-

EXECUTIVE SUMMARY 14

-

MARKET ATTRACTIVENESS

- GLOBAL HIGH PRESSURE SEALS MARKET, BY MATERIAL 17

-

ANALYSIS 16

-

1.1.2

-

GLOBAL HIGH PRESSURE SEALS MARKET, BY APPLICATION 18

-

GLOBAL HIGH PRESSURE

-

SEALS MARKET, BY END-USE INDUSTRY 19

-

MARKET INTRODUCTION 20

-

DEFINITION

-

20

-

SCOPE OF THE STUDY 20

-

MARKET STRUCTURE 20

-

RESEARCH METHODOLOGY

-

21

-

RESEARCH PROCESS 21

-

PRIMARY RESEARCH 22

-

SECONDARY

-

RESEARCH 23

-

MARKET SIZE ESTIMATION 23

-

TOP DOWN & BOTTOM UP

-

APPROACH 24

-

FORECAST MODEL 25

-

LIST OF ASSUMPTIONS 26

-

MARKET

-

DYNAMICS 27

-

INTRODUCTION 27

-

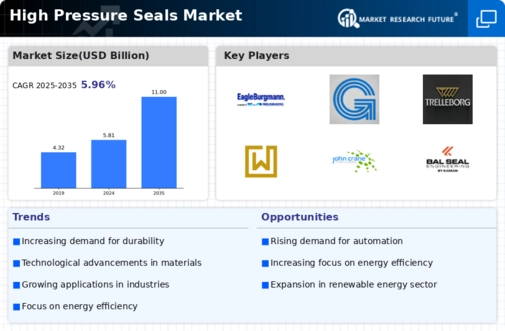

DRIVERS 28

- ROBUST GROWTH

- EXPANDING AEROSPACE & DEFENSE INDUSTRY

- DRIVERS IMPACT ANALYSIS 29

-

IN OIL & GAS INDUSTRY 28

-

28

-

RESTRAINTS 30

- GROWING

- RESTRAINTS IMPACT ANALYSIS 30

-

USE OF SEALLESS PUMPS 30

-

OPPORTUNITIES

- RISING INDUSTRIALIZATION IN THE ASIA-PACIFIC REGION 31

-

31

-

CHALLENGES

- VOLATILE OIL & GAS PRICES 31

- DETERIORATION IN RUBBER

-

31

-

OR ELASTOMER-BASED SEALS 32

-

TRENDS 32

- GROWING PREFERENCE OF

- NEW PRODUCT DEVELOPMENTS 33

-

PTFE MATERIAL IN HIGH PRESSURE SEALS 32

-

MARKET FACTOR ANALYSIS 34

-

SUPPLY/VALUE CHAIN ANALYSIS 34

- HIGH PRESSURE SEAL MANUFACTURERS 35

- CUSTOMERS (END USERS) 35

-

5.1.1

-

RAW MATERIAL SUPPLIERS 34

-

5.1.3

-

PRODUCT DISTRIBUTORS 35

-

PORTER’S

- THREAT OF NEW ENTRANTS 36

- BARGAINING

- BARGAINING POWER OF BUYERS 37

- THREAT

- INTENSITY OF RIVALRY 37

-

FIVE FORCES MODEL 36

-

POWER OF SUPPLIERS 36

-

OF SUBSTITUTES 37

-

GLOBAL HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL 38

-

OVERVIEW 38

- GLOBAL HIGH PRESSURE

-

SEALS MARKET ESTIMATES & FORECAST BY MATERIAL, 2023-2032 (USD MILLION) 39

-

ELASTOMERS 40

- ELASTOMERS: HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST BY REGION, 2023-2032 40

-

METALS 41

- METALS: HIGH

- PTFE: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY

-

PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 41

-

6.4

-

PTFE 42

-

REGION, 2023-2032 42

-

RUBBER-METAL COMBINATION 43

- RUBBER-METAL

-

COMBINATION: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST

-

BY REGION,

-

OTHERS 43

- OTHERS: HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST BY REGION, 2023-2032 43

-

GLOBAL HIGH PRESSURE SEALS MARKET,

-

APPLICATION 44

-

OVERVIEW 44

- GLOBAL HIGH PRESSURE SEALS MARKET

-

ESTIMATES & FORECAST APPLICATION, 2023-2032 (USD MILLION) 45

-

PUMPS

- PUMPS: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION,

-

46

-

VALVES 47

- VALVES: HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST BY REGION, 2023-2032 47

-

COMPRESSORS 48

- COMPRESSORS:

- PIPES: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 48

-

7.5

-

PIPES 49

-

REGION, 2023-2032 49

-

DUCTS 50

- DUCTS: HIGH PRESSURE SEALS MARKET

-

ESTIMATES & FORECAST BY REGION, 2023-2032 50

-

OTHERS 50

- OTHERS:

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 50

-

8

-

GLOBAL HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY 51

-

OVERVIEW 51

- GLOBAL HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY END-USE INDUSTRY,

-

OIL & GAS 53

- OIL & GAS:

- AEROSPACE & DEFENSE: HIGH PRESSURE SEALS

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 53

-

8.3

-

AEROSPACE & DEFENSE 54

-

MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 54

-

POWER GENERATION

- POWER GENERATION: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST

-

55

-

BY REGION, 2023-2032 55

-

CHEMICAL 56

- CHEMICAL: HIGH PRESSURE

-

SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 56

-

AUTOMOTIVE

- AUTOMOTIVE: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST BY

-

57

-

REGION, 2023-2032 57

-

PHARMACEUTICAL 58

- PHARMACEUTICAL: HIGH

- OTHERS: HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST

-

PRESSURE SEALS MARKET ESTIMATES & FORECAST BY REGION, 2023-2032 58

-

8.8

-

OTHERS 59

-

BY REGION, 2023-2032 59

-

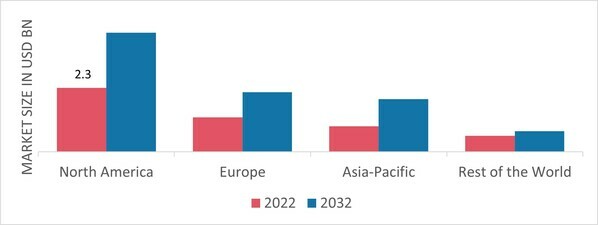

GLOBAL HIGH PRESSURE SEALS MARKET, BY REGION 60

-

OVERVIEW 60

-

NORTH AMERICA 62

- U.S. 64

- CANADA

-

65

-

EUROPE 66

- FRANCE 69

- GERMANY 70

- UK 71

- SPAIN 72

- ITALY 73

- POLAND 74

- RUSSIA 75

- REST OF EUROPE 76

-

-

ASIA PACIFIC 77

- CHINA

- JAPAN 80

- INDIA 81

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC 83

-

79

-

82

-

LATIN AMERICA 85

- BRAZIL

- ARGENTINA 88

- MEXICO 89

- REST OF LATIN AMERICA

-

87

-

90

-

MIDDLE EAST & AFRICA 91

- GCC 93

- ISRAEL 94

- SOUTH AFRICA 95

- NORTH AFRICA 96

- REST OF MIDDLE EAST

-

& AFRICA 97

-

COMPETITIVE LANDSCAPE 99

-

INTRODUCTION 99

-

10.2

-

MARKET STRATEGY 99

-

KEY DEVELOPMENT ANALYSIS 100

-

COMPANY PROFILES

-

101

-

EAGLEBURGMANN 101

- COMPANY OVERVIEW 101

- FINANCIAL

- PRODUCTS OFFERINGS 101

- KEY DEVELOPMENTS 101

- SWOT ANALYSIS 102

- KEY STRATEGIES 102

-

OVERVIEW 101

-

GALLAGHER SEALS

- COMPANY OVERVIEW 103

- FINANCIAL OVERVIEW 103

- KEY DEVELOPMENTS 104

- SWOT ANALYSIS

- KEY STRATEGIES 105

-

103

-

11.2.3

-

PRODUCTS OFFERINGS 103

-

104

-

-

PERFORMANCE SEALING INC

- COMPANY OVERVIEW 106

- FINANCIAL OVERVIEW 106

- KEY DEVELOPMENTS 107

- SWOT ANALYSIS

- KEY STRATEGIES 108

-

106

-

11.3.3

-

PRODUCTS OFFERINGS 106

-

108

-

FTL 109

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW 109

- PRODUCTS OFFERINGS 109

- SWOT ANALYSIS 111

- KEY STRATEGIES 111

-

109

-

11.4.4

-

KEY DEVELOPMENTS 110

-

TRELLEBORG GROUP 112

- COMPANY OVERVIEW 112

- FINANCIAL

- PRODUCTS OFFERINGS 113

- KEY DEVELOPMENTS 113

- SWOT ANALYSIS 114

- KEY STRATEGIES 114

-

OVERVIEW 112

-

JAMES WALKER

- COMPANY OVERVIEW 115

- FINANCIAL OVERVIEW 115

- KEY DEVELOPMENTS 115

- SWOT ANALYSIS

- KEY STRATEGIES 116

-

115

-

11.6.3

-

PRODUCTS OFFERINGS 115

-

116

-

JOHN CRANE 117

- COMPANY

- FINANCIAL OVERVIEW 117

- PRODUCTS OFFERINGS 117

- KEY DEVELOPMENTS 118

- SWOT ANALYSIS 119

- KEY STRATEGIES

-

OVERVIEW 117

-

119

-

KALSI ENGINEERING, INC. 120

- COMPANY OVERVIEW 120

- PRODUCTS OFFERINGS 120

- KEY DEVELOPMENTS

- SWOT ANALYSIS 122

- KEY STRATEGIES 122

-

11.8.2

-

FINANCIAL OVERVIEW 120

-

121

-

PARKER

- COMPANY OVERVIEW 123

- FINANCIAL OVERVIEW

- PRODUCTS OFFERINGS 124

- KEY DEVELOPMENTS 124

- KEY STRATEGIES 125

-

HANNIFIN CORP 123

-

123

-

11.9.5

-

SWOT ANALYSIS 125

-

FLOWSERVE CORPORATION

- COMPANY OVERVIEW 126

- FINANCIAL OVERVIEW 126

- KEY DEVELOPMENTS 127

- SWOT ANALYSIS

- KEY STRATEGIES 128

-

126

-

11.10.3

-

PRODUCTS OFFERINGS 127

-

128

-

F.LLI PARIS S.R.L. A SOCIO UNICO

- COMPANY OVERVIEW 129

- FINANCIAL OVERVIEW 129

- KEY DEVELOPMENTS 130

- SWOT ANALYSIS

- KEY STRATEGIES 131

-

129

-

11.11.3

-

PRODUCTS OFFERINGS 129

-

131

-

BAL SEAL ENGINEERING 132

- FINANCIAL OVERVIEW 132

- PRODUCTS OFFERINGS

- KEY DEVELOPMENTS 132

- SWOT ANALYSIS 133

-

11.12.1

-

COMPANY OVERVIEW 132

-

132

-

11.12.6

-

KEY STRATEGIES 133

-

APPENDIX 134

-

REFERENCES 134

-

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS 26

-

GLOBAL

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY MATERIAL, 2023-2032 (USD

-

MILLION) 39

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY

-

REGION, 2023-2032 (USD MILLION) 40

-

HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST, BY REGION, 2023-2032 (USD MILLION) 41

-

HIGH PRESSURE

-

SEALS MARKET ESTIMATES & FORECAST, BY REGION, 2023-2032 (USD MILLION) 42

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY REGION, 2023-2032

-

(USD MILLION) 43

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST,

-

BY REGION, 2023-2032 (USD MILLION) 43

-

GLOBAL HIGH PRESSURE SEALS MARKET

-

ESTIMATES & FORECAST, APPLICATION, 2023-2032 (USD MILLION) 45

-

HIGH

-

PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY PUMPS, BY REGION, 2023-2032 (USD

-

MILLION) 46

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY

-

VALVES, BY REGION, 2023-2032 (USD MILLION) 47

-

HIGH PRESSURE SEALS

-

MARKET ESTIMATES & FORECAST, BY COMPRESSORS, BY REGION, 2023-2032 (USD MILLION)

-

48

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY PIPES,

-

BY REGION, 2023-2032 (USD MILLION) 49

-

HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST, BY DUCTS, BY REGION, 2023-2032 (USD MILLION) 50

-

HIGH

-

PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY OTHERS, BY REGION, 2023-2032

-

(USD MILLION) 50

-

GLOBAL HIGH PRESSURE SEALS MARKET ESTIMATES &

-

FORECAST, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 52

-

HIGH PRESSURE

-

SEALS MARKET ESTIMATES & FORECAST, BY OIL & GAS, BY REGION, 2023-2032 (USD

-

MILLION) 53

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY

-

AEROSPACE & DEFENSE, BY REGION, 2023-2032 (USD MILLION) 54

-

HIGH

-

PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY HCV, BY REGION, 2023-2032 (USD

-

MILLION) 55

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY

-

CHEMICAL, BY REGION, 2023-2032 (USD MILLION) 56

-

HIGH PRESSURE SEALS

-

MARKET ESTIMATES & FORECAST, BY AUTOMOTIVE, BY REGION, 2023-2032 (USD MILLION)

-

57

-

HIGH PRESSURE SEALS MARKET ESTIMATES & FORECAST, BY PHARMACEUTICAL,

-

BY REGION, 2023-2032 (USD MILLION) 58

-

HIGH PRESSURE SEALS MARKET ESTIMATES

-

& FORECAST, BY OTHERS, BY REGION, 2023-2032 (USD MILLION) 59

-

GLOBAL

-

HIGH PRESSURE SEALS MARKET, BY REGION, 2023-2032 (USD MILLION) 61

-

TABLE 24

-

NORTH AMERICA: HIGH PRESSURE SEALS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 62

-

NORTH AMERICA: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD

-

MILLION) 63

-

NORTH AMERICA: HIGH PRESSURE SEALS MARKET, APPLICATION,

-

NORTH AMERICA: HIGH PRESSURE SEALS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 63

-

U.S.: HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 64

-

U.S.: HIGH PRESSURE

-

SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 64

-

U.S.: HIGH PRESSURE

-

SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 64

-

CANADA:

-

HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 65

-

TABLE 32

-

CANADA: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 65

-

TABLE

-

CANADA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

65

-

EUROPE: HIGH PRESSURE SEALS MARKET, BY COUNTRY, 2023-2032 (USD

-

MILLION) 67

-

EUROPE: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 67

-

EUROPE: HIGH PRESSURE SEALS MARKET, APPLICATION,

-

EUROPE: HIGH PRESSURE SEALS MARKET, BY

-

END-USE INDUSTRY, 2023-2032 (USD MILLION) 68

-

FRANCE: HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 69

-

FRANCE: HIGH

-

PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 69

-

FRANCE:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 69

-

TABLE

-

GERMANY: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 70

-

GERMANY: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION)

-

70

-

GERMANY: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 70

-

UK: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 71

-

UK: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032

-

(USD MILLION) 71

-

UK: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

SPAIN: HIGH PRESSURE SEALS MARKET, BY MATERIAL,

-

SPAIN: HIGH PRESSURE SEALS MARKET, APPLICATION,

-

SPAIN: HIGH PRESSURE SEALS MARKET, BY END-USE

-

INDUSTRY, 2023-2032 (USD MILLION) 72

-

ITALY: HIGH PRESSURE SEALS MARKET,

-

BY MATERIAL, 2023-2032 (USD MILLION) 73

-

ITALY: HIGH PRESSURE SEALS

-

MARKET, APPLICATION, 2023-2032 (USD MILLION) 73

-

ITALY: HIGH PRESSURE

-

SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 73

-

POLAND:

-

HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 74

-

TABLE 54

-

POLAND: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 74

-

TABLE

-

POLAND: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

74

-

RUSSIA: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD

-

MILLION) 75

-

RUSSIA: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032

-

(USD MILLION) 75

-

RUSSIA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

REST OF EUROPE: HIGH PRESSURE SEALS MARKET,

-

BY MATERIAL, 2023-2032 (USD MILLION) 76

-

REST OF EUROPE: HIGH PRESSURE

-

SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 76

-

REST OF EUROPE:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 76

-

TABLE

-

ASIA PACIFIC: HIGH PRESSURE SEALS MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

-

77

-

ASIA PACIFIC: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 78

-

ASIA PACIFIC: HIGH PRESSURE SEALS MARKET, APPLICATION,

-

ASIA PACIFIC: HIGH PRESSURE SEALS MARKET,

-

BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 78

-

CHINA: HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 79

-

CHINA: HIGH

-

PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 79

-

CHINA:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 79

-

TABLE

-

JAPAN: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 80

-

JAPAN: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION)

-

80

-

JAPAN: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 80

-

INDIA: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 81

-

INDIA: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032

-

(USD MILLION) 81

-

INDIA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

AUSTRALIA & NEW ZEALAND: HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 82

-

AUSTRALIA &

-

NEW ZEALAND: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 82

-

AUSTRALIA & NEW ZEALAND: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

REST OF ASIA-PACIFIC: HIGH PRESSURE SEALS

-

MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 83

-

REST OF ASIA-PACIFIC:

-

HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 83

-

TABLE 80

-

REST OF ASIA-PACIFIC: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 84

-

LATIN AMERICA: HIGH PRESSURE SEALS MARKET, BY COUNTRY,

-

LATIN AMERICA: HIGH PRESSURE SEALS MARKET,

-

BY MATERIAL, 2023-2032 (USD MILLION) 86

-

LATIN AMERICA: HIGH PRESSURE

-

SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 86

-

LATIN AMERICA:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 86

-

TABLE

-

BRAZIL: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 87

-

BRAZIL: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION)

-

87

-

BRAZIL: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 87

-

ARGENTINA: HIGH PRESSURE SEALS MARKET, BY MATERIAL,

-

ARGENTINA: HIGH PRESSURE SEALS MARKET,

-

APPLICATION, 2023-2032 (USD MILLION) 88

-

ARGENTINA: HIGH PRESSURE SEALS

-

MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 88

-

MEXICO: HIGH

-

PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 89

-

MEXICO:

-

HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 89

-

TABLE 93

-

MEXICO: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

89

-

REST OF LATIN AMERICA: HIGH PRESSURE SEALS MARKET, BY MATERIAL,

-

REST OF LATIN AMERICA: HIGH PRESSURE SEALS

-

MARKET, APPLICATION, 2023-2032 (USD MILLION) 90

-

REST OF LATIN AMERICA:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 90

-

TABLE

-

MIDDLE EAST & AFRICA: HIGH PRESSURE SEALS MARKET, BY COUNTRY, 2023-2032 (USD

-

MILLION) 91

-

MIDDLE EAST & AFRICA: HIGH PRESSURE SEALS MARKET,

-

BY MATERIAL, 2023-2032 (USD MILLION) 92

-

MIDDLE EAST & AFRICA:

-

HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 92

-

TABLE 100

-

MIDDLE EAST & AFRICA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 92

-

GCC: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 93

-

GCC: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032

-

(USD MILLION) 93

-

GCC: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

ISRAEL: HIGH PRESSURE SEALS MARKET, BY

-

MATERIAL, 2023-2032 (USD MILLION) 94

-

ISRAEL: HIGH PRESSURE SEALS

-

MARKET, APPLICATION, 2023-2032 (USD MILLION) 94

-

ISRAEL: HIGH PRESSURE

-

SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 94

-

SOUTH

-

AFRICA: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 95

-

TABLE

-

SOUTH AFRICA: HIGH PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION)

-

95

-

SOUTH AFRICA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY,

-

NORTH AFRICA: HIGH PRESSURE SEALS MARKET,

-

BY MATERIAL, 2023-2032 (USD MILLION) 96

-

NORTH AFRICA: HIGH PRESSURE

-

SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 96

-

NORTH AFRICA:

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 96

-

TABLE

-

REST OF MIDDLE EAST & AFRICA: HIGH PRESSURE SEALS MARKET, BY MATERIAL, 2023-2032

-

(USD MILLION) 97

-

REST OF MIDDLE EAST & AFRICA: HIGH PRESSURE

-

SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 97

-

REST OF MIDDLE

-

EAST & AFRICA: HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD

-

MILLION) 98

-

MARKET STRATEGIES 99

-

EAGLEBURGMANN: PRODUCTS

-

OFFERINGS 101

-

EAGLEBURGMANN: KEY DEVELOPMENTS 101

-

TABLE 119

-

GALLAGHER SEALS: PRODUCTS OFFERINGS 103

-

GALLAGHER SEALS: KEY DEVELOPMENTS

-

104

-

PERFORMANCE SEALING INC: PRODUCTS OFFERINGS 106

-

TABLE 122

-

FTL: PRODUCTS OFFERINGS 109

-

FTL: KEY DEVELOPMENTS 110

-

TABLE

-

TRELLEBORG GROUP: PRODUCTS OFFERINGS 113

-

TRELLEBORG GROUP: KEY

-

DEVELOPMENTS 113

-

JAMES WALKER: PRODUCTS OFFERINGS 115

-

TABLE

-

TRELLEBORG GROUP: KEY DEVELOPMENTS 115

-

JOHN CRANE: PRODUCTS OFFERINGS

-

117

-

JOHN CRANE: KEY DEVELOPMENTS 118

-

KALSI ENGINEERING,

-

INC.: PRODUCTS OFFERINGS 120

-

KALSI ENGINEERING, INC.: KEY DEVELOPMENTS

-

121

-

PARKER HANNIFIN CORP: PRODUCTS OFFERINGS 124

-

FLOWSERVE

-

CORPORATION: PRODUCTS OFFERINGS 127

-

F.LLI PARIS S.R.L. A SOCIO UNICO:

-

PRODUCTS OFFERINGS 129

-

BAL SEAL ENGINEERING: PRODUCTS OFFERINGS 132

-

-

LIST OF FIGURES

-

MARKET SYNOPSIS 15

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL HIGH PRESSURE SEALS MARKET, BY

-

REGION 16

-

GLOBAL HIGH PRESSURE SEALS MARKET ANALYSIS BY MATERIAL 17

-

GLOBAL HIGH PRESSURE SEALS MARKET ANALYSIS BY APPLICATION 18

-

FIGURE

-

GLOBAL HIGH PRESSURE SEALS MARKET ANALYSIS BY END-USE INDUSTRY 19

-

FIGURE

-

GLOBAL HIGH PRESSURE SEALS MARKET: MARKET STRUCTURE 20

-

RESEARCH

-

PROCESS OF MRFR 21

-

DROT ANALYSIS OF GLOBAL HIGH PRESSURE SEALS MARKET

-

27

-

DRIVERS IMPACT ANALYSIS: HIGH PRESSURE SEALS MARKET 29

-

FIGURE

-

RESTRAINTS IMPACT ANALYSIS: HIGH PRESSURE SEALS MARKET 30

-

SUPPLY

-

/ VALUE CHAIN: GLOBAL HIGH PRESSURE SEALS MARKET 34

-

GLOBAL HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023 (% SHARE) 38

-

GLOBAL HIGH PRESSURE

-

SEALS MARKET, BY MATERIAL, 2023-2032 (USD MILLION) 39

-

GLOBAL HIGH

-

PRESSURE SEALS MARKET, APPLICATION, 2023 (% SHARE) 44

-

GLOBAL HIGH

-

PRESSURE SEALS MARKET, APPLICATION, 2023-2032 (USD MILLION) 45

-

GLOBAL

-

HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023 (% SHARE) 51

-

FIGURE 18

-

GLOBAL HIGH PRESSURE SEALS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION)

-

52

-

GLOBAL HIGH PRESSURE SEALS MARKET, BY REGION, 2023-2032 (USD MILLION)

-

60

-

GLOBAL HIGH PRESSURE SEALS MARKET, BY REGION, 2023 (% SHARE) 61

-

NORTH AMERICA: HIGH PRESSURE SEALS MARKET SHARE, BY COUNTRY, 2023 (%

-

SHARE) 62

-

EUROPE: HIGH PRESSURE SEALS MARKET SHARE, BY COUNTRY, 2023

-

(% SHARE) 66

-

ASIA PACIFIC: HIGH PRESSURE SEALS MARKET SHARE, BY COUNTRY,

-

LATIN AMERICA: HIGH PRESSURE SEALS MARKET SHARE,

-

BY COUNTRY, 2023 (% SHARE) 85

-

MIDDLE EAST & AFRICA: HIGH PRESSURE

-

SEALS MARKET SHARE, BY COUNTRY, 2023 (% SHARE) 91

-

KEY DEVELOPMENT

-

ANALYSIS, 2023 100

-

EAGLEBURGMANN: SWOT ANALYSIS 102

-

FIGURE 28

-

GALLAGHER SEALS: SWOT ANALYSIS 104

-

PERFORMANCE SEALING INC: SWOT

-

ANALYSIS 108

-

FTL: SWOT ANALYSIS 111

-

TRELLEBORG GROUP:

-

FINANCIAL OVERVIEW SNAPSHOT 112

-

TRELLEBORG GROUP: SWOT ANALYSIS 114

-

JAMES WALKER: SWOT ANALYSIS 116

-

JOHN CRANE: SWOT ANALYSIS

-

119

-

KALSI ENGINEERING, INC.: SWOT ANALYSIS 122

-

PARKER

-

HANNIFIN CORP: FINANCIAL OVERVIEW SNAPSHOT 123

-

PARKER HANNIFIN CORP:

-

SWOT ANALYSIS 125

-

FLOWSERVE CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

126

-

FLOWSERVE CORPORATION: SWOT ANALYSIS 128

-

F.LLI

-

PARIS S.R.L. A SOCIO UNICO: SWOT ANALYSIS 131

-

BAL SEAL ENGINEERING:

-

SWOT ANALYSIS 133

Leave a Comment