Market Analysis

In-depth Analysis of Healthcare Regulatory Affairs Outsourcing Market Industry Landscape

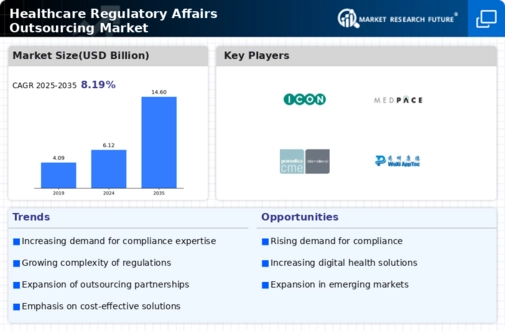

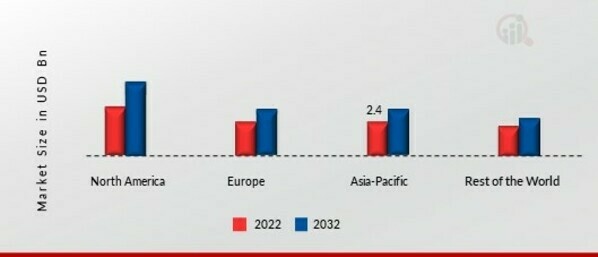

The regulatory affairs outsourcing healthcare market shows a shifting environment caused by several factors that are now shaping its growth and evolution. Social Affairs forms a fundamental pillar of the healthcare sector, guiding the intricate process of legislation, optimizing for compliance, and fast tracking approvals. As a consequence of this the regulatory affairs talent being more and more specialized as well as the product portfolio rising, the most in demand services in outsourcing field are now connected with regulatory affairs. Healthcare companies nowadays have been relying more and more on outsourcing partners to handle global regulatory issues and thereby enable them create their own products within a short span of time.

The rapid evolution and the bulk of the healthcare sector through the technological advancements worldwide is among the major factors strongly affect the healthcare regulatory affairs outsourcing market dynamics. Through digitization of process of regulation, through implementation of e-submission system and through applying modern analytics, businesses regulation is creating efficiencies. These systems enhance functioning not only at the level of forming a more coordinated response of the companies but also of the government of the country to the challenges which they might face.

The situation and factors are more complicated which require guidance from specialized expertise and the increase in cost of keeping in-house regulatory affairs unit. With the regulation framework itself changing all the time, there is a need for a good understanding of the regulatory customs nationally and internationally. This is why companies must be able to use their specific knowledge. Outsourcing to regulatory affairs functions could be selling clients the competencies of regulatory experts without having to hire and train all the staff internally. On the other side, the high costs of these processes as a consequence of salaries and need for constant training, the trend toward outsourcing, especially among the small and mid-sized companies, gets intensified.

Some of the problems within market dynamic are such as security of data, content and possible bottlenecks within regulatory processes. Outsourcing partners hold the responsibility of handling regulatory data inputs from companies, such measure becomes important in giving data security. Partners must ensure quality control and ability to follow timelines for outsourcing processes that is vital to build trust. First of all, the regime of success for outsourcing also will depend on effective communication and team work among companies and their regulatory affairs outsourcing partners who will work together to avoid delays that can accompany this kind of activities.

Generally, regulatory issues substantially shape health market operation for Healthcare Regulatory Affairs Outsourcing (HRAO). Strict rules and regulations are put in place for the constitution of regulatory functions by outsourcing and data protection regulations too has to be put in place. Customerships must have precise requirements that their outsourcing partners to fulfill by showcasing commitment to this if only the collaboration is going to be seamless. Besides, being ethical and adhering to regulations is imperative to develop trust.

Leave a Comment