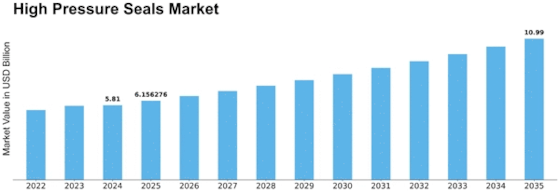

High Pressure Seals Size

High pressure seals Market Growth Projections and Opportunities

The High-Pressure Seals Market experiences influences from a variety of factors that collectively impact its growth, demand, and overall dynamics across industries such as oil and gas, manufacturing, and aerospace. These factors play a pivotal role in determining the market's competitiveness and trajectory. Here are key market factors significantly impacting the High-Pressure Seals Market:

Expansion in Oil and Gas Exploration: The continual expansion of oil and gas exploration activities, particularly in challenging environments such as deep-sea drilling and unconventional reservoirs, drives the demand for high-pressure seals. These seals are crucial components in wellhead equipment and drilling systems, providing reliable containment of fluids under high pressures.

Rising Demand for Energy: The global demand for energy, including oil and natural gas, continues to rise. As energy exploration and extraction efforts intensify, there is a corresponding increase in the need for high-pressure seals to maintain operational integrity and prevent leaks in high-pressure equipment.

Growing Industrial Manufacturing: High-pressure seals are essential components in various industrial manufacturing processes, including those in the chemical, pharmaceutical, and food processing industries. The growth of industrial manufacturing activities worldwide contributes to the demand for high-pressure seals to ensure the reliable operation of equipment in high-pressure applications.

Advancements in Hydraulic Systems: The increasing use of hydraulic systems in various industries, such as construction, agriculture, and manufacturing, contributes to the demand for high-pressure seals. These seals play a critical role in hydraulic cylinders and systems, ensuring efficient and leak-free operation under high-pressure conditions.

Aerospace Industry Requirements: The aerospace sector, characterized by high-performance and precision requirements, relies on high-pressure seals for critical applications. These seals are used in aircraft hydraulic systems, landing gear, and other components, contributing to the safety and reliability of aerospace equipment.

Technological Advancements in Seal Materials: Ongoing advancements in materials science lead to the development of high-performance seal materials, including advanced polymers, composites, and metal alloys. Innovations in seal materials enhance durability, wear resistance, and the overall performance of high-pressure seals across diverse applications.

Stringent Regulatory Standards: Stringent safety and environmental regulations, especially in industries such as oil and gas, drive the adoption of high-quality seals to meet compliance requirements. Manufacturers are compelled to design and produce high-pressure seals that adhere to international standards and ensure safe operations in high-pressure environments.

Focus on Preventive Maintenance: The emphasis on preventive maintenance in industrial operations encourages the use of high-quality seals to avoid downtime and equipment failures. High-pressure seals, when properly selected and maintained, contribute to the longevity of machinery and reduce the likelihood of costly repairs.

Globalization of Supply Chains: The globalization of supply chains in various industries increases the demand for high-pressure seals across borders. Manufacturers and suppliers seek reliable sealing solutions to support global operations, leading to a broader market for high-pressure seal products.

Cost-Effective Seal Solutions: While high-performance is paramount, cost-effective seal solutions are gaining significance in the market. Manufacturers are focused on providing seals that offer a balance between performance and cost efficiency, addressing the need for competitive pricing in diverse industrial applications.

Leave a Comment