits for low-carbon steel production, are also being introduced to encourage investment in green technologies. This regulatory environment is likely to accelerate the shift towards greener steel production methods.

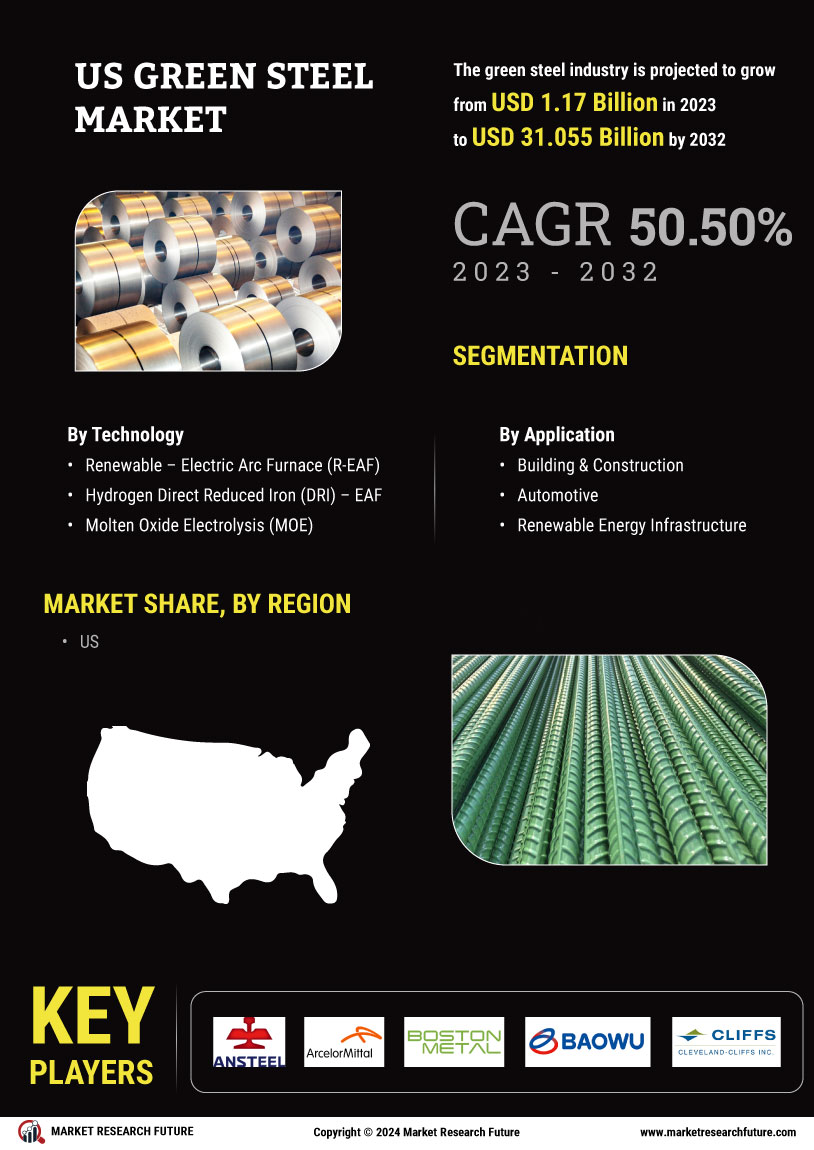

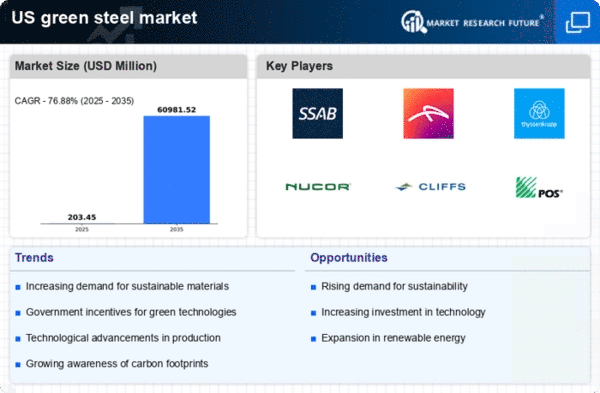

Technological Innovations in Steel Production

The US Green Steel Market is experiencing a surge in technological innovations that enhance the efficiency and sustainability of steel production. Advanced methods such as electric arc furnaces and hydrogen-based reduction processes are gaining traction. These technologies not only reduce carbon emissions but also improve energy efficiency. For instance, the adoption of electric arc furnaces can lead to a reduction of up to 75% in greenhouse gas emissions compared to traditional blast furnaces. As these technologies become more mainstream, they are likely to reshape the competitive landscape of the US Green Steel Market, making it more attractive for investors and manufacturers alike.

Consumer Preferences for Eco-Friendly Products

The US Green Steel Market is witnessing a shift in consumer preferences towards eco-friendly products. As awareness of climate change and environmental issues grows, consumers are increasingly demanding sustainable options in various sectors, including construction and automotive. This trend is compelling manufacturers to source green steel, which is produced with lower carbon footprints. Market Research Future indicates that nearly 70% of consumers are willing to pay a premium for products made from sustainable materials. This consumer behavior is likely to drive the demand for green steel, thereby influencing the dynamics of the US Green Steel Market.

Increasing Investment in Sustainable Infrastructure

The US Green Steel Market is poised for growth due to increasing investments in sustainable infrastructure. The Biden administration's infrastructure plan allocates substantial funding for green projects, which includes the use of green steel in construction and manufacturing. This investment is expected to create a robust demand for low-carbon steel products, as stakeholders seek to meet sustainability goals. According to estimates, the demand for green steel could reach 20 million tons by 2030, driven by infrastructure projects that prioritize environmentally friendly materials. This trend indicates a promising future for the US Green Steel Market.