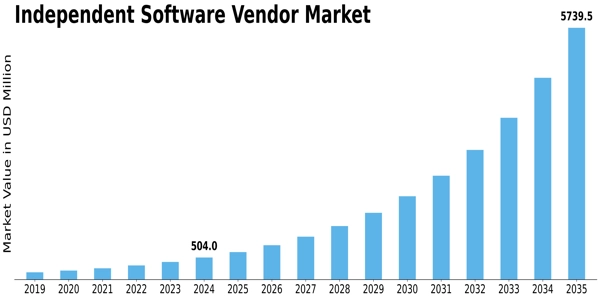

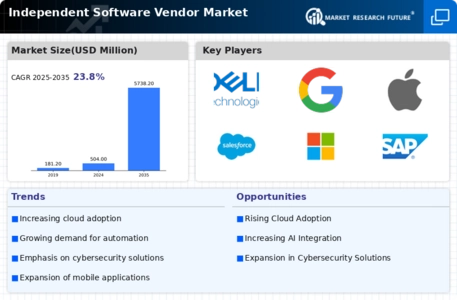

Independent Software Vendors Size

Independent Software Vendors Market Growth Projections and Opportunities

The Independent Software Vendors (ISVs) market is a dynamic and rapidly evolving ecosystem shaped by myriad factors that influence these software providers' success and growth. One crucial market factor is technological innovation. As advancements continue to emerge, ISVs must stay at the forefront of cutting-edge technologies to remain competitive. The ability to adapt and integrate emerging trends such as AI, cloud computing, and blockchain into their software offerings is pivotal for ISVs to meet the ever-changing demands of customers. Market demand plays a causal role in the success of ISVs.

Understanding customer needs and preferences is essential for developing software solutions that address specific challenges and deliver tangible value. ISVs that can effectively identify and respond to market demands are better positioned to gain market share and build a loyal customer base. Moreover, the increasing focus on digital transformation across industries contributes to the demand for innovative software solutions, providing ample opportunities for ISVs to thrive. The competitive landscape is another key factor influencing ISV market dynamics. With numerous players vying for market share, ISVs must differentiate themselves through unique value propositions, features, and pricing models. Partnerships and collaborations also play a crucial role, enabling ISVs to leverage complementary technologies and expand their reach. Moreover, strategic alliances with major technology platforms and service providers can enhance the visibility and credibility of ISVs in the market.

Regulatory and compliance factors also impact the ISV market. As data privacy and security concerns become more pronounced, ISVs must navigate a complex landscape of regulations and standards. Adhering to these requirements not only ensures legal compliance but also builds trust among customers. ISVs that prioritize security and compliance in their software solutions help them gain a competitive advantage in an increasingly regulated environment. Economic factors, including overall market conditions and budget constraints, influence the purchasing decisions of businesses and organizations. During economic downturns, organizations may be more cost-conscious, leading to a greater emphasis on the value proposition offered by ISVs. On the other hand, periods of economic growth may provide opportunities for ISVs to invest in research and development, expand their offerings, and explore new markets. The globalization of markets has opened up new avenues for ISVs to reach a diverse and geographically dispersed customer base. However, it also introduces challenges related to cultural differences, language barriers, and varying business practices.

Successful ISVs must navigate these challenges by tailoring their software solutions to help meet the specific needs of different regions while maintaining a global perspective. Lastly, the pace of technological obsolescence poses a constant challenge for ISVs. Rapid advances in technology can quickly render existing software outdated. To stay relevant, ISVs must commit to continuous innovation, regular updates, and a responsive approach to customer feedback. The ability to anticipate and adapt to technological shifts ensures that ISVs remain competitive and resilient in a fast-paced market environment.

Leave a Comment