Market Share

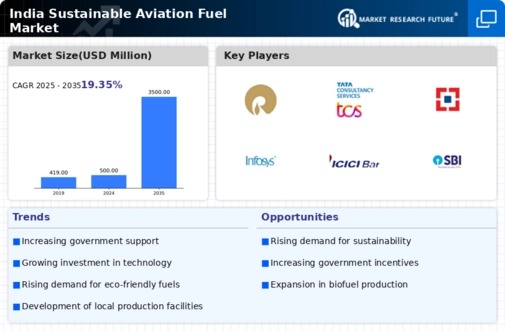

India Sustainable Aviation fuel Market Share Analysis

In the dynamic landscape of the India Sustainable Aviation Fuel (SAF) market, market share positioning strategies play a pivotal role in shaping the competitive landscape. The market for sustainable aviation fuel in India is gaining traction as the aviation industry increasingly recognizes the importance of reducing its environmental footprint. Various companies operating in this space employ diverse strategies to carve out their market share.

One prominent strategy revolves around establishing robust partnerships and collaborations. Companies often form alliances with key players in the aviation and energy sectors to strengthen their market presence. By aligning with airlines, airports, and biofuel producers, these companies can secure a steady supply chain for sustainable aviation fuel and foster a sense of reliability within the market. Such collaborations not only contribute to the growth of the individual companies but also propel the overall development of the sustainable aviation fuel ecosystem in India.

Furthermore, technological innovation is a key driver in market share positioning within the India SAF market. Companies that invest in research and development to enhance the efficiency and cost-effectiveness of their production processes gain a competitive edge. The ability to offer advanced and sustainable solutions positions these companies as leaders in the market. Continuous improvements in production technologies also contribute to scaling up production capacities, meeting the increasing demand for sustainable aviation fuel in India.

Additionally, companies often focus on building strong brand identities and reputations in the market. Communicating their commitment to sustainability and environmental responsibility helps in establishing trust among customers, investors, and stakeholders. Creating awareness about the benefits of sustainable aviation fuel and showcasing successful case studies can positively influence the perception of a company in the market, ultimately contributing to its market share.

Price competitiveness is another crucial element in market share positioning. Companies that can offer sustainable aviation fuel at competitive prices gain an advantage in the market. As the demand for sustainable aviation fuel increases, achieving economies of scale becomes imperative to reduce production costs. Companies adopting efficient production processes and optimizing their supply chains can pass on the cost benefits to customers, thereby securing a larger market share.

Government policies and regulations also play a significant role in shaping market share dynamics in the India SAF market. Companies that stay abreast of regulatory developments and proactively adapt their strategies to align with evolving standards are better positioned for success. Government support and incentives for sustainable aviation fuel production can further boost the market share of companies that align with national sustainability goals.

The market share positioning strategies in the India Sustainable Aviation Fuel market are multifaceted and dynamic. Collaboration, technological innovation, branding, price competitiveness, and responsiveness to regulatory changes are integral components of successful market positioning. As the aviation industry continues its shift towards sustainability, companies that effectively navigate these factors are poised to capture a significant share of the growing India SAF market.

Leave a Comment