Market Analysis

In-depth Analysis of India Sustainable Aviation fuel Market Industry Landscape

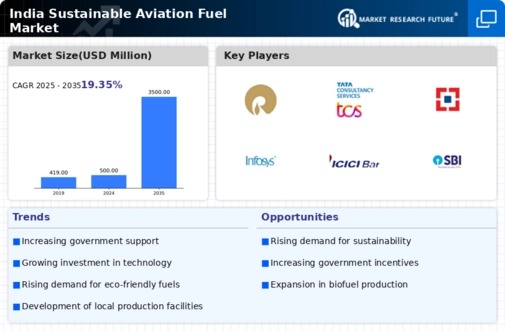

The India Sustainable Aviation Fuel (SAF) market is currently witnessing dynamic changes driven by a growing awareness of environmental sustainability and the aviation industry's efforts to reduce its carbon footprint. As the global focus on sustainable practices intensifies, India is not far behind in embracing cleaner alternatives for aviation fuel. The market dynamics of the India SAF sector are shaped by a combination of regulatory initiatives, technological advancements, and the increasing demand for eco-friendly aviation solutions.

One of the key drivers of the market is the Indian government's push towards sustainable development and its commitment to reducing greenhouse gas emissions. Various policy measures and incentives have been introduced to promote the production and use of SAF in the aviation sector. The government's proactive stance has encouraged both domestic and international players to invest in research and development of sustainable aviation fuel technologies.

Technological advancements play a pivotal role in shaping the market dynamics. Ongoing research and innovation have led to the development of more efficient and cost-effective methods for producing SAF. India is witnessing increased collaboration between research institutions, aviation companies, and biofuel producers to explore and implement cutting-edge technologies. These advancements not only enhance the overall performance of SAF but also contribute to making it a viable and competitive alternative to traditional aviation fuels.

The demand for sustainable aviation fuel in India is on the rise, driven by a growing consciousness among airlines and passengers about the environmental impact of air travel. Airlines are increasingly incorporating SAF into their operations as part of their sustainability initiatives. Passengers, too, are showing a preference for airlines that prioritize environmental responsibility. This shift in consumer behavior is creating a positive feedback loop, encouraging further investment and innovation in the India SAF market.

Market dynamics are also influenced by the global trends in the aviation industry. As international aviation bodies set more stringent emissions reduction targets, Indian airlines are under pressure to adopt sustainable practices. This not only aligns with global environmental goals but also positions India as a responsible player in the international aviation community. The market dynamics of the India SAF sector are, therefore, intricately connected to the broader global context of sustainable aviation.

Challenges, however, do exist. The cost of producing sustainable aviation fuel remains a concern, and widespread adoption may be hindered until production processes become more economically viable. Additionally, the infrastructure for the production and distribution of SAF needs further development to meet the growing demand. Overcoming these challenges will require continued collaboration between government bodies, industry stakeholders, and technology developers.

The market dynamics of the India Sustainable Aviation Fuel sector are undergoing a transformative phase driven by regulatory support, technological advancements, and a changing consumer landscape. The country is making significant strides towards a more sustainable aviation future, aligning itself with global efforts to reduce carbon emissions in the aviation sector. As the industry continues to evolve, the India SAF market is poised for growth, presenting both challenges and opportunities for stakeholders committed to a greener and more sustainable aviation ecosystem.

Leave a Comment